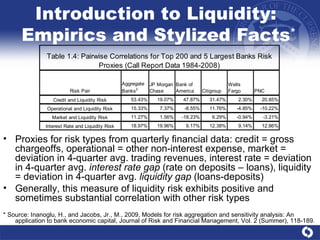

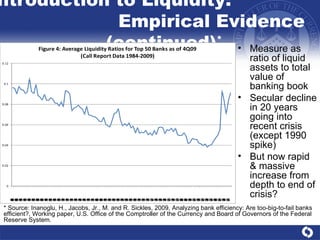

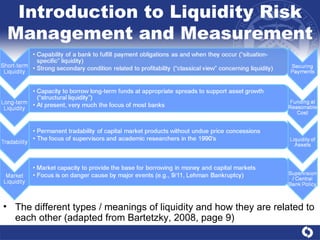

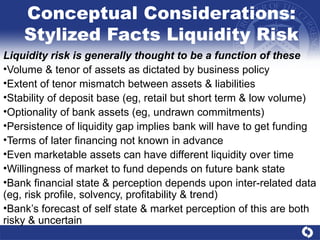

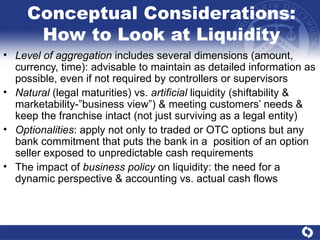

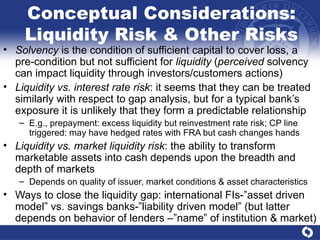

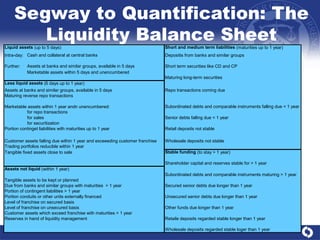

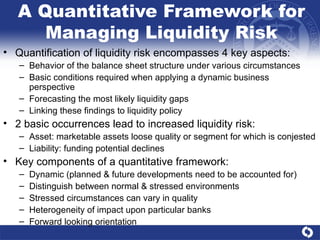

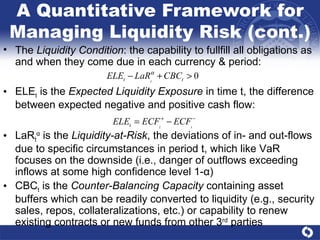

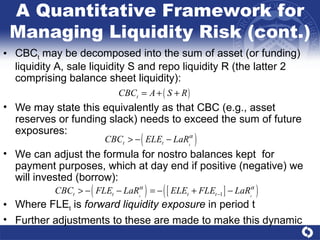

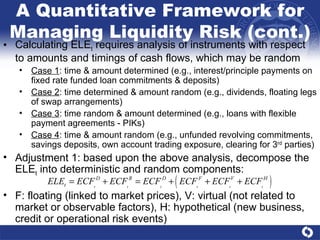

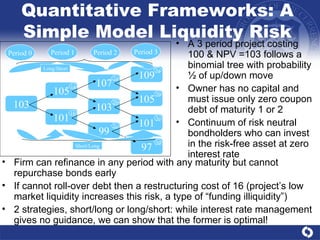

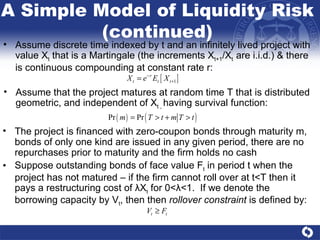

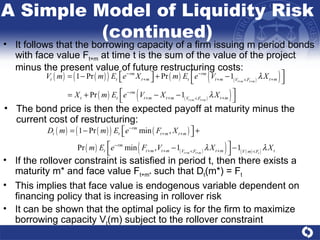

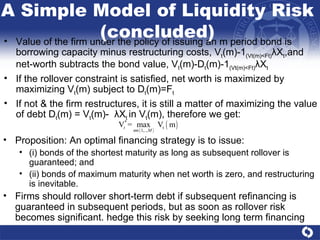

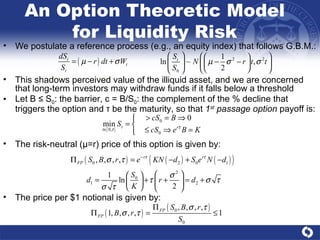

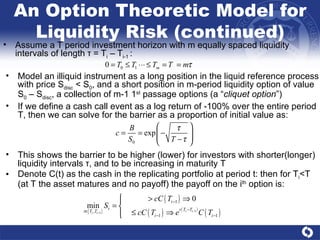

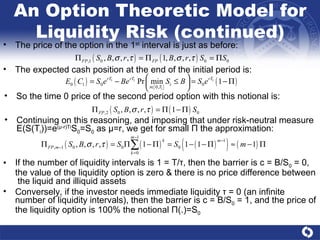

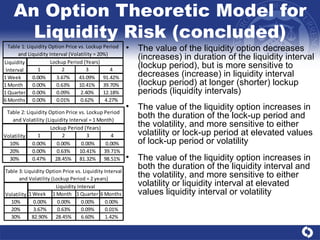

This document presents a comprehensive analysis of liquidity risk management and measurement in banking, detailing the definitions of liquidity and liquidity risk, various quantitative frameworks, and empirical evidence of liquidity risk. It discusses conceptual considerations, the correlation between liquidity risk and other types of risk, and outlines models for assessing liquidity needs and managing liquidity within banks. Key findings emphasize the importance of understanding cash flows and maintaining sufficient liquidity under both normal and stressed conditions.