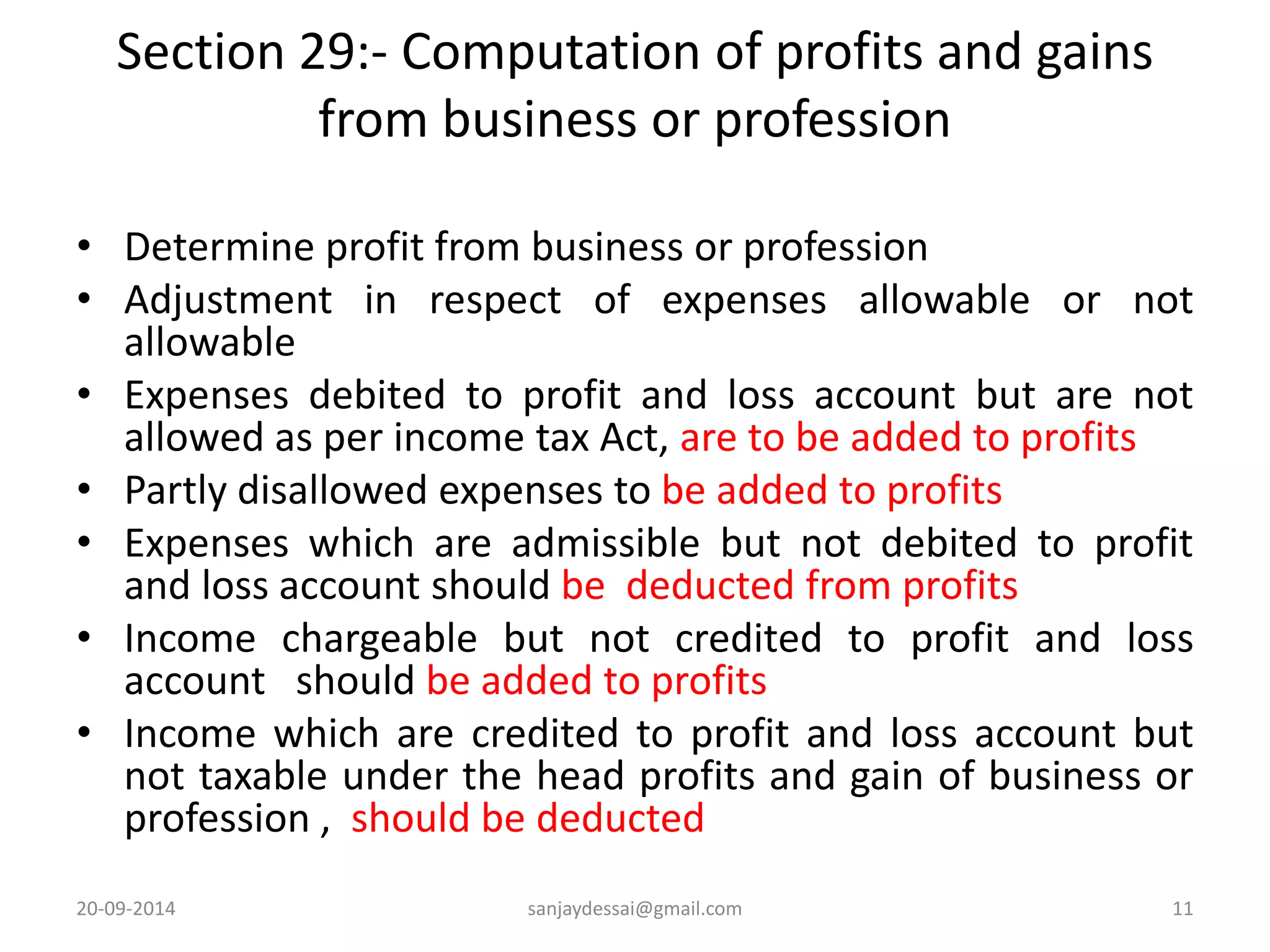

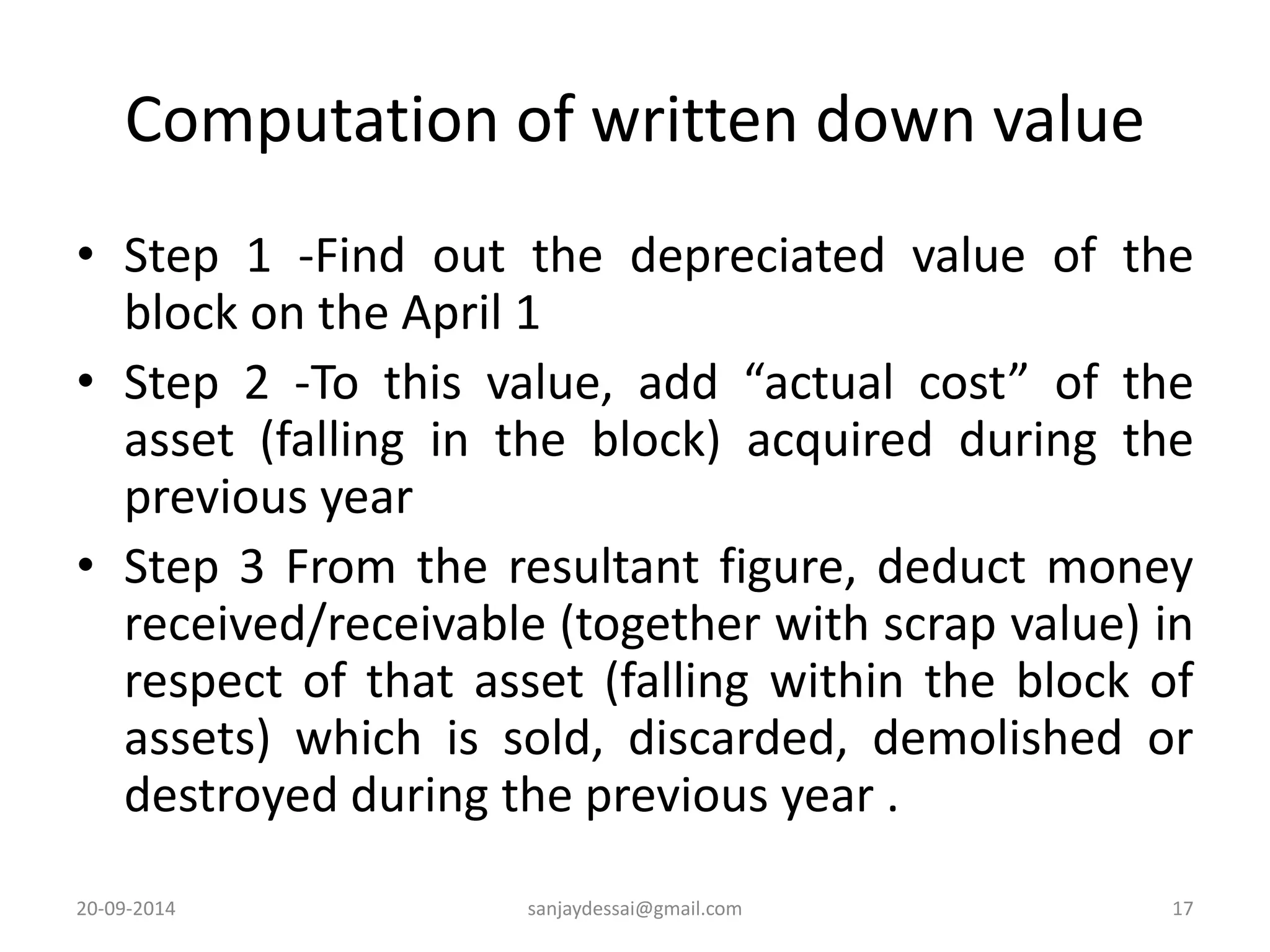

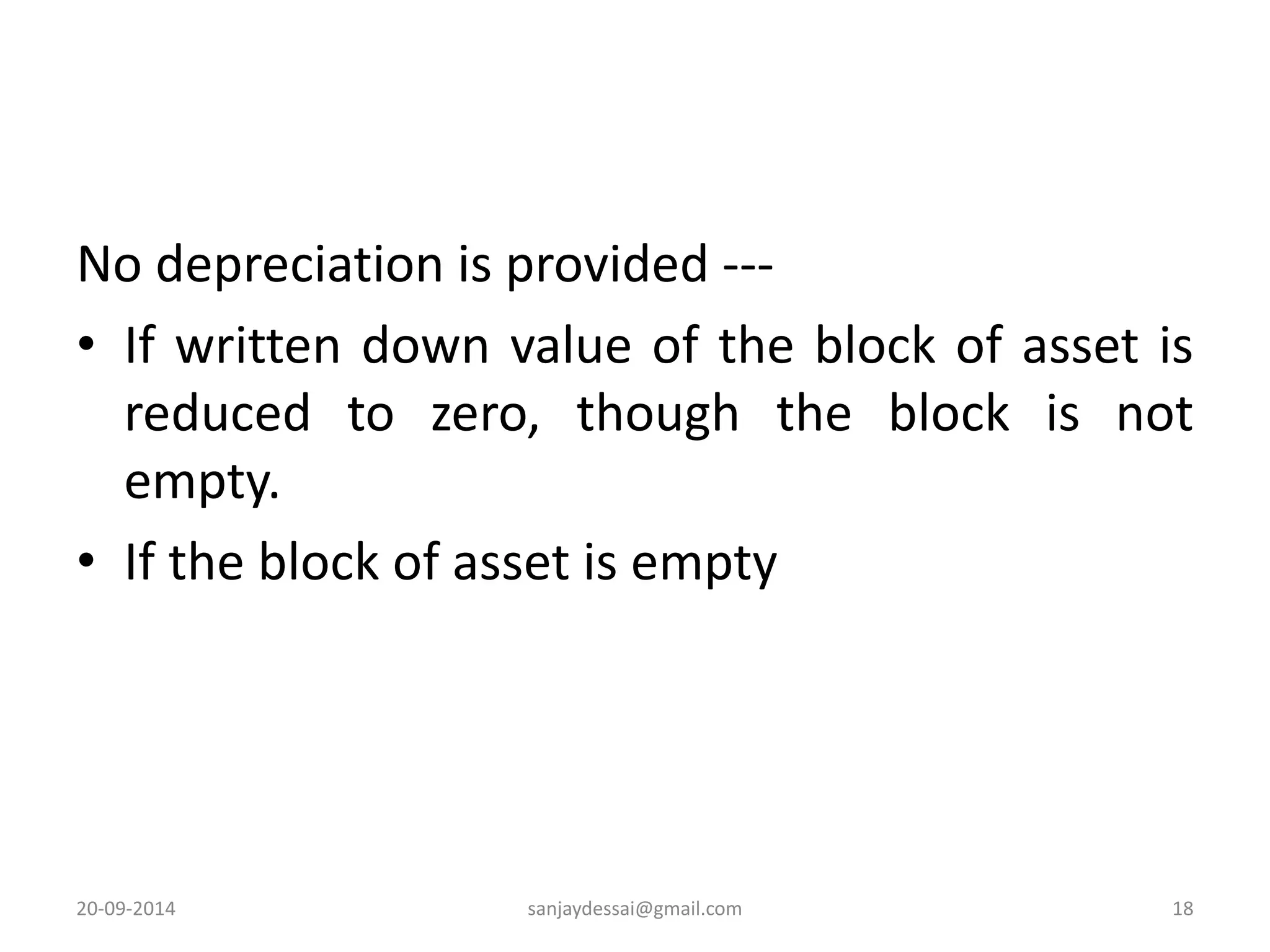

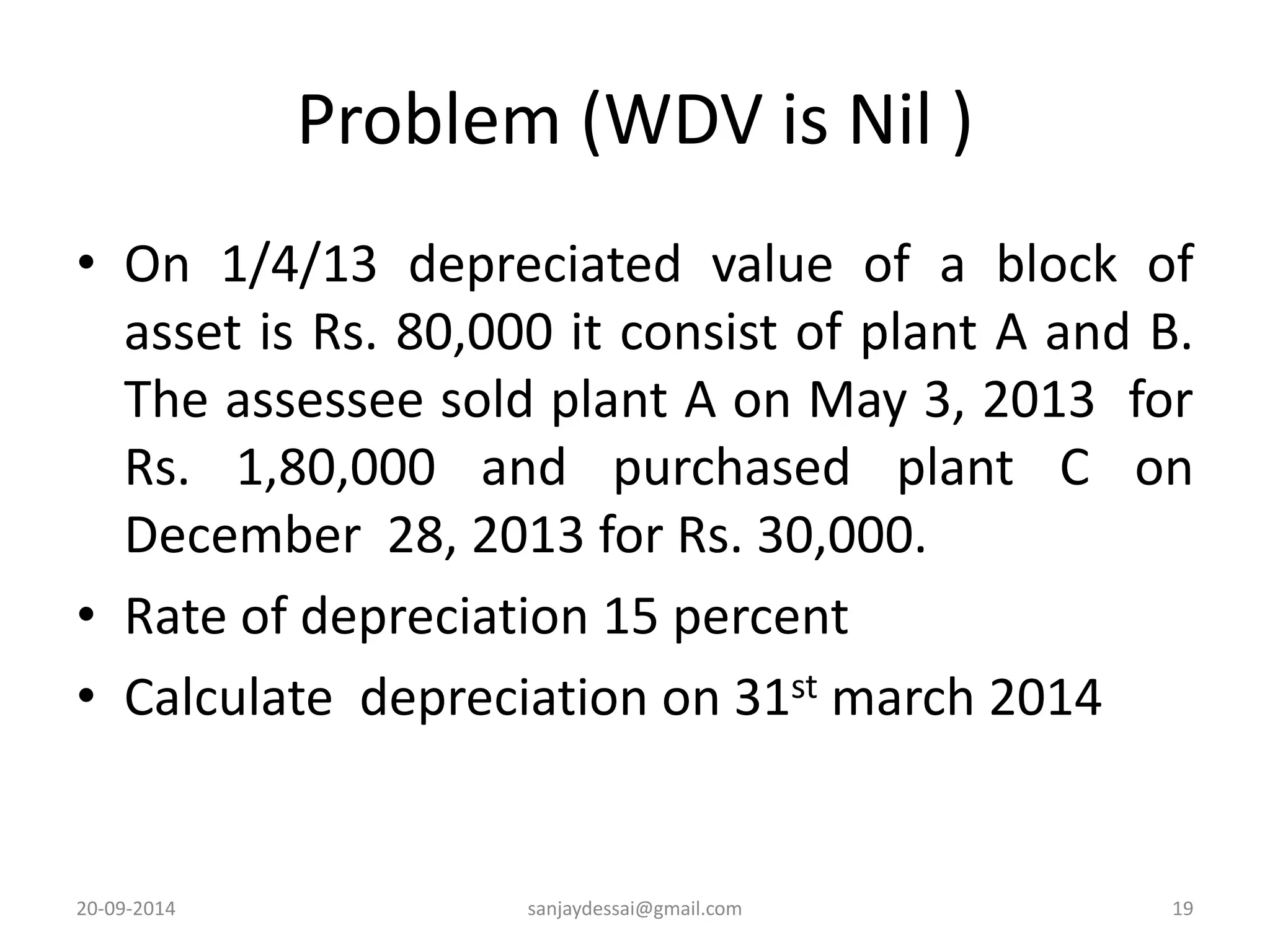

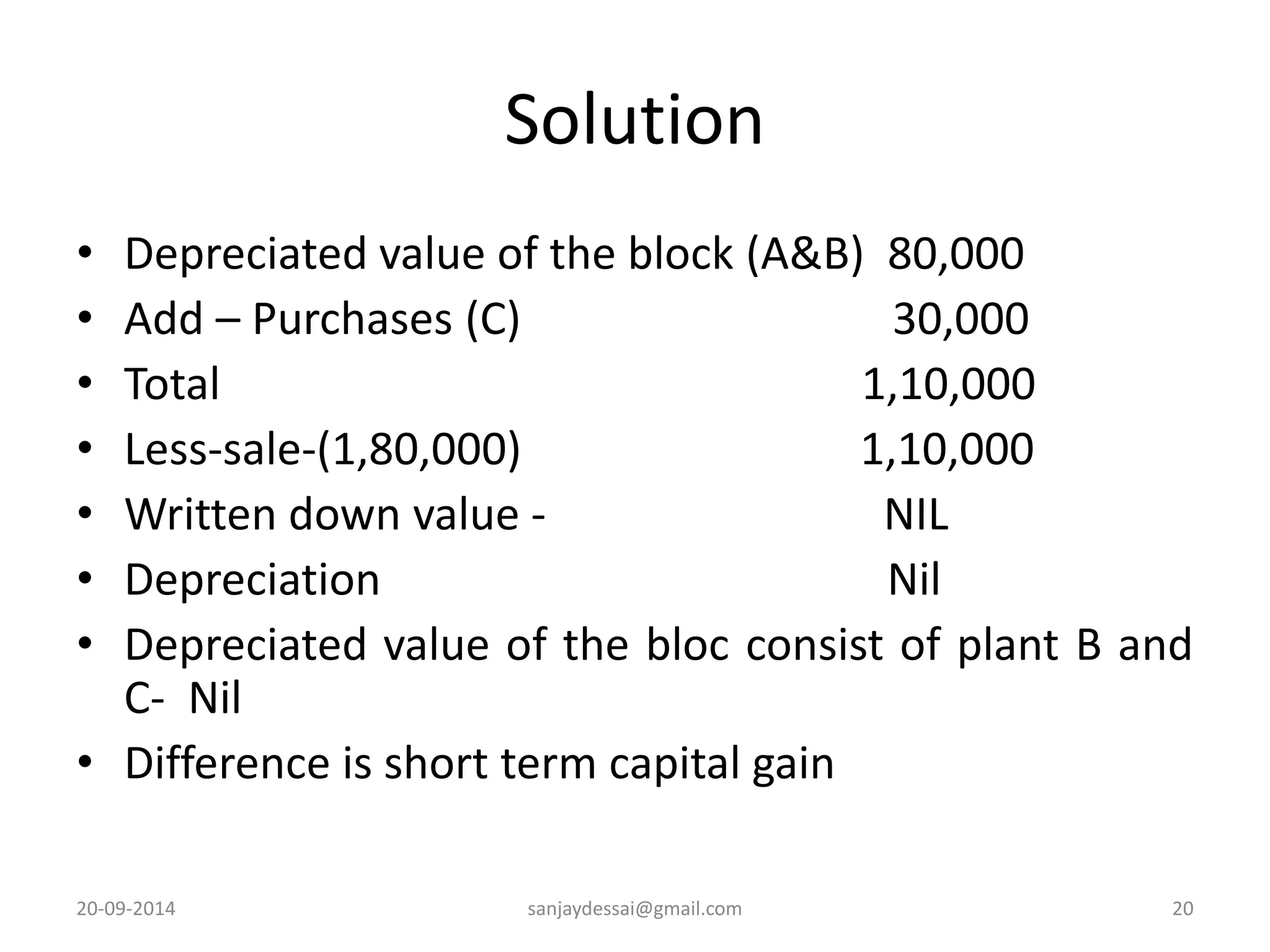

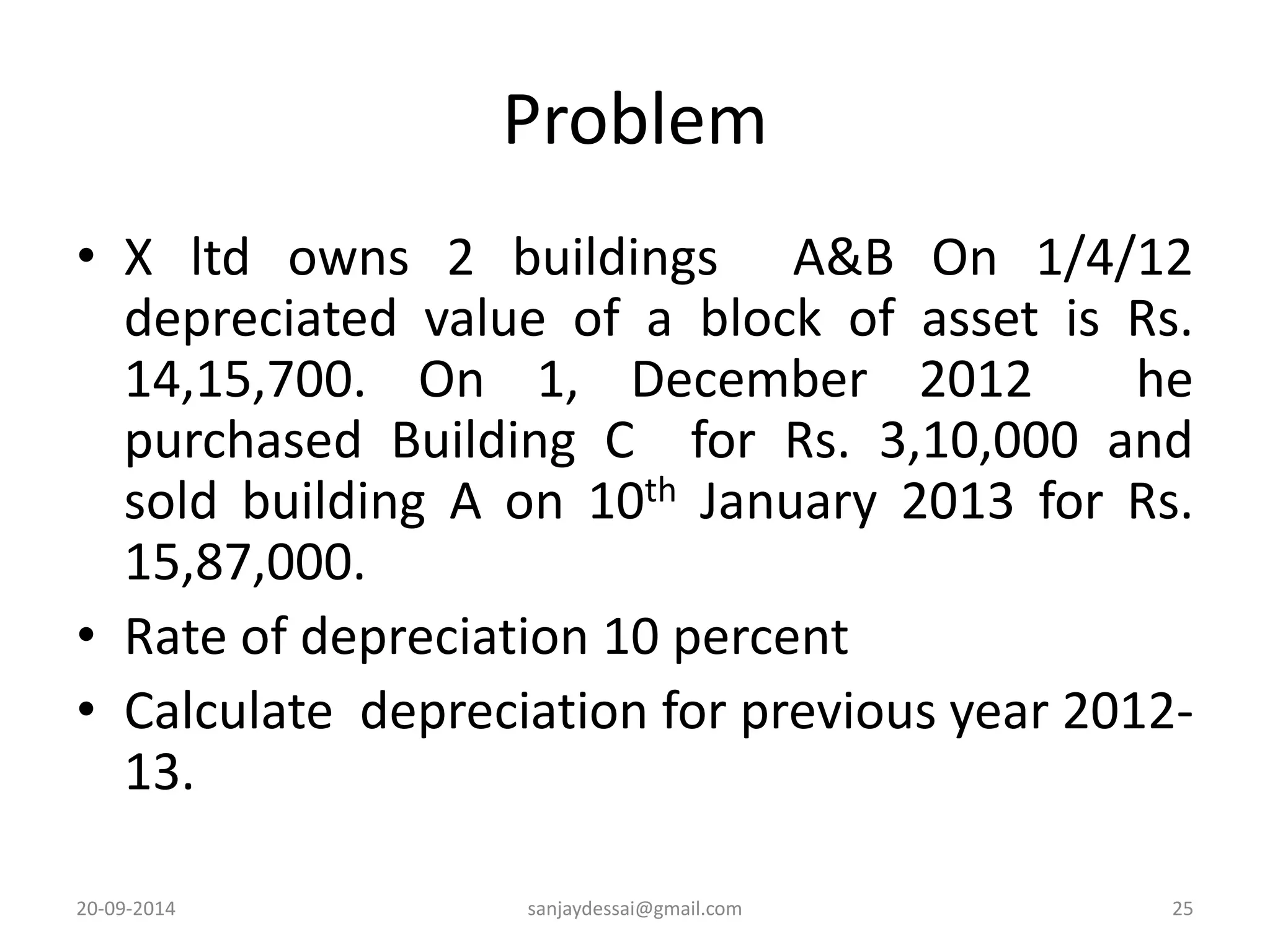

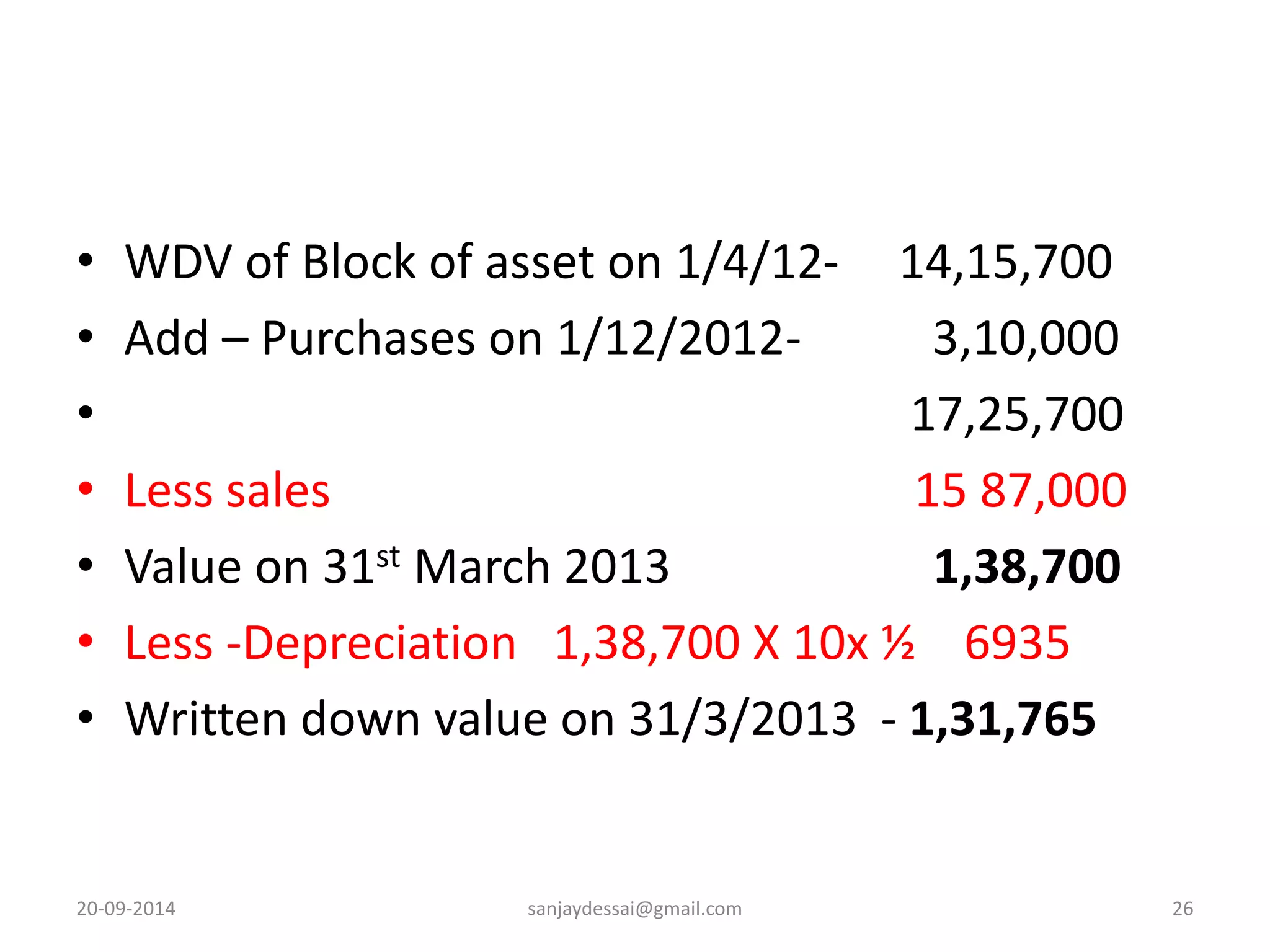

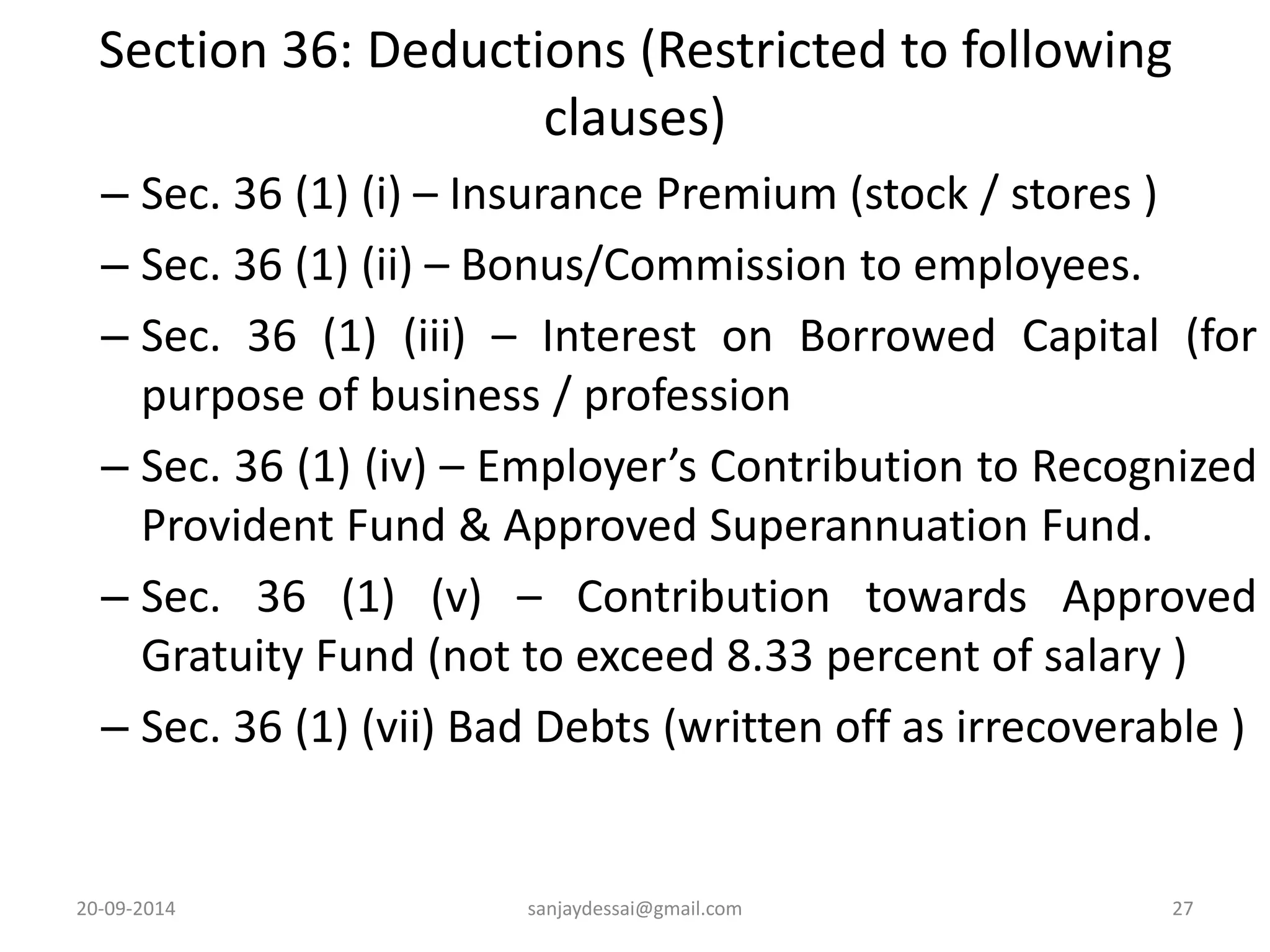

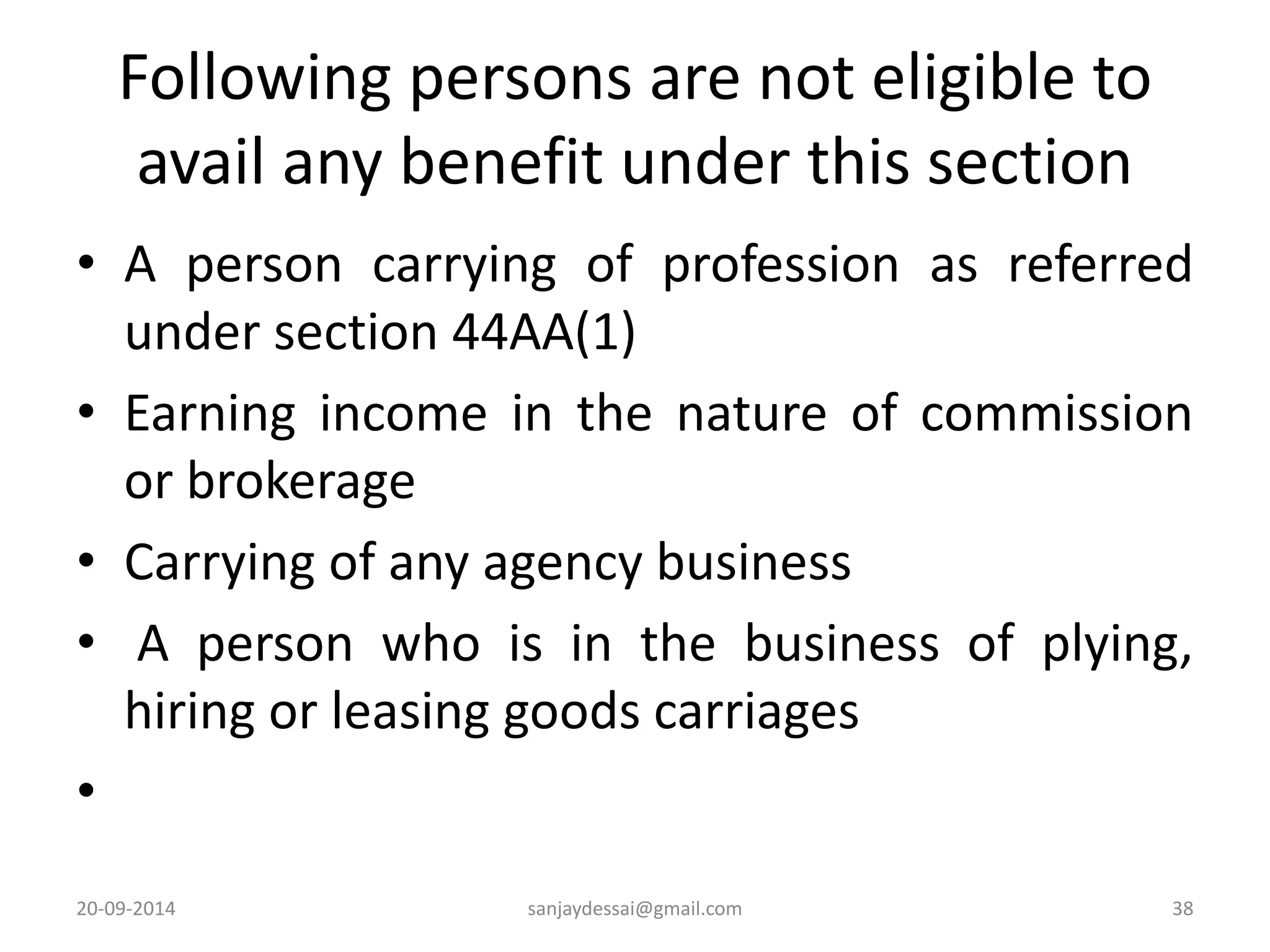

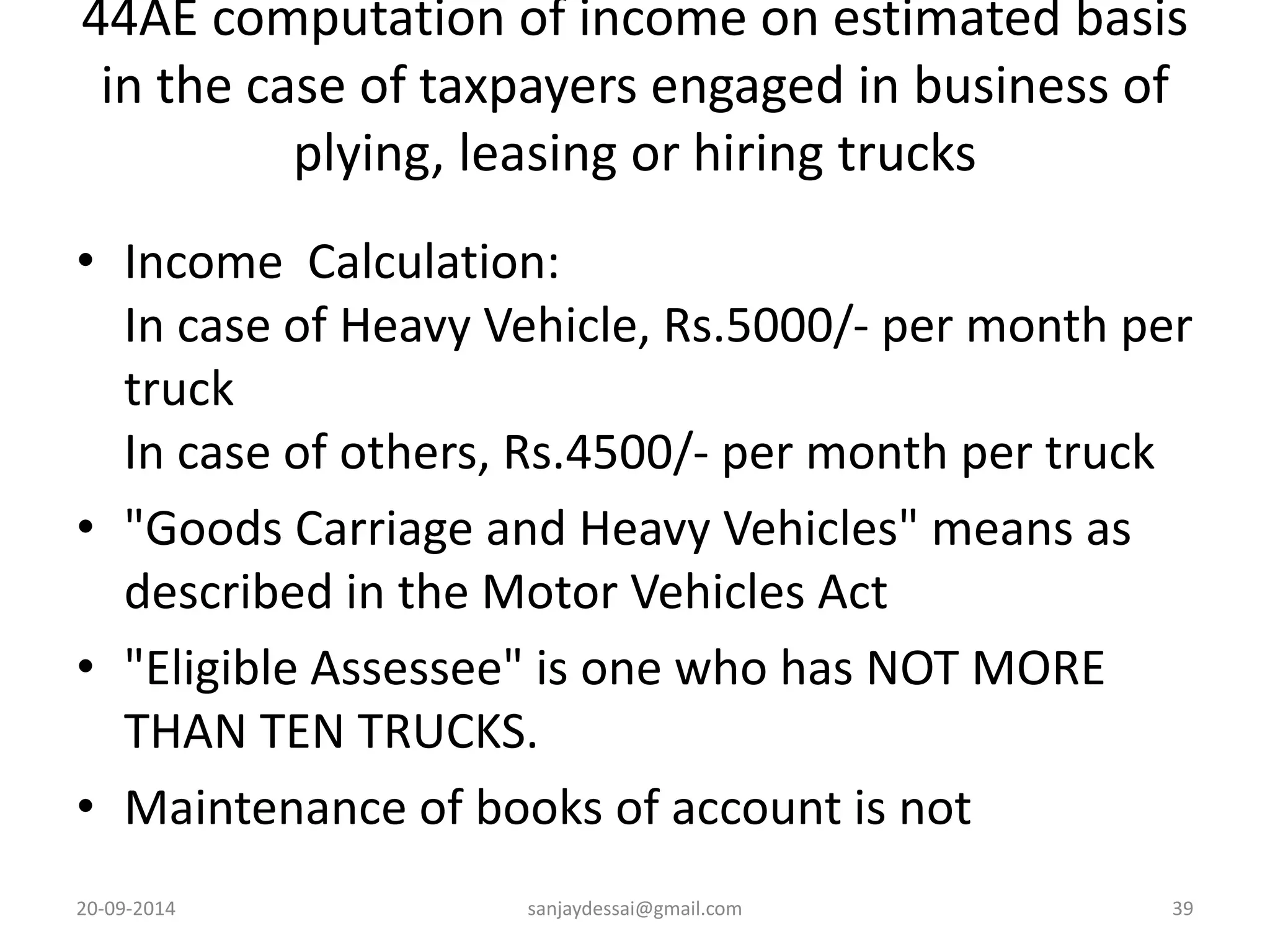

The document provides an overview of the computation of profits and gains of business or profession relevant for B.Com (Taxation) students at Goa University, including key sections of the Income Tax Act. It covers aspects such as chargeability, allowable deductions, methods of accounting, and specific provisions for maintaining books of accounts and audits. Additionally, particular attention is given to expenses that are not deductible and the criteria for different taxation scenarios.