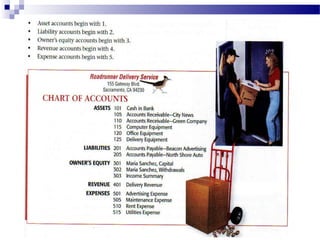

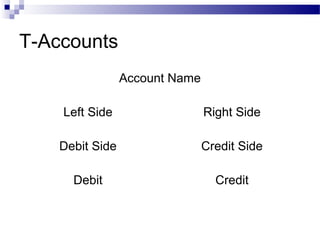

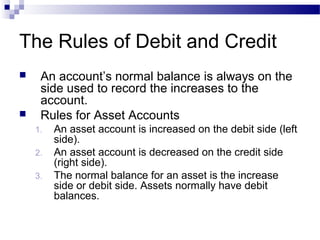

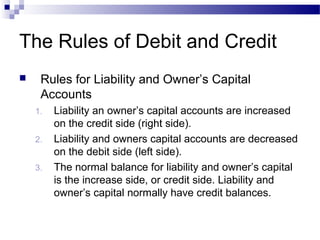

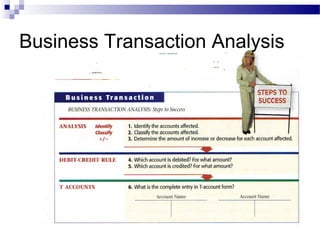

The document discusses accounting concepts such as T-accounts, debits and credits, the chart of accounts, and analyzing business transactions that affect assets, liabilities, and owner's equity through examples. It also provides an ethical scenario about software piracy and questions to consider for ethical decision making.