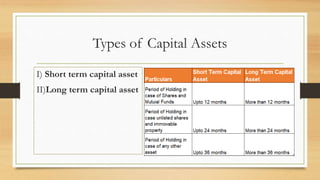

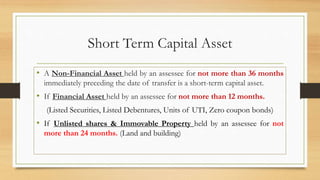

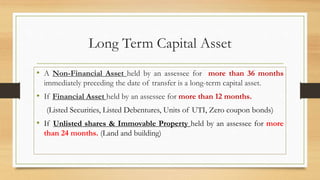

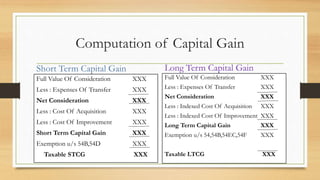

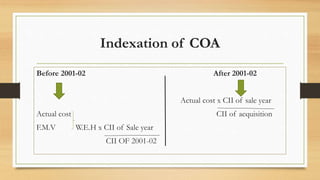

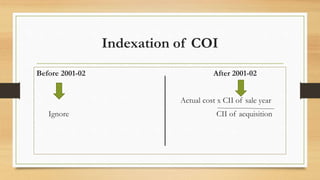

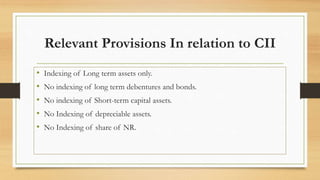

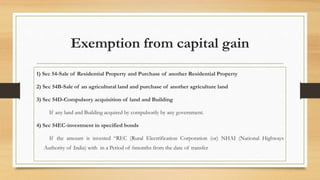

Capital gains are profits arising from the transfer of a capital asset. There are two types of capital assets - short term (held for less than 3 years for non-financial assets and 1 year for financial assets) and long term (held for more than 3 years/1 year). Capital gains are taxed differently based on whether the asset is short term or long term. Indexation of cost is allowed for long term capital gains to account for inflation. Various sections like 54, 54B, 54D, 54EC, 54F provide exemptions from capital gains tax if certain conditions are met like reinvestment of sale proceeds.