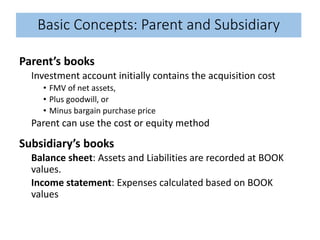

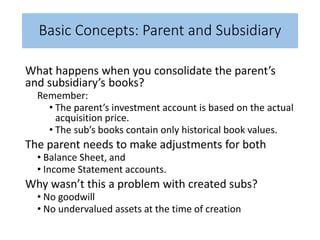

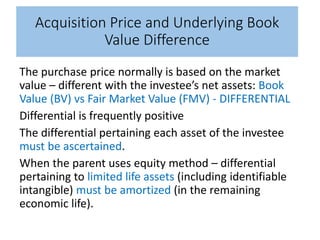

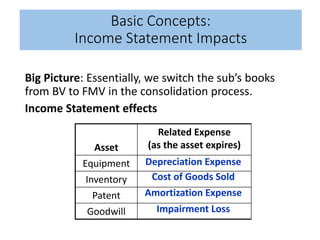

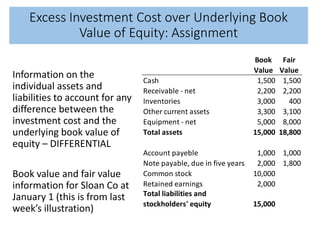

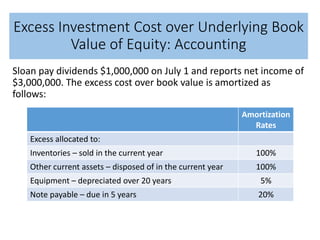

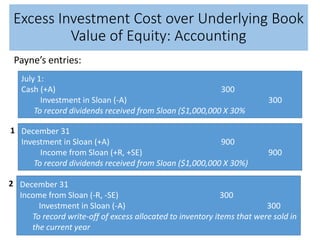

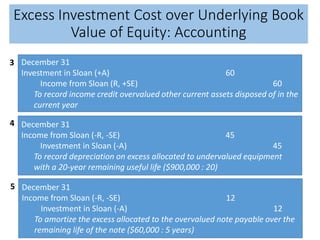

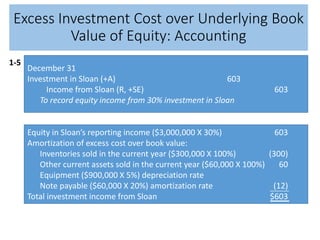

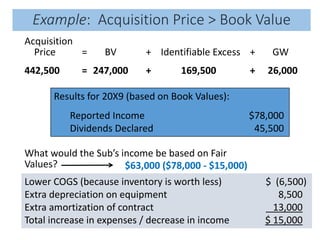

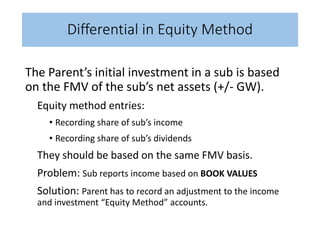

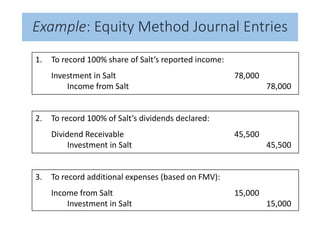

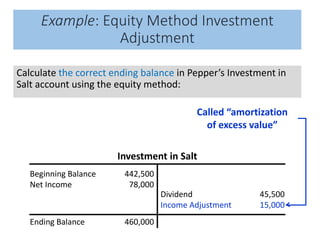

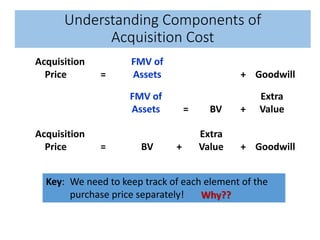

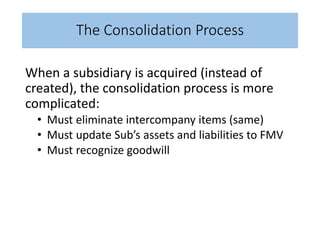

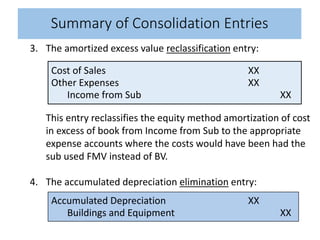

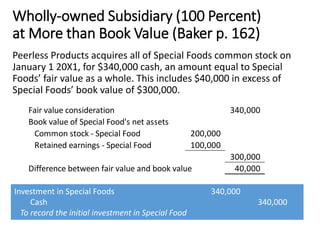

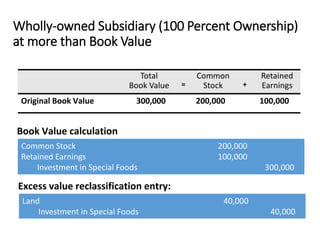

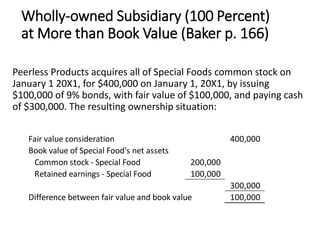

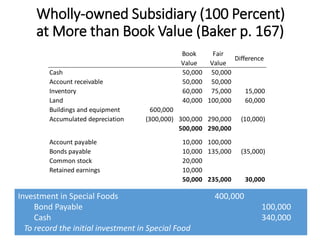

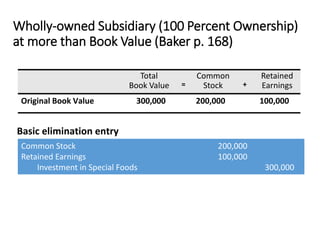

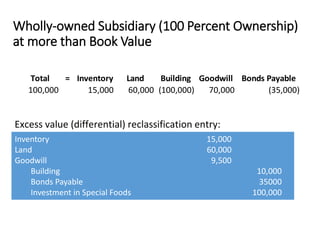

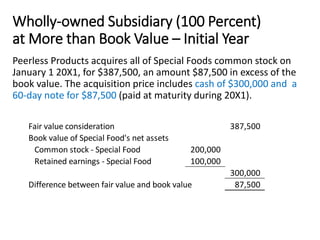

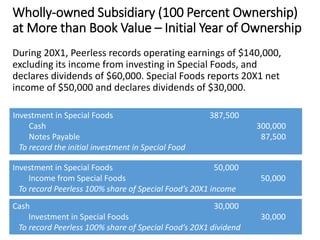

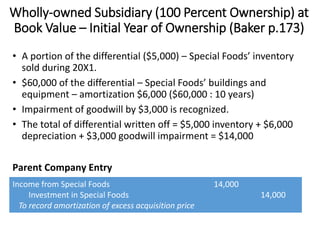

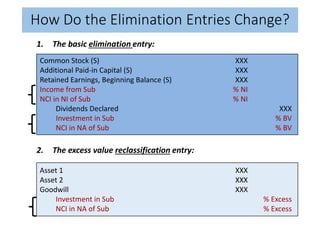

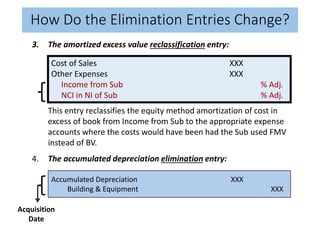

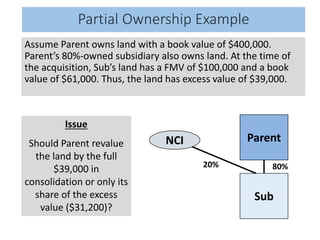

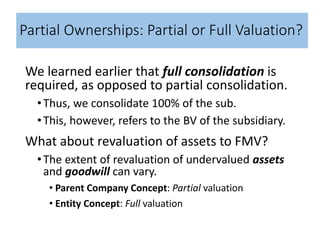

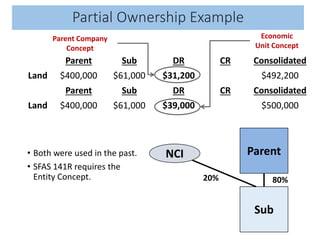

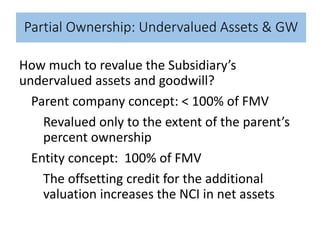

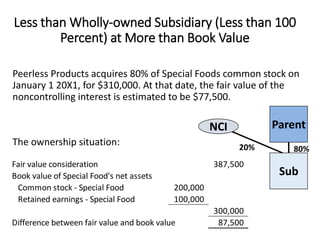

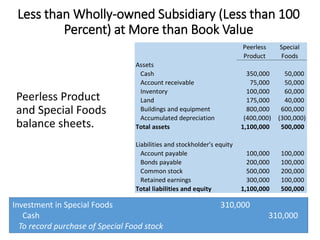

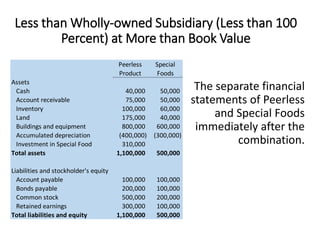

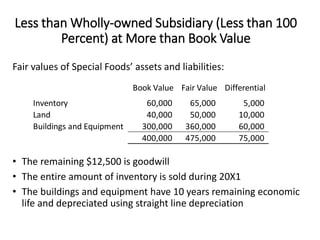

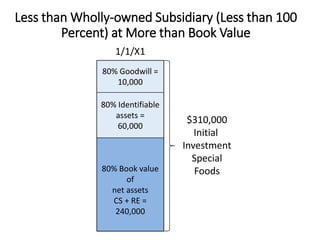

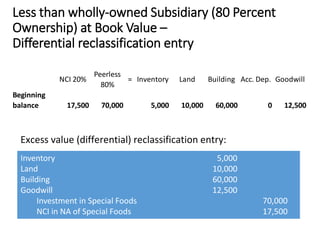

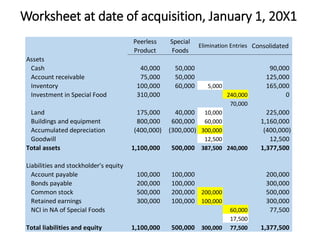

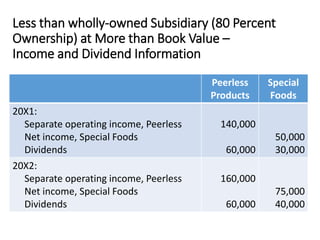

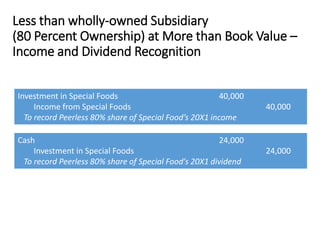

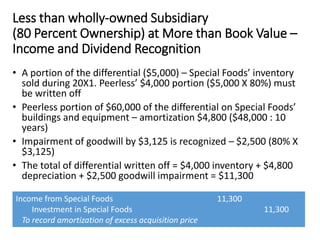

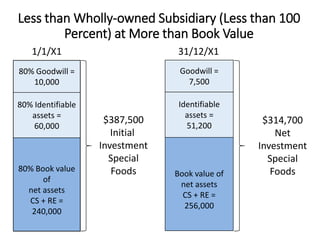

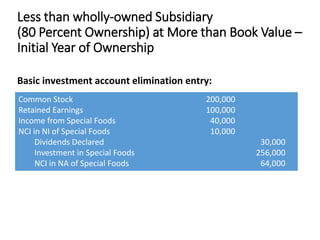

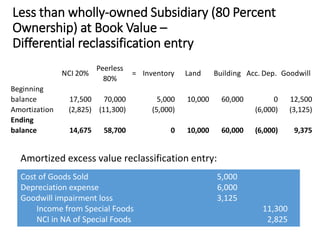

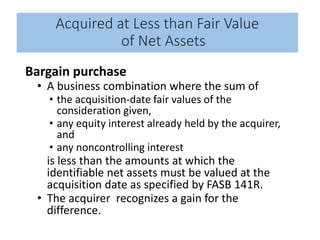

The document discusses the complexities of consolidating financial statements during the acquisition of a subsidiary, particularly when the acquisition occurs at more than book value. It explains the adjustments needed for both balance sheets and income statements, as well as the impacts of different valuation methods on reported income. Additionally, it provides examples illustrating the differential between fair market value and book value, and the necessary accounting entries for accurately reflecting these differences in financial statements.