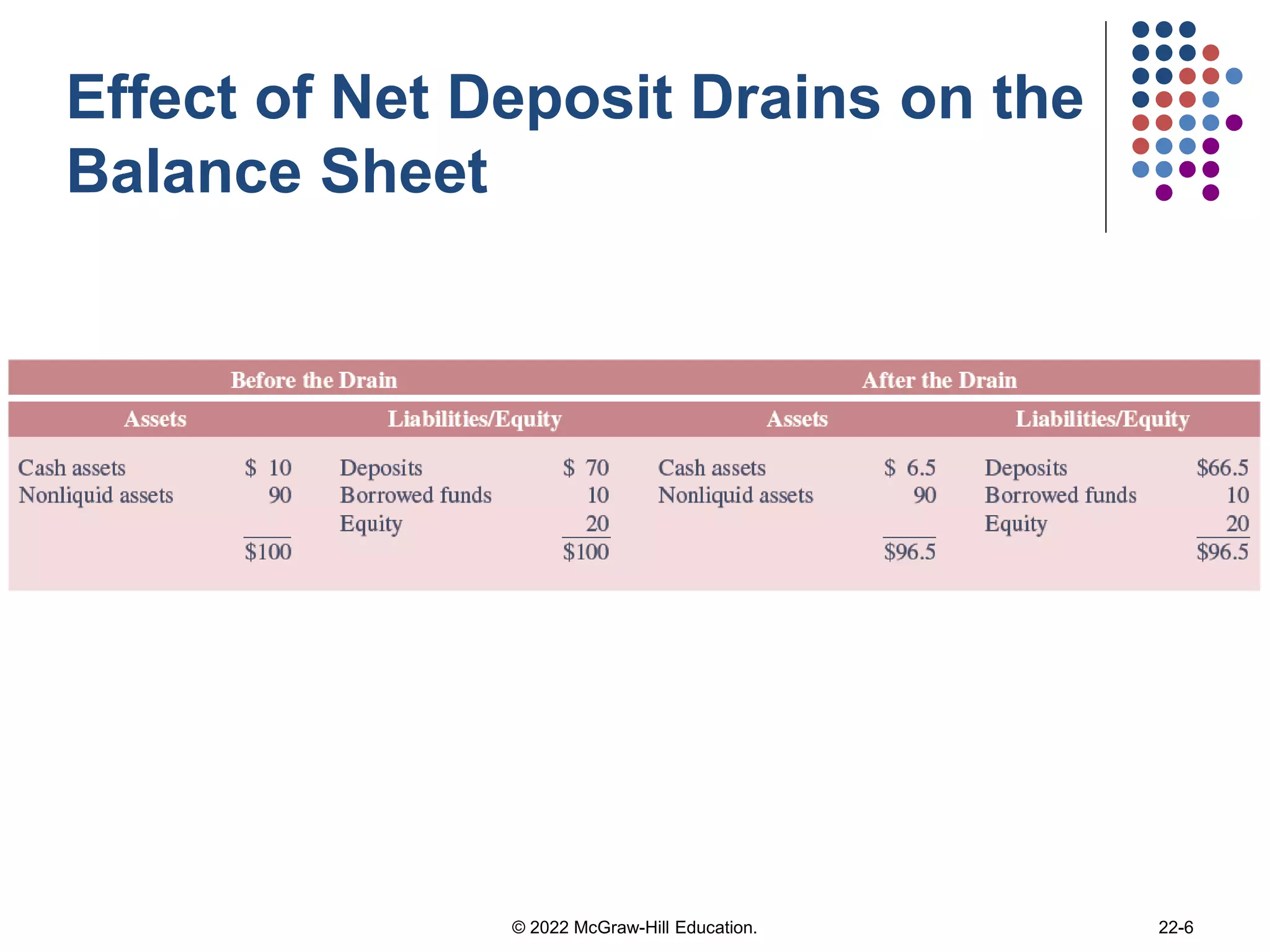

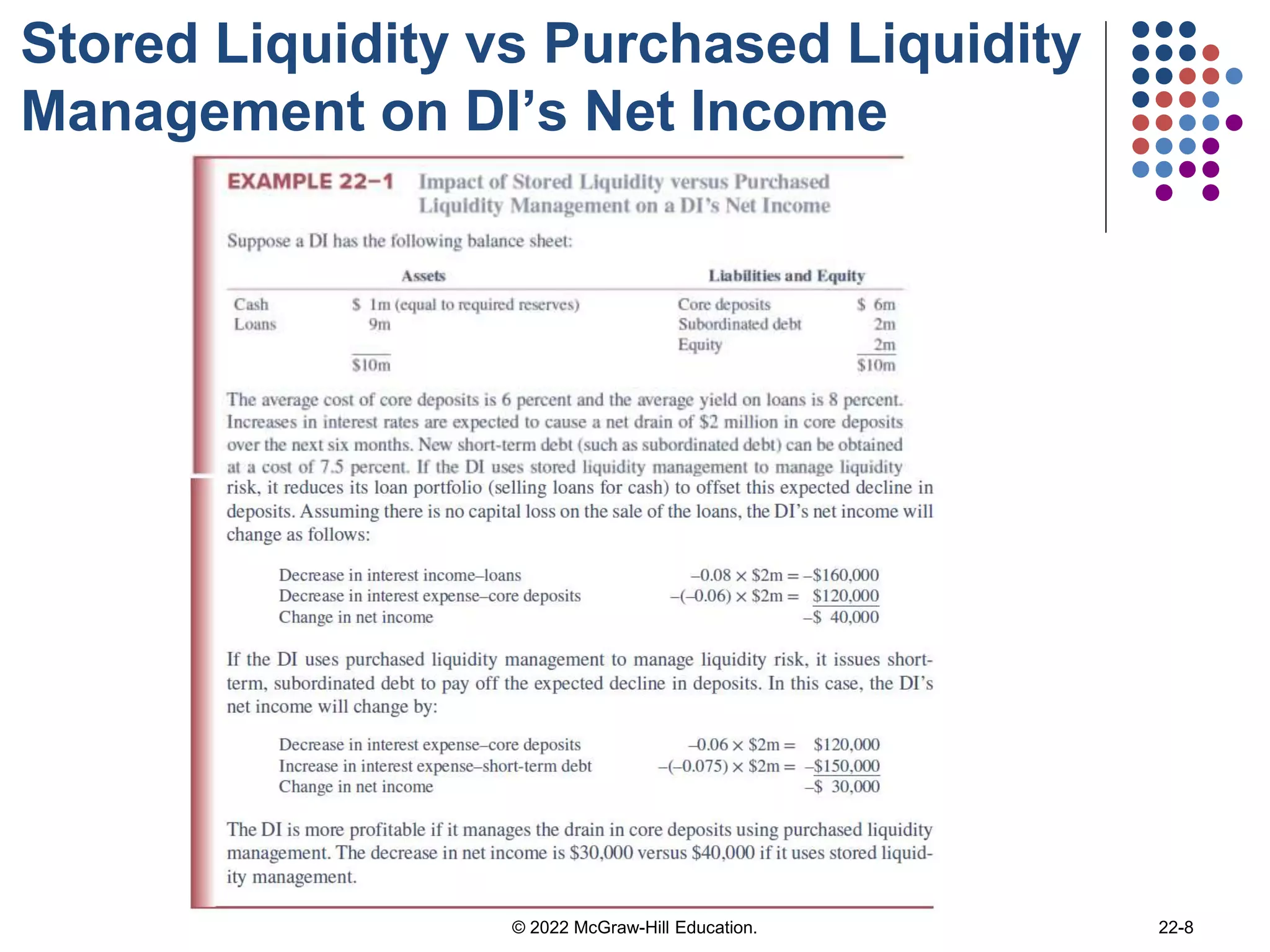

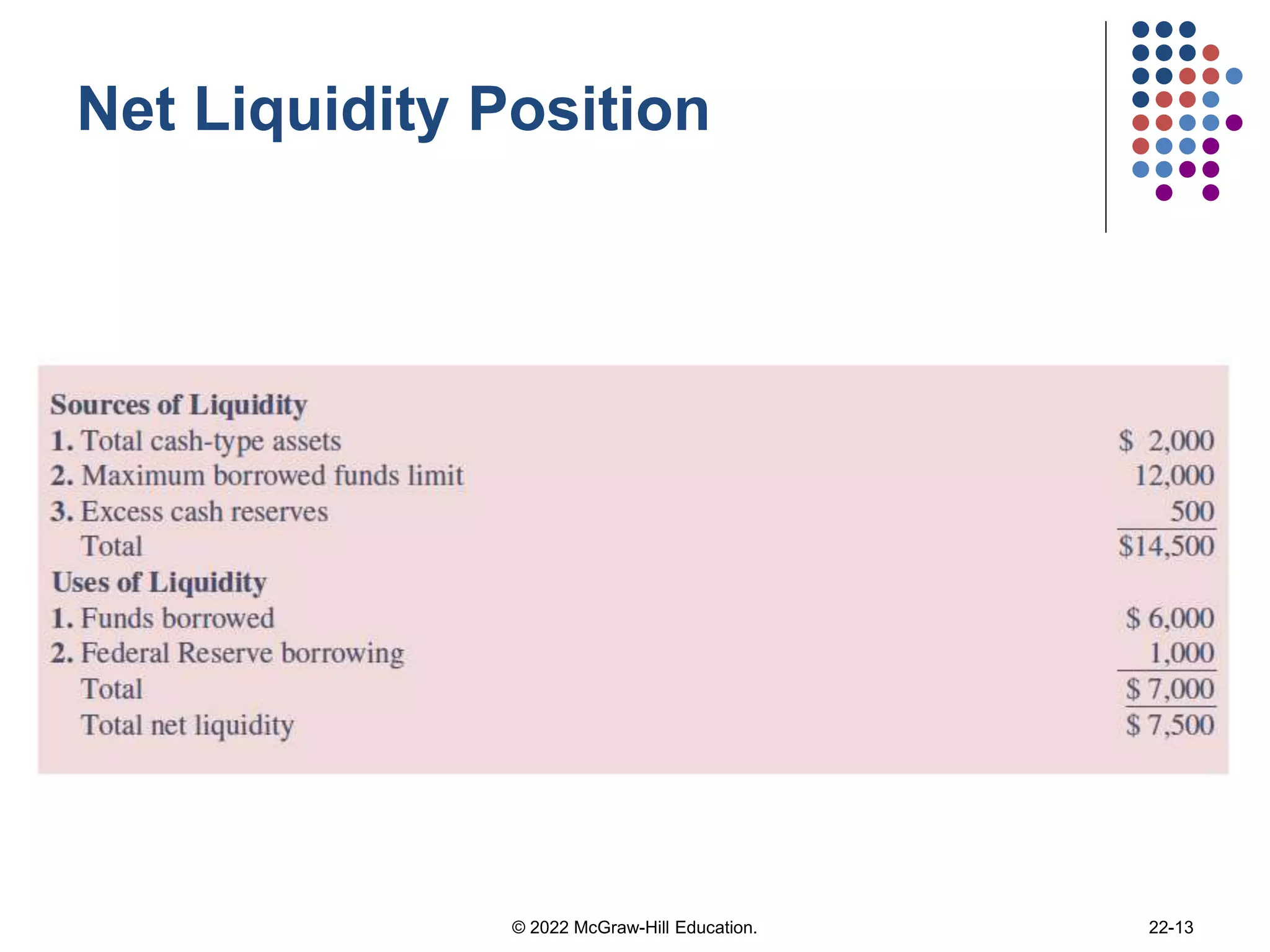

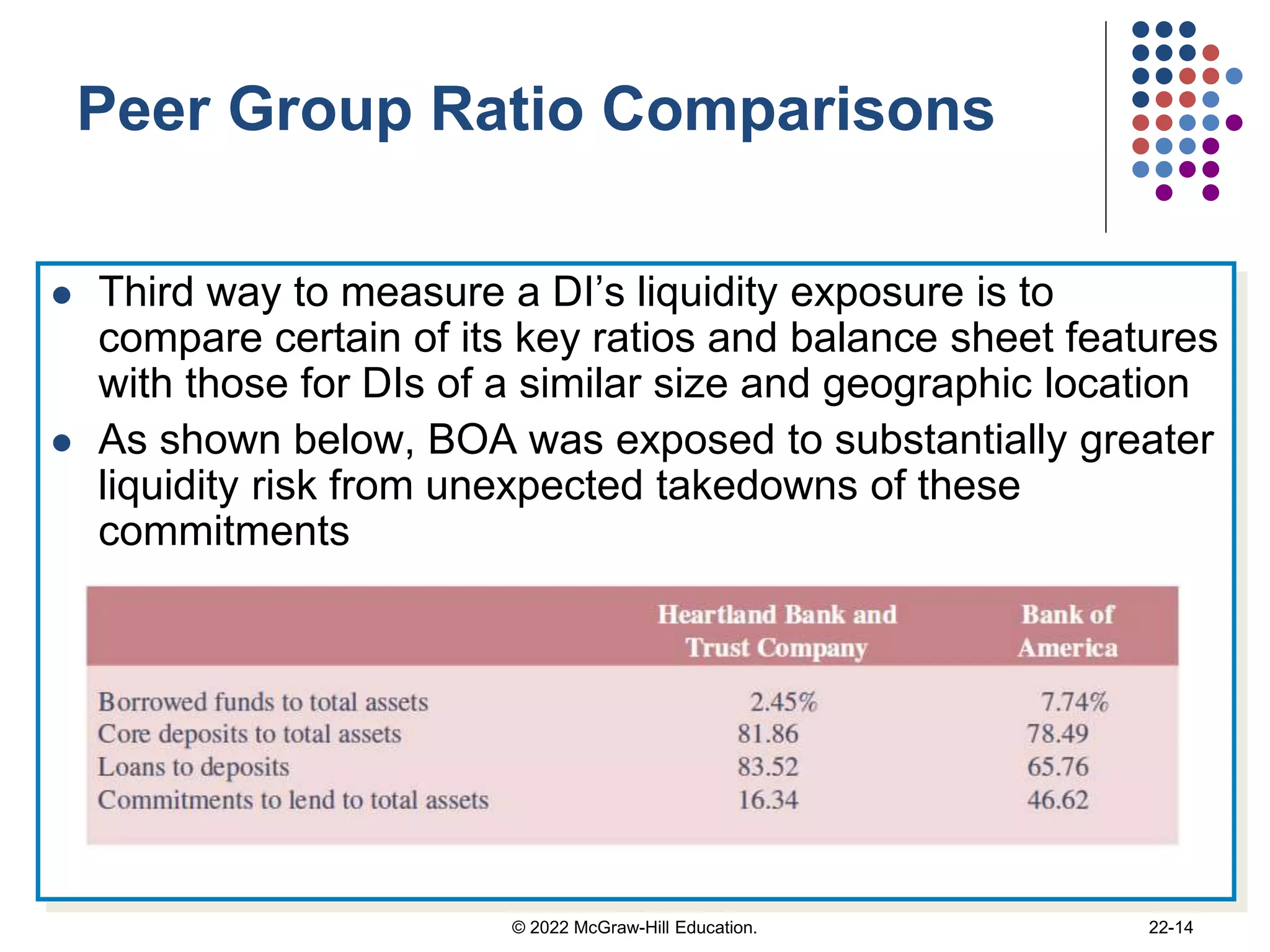

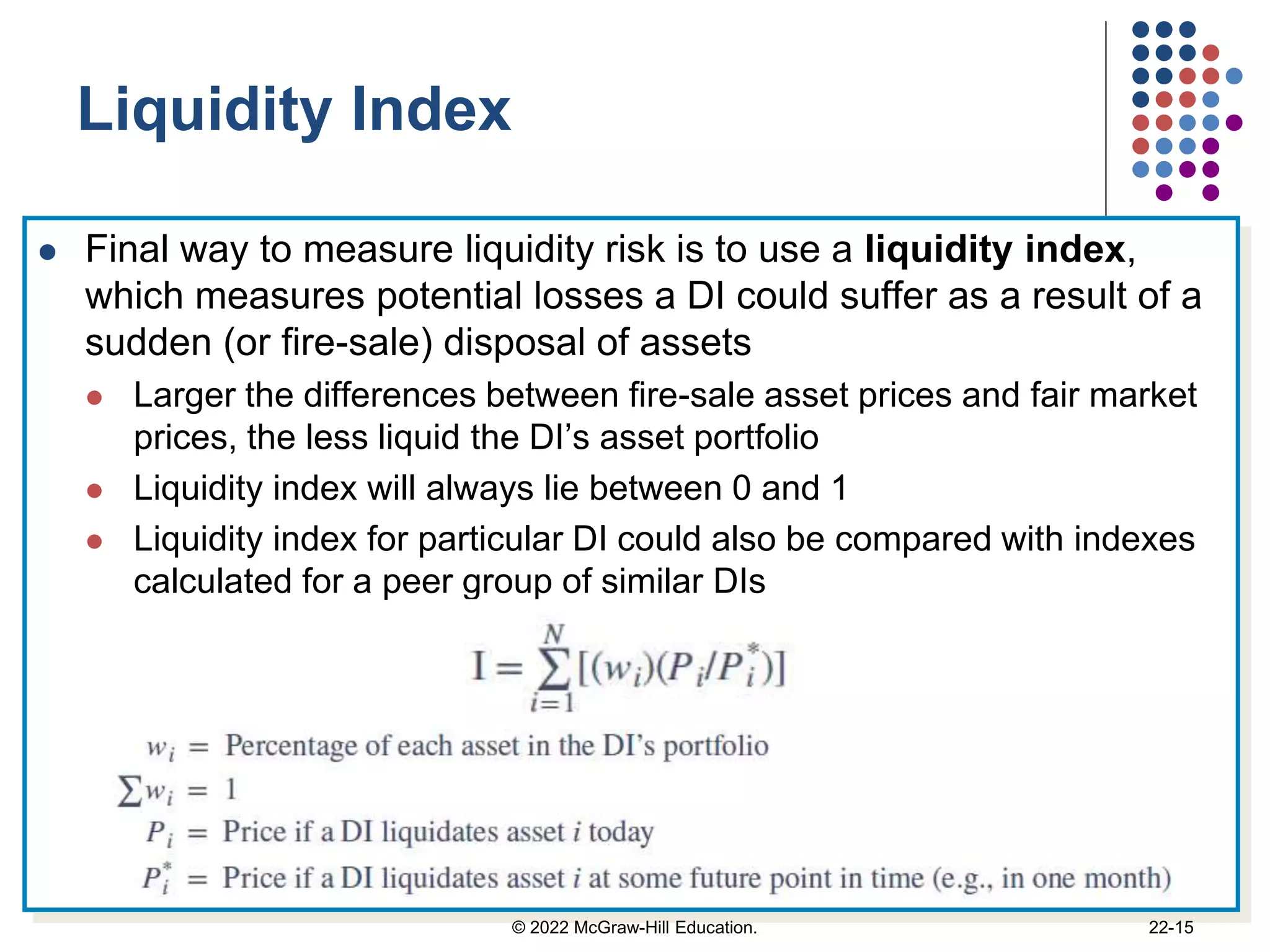

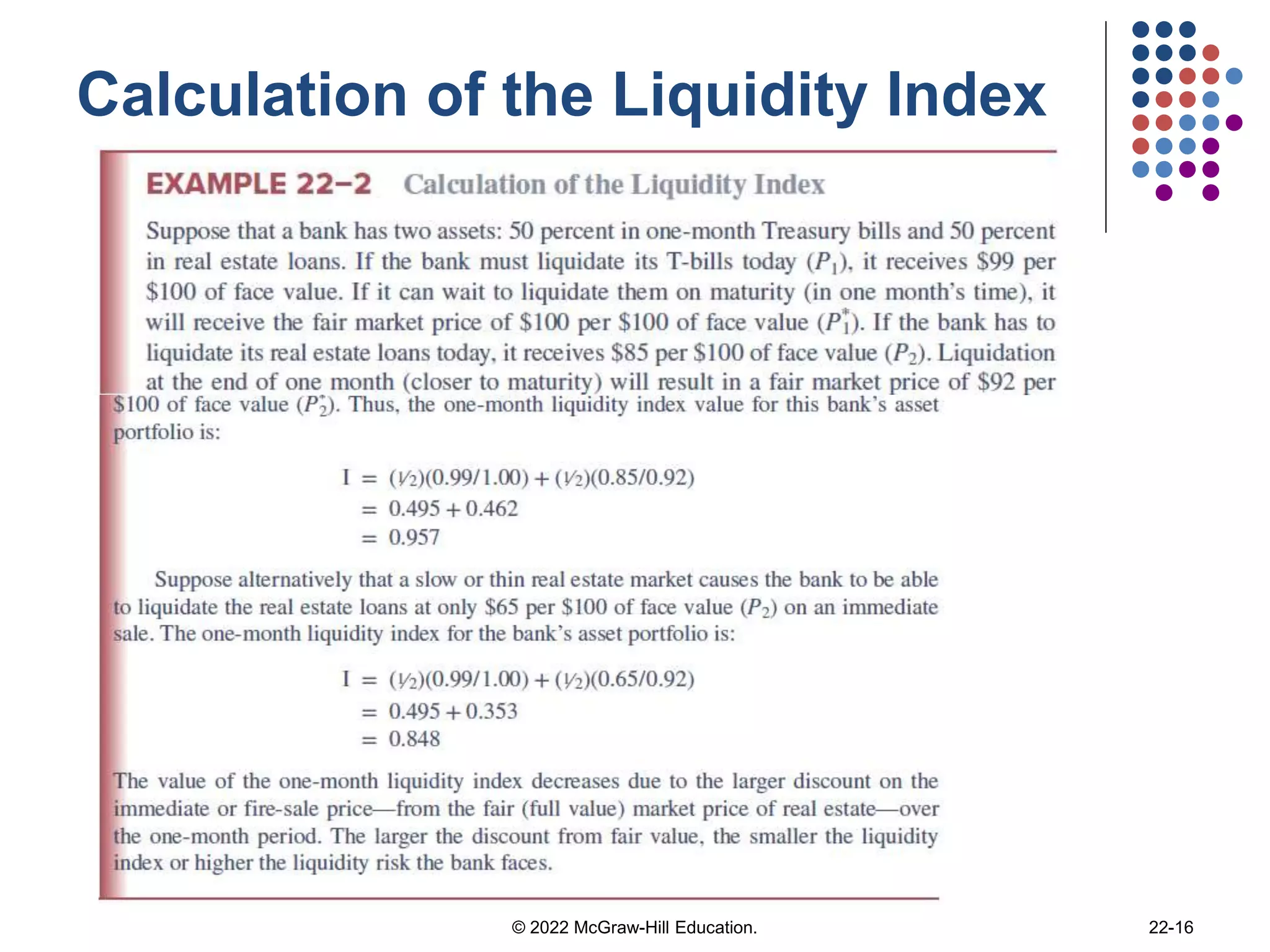

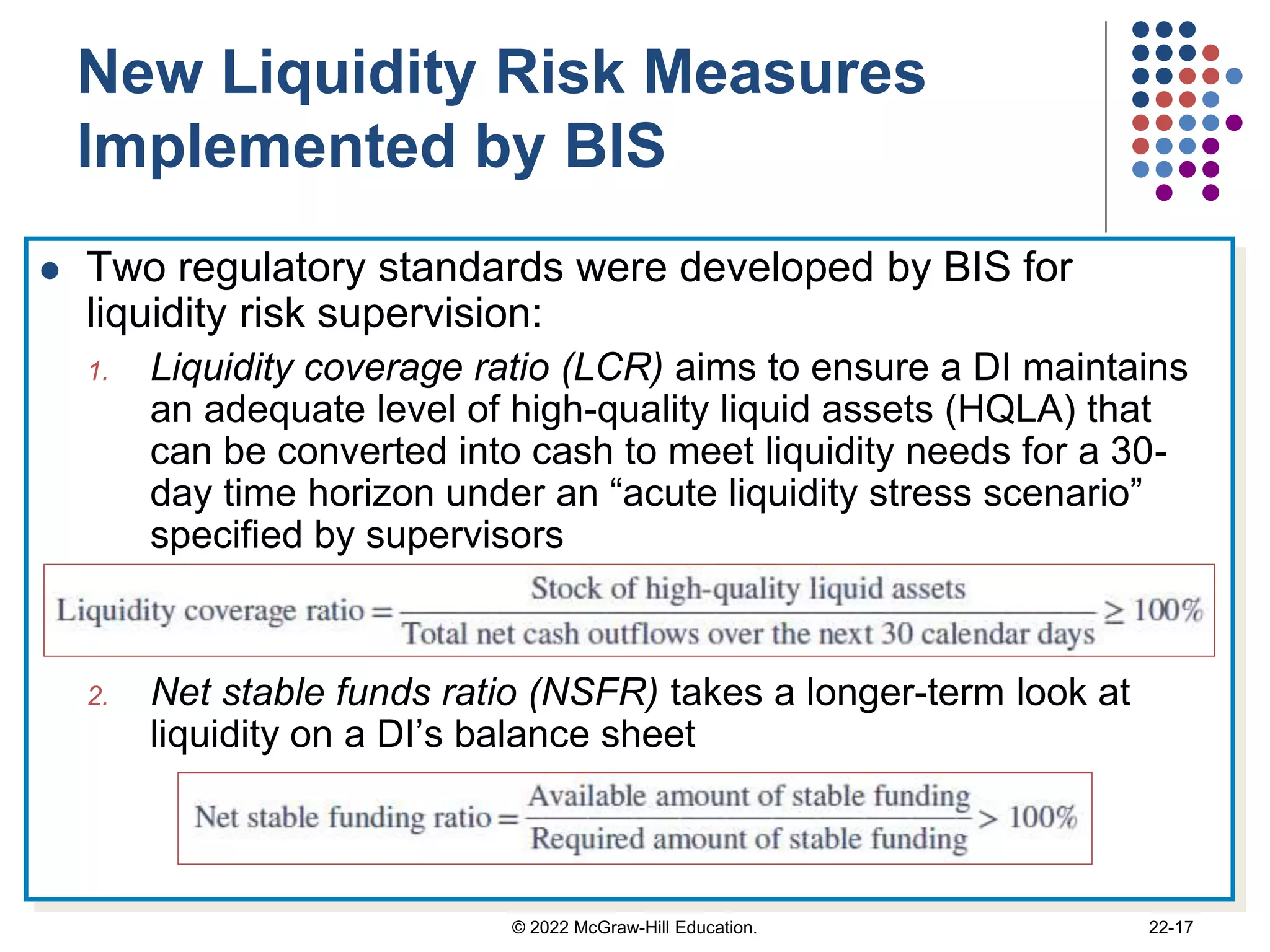

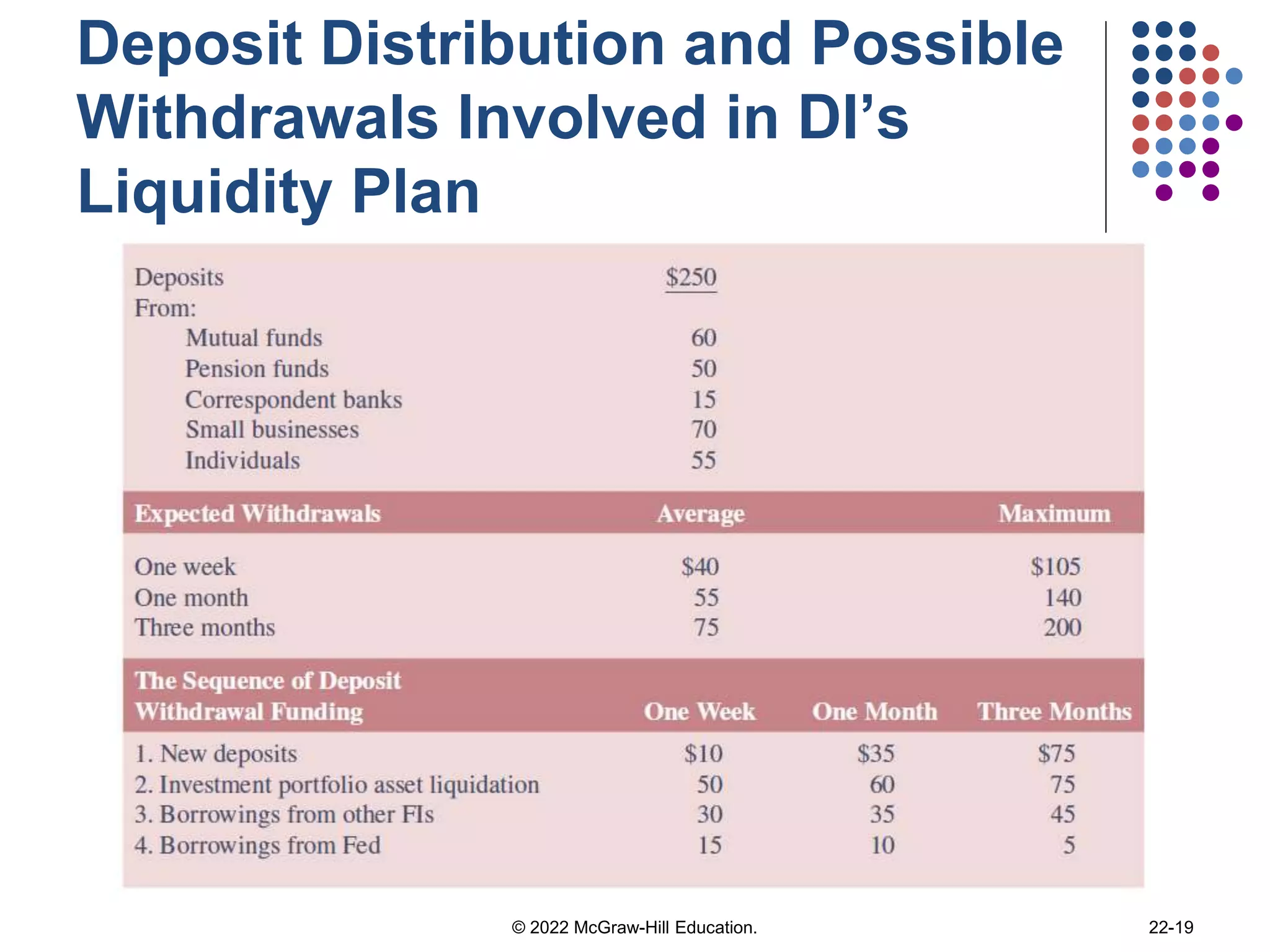

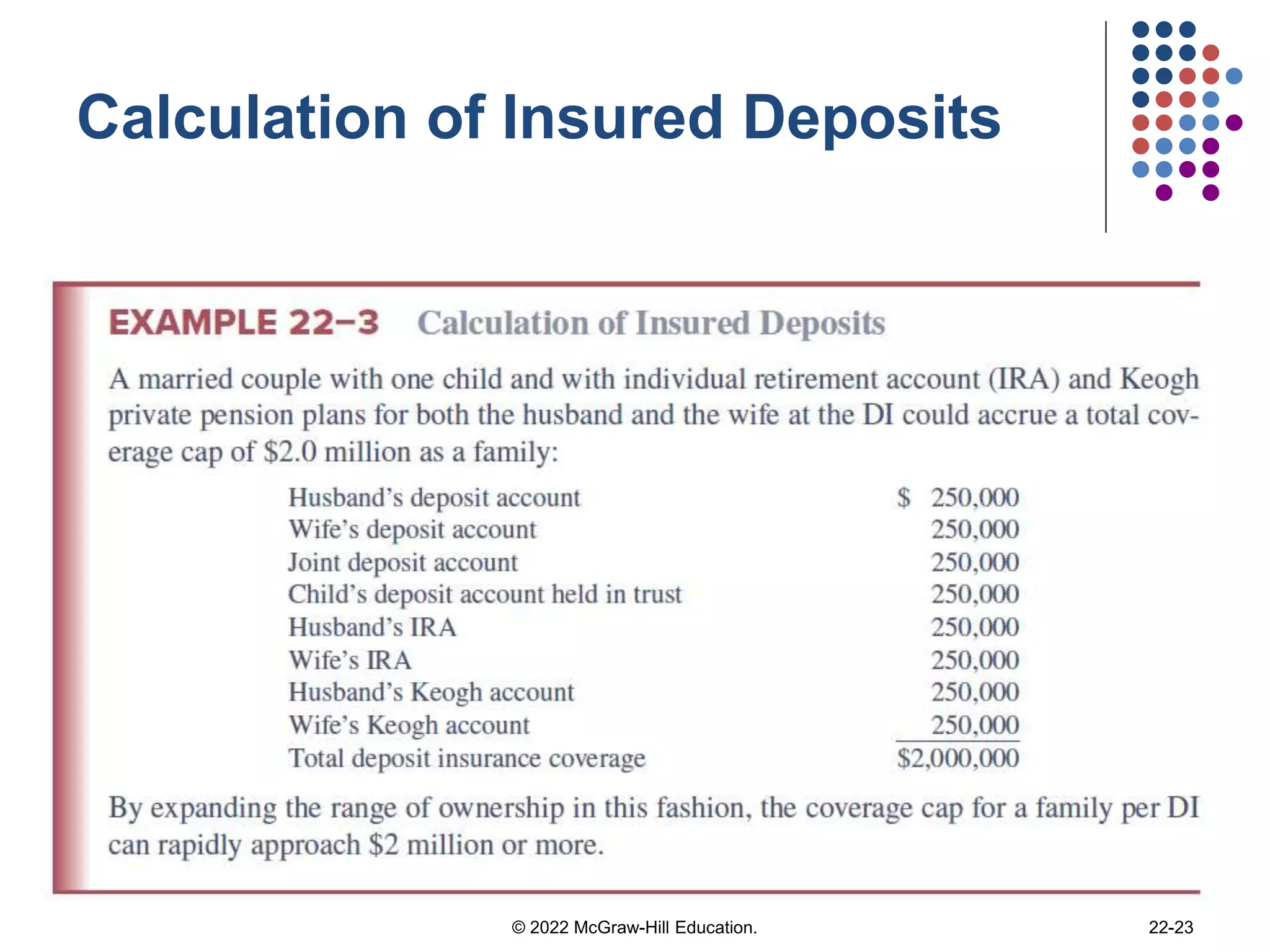

This document discusses liquidity risk management for financial institutions. It begins by defining liquidity risk and explaining that depository institutions are highly exposed due to holding short-term liabilities to fund long-term assets. It then examines the causes of liquidity risk, effects of deposit drains on banks' balance sheets, and tools for measuring and managing liquidity risk such as the financing gap and net liquidity statement. The document also addresses liquidity issues for other financial institutions like insurance companies and investment funds.