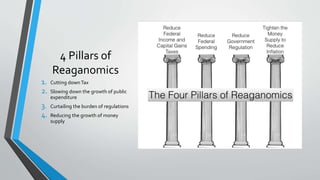

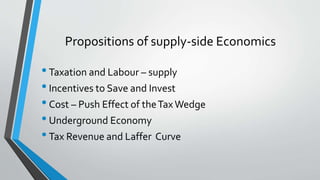

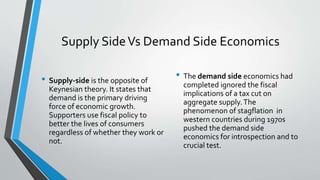

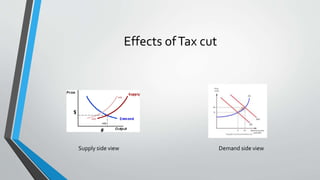

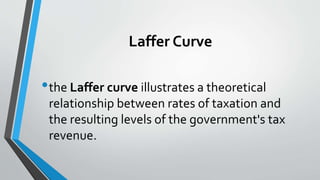

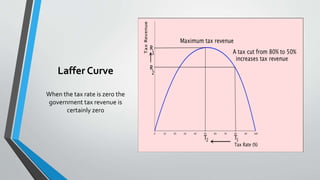

This document provides an overview of supply-side economics. It discusses how supply-side economics focuses on using tax cuts and deregulation to spur economic growth by increasing production. The four pillars of Reaganomics are outlined as cutting taxes, slowing spending growth, reducing regulations, and controlling money supply. The Laffer Curve is introduced as illustrating the relationship between tax rates and tax revenue, suggesting that extremely high tax rates can reduce revenue. Criticisms of supply-side economics include that it is more ideology than analysis and tax cuts may not reliably increase tax revenue or trickle down benefits.