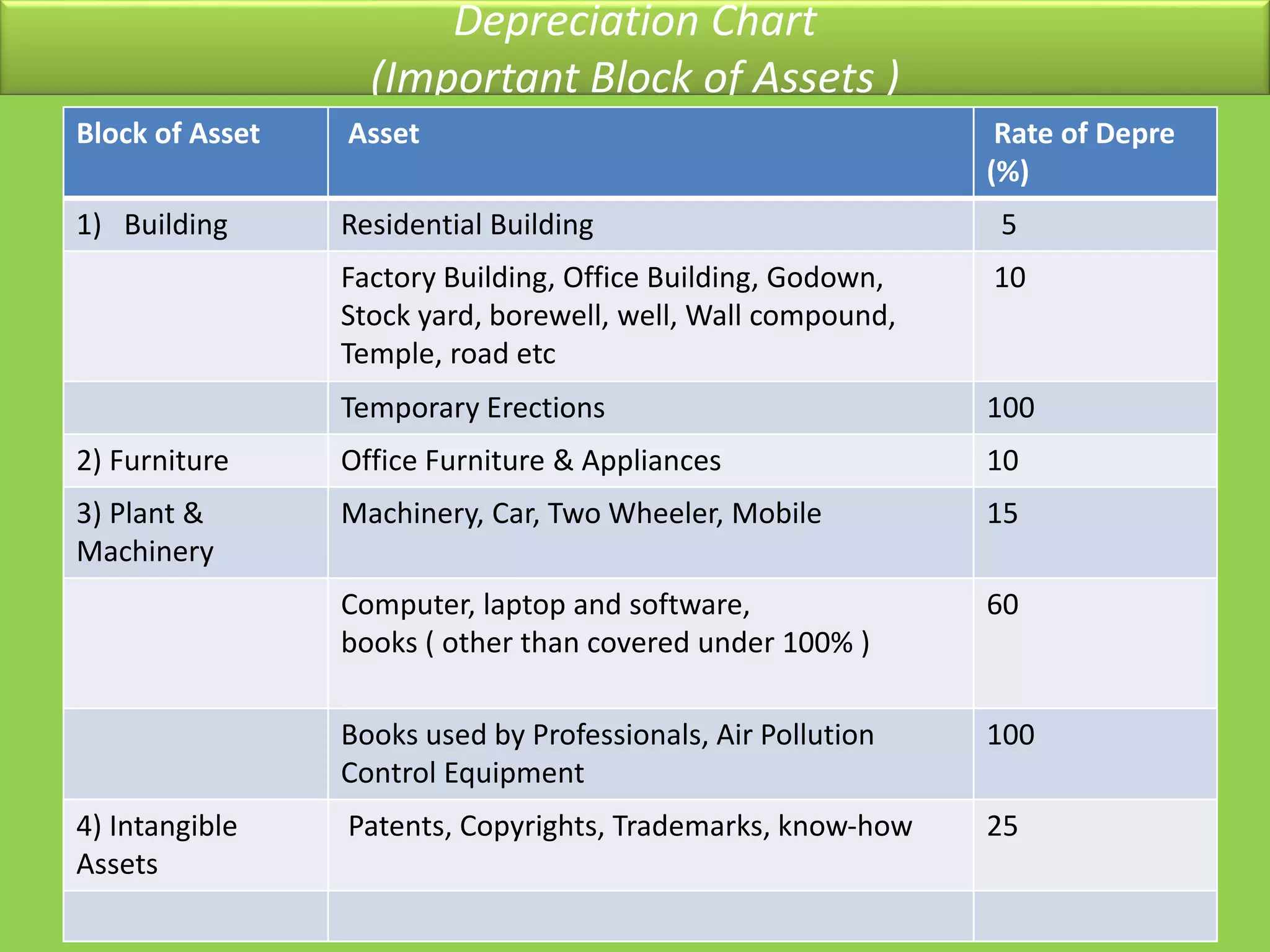

This document provides an overview of income from business and profession under the Indian Income Tax Act. It defines business and profession, outlines the key points and basis of charge for income from business/profession. It also discusses the computation of income, specific deductions allowed, depreciation rules and amounts that are not deductible. The key information includes definitions of business and profession, income includes profits and losses, relevance of accounting method, and that income from illegal businesses is taxable.

![Income from Business & Profession

Meaning of Business : [ Sec 2(13) ]

Business Includes,

a)Trade,

b) Commerce

c) Manufacture

d) Any adventure or concern in the nature of trade, commerce or

manufacture.

Meaning of Profession : [ Sec 2(36) ]

Profession includes vocation.

Profession requires purely intellectual skill or manual skill on the

basis of some special learning.](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-2-2048.jpg)

![Income from Business & Profession

Basis of Charge : [ Sec 28 ]

The following income shall be chargeable to income tax under the head “ Profit & Gains of

Business or Profession.

The profit or gains of any business or profession. [ Sec 28 (i) ]

Income derived by a trade, professional or similar association from specified services

performed for its members. [ Sec 28 (ii) ]

Export Incentive. [ Sec 28 (iiia), Sec 28 (iiib), Sec 28 (iiic), Sec 28 (iiid) ]

- Profit on sale of import license or duty entitlement pass book.

- Cash Assistant received or receivable by an exporter under any scheme of the Govt.

- Export Duty draw back.

The Value of any benefit or perquisite, whether convertible into money or not, arising from

business or the exercise of profession. [ Sec 28 (iv) ]

Any interest, Salary, bonus, commission or remuneration due to or received by a partner

from a firm. [ Sec 28 (v) ]

Any Sum received for not carrying out any activity in relation to any business or not to share

any know-how, patent, copyright, trademark etc. [ Sec 28(va) ]

Income from speculative transaction

Any sum received under Keyman Insurance Policy including Bonus on such policy.](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-4-2048.jpg)

![Income from Business & Profession

COMPUTATION OF INCOME FROM BUSINESS [ Sec 29 ]

The profit and gains of business or profession shall be computed in accordance with

the provisions contained in Sec 30 to 44 DB.

It must however be noted that the allowances and deductions are not exhaustively

listed.

Admissibility of deduction will depend upon the method of accounting followed by

assessee, subject to deeming provisions of the Act.](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-5-2048.jpg)

![Income from Business & Profession

SPECIFIC DEDUCTIONS [ Sec.30 to Sec 37 ]

1. Rent, Rates ,Taxes & Insurance for Building [ Sec 30 ]

2. Repairs & Insurance of Plant & Machinery , Furniture [ Sec 31 ]

3. Depreciation [ Sec 32 ]

4. Investment Allowance [ Sec 32 AC ]

5. Tea/Coffee/Rubber Development A/c [ Sec 33 AB ]

6. Site Restoration Fund [ Sec 33 ABA ]

7. Reserve for Shipping Business [ Sec 33 AC ]

8. Scientific Research Exp [ Sec 35 ]

9. Amortisation of telecom licence fees [ Sec 35 ABB ]

10. Expenditure on eligible projects or scheme [ Sec 35 AC ]

11. Deduction in respect of exp on specific business [ Sec 35 AD ]

12. Payment to Association and institution for carrying out rural development program [ Sec 35

CCA ]

13. Weighted deduction for expenditure incurred on Agricultural Extension Project [ Sec 35 CCC ]

14. Weighted deduction for expenditure for skill development [ Sec 35CCD ]

15. Amortisation of Preliminary Expenses [ Sec 35 D]

16. Amortisation of Expenditure on development of certain minerals [ Sec 35 E ]](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-6-2048.jpg)

![Income from Business & Profession

-: Deduction U/s 36 :-

1. Insurance Premium [ Sec 36 (1) (i) ]

2. Insurance premium paid by a Federal Milk Co-op Socierty [ Sec 36 (1)(ia ]

3. Insurance premium on health of employees [ Sec 36(1) (ib) ]

4. Bonus or Commission to employees [ Sec 36 (1) (ii )

5. Interest on Borrowed Capital [ Sec 36 (1) (iii ) ]

6. Discount on Zero Coupon Bond [ Sec 36(1) (iiia) ]

7. Employer’s Contribution to Recognised PF & Superannuation Fund [ Sec 36(1)(iv)]

8. Employer’s Contribution to Notified Pension Scheme (NPS) [ Sec 36(1)(iva)]

9. Provision for bad & doubtful debts relating to rural branches of scheduled

commercial Bank. [ Sec 36(1)(viia) ]

10. Transfer to Special Reserve [ Sec 36 (1) (viii) ]

11. Family Planning Expenditure [ Sec 36(1) (ix) ]

12. Revenue Expenditure incurred by entities establised under any Central, State or

Provincial Act. [ Sec 36 (1) (xii ) ]

13. Banking Cash Transaction Tax & Securities Transaction Tax.

14. Contribution to Credit Guarantee Trust Fund [ Sec 36(1) (xiv) ]

15. Commodities transaction tax [ Sec 36(1) (xvi) ]

16. Advertisement Expenses [ Sec 37 (2B) ]](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-7-2048.jpg)

![Amount Not Deductible [ Sec 40 ]

Sec 40 (a) (i) { TDS Compliance related }

No deduction is allowed in respect of interest, royalty, fees for technical service or

other sum payable to :

a) Any person outside India OR

b) In India to a Non-resident (not being Company or Foreign Company) on

which TDS under chapter XVII B has not been deducted or paid.

Sec 40 (a) (ia)

No deduction is allowed in respect of payment to resident towards interest,

commission, brokrage, fees for professional service or technical service, amount

payable to Contractor or sub contractor, rent or royalty in which provisions of TDS

under chapter XVII-B has not been complied with.](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-12-2048.jpg)

![Amount Not Deductible [ Sec 40 ]...

Sec 40 (b ) { Related to Partnership Firm }

According to Scheme of assessee of Firms, Salary, Bonus, commission or

remuneration to partners of firms is allowable as deduction in the hands of the

firm, as under :-

* Remuneration to Partners :

Maximum Permissible limit

* Interest on Capital to Partners :

Conditions to be satisfied :

i) Rate of interest should not exceed 12% p.a. Simple interset.

ii) Payment of interest on capital should be authorised by partnership deed.

iii) Payment of int should be pertained to the period after partnership Deed.

Book Profit Limit

On the First Rs.300000 of Book

profit or in case of LOSS

Rs.150000 or 90% of Book

profit whichever is more

On the balance of Book Profit 60% of Book Profit.](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-13-2048.jpg)

![Amount Not Deductible [ Sec 40 ]...

Sec 40 A (2 ) : Excessive or Unreasonable Payments to Relatives/Associates

Any Expenditure in respect of which payments have been or is made to a relative

or associate concern, so much of the expenditure as is concerned to be excessive

or unreasonable shall be disallowed by the Income Tax Officer.

Sec 40 A (3) : Payment in excess of Rs.20000/- in cash.

As per Income Tax Act,1961, any expenditure incurred in respect of which

payment is made in a sum exceeding Rs.20000/- in CASH, shall not be allowed as

deduction.

Explanation : In case payment is made to same party on one day and the total of

payment in a day crosses Rs.20000 , then this section is attracted.

( Note : In case of payment is made to plying , hiring or leasing goods carrier the

limit of payment is increased to Rs.35000 )](https://image.slidesharecdn.com/pgbprj-150325155646-conversion-gate01/75/Profit-Gains-from-Business-or-Profession-14-2048.jpg)