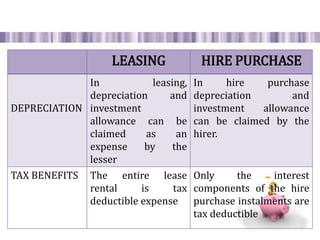

The document compares and contrasts leasing and hire purchase financing. Leasing involves an agreement between a lessor and lessee where the lessee pays periodic lease rentals to use an asset over time, but ownership remains with the lessor. Hire purchase allows a hirer to pay for an asset in installments, with ownership transferring to the hirer after the final payment. Key differences include that leasing is typically used to finance business assets while hire purchase can be for business or consumer goods, and ownership transfers to the hirer under hire purchase but reverts to the lessor under leasing.