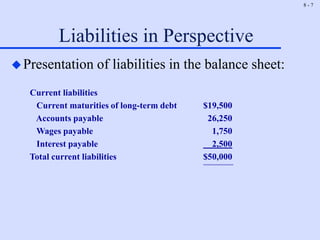

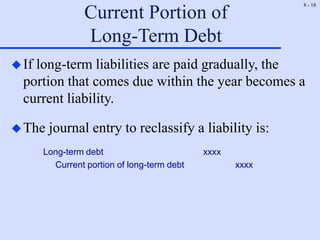

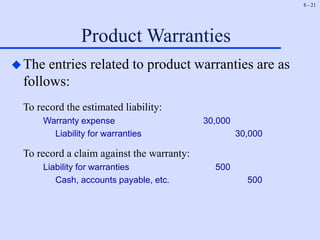

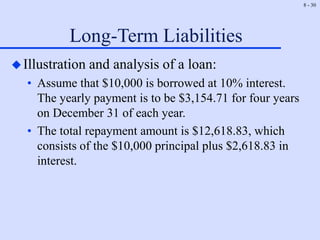

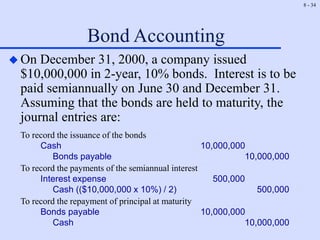

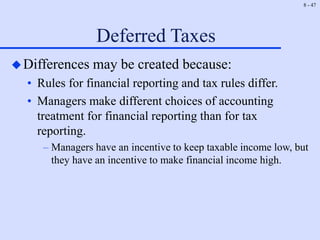

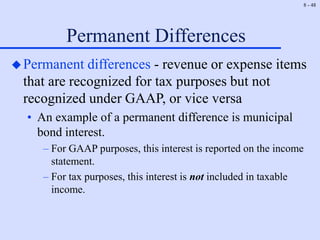

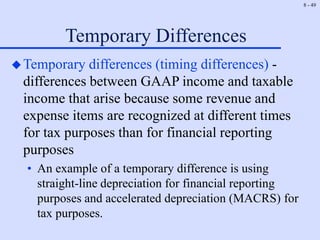

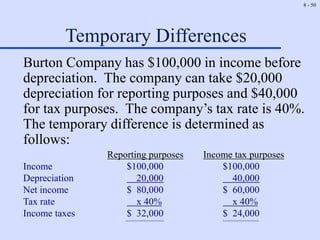

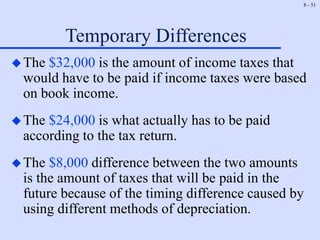

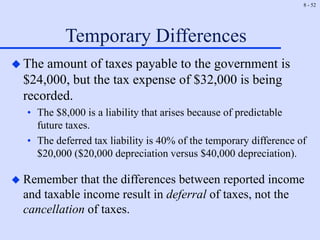

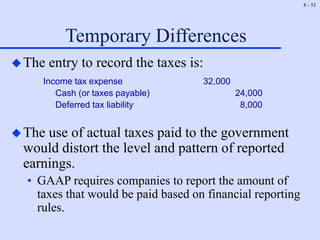

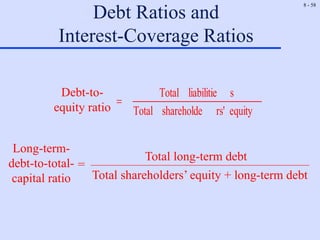

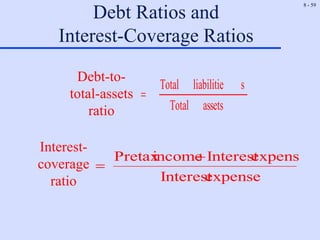

This document discusses the accounting of liabilities, emphasizing the classification of current and long-term liabilities, internal controls over payables, and various types of liabilities such as accounts payable, notes payable, and product warranties. It highlights the importance of maintaining accurate records and effective controls to prevent fraud, as well as detailing the relationship between liabilities and company financial health. Additionally, the document covers concepts of deferred tax liabilities and differences in financial reporting and tax regulations.