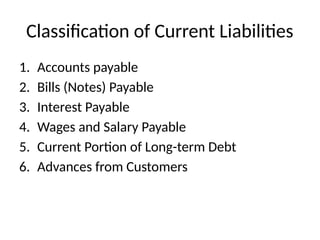

Chapter 6 discusses the accounting principles surrounding liabilities and equity, defining liabilities as financial obligations of an enterprise that require future sacrifice of assets. It covers the valuation of liabilities, distinguishing between current and contingent liabilities, and emphasizes the inconsistencies in current liability classifications which may mislead creditors. The chapter also explains various theories of equity, including entity, residual equity, proprietary, fund, and enterprise theories, which provide different perspectives on the relationship between a business, its owners, and creditors.