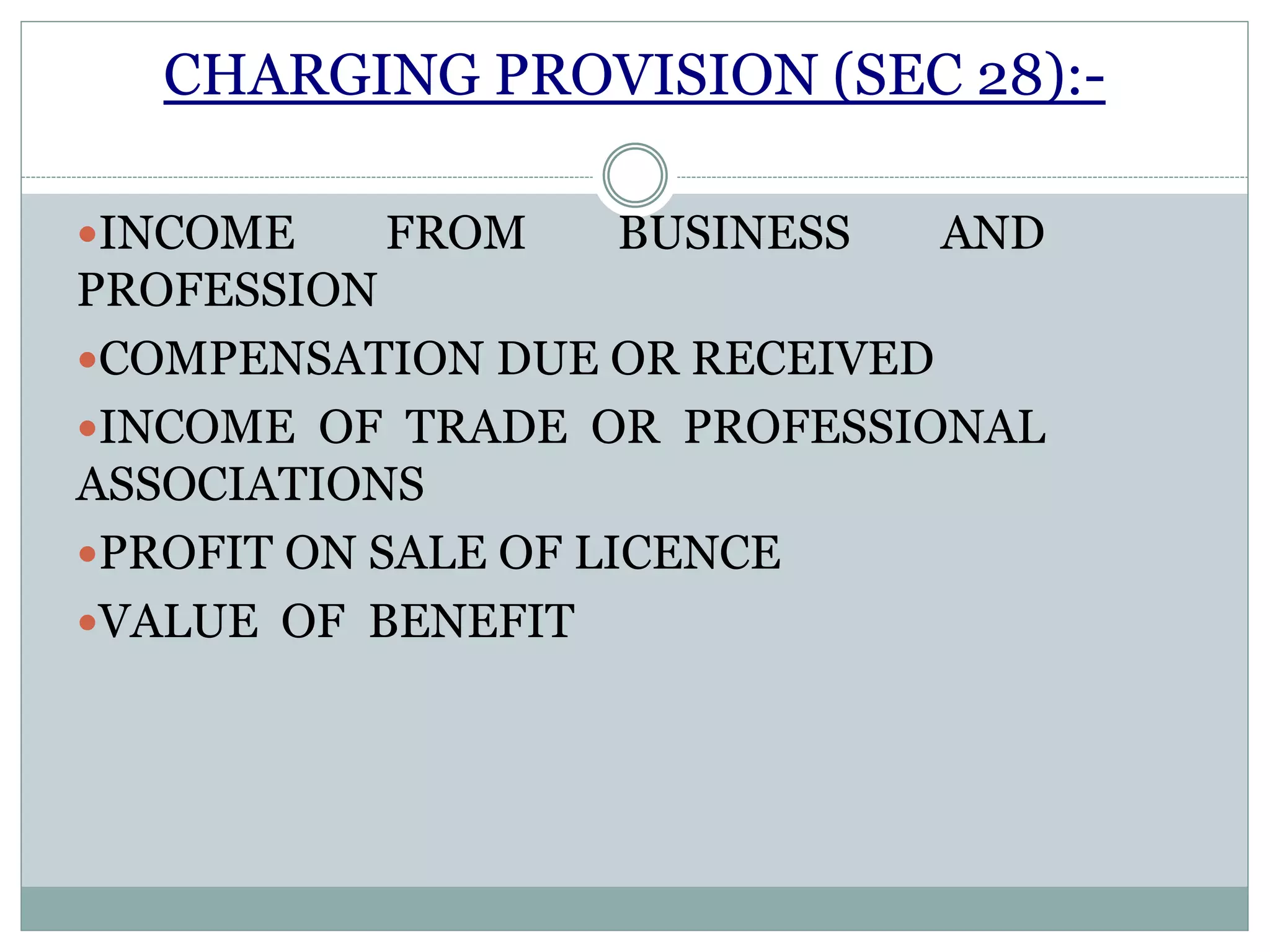

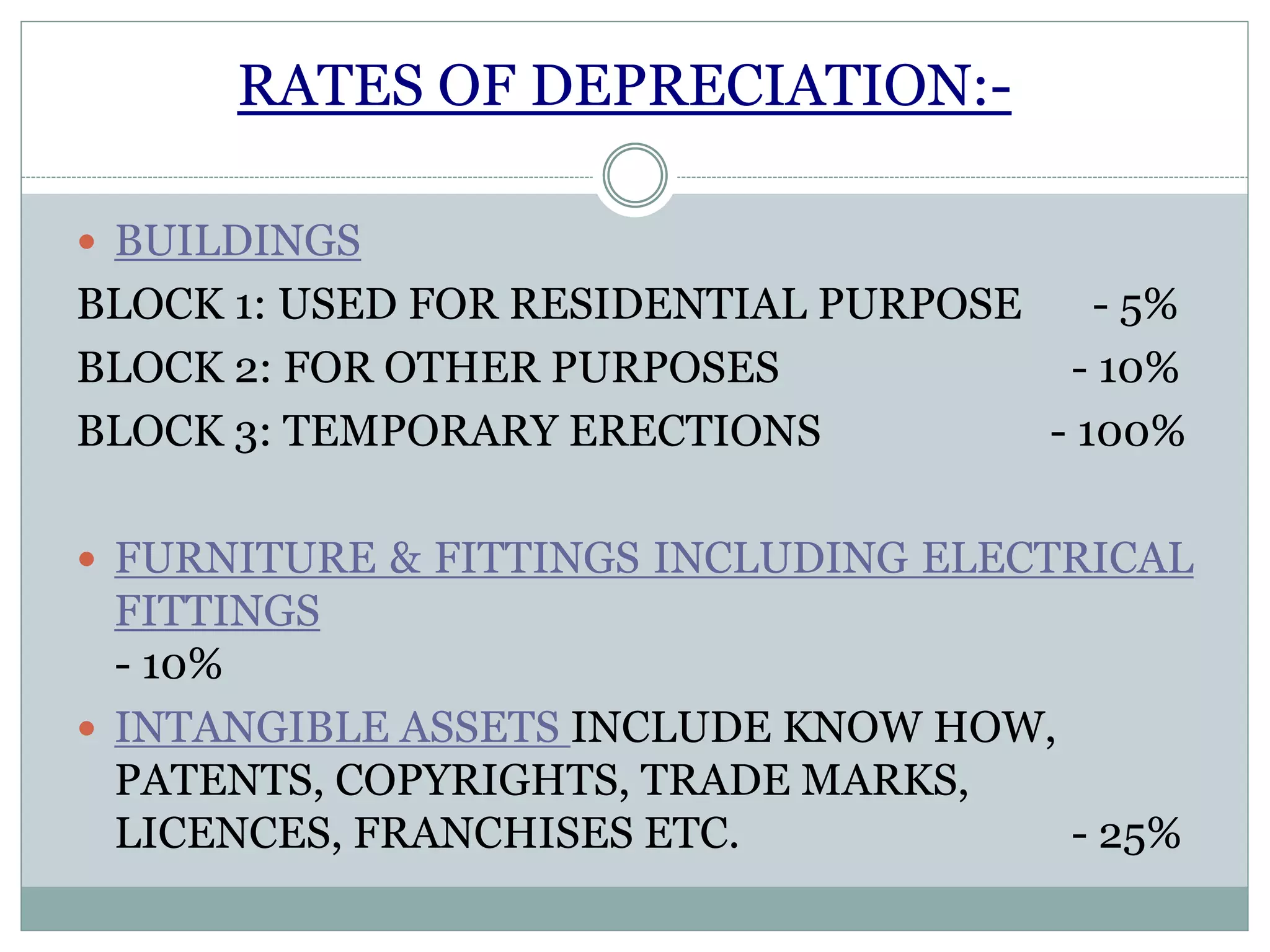

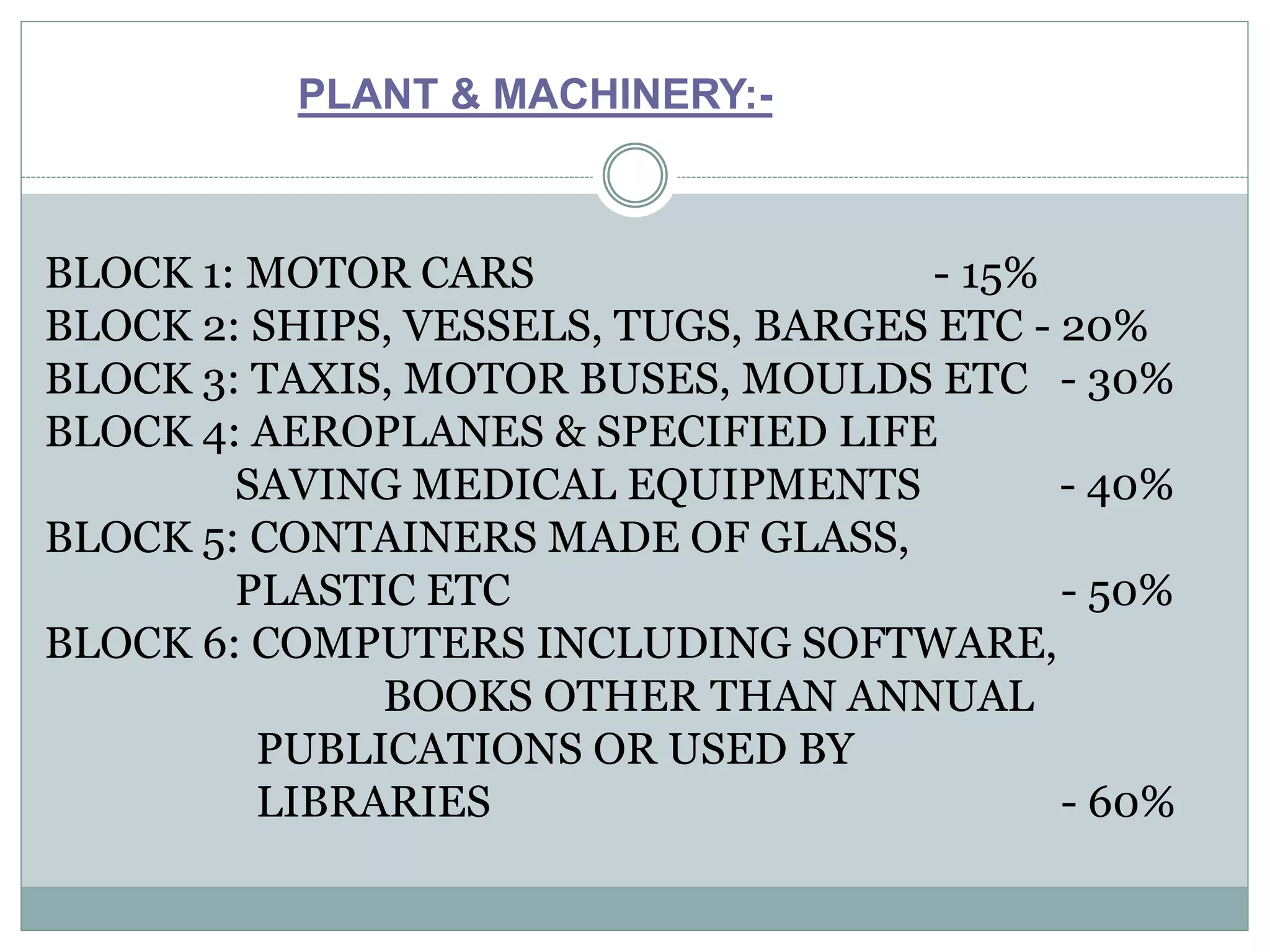

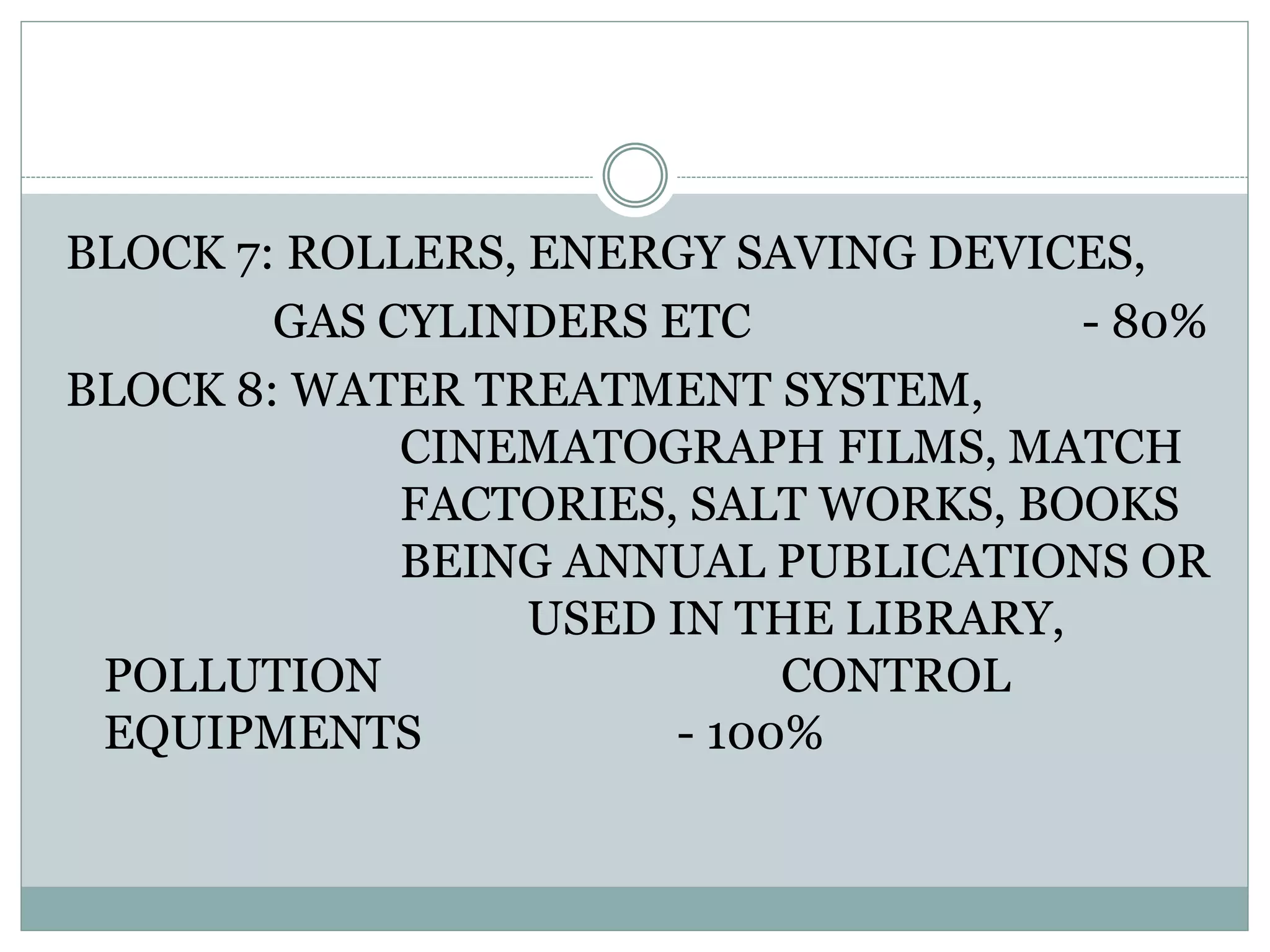

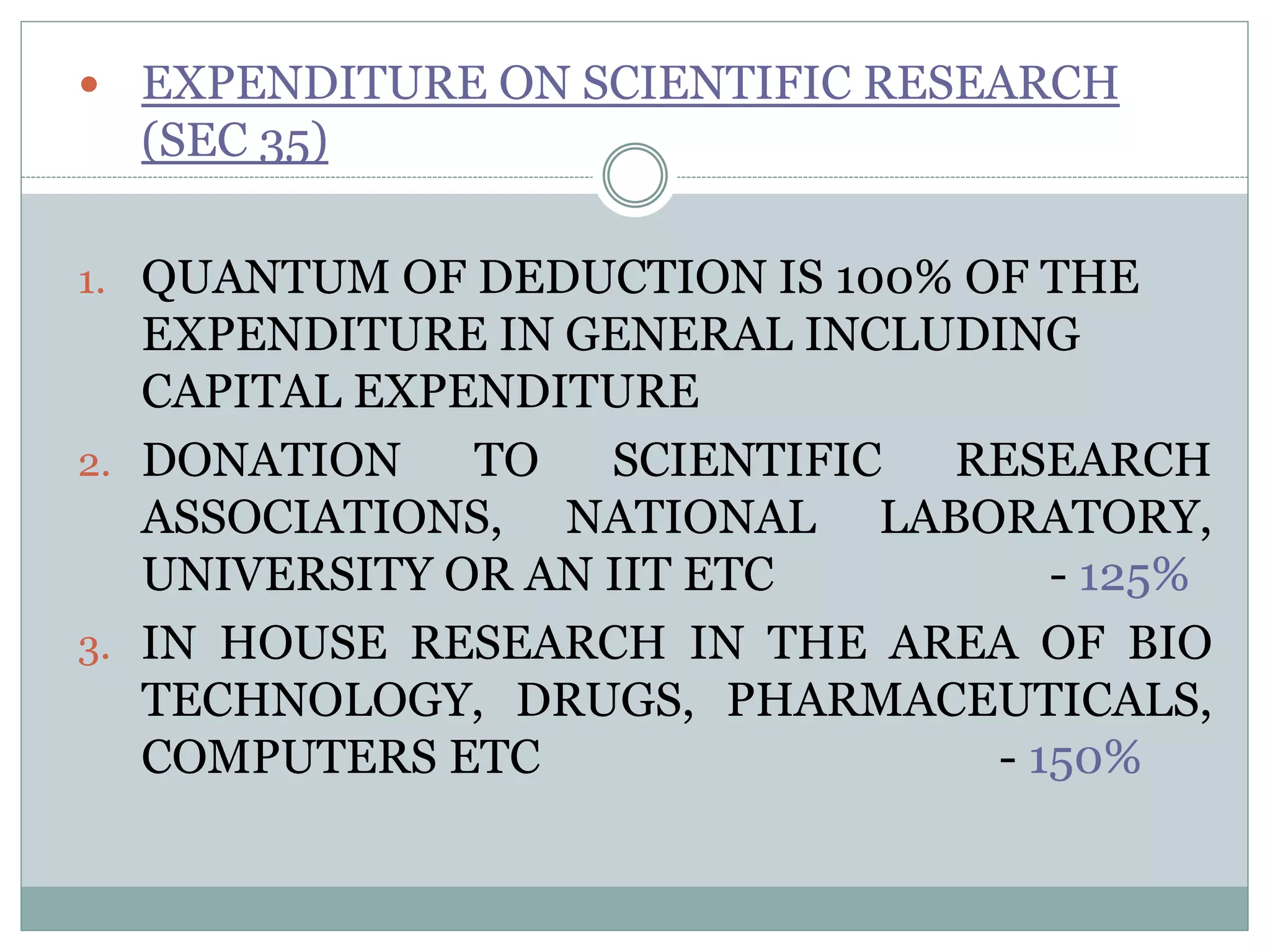

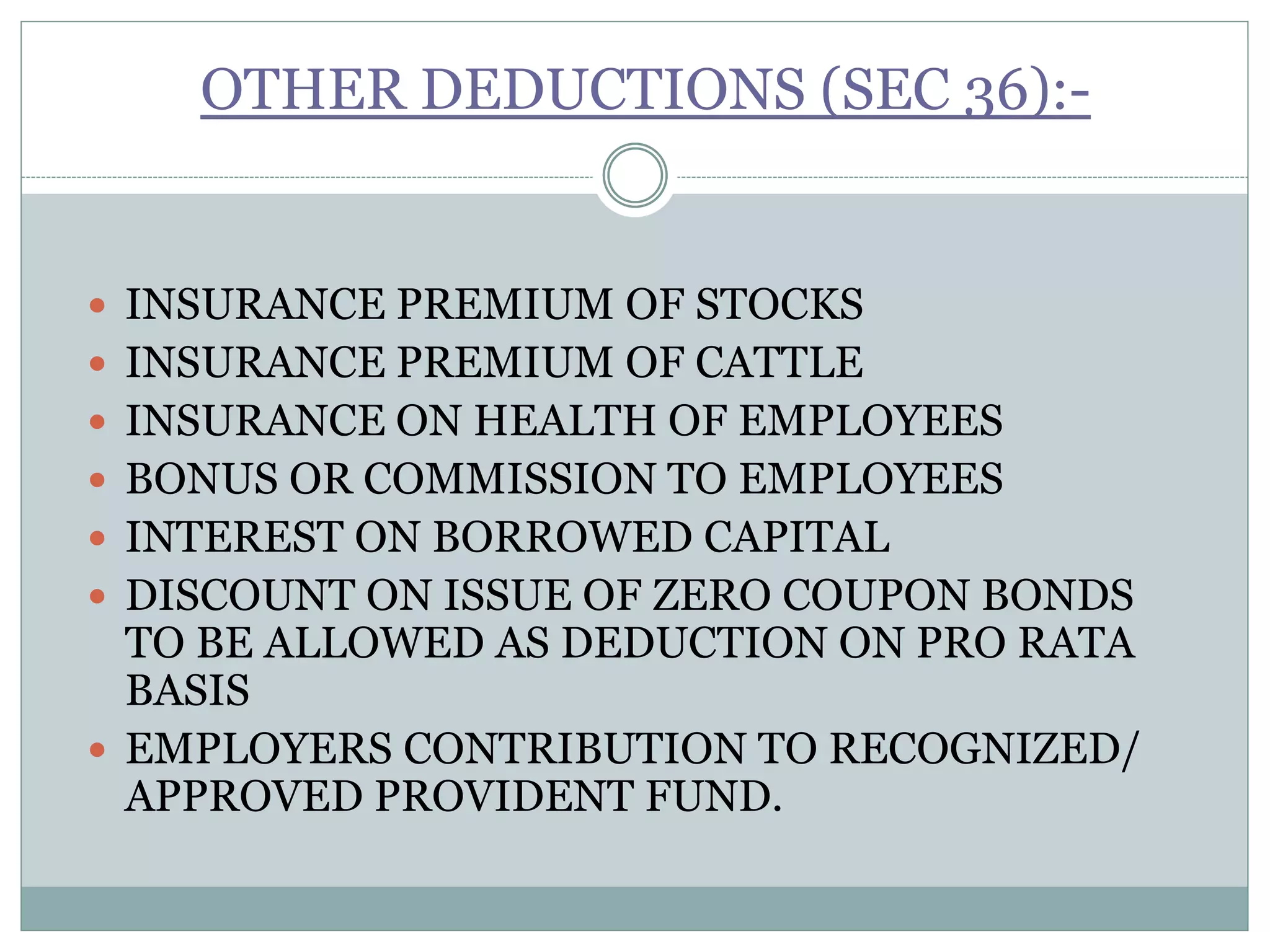

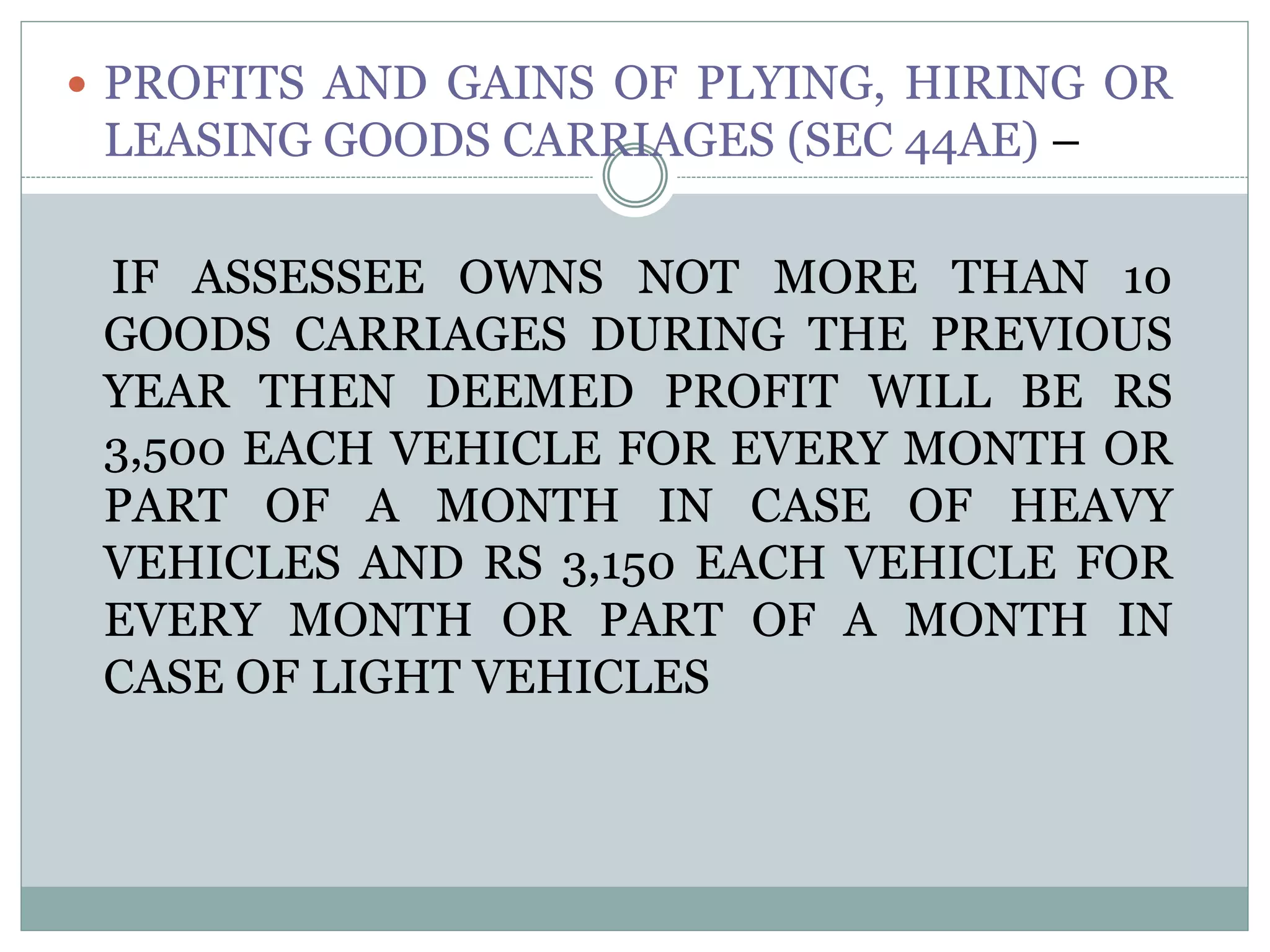

The document defines key terms related to profits and gains from business and profession under the Income Tax Act. It discusses the charging provisions for income from business and profession and outlines the methods for computing income from business and allowable deductions. It also discusses the provisions for maintenance of accounts, audit requirements, and presumptive taxation schemes for certain businesses where accounts are not maintained.