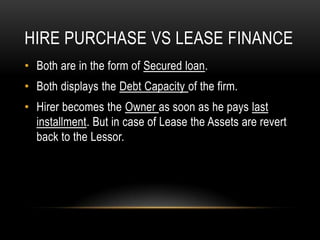

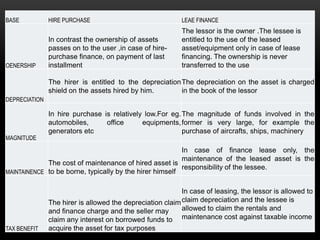

Hire purchase is a method of buying goods through installment payments over time, similar to rent-to-own agreements. Under a hire purchase contract, the buyer leases the goods until full payment is made, at which point ownership transfers. While installment sales transfer ownership upon purchase, hire purchase and installment sales are otherwise similar forms of financing. The key differences between hire purchase and lease financing are that hire purchase transfers ownership to the buyer after final payment, while lease assets revert to the lessor; the hirer claims depreciation tax benefits under hire purchase but the lessor does under leasing.