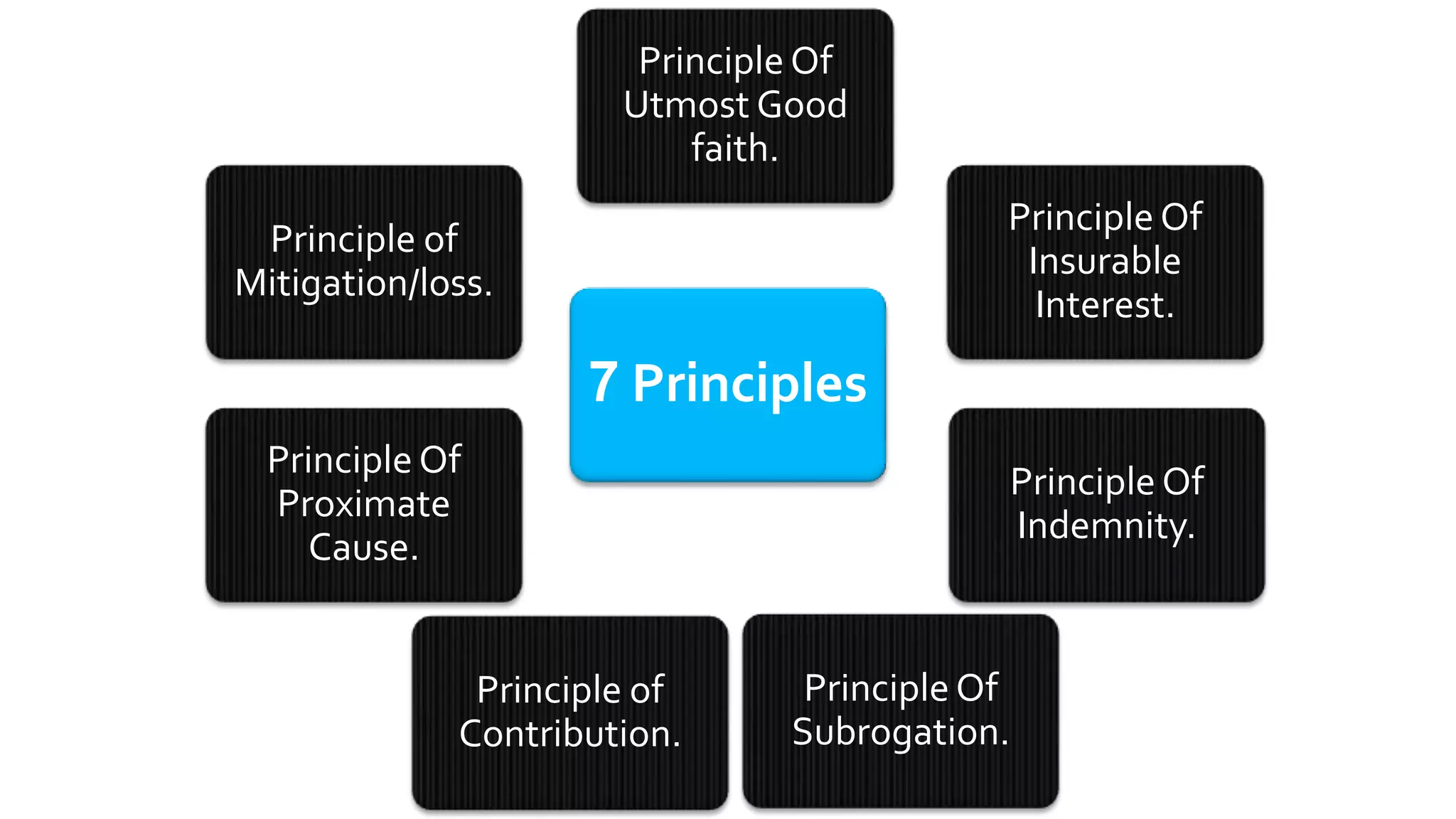

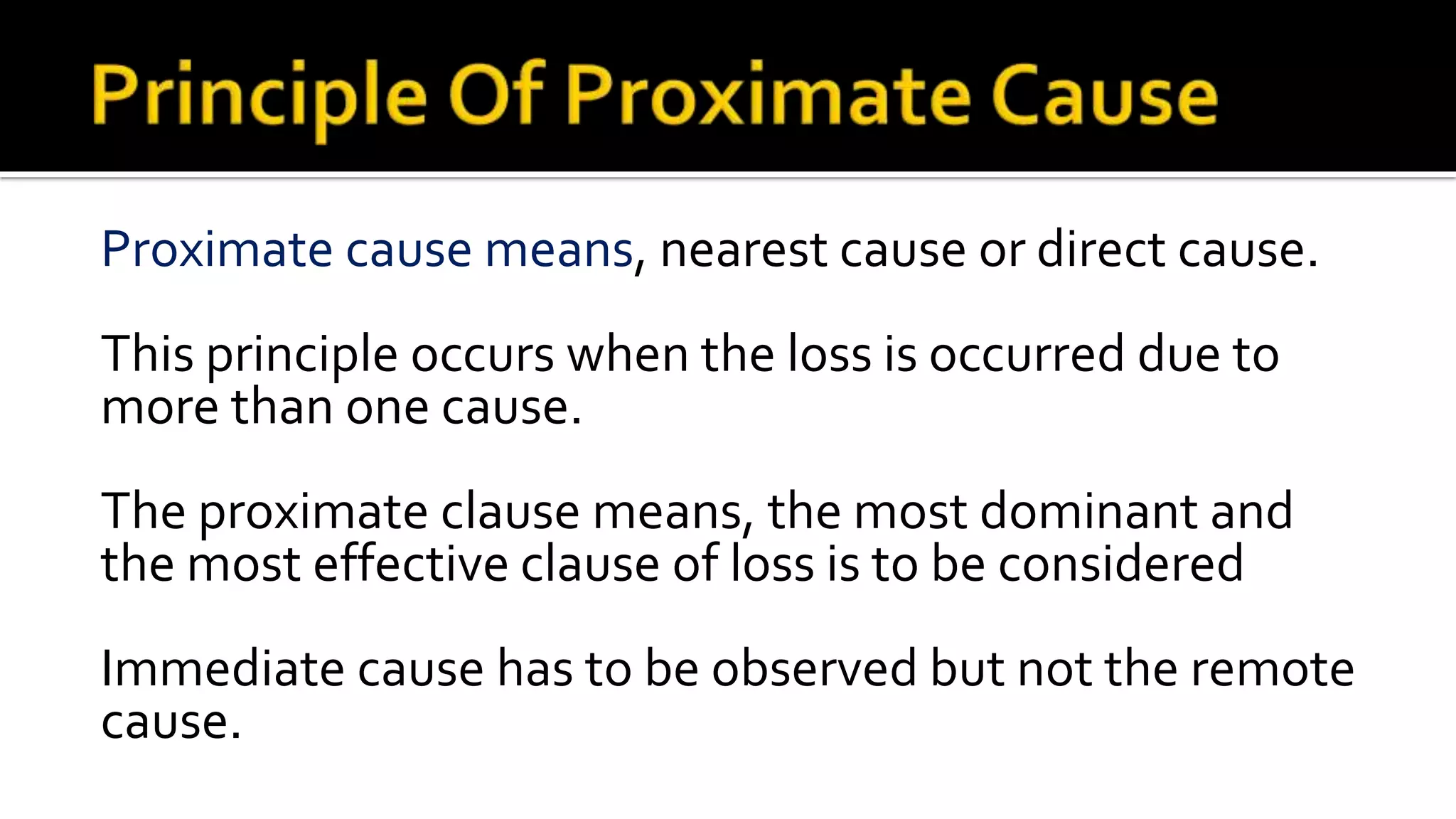

Insurance can be defined as the equitable transfer of risk of loss from one entity to another in exchange for payment. It involves an insurer, insured, a premium, and compensation for loss due to a specified peril or risk. Key principles of insurance include utmost good faith, insurable interest, indemnity, subrogation, contribution, proximate cause, and mitigation of loss. Insurance provides important social and economic benefits but also involves costs like business costs and fraudulent claims. Regulations ensure transparency and consumer protection in the insurance industry.