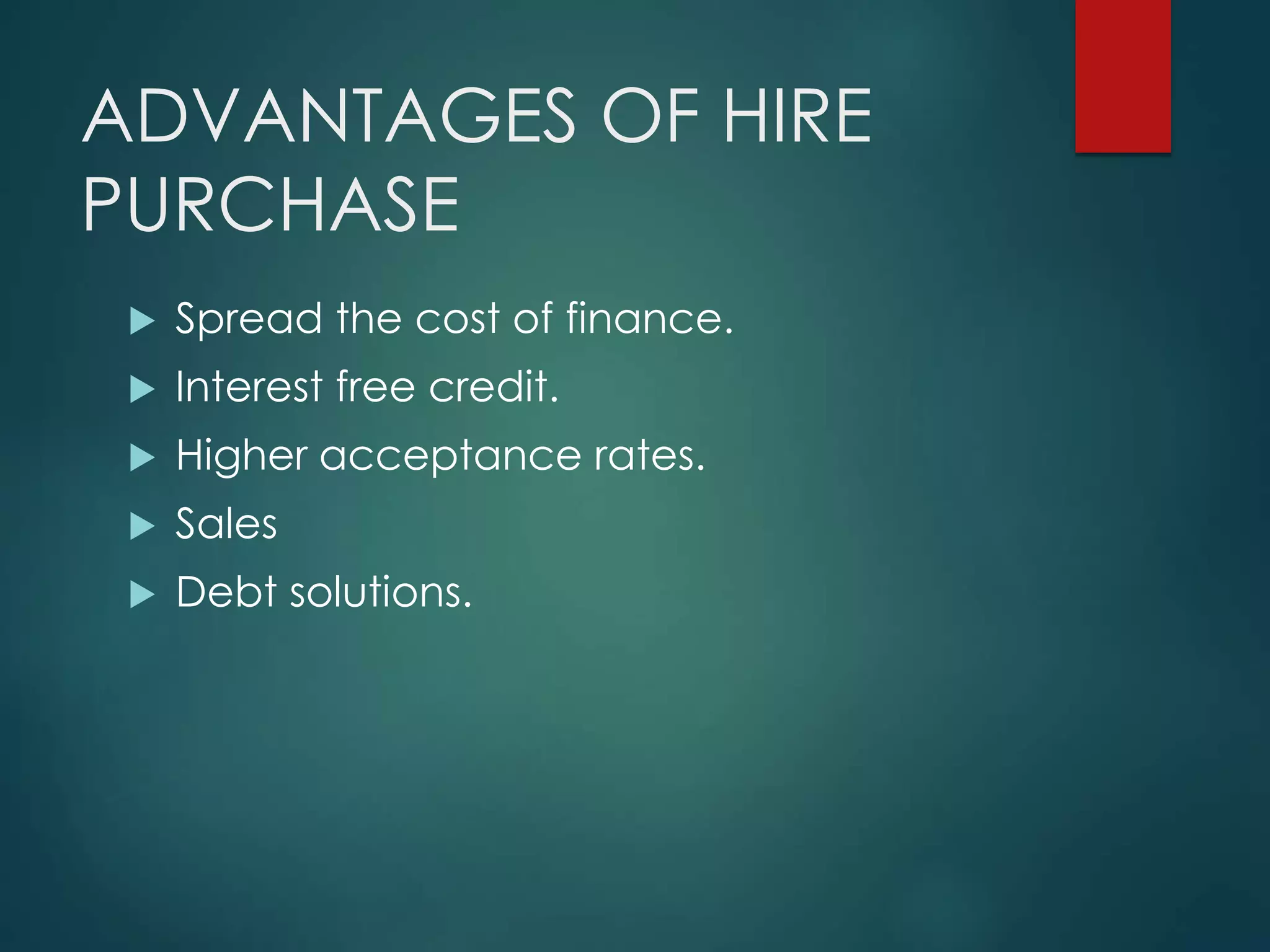

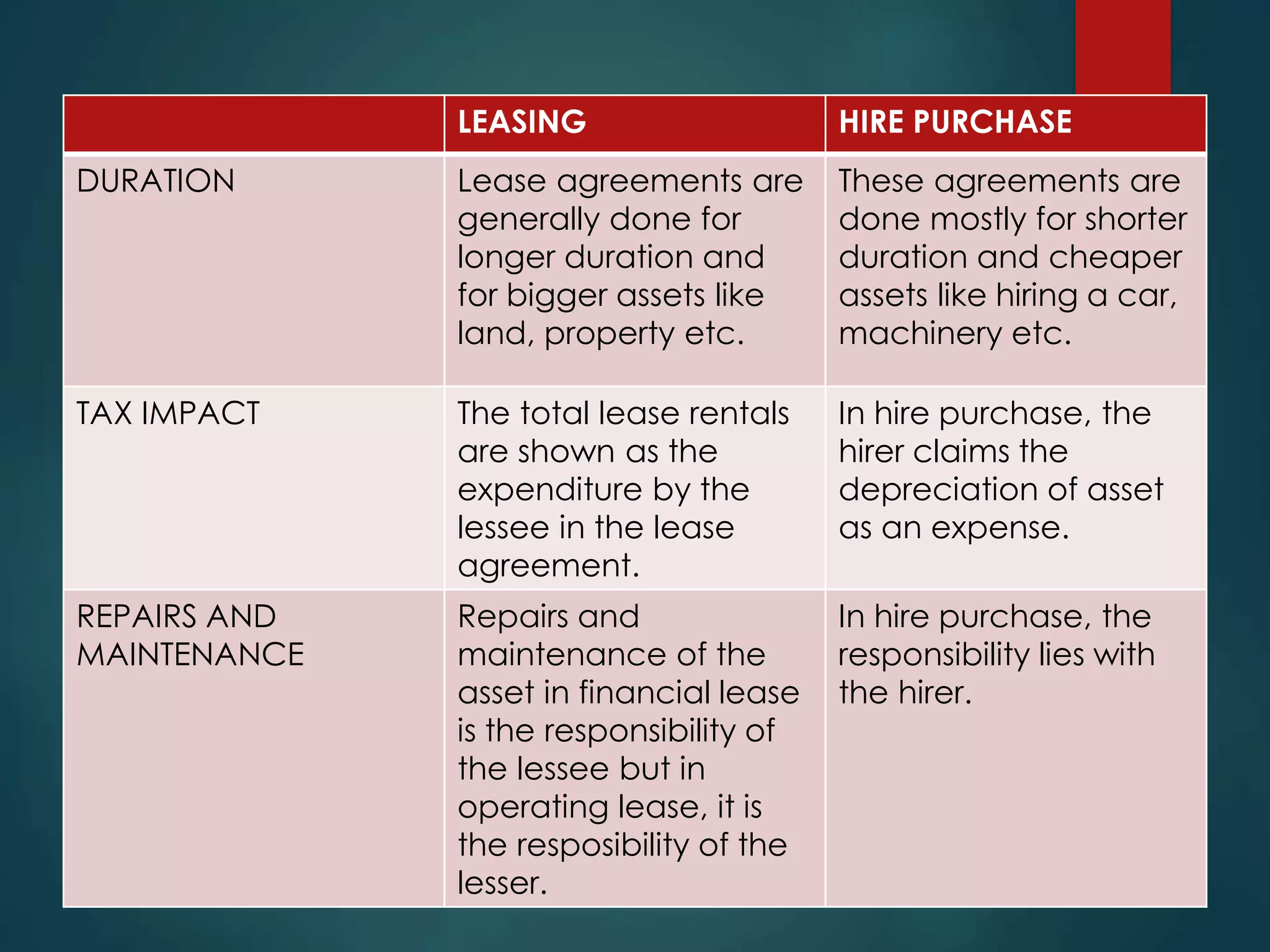

This document discusses leasing and hire purchase. It defines leasing as a contract where the owner of an asset grants another party exclusive use of the asset for an agreed period in exchange for rent payments. Hire purchase allows a party to take possession of a good by paying in installments, with ownership transferring after all payments are made. The document outlines the key features, types, advantages and disadvantages of both leasing and hire purchase agreements.