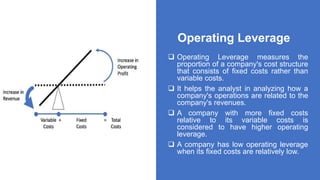

Operating leverage measures the proportion of a company's fixed costs compared to its variable costs. A company with higher fixed costs has higher operating leverage. Degree of operating leverage quantifies how much a company's operating income changes with changes in sales.

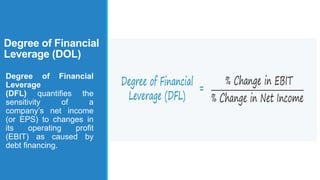

Financial leverage refers to using debt to fund assets, with the expectation that returns will exceed borrowing costs. Degree of financial leverage quantifies how sensitive a company's net income is to changes in operating profit due to debt financing.

Both operating and financial leverage are determined by the relationships between sales, operating profit, and net income, with operating leverage based on fixed operating costs and financial leverage based on fixed financing charges. Higher proportions of fixed costs or charges result in higher degrees of leverage.