This presentation discusses the taxation of profits and gains from business or profession under the Indian Income Tax Act. It covers the basis of charging such income, what constitutes a business, basic principles for arriving at business income, methods of accounting, concepts of block of assets and depreciation, examples of deductible and non-deductible expenses, and how to calculate taxable business/profession income. The key topics covered include profits and other payments considered business income, the definition of business, principles of determining taxable profits, and rules around depreciation of assets used in business.

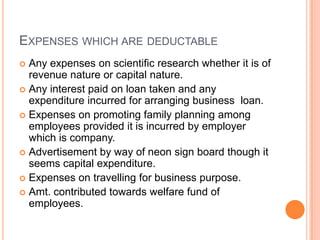

![BASIS OF CHARGE [SECTION 28]

profits and gains of any business or profession

any compensation or other payments due to or received by any person

specified in section 28(ii)

income derived by a trade, professional or similar association from specific

services performed for its members

the value of any benefit or perquisite, whether convertible into money or

not, arising from business or the exercise of profession

any profit on transfer of the Duty Entitlement Pass Book Scheme

any profit on transfer of duty free replenishment certificate

export incentive available to exporters

any interest, salary, bonus, commission or remuneration received by a

partner from firm

any sum received for not carrying out any activity in relation to any

business or not to share any know how , patent, copyright, trademark , etc.

profit and gains of managing agency and

income from speculative transactions](https://image.slidesharecdn.com/group6-120215020921-phpapp02/85/Group-6-2-320.jpg)

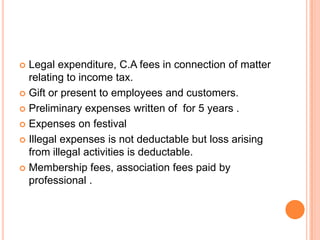

![BUSINESS [SECTION 2(13)]

It includes any trade, commerce, manufacture or

any adventure or concern in nature of

trade, commerce or manufacture

A person who purchases goods with a view to sell them as

profit is trade

Whereas if such transactions are repeated on a large scale

it is called commerce

Manufacture is a process which results in alteration or

change in goods which are subjected to such manufacture.](https://image.slidesharecdn.com/group6-120215020921-phpapp02/85/Group-6-3-320.jpg)