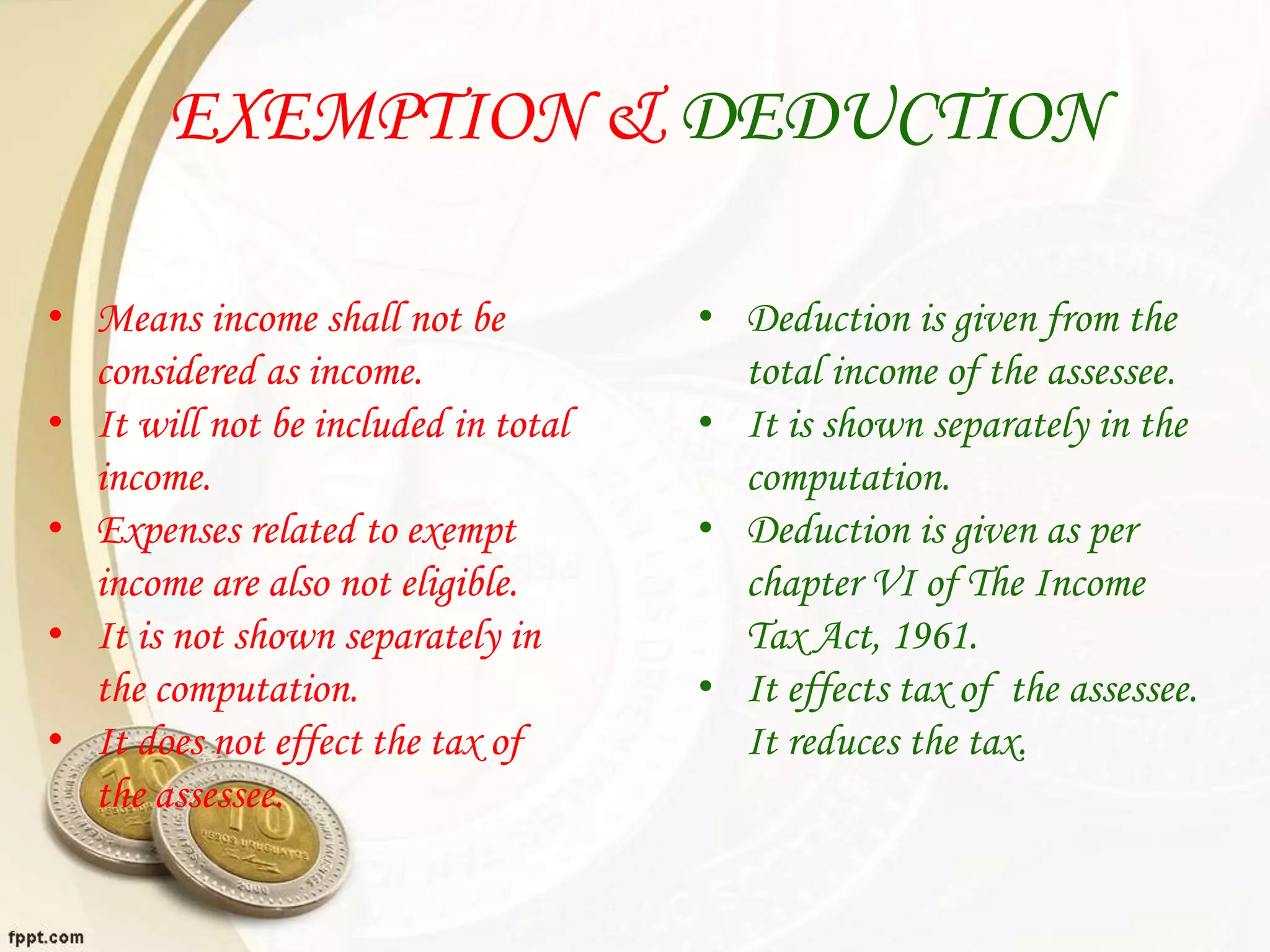

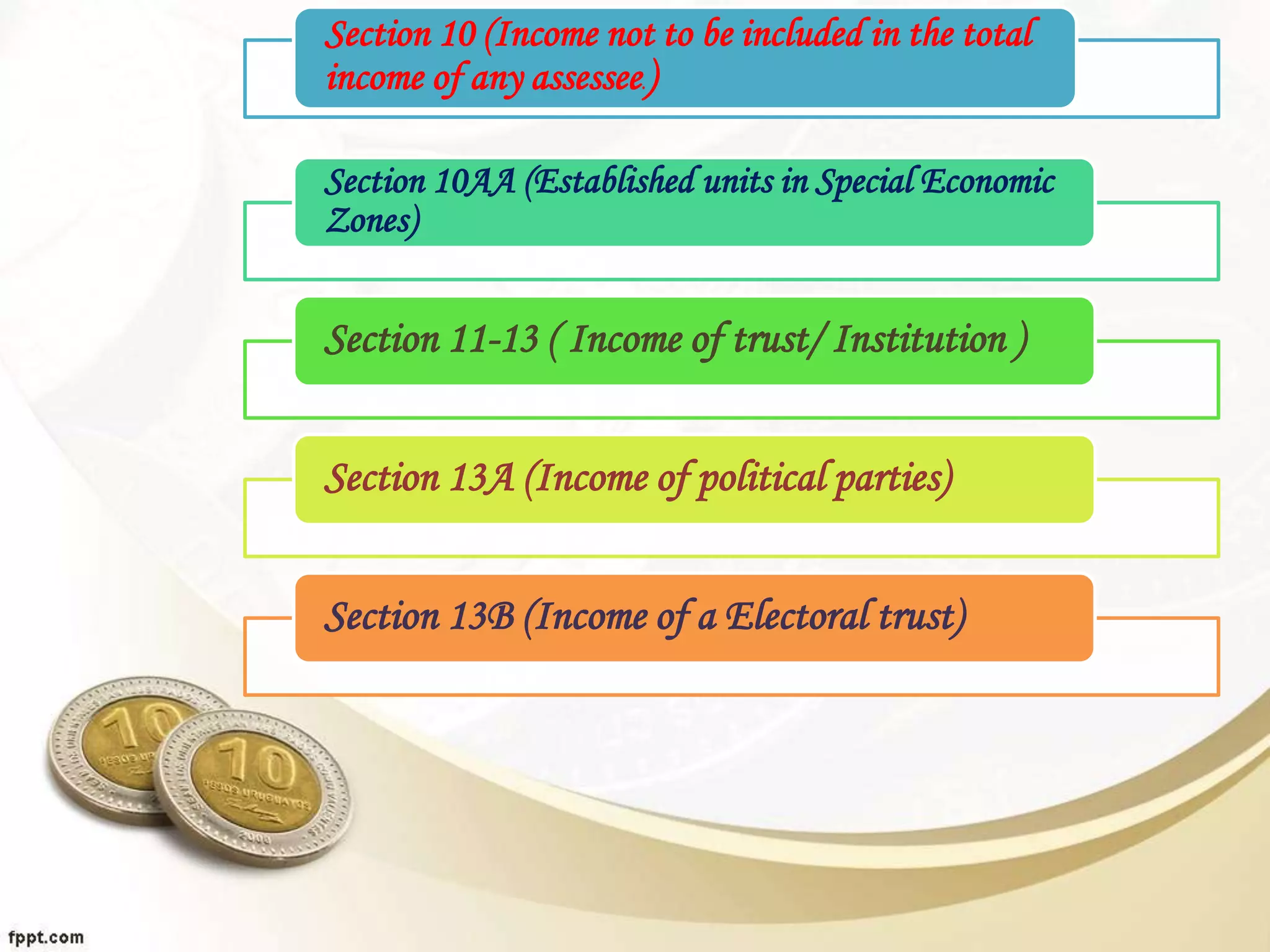

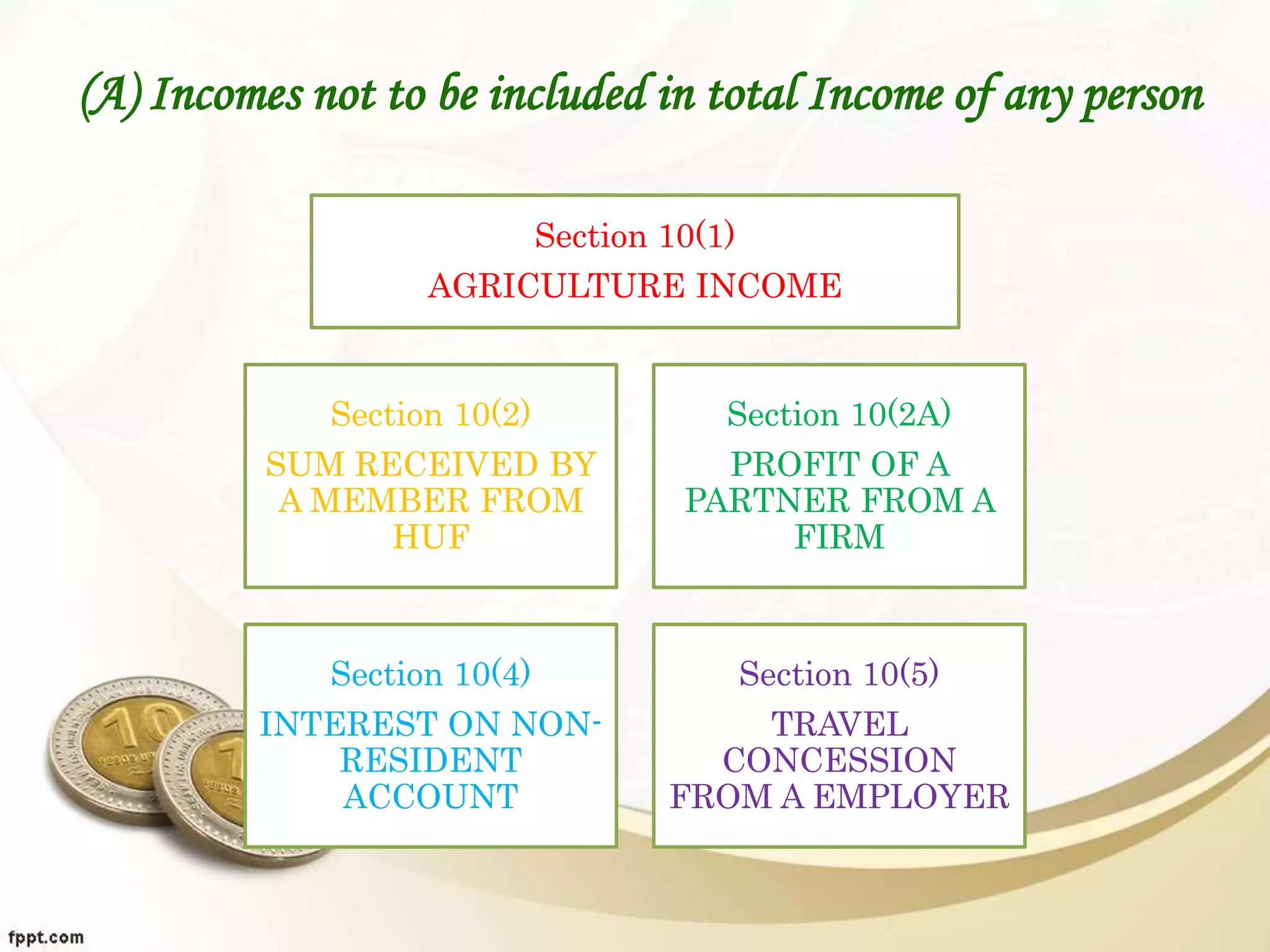

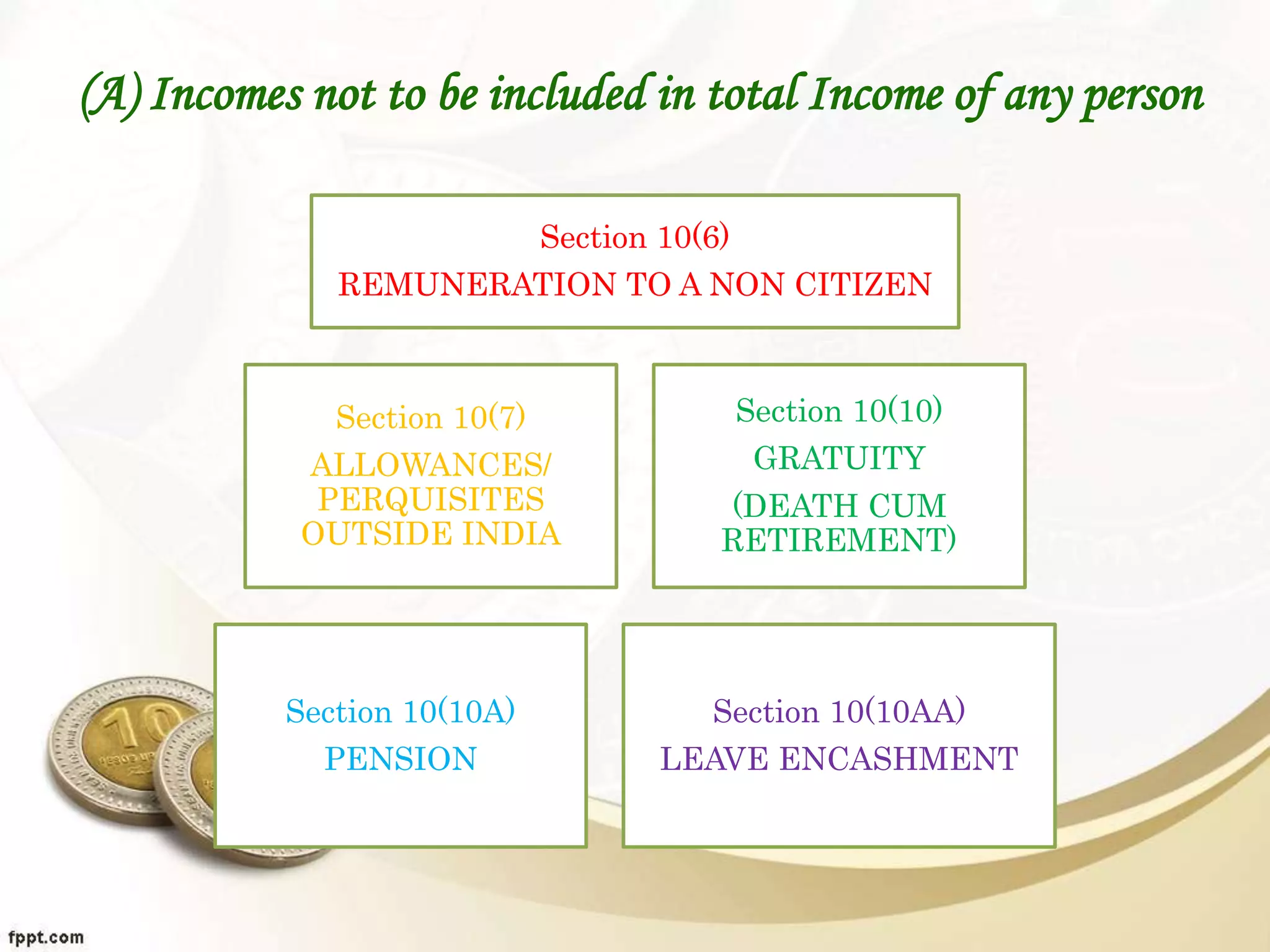

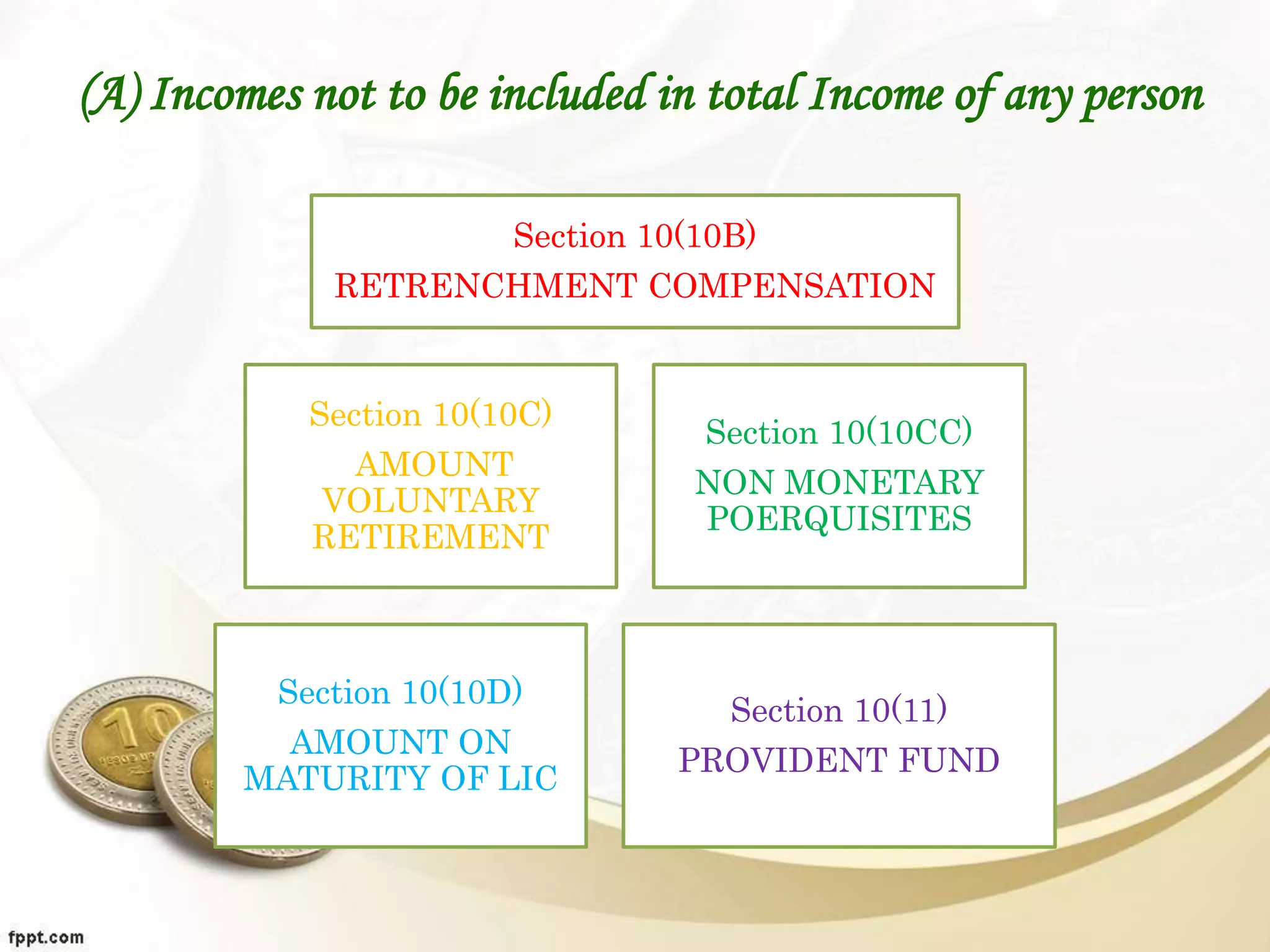

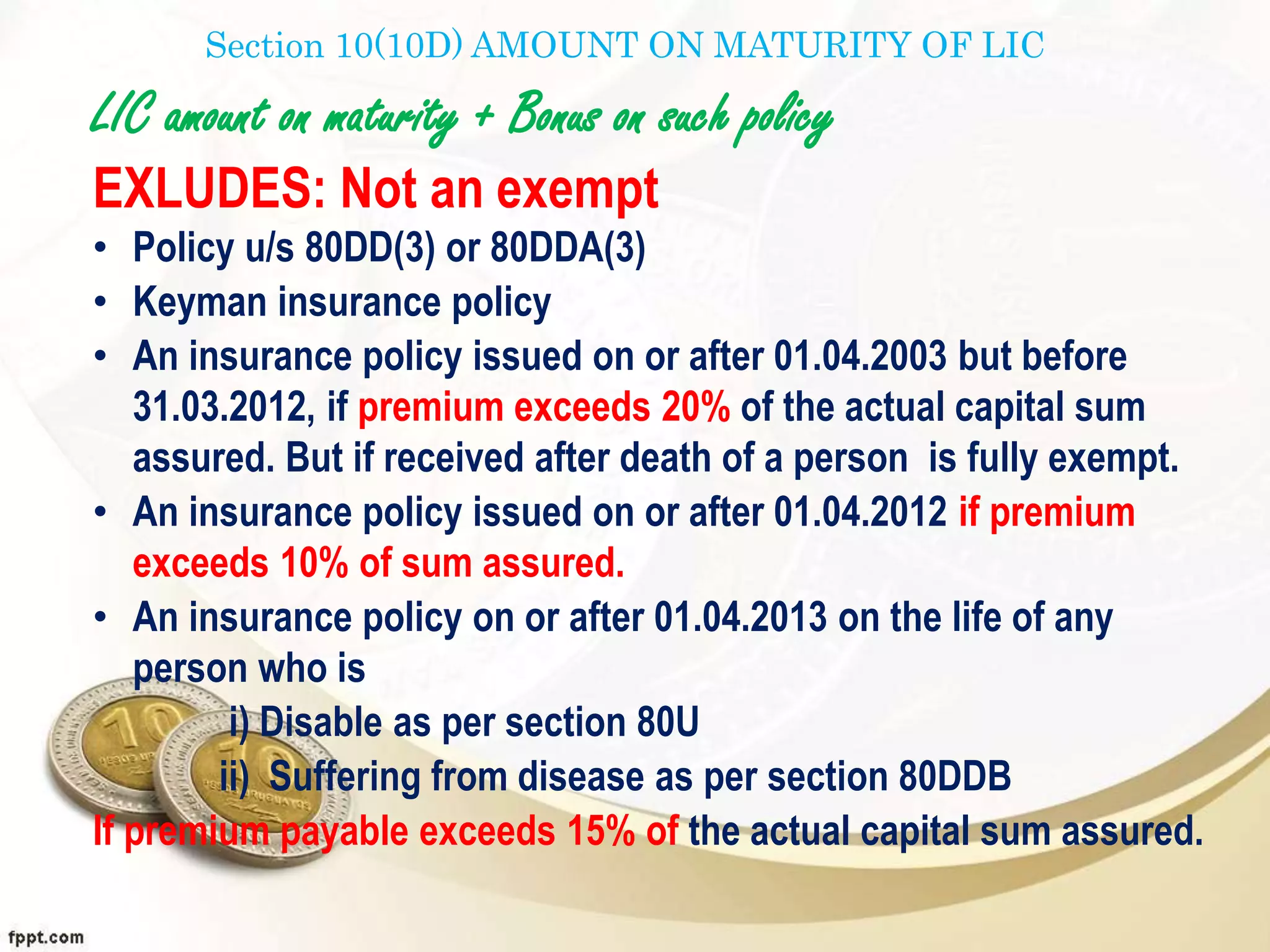

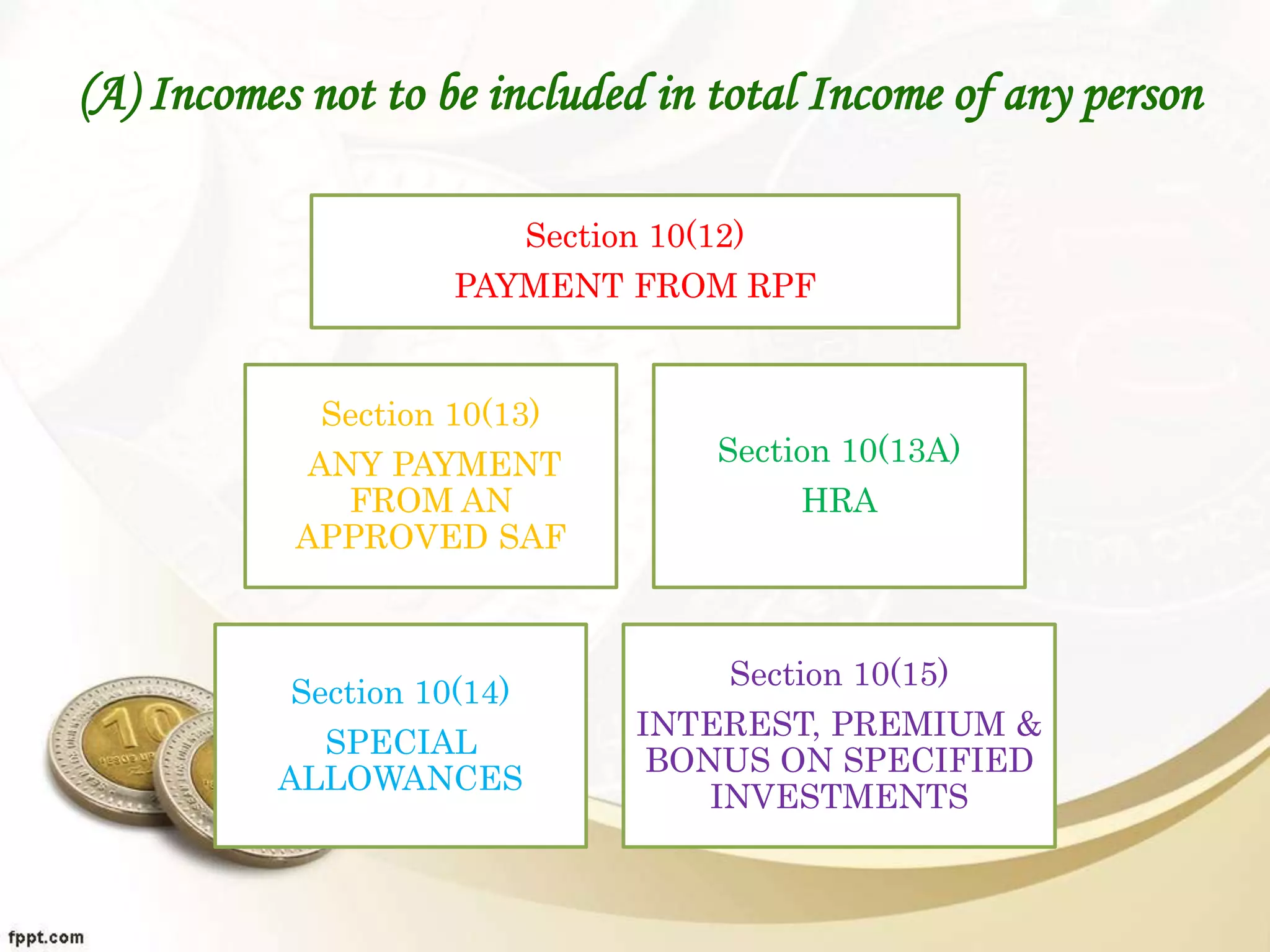

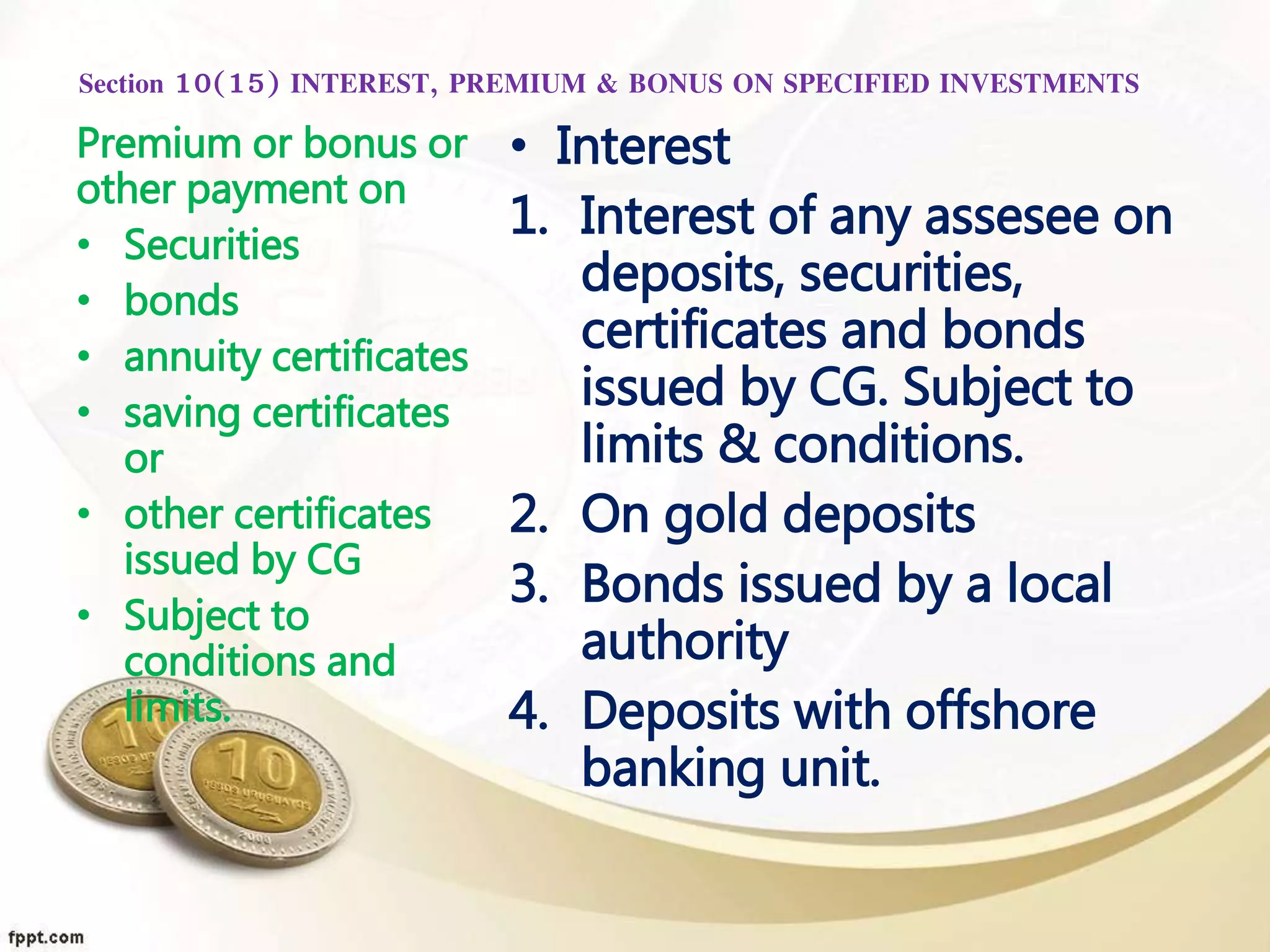

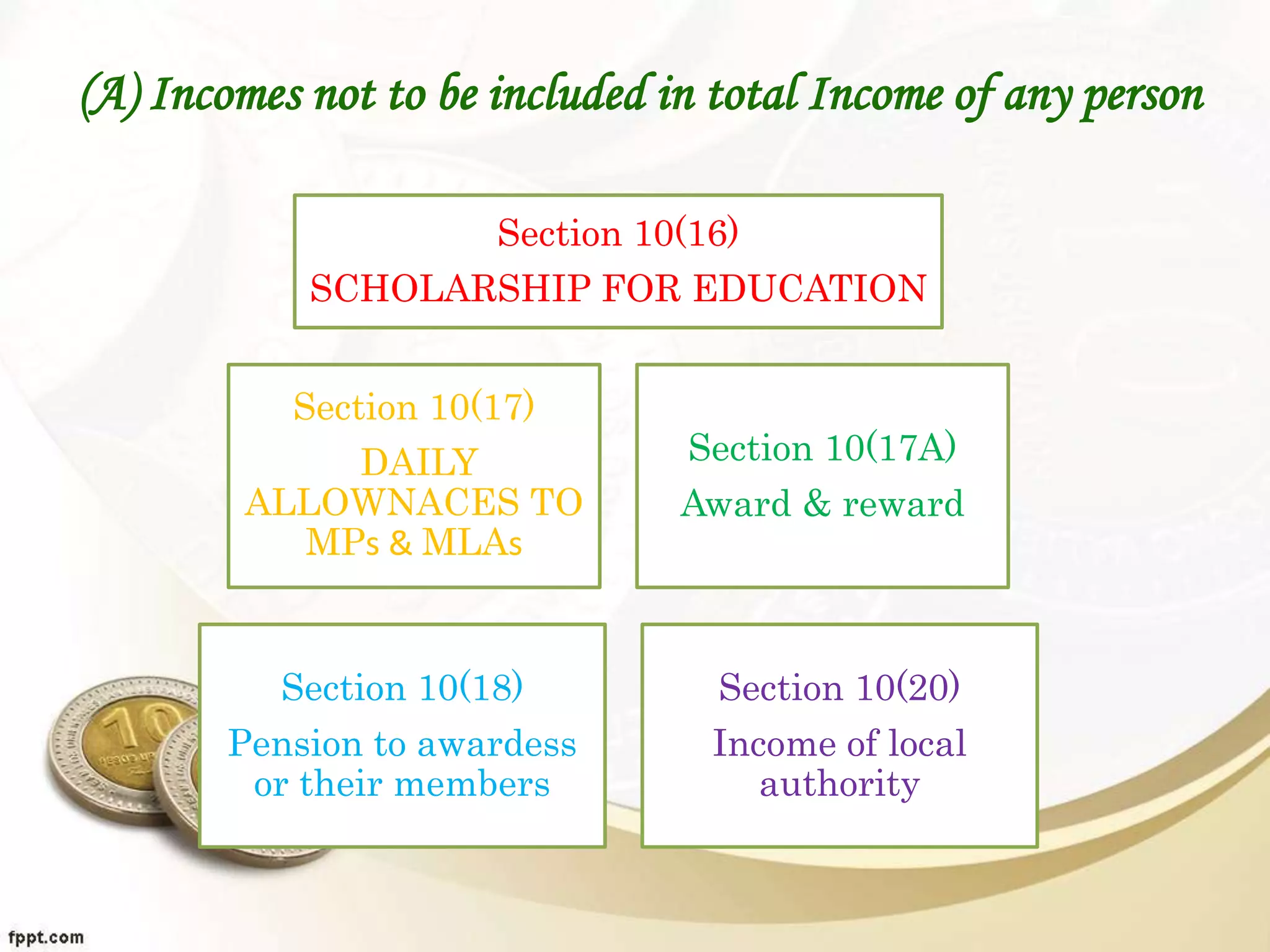

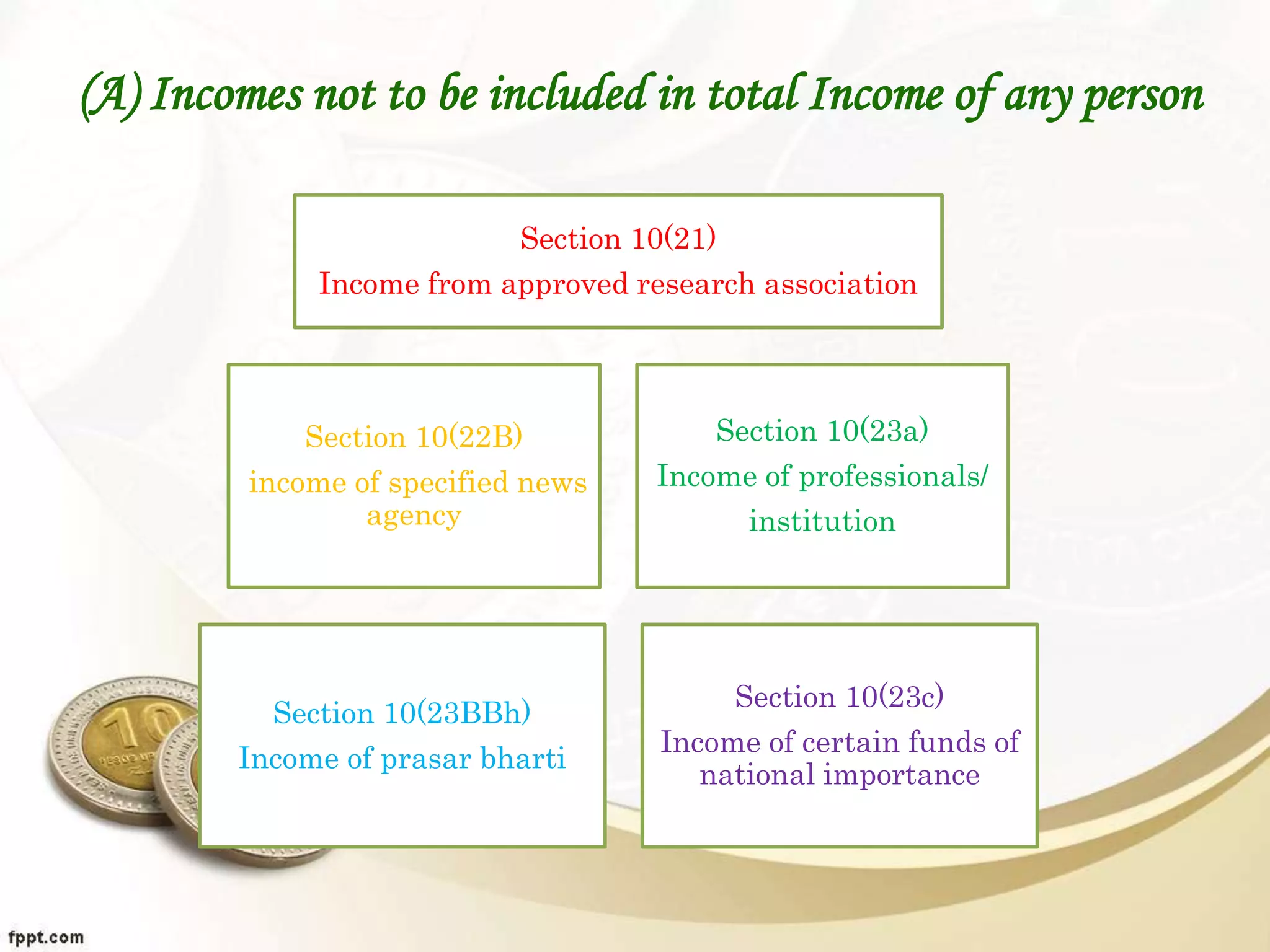

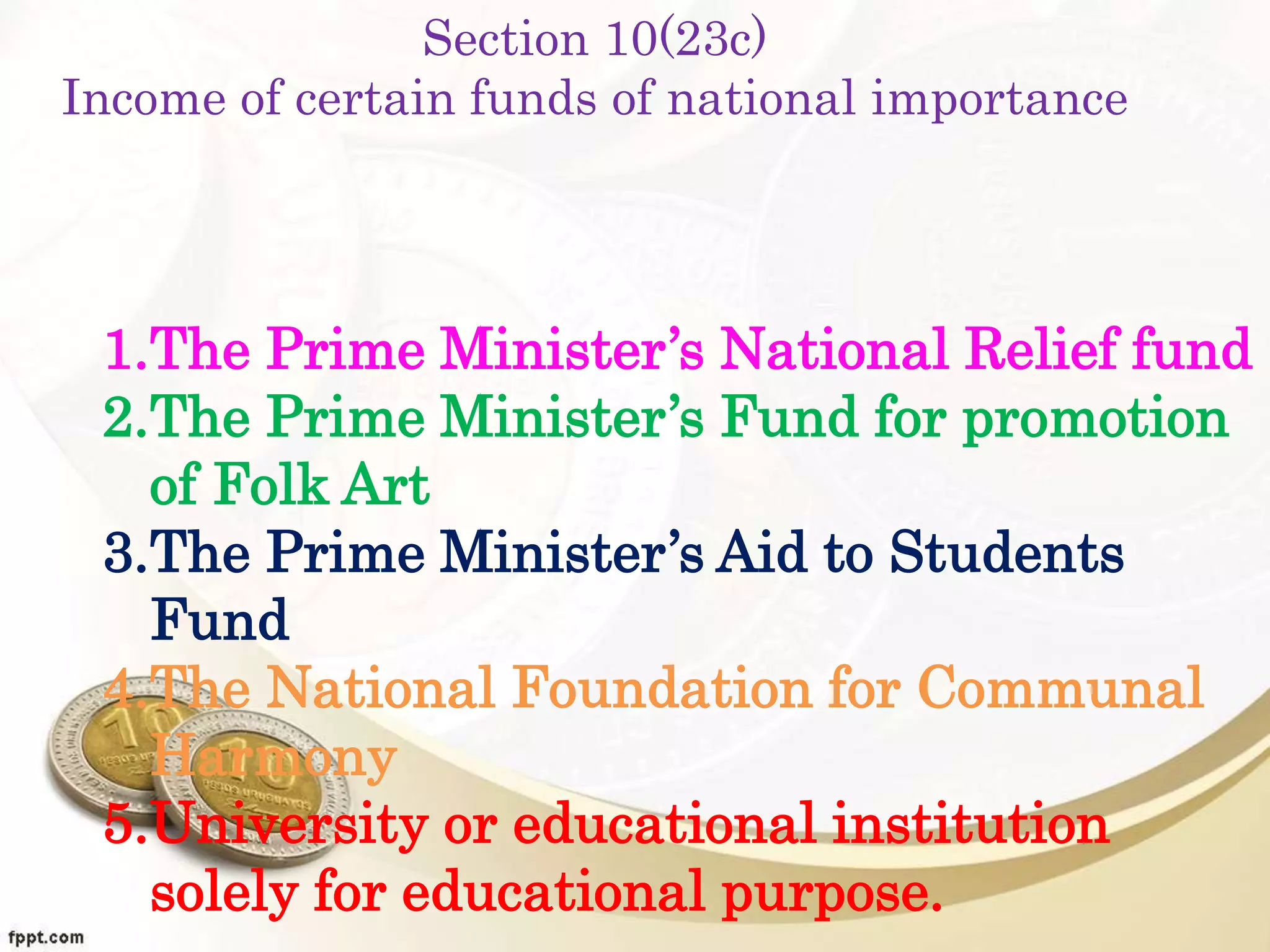

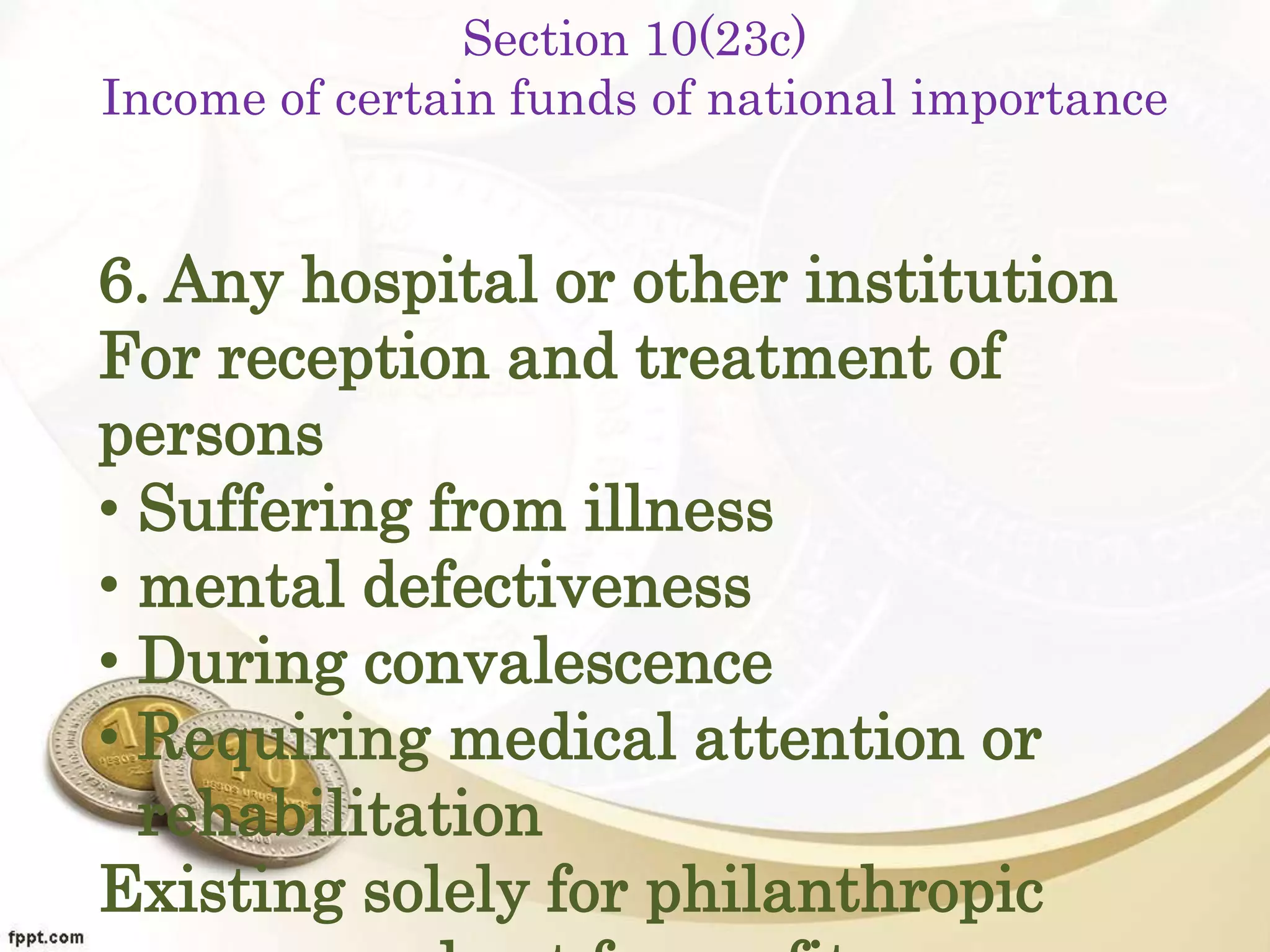

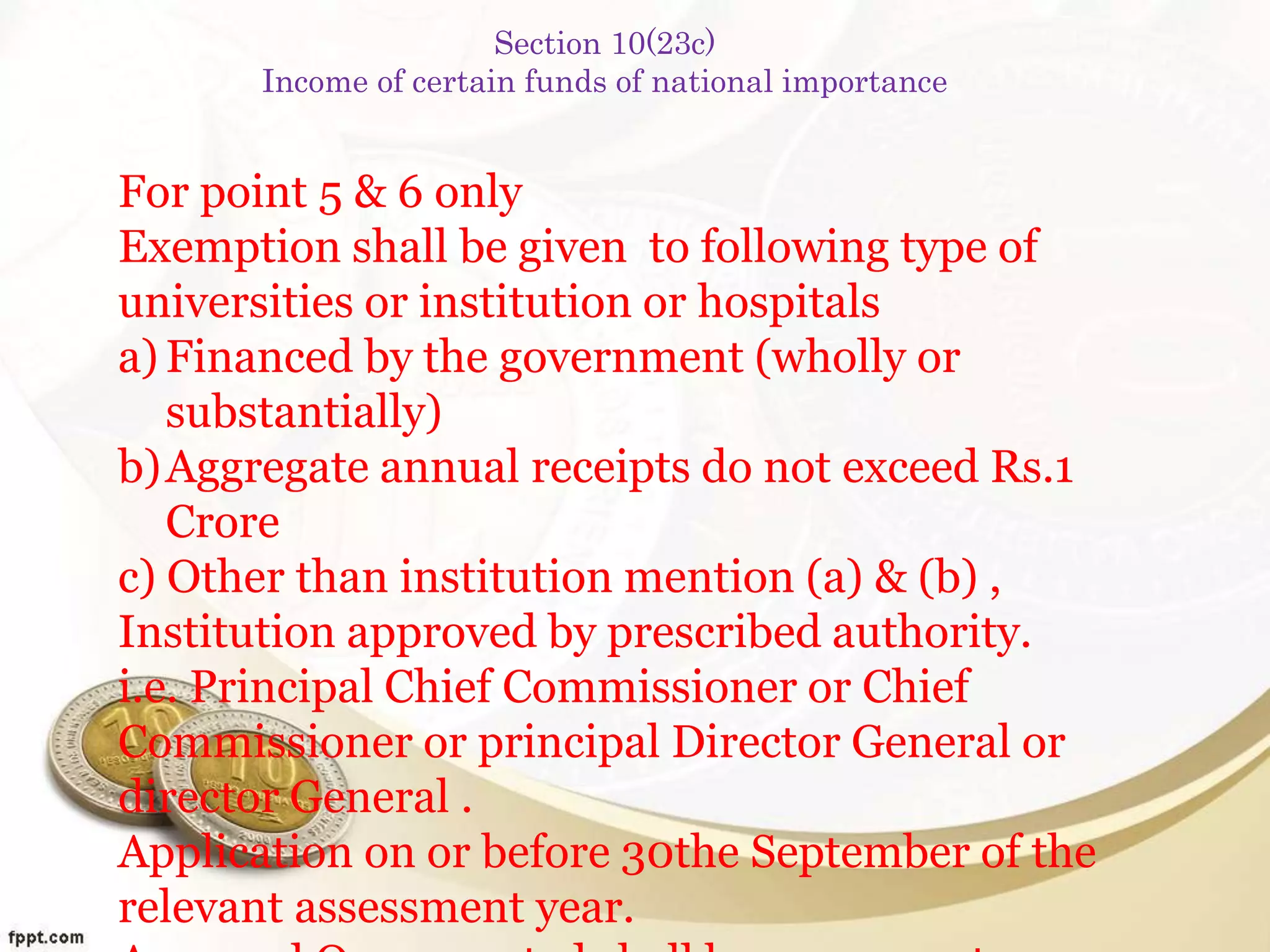

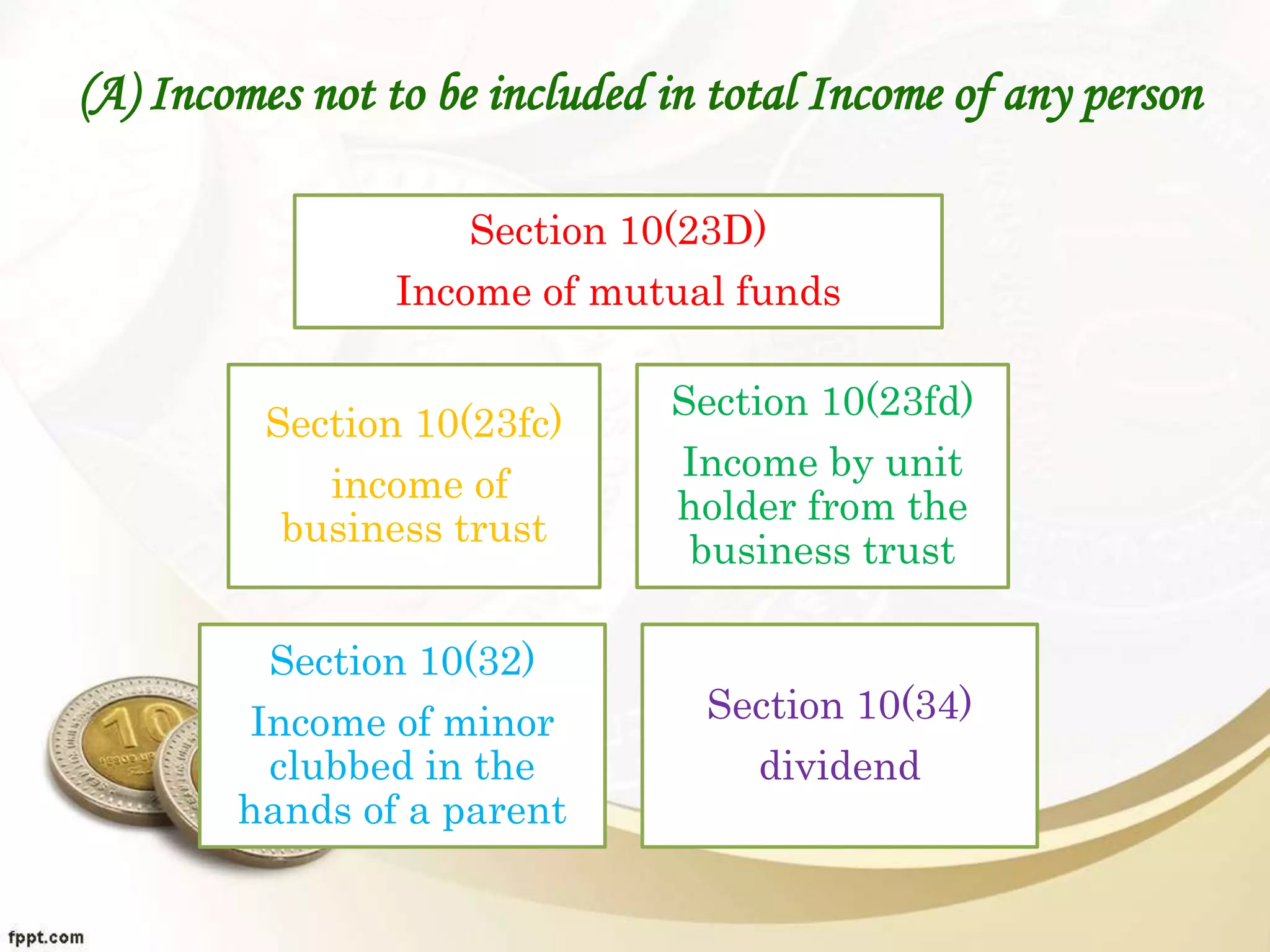

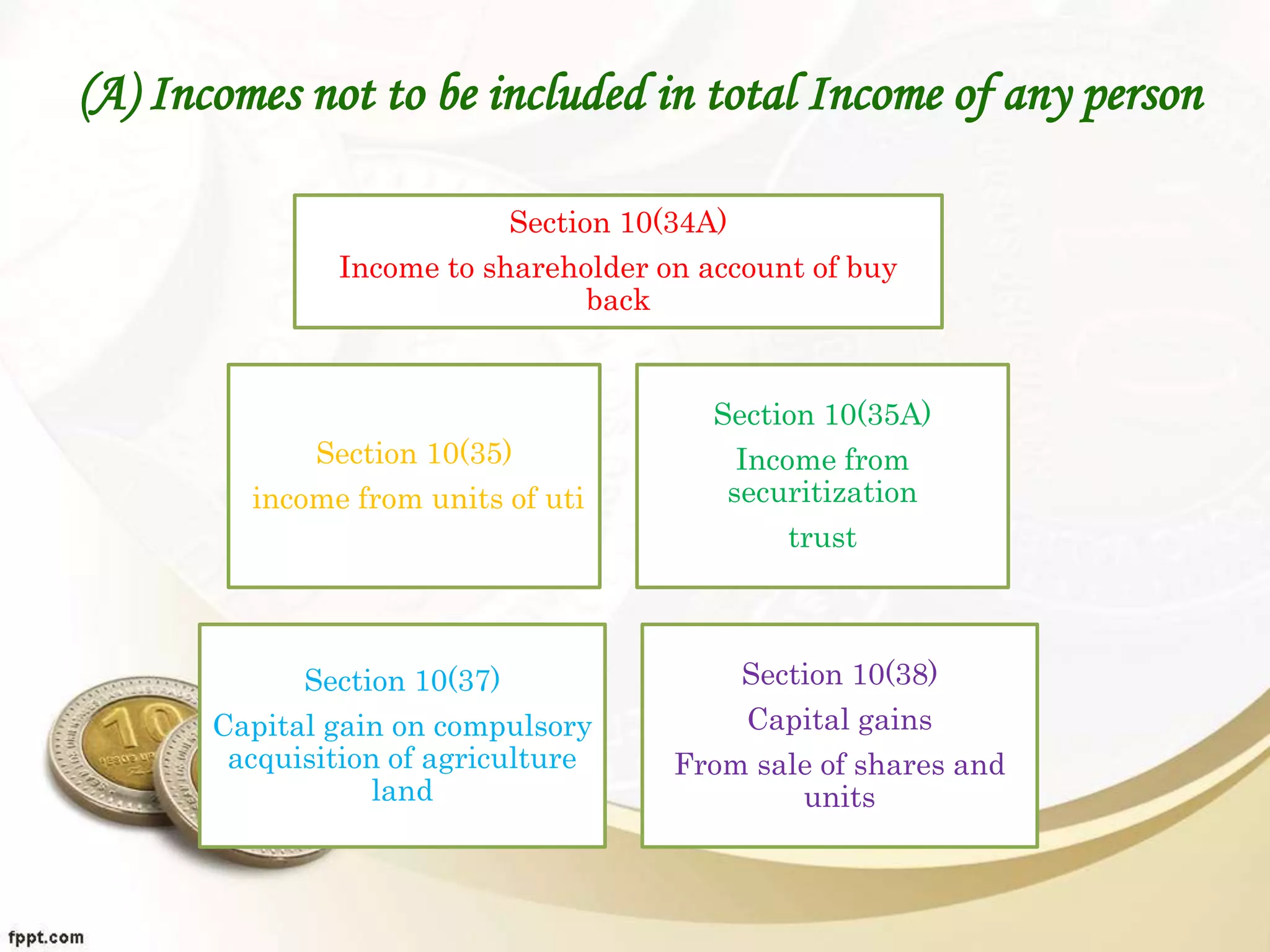

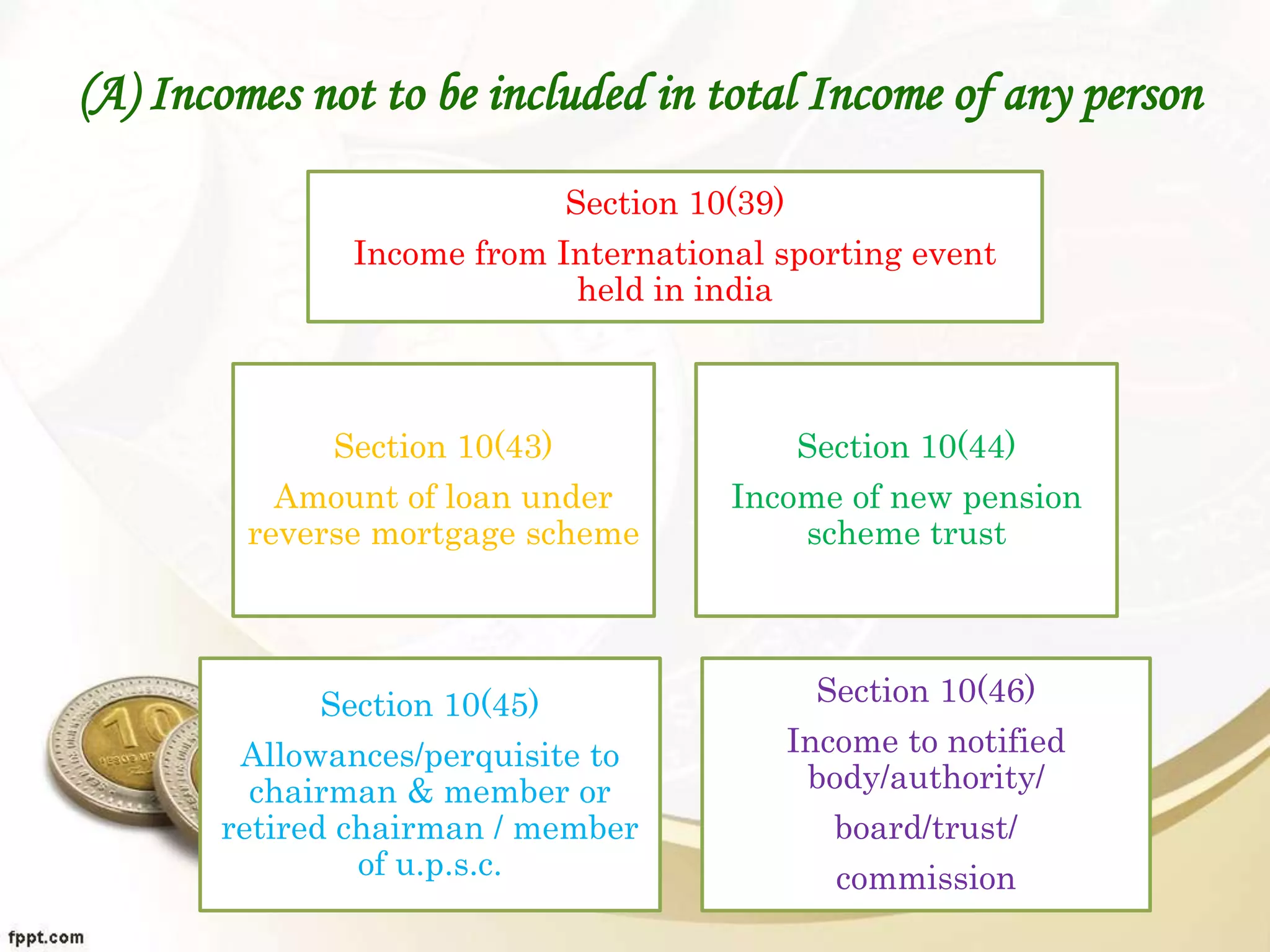

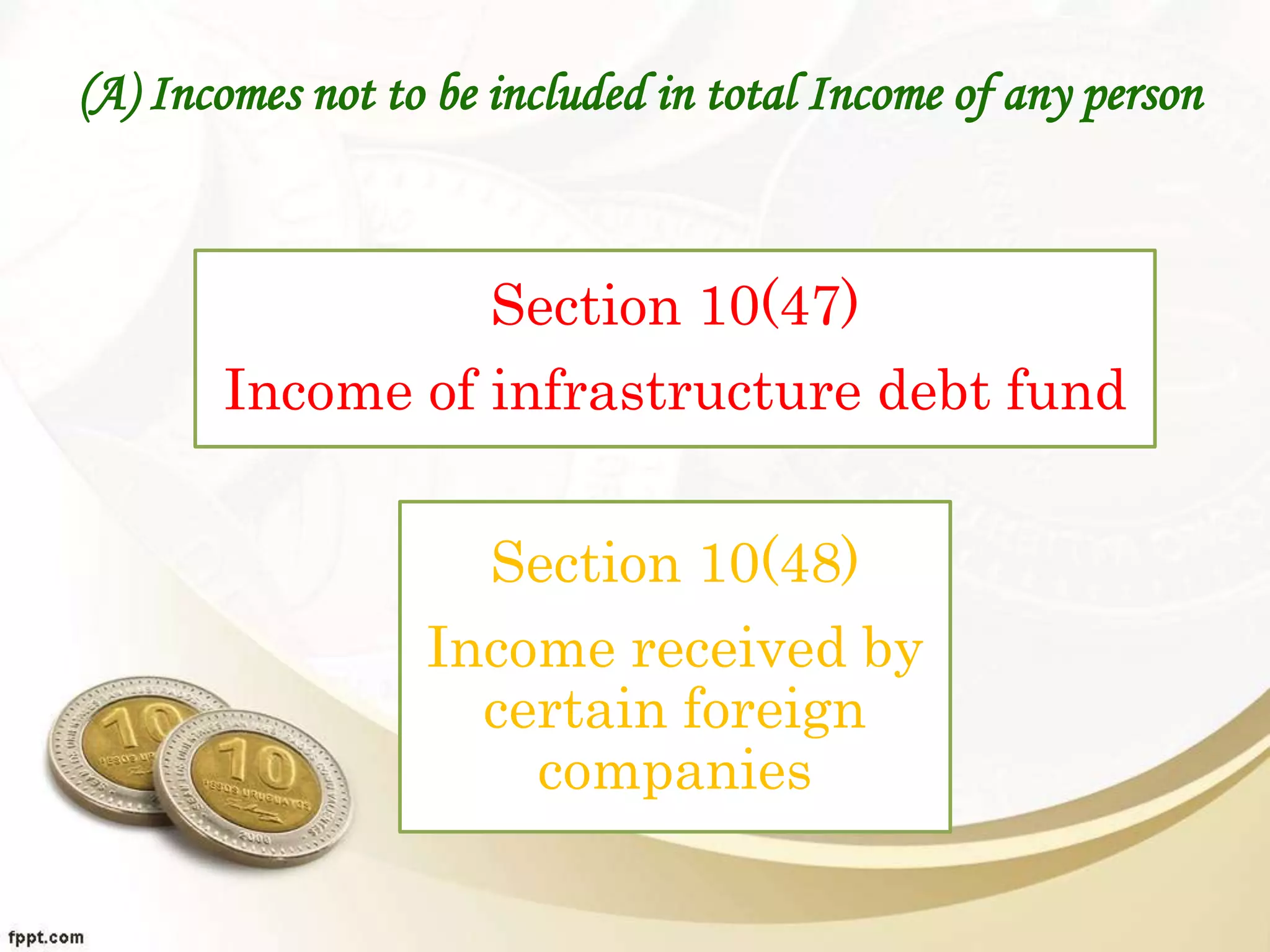

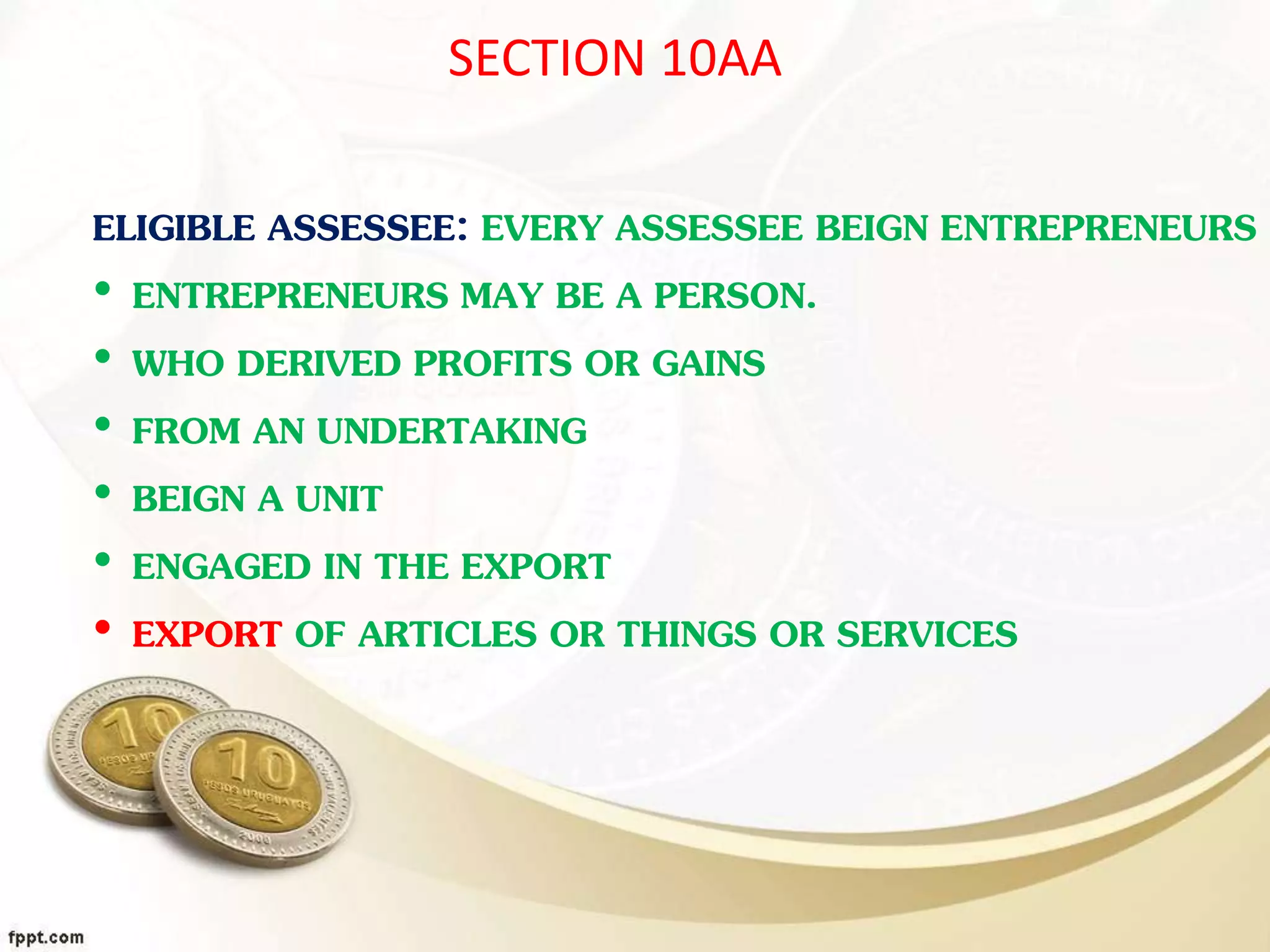

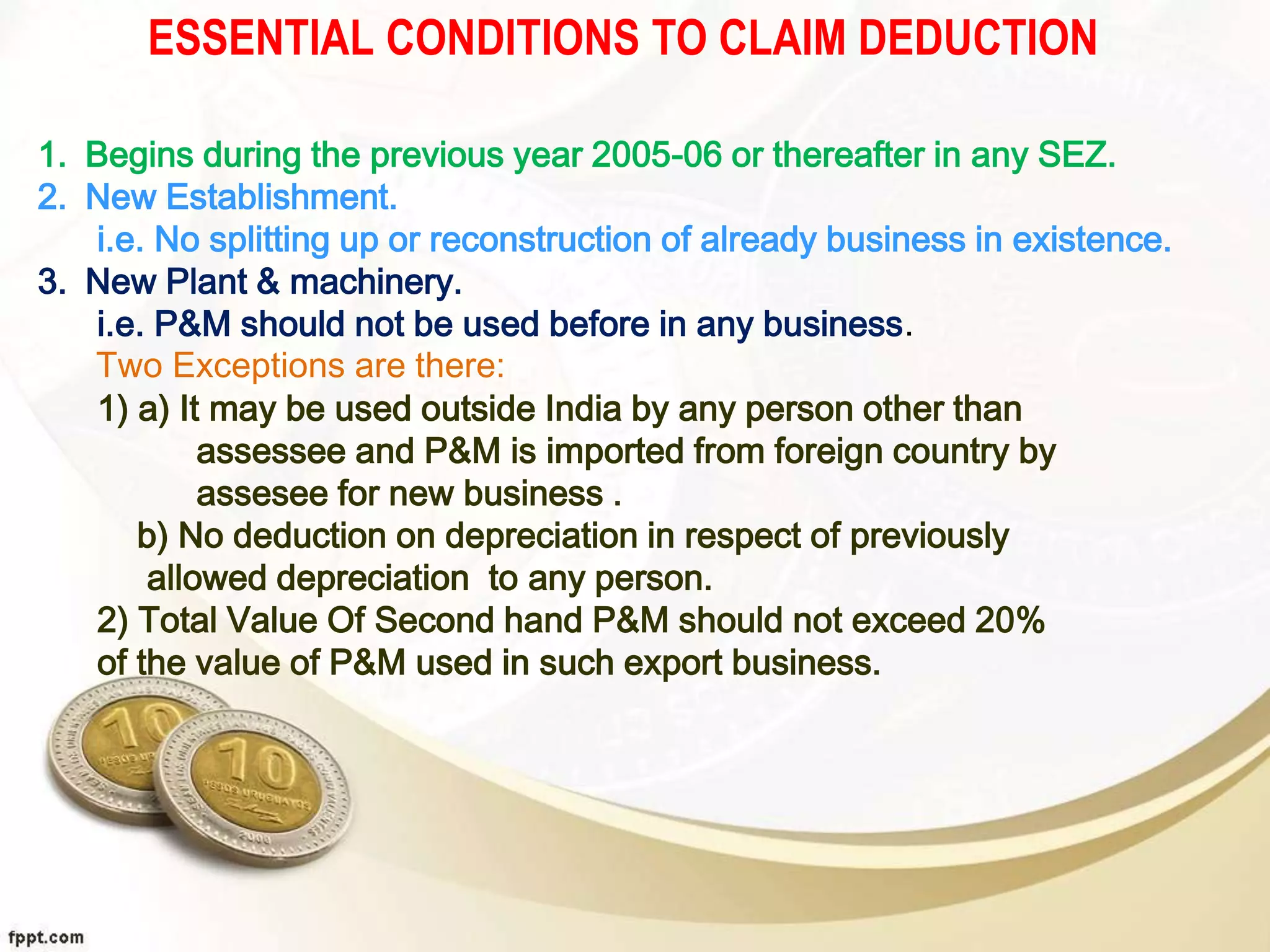

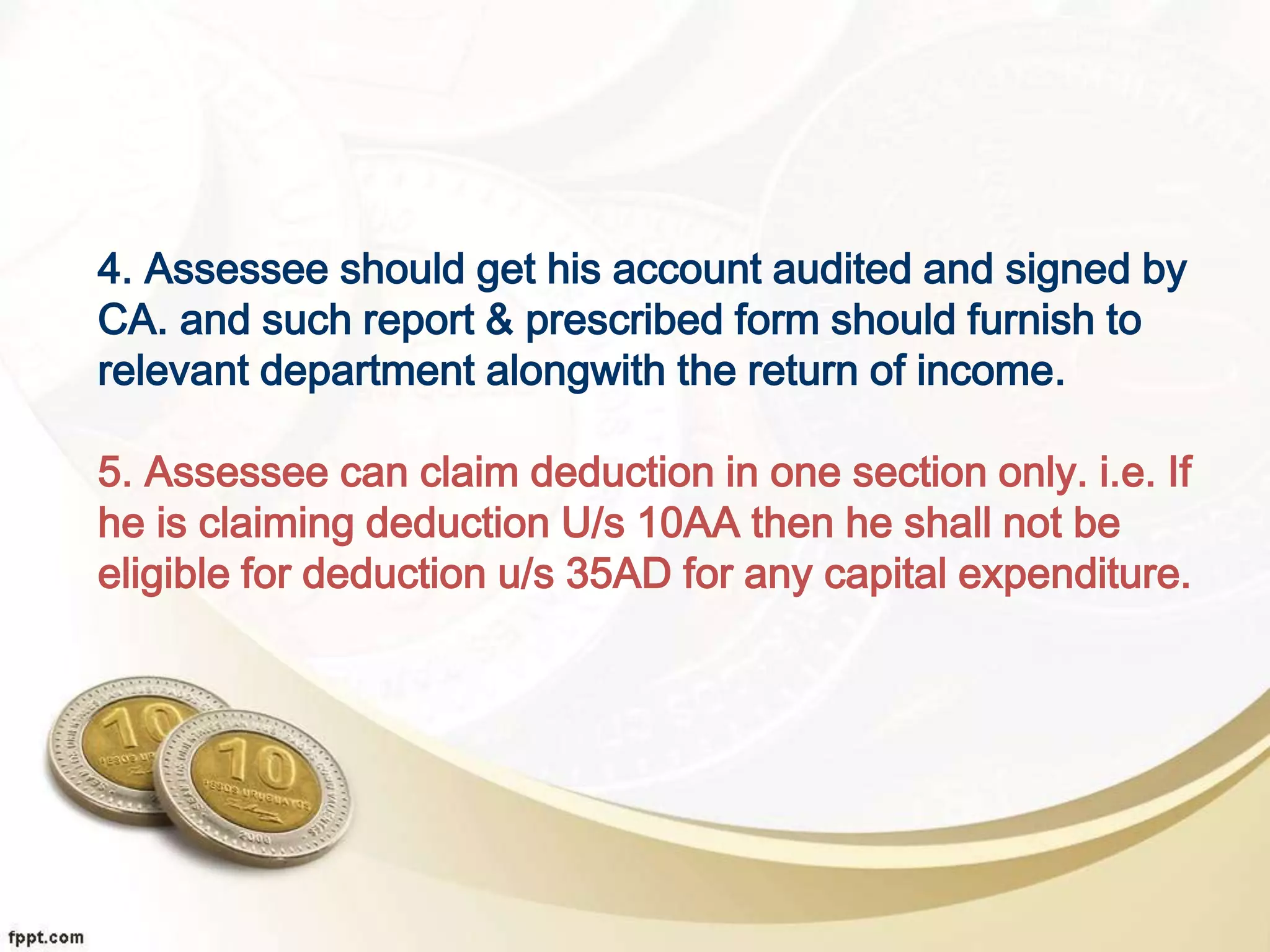

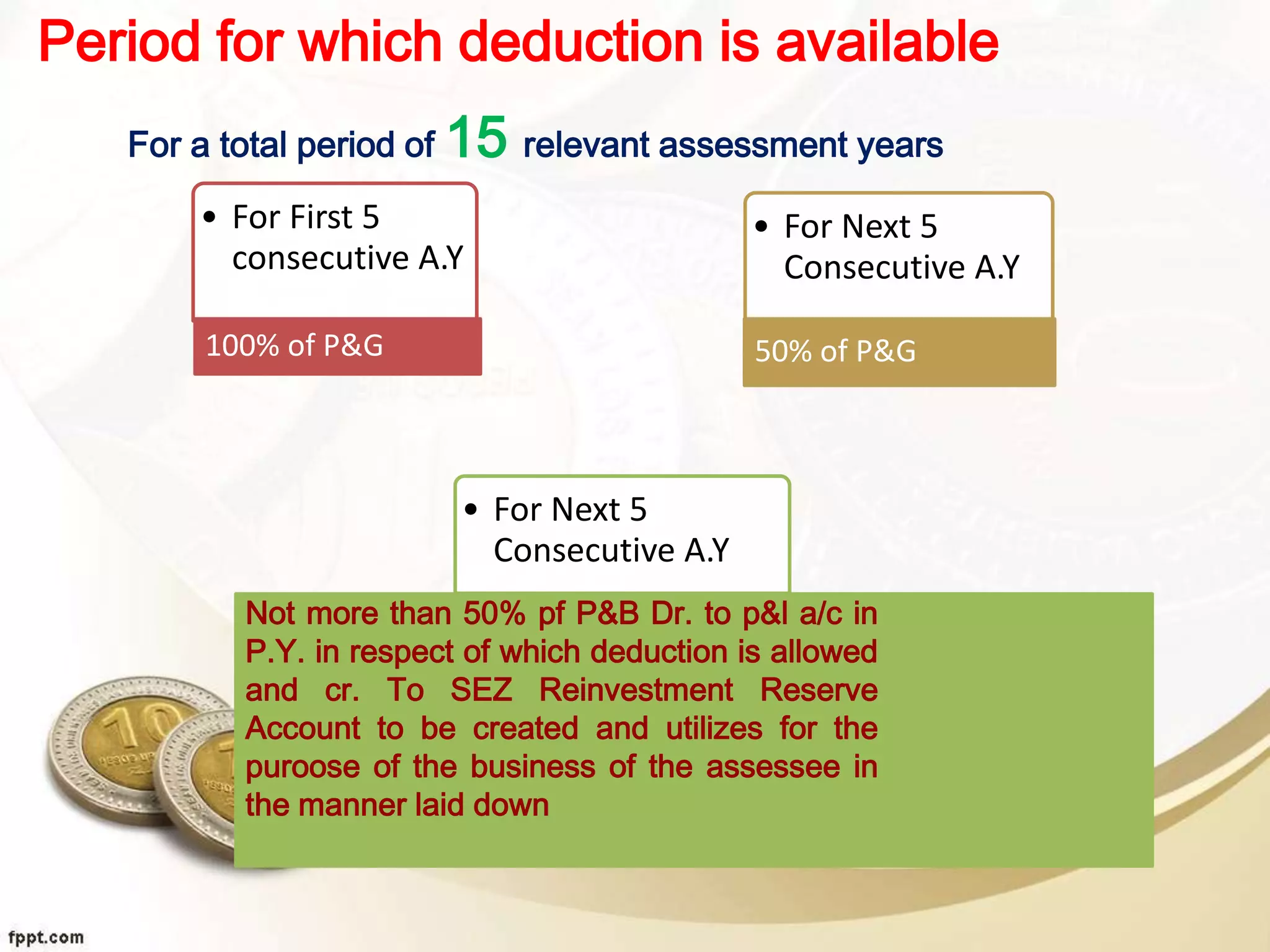

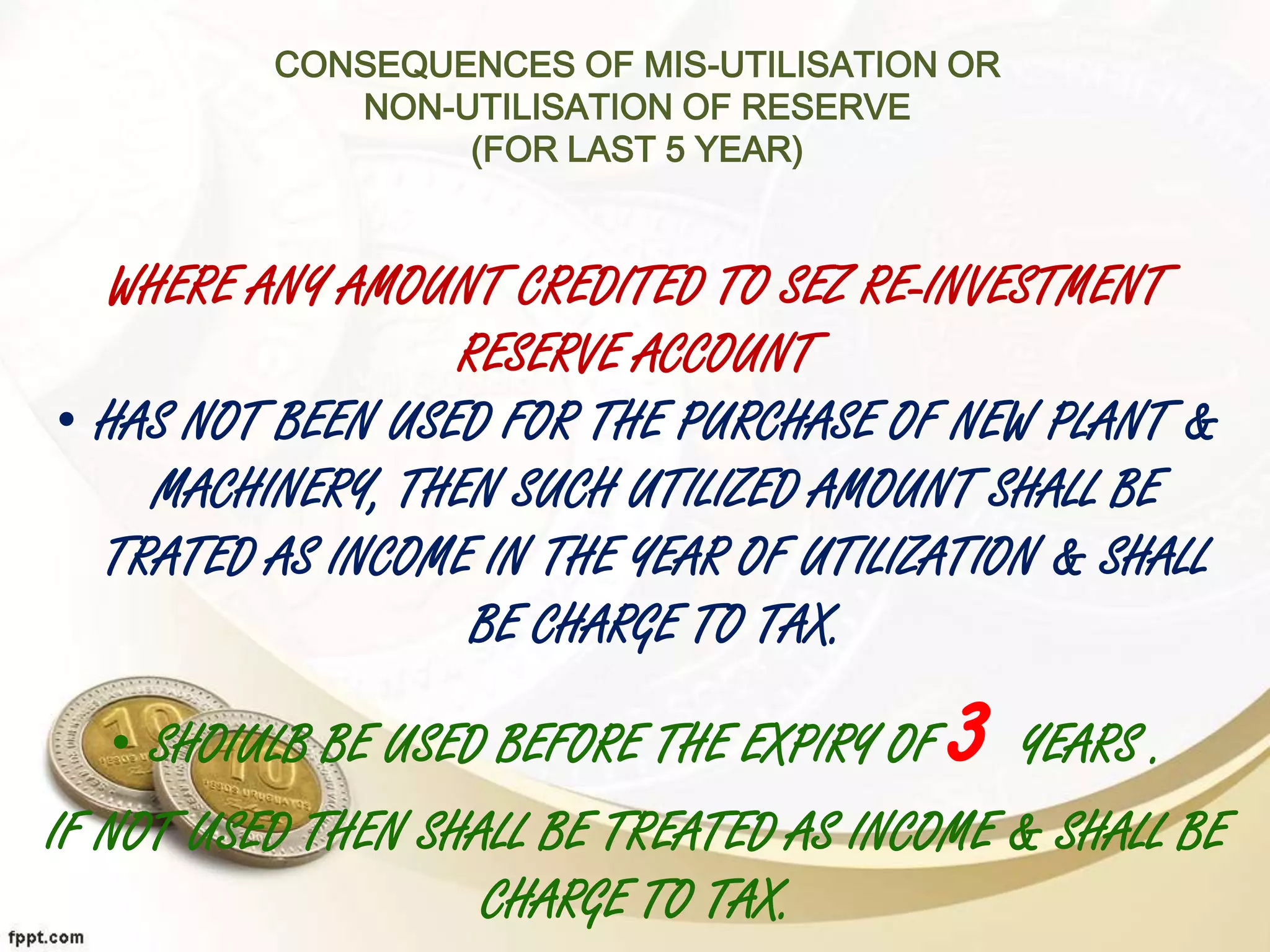

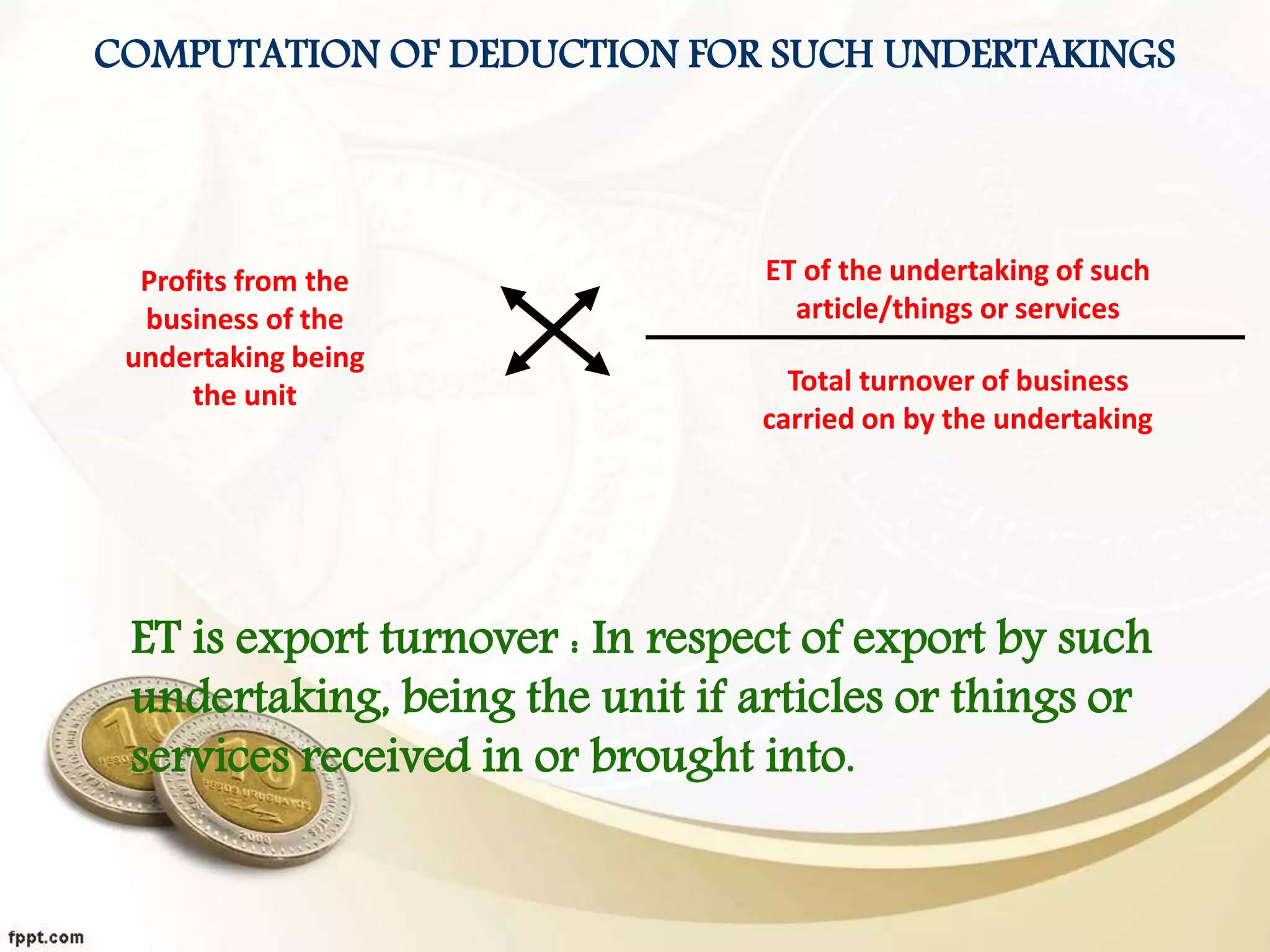

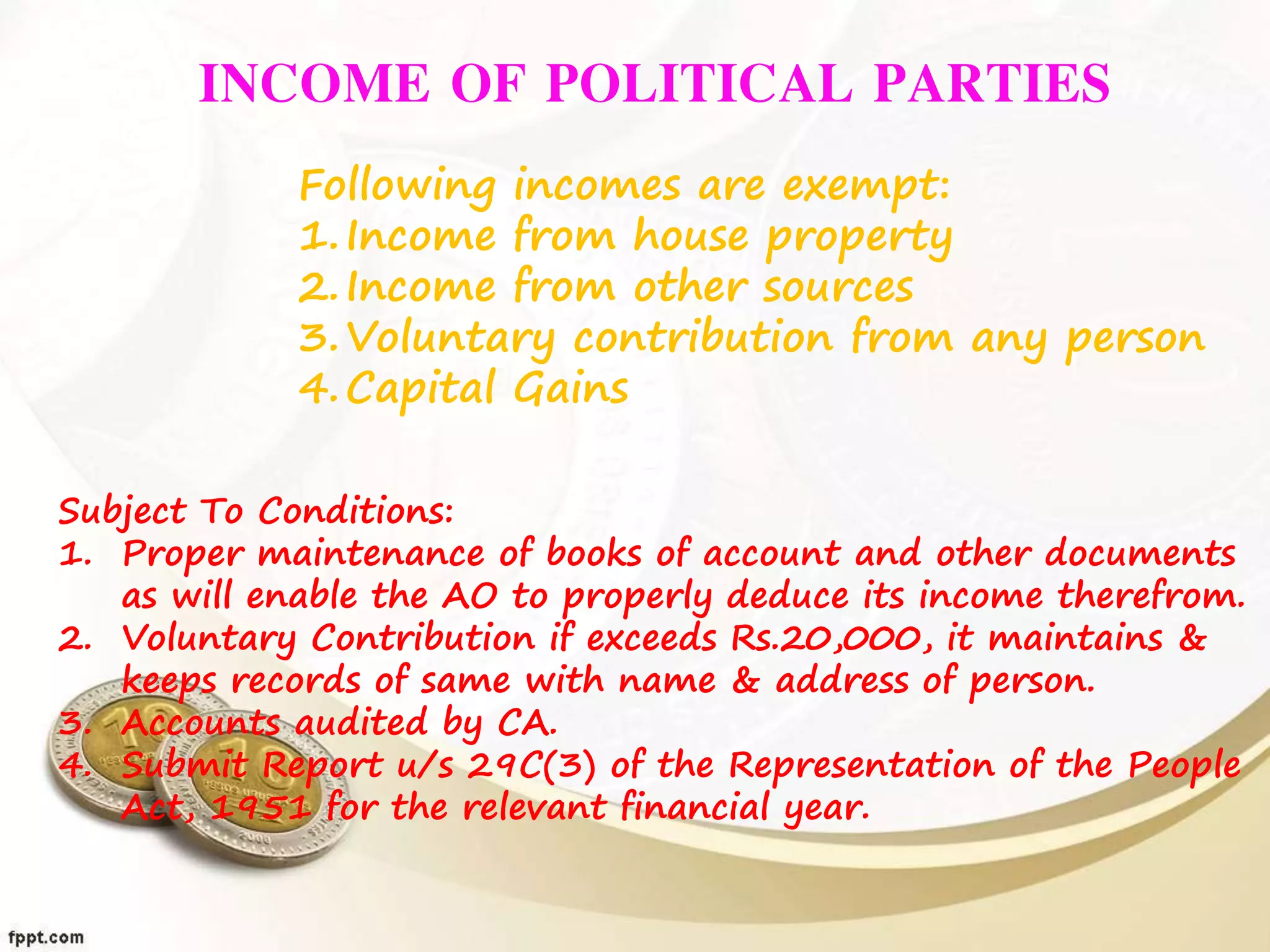

This document discusses various types of income that are exempt from tax in India. It explains that exempt incomes do not form part of an assessee's total income for tax computation. Sections 10-13A of the Income Tax Act list incomes that are totally or partially exempt. Some key exempt incomes mentioned include agriculture income, interest from certain bonds/deposits, leave encashment, gratuity, pension received by an assessee, and income of political parties and electoral trusts (subject to conditions). Special provisions like Section 10AA provide tax deductions to new units set up in Special Economic Zones for a certain period.