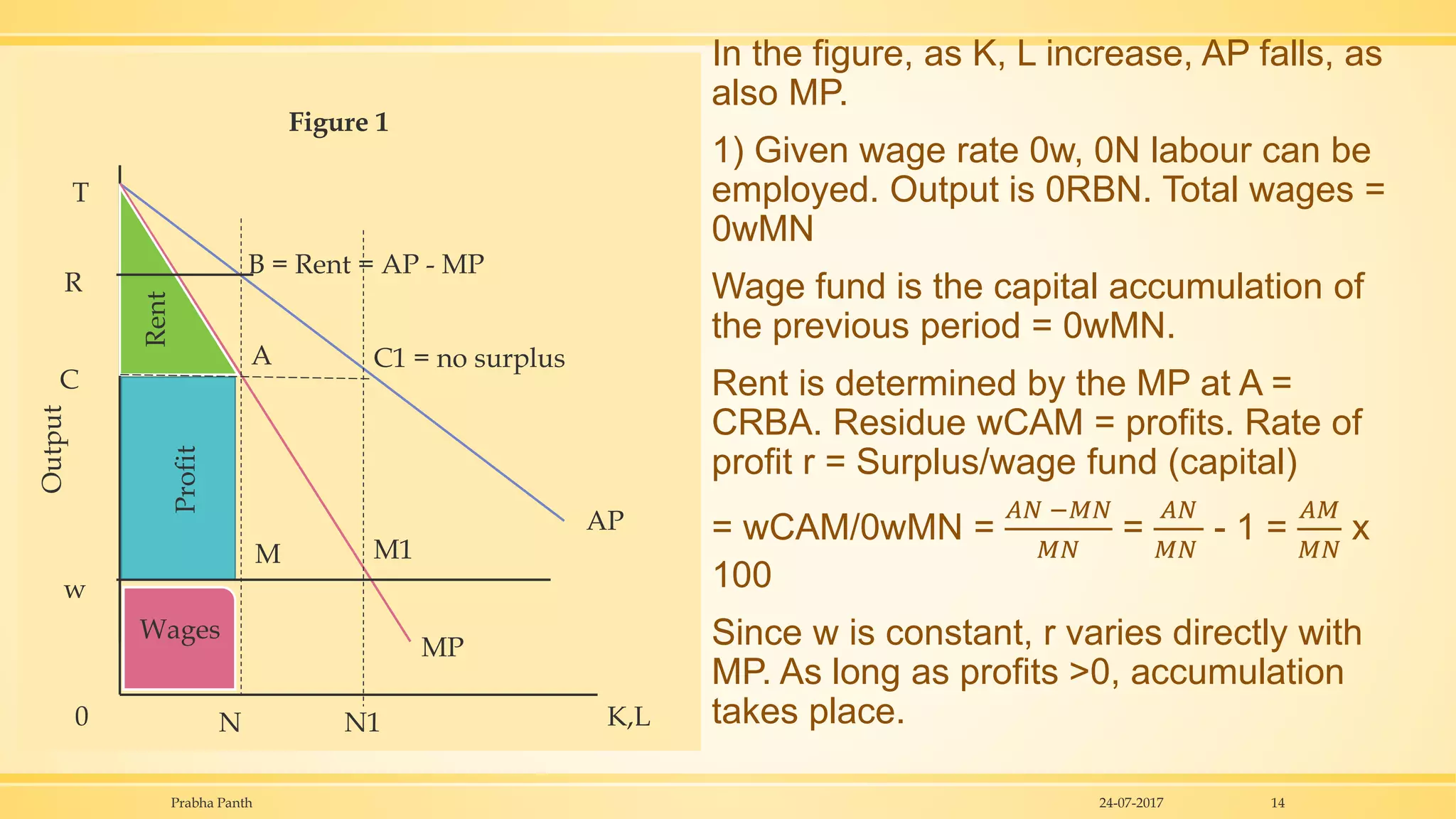

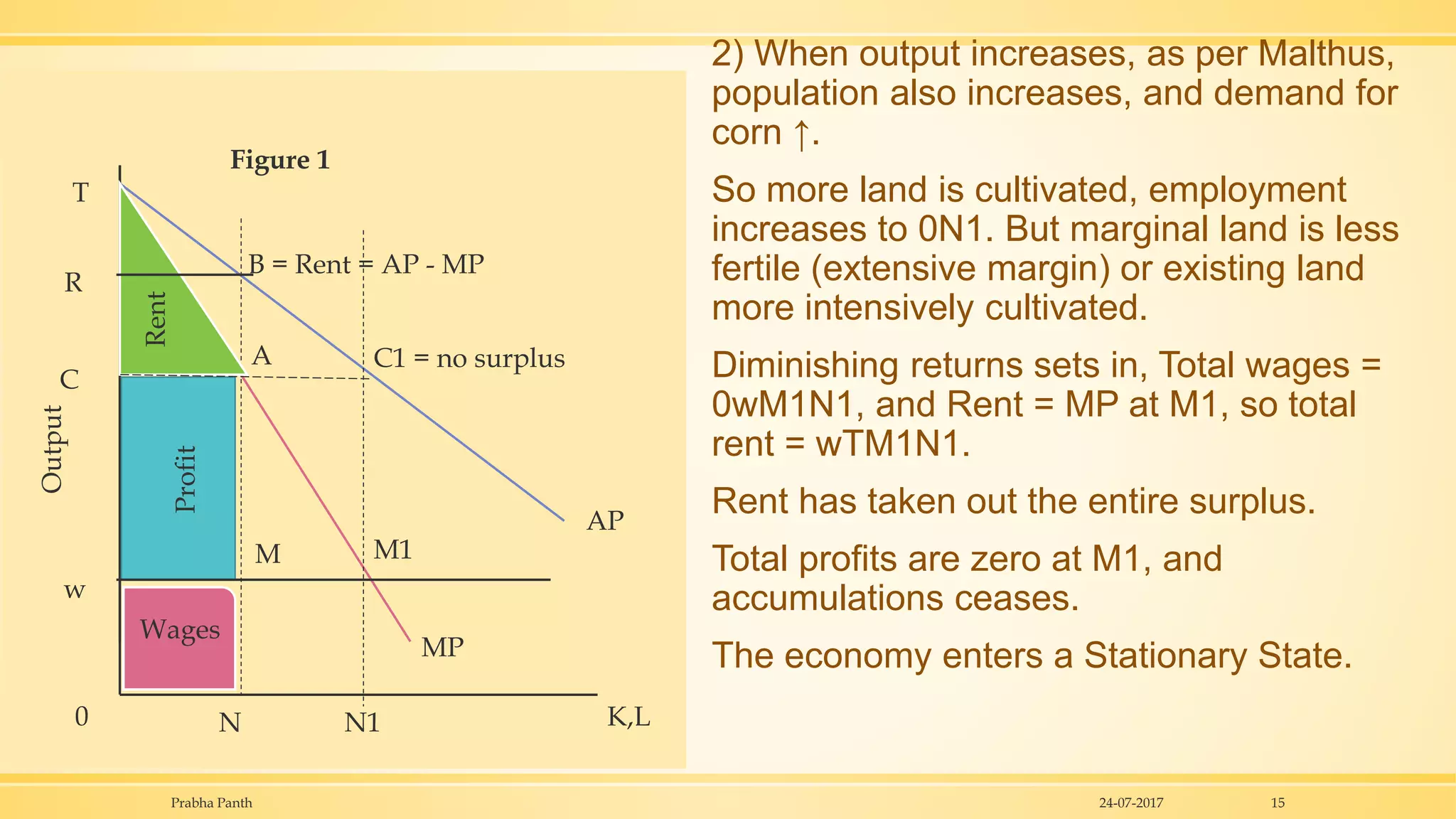

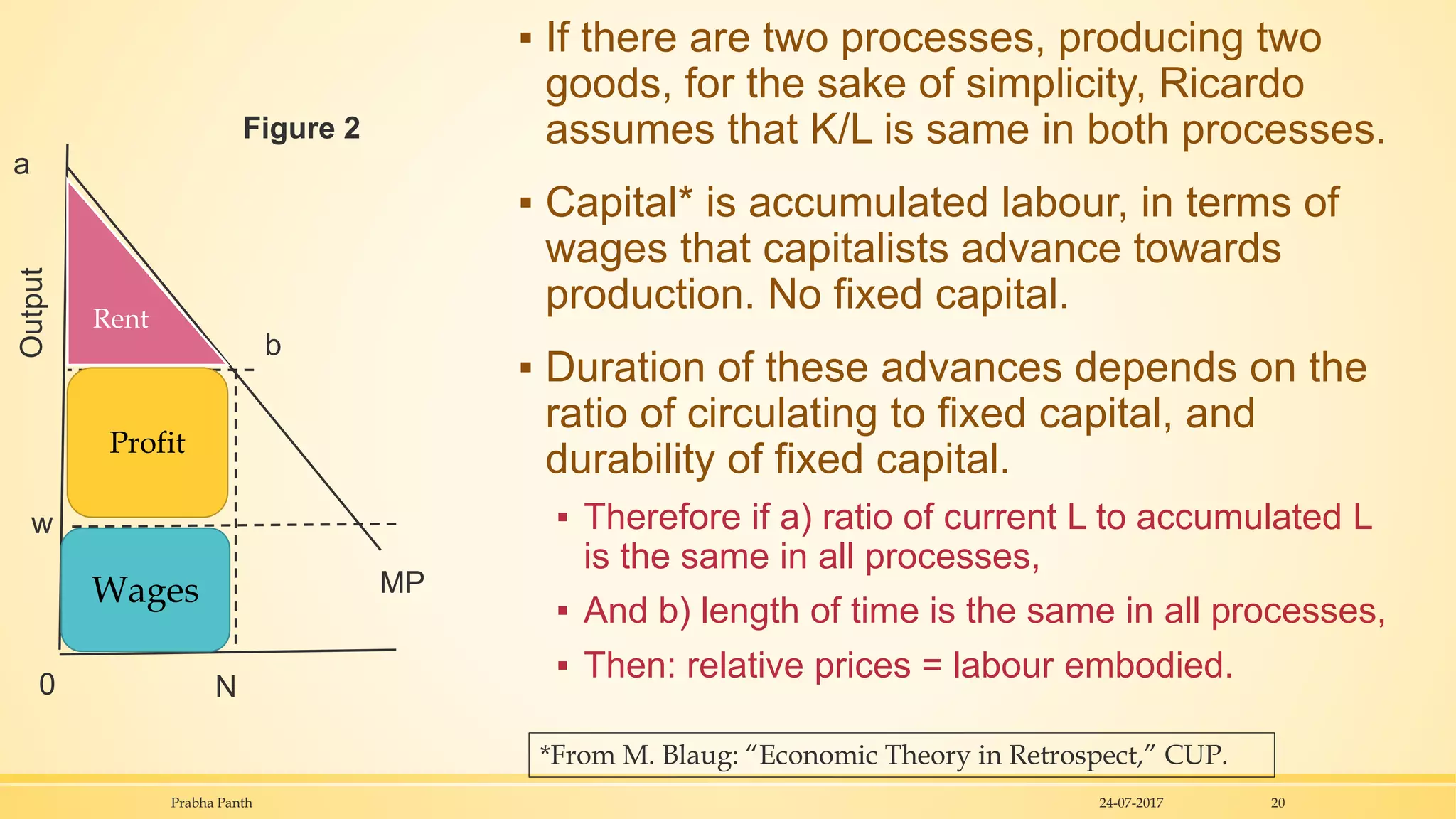

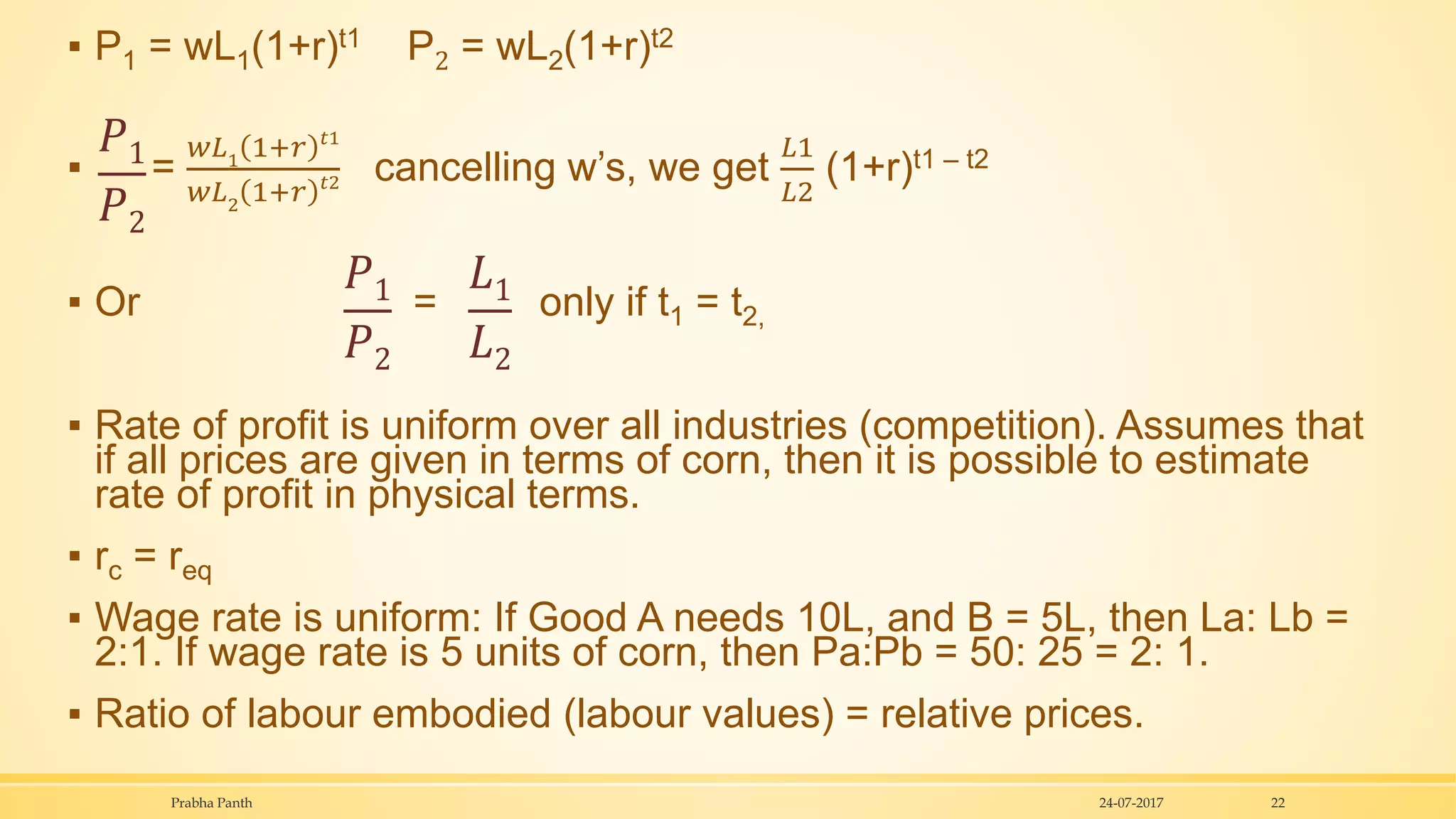

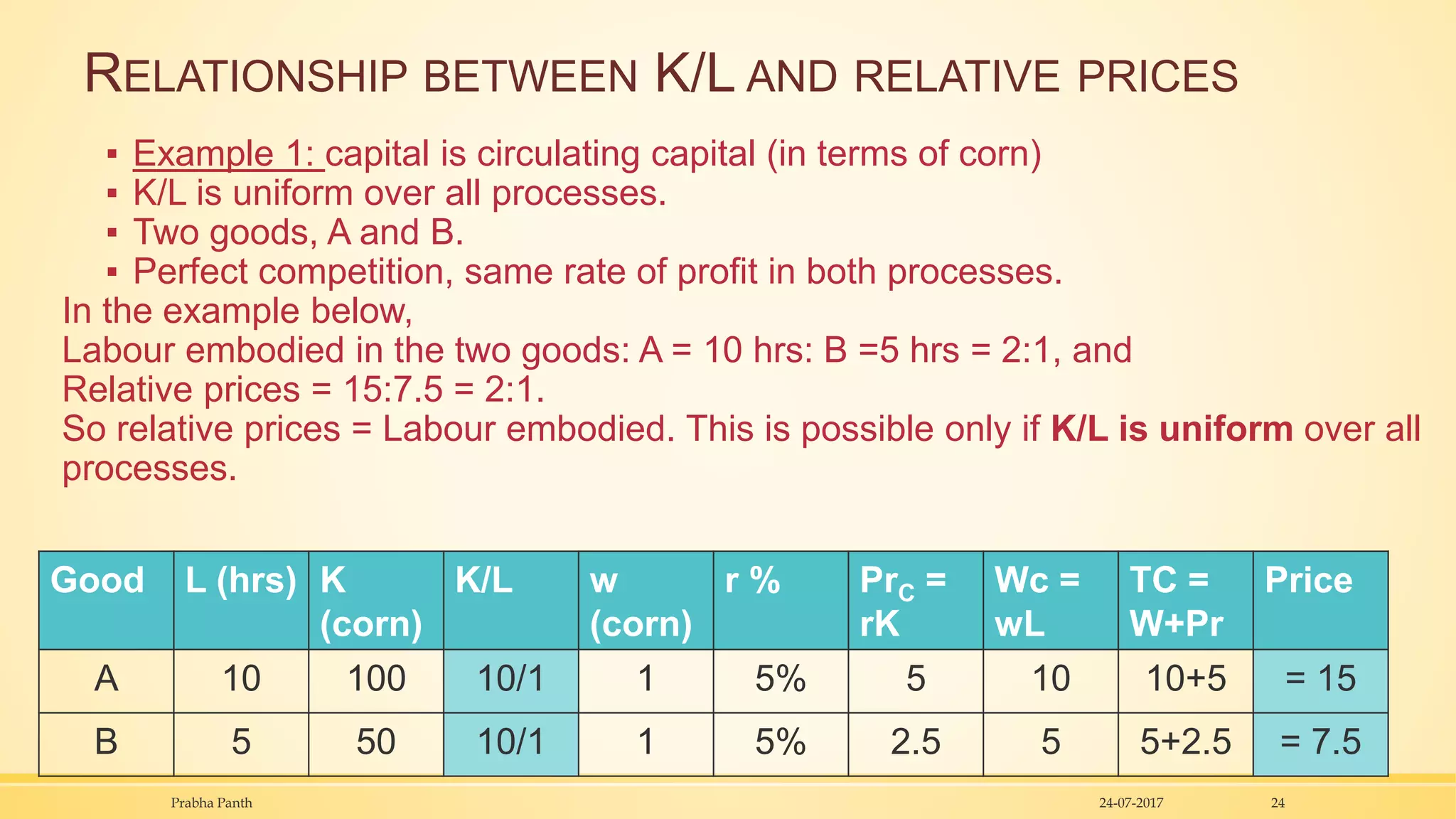

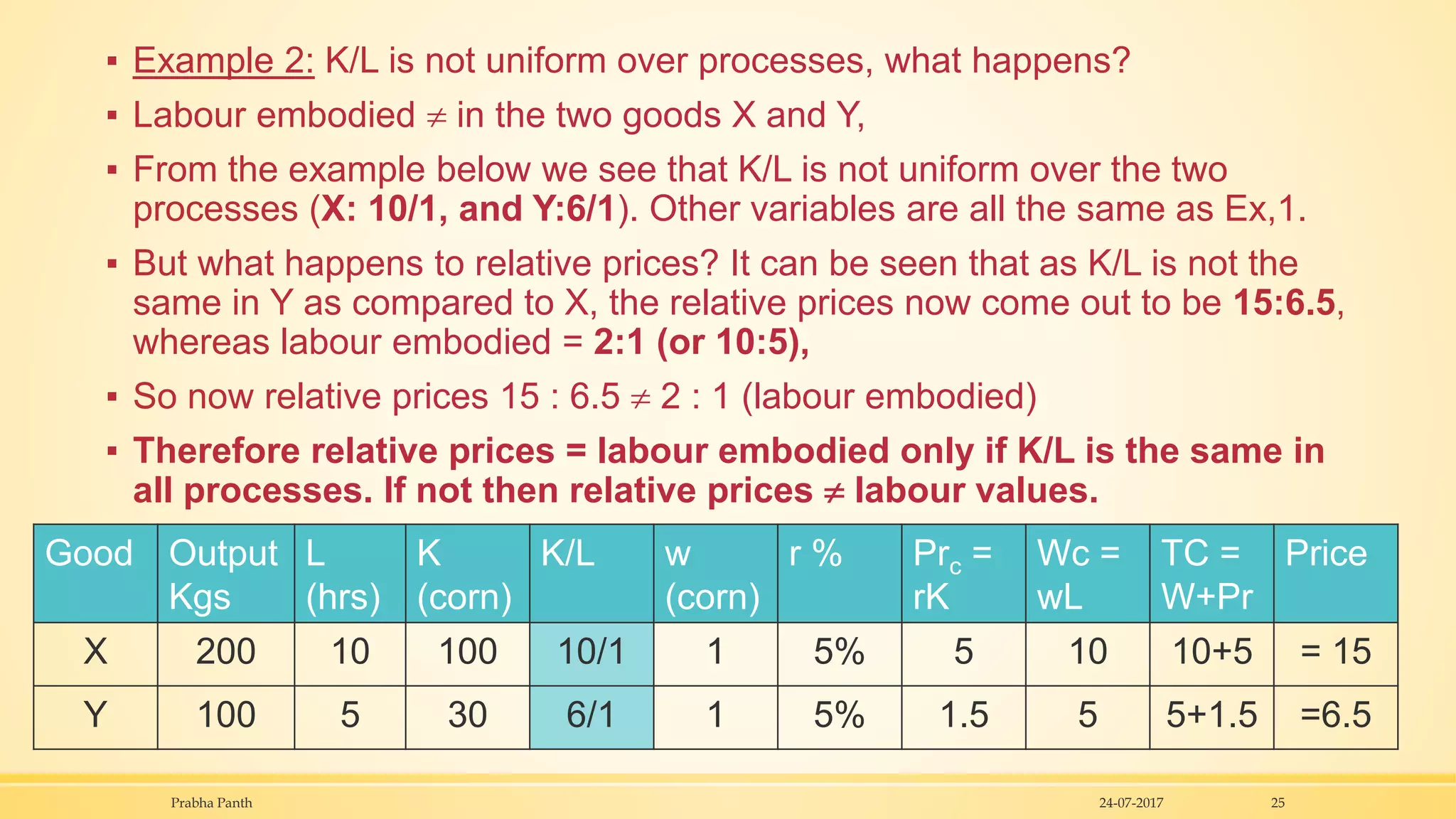

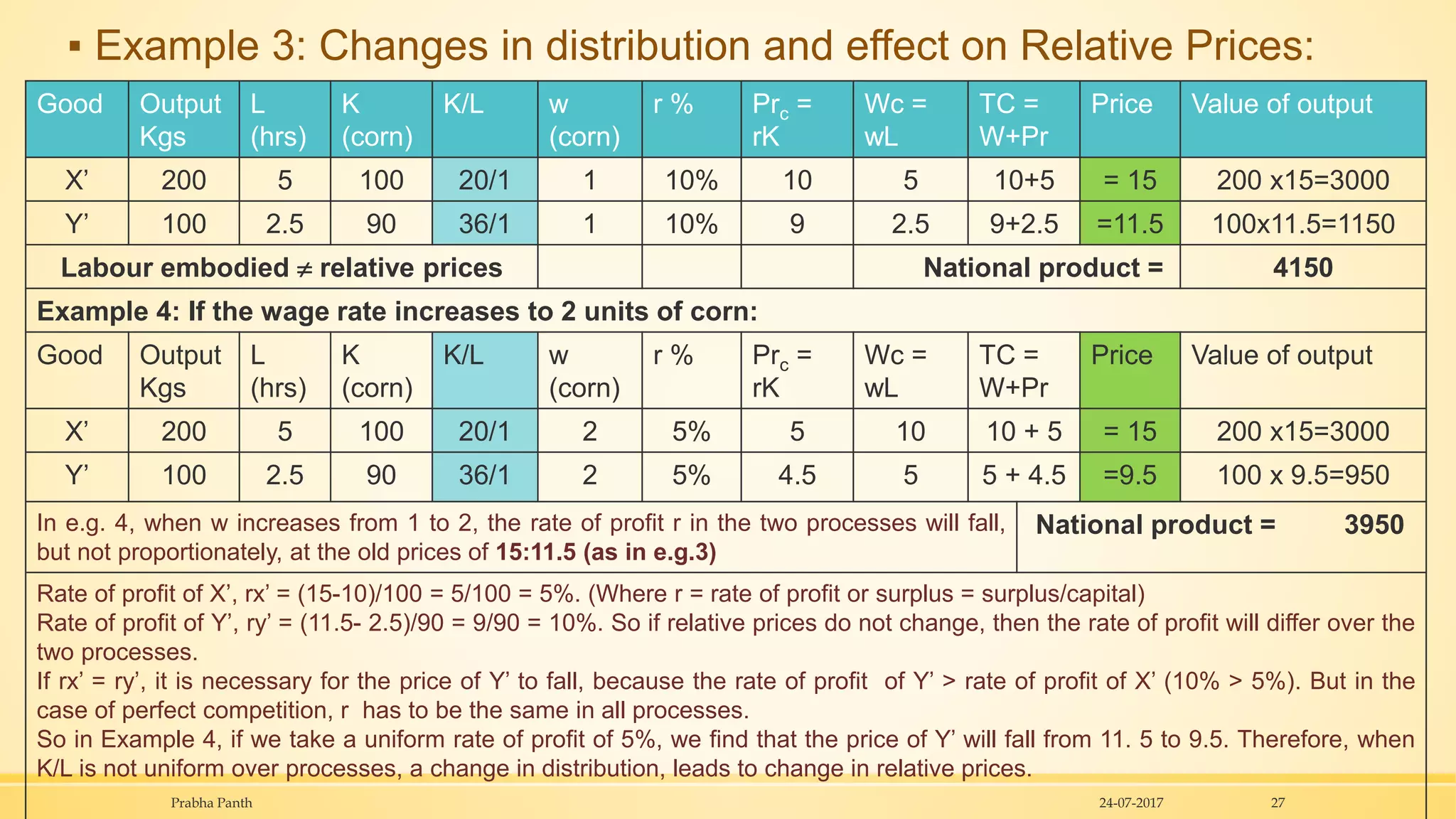

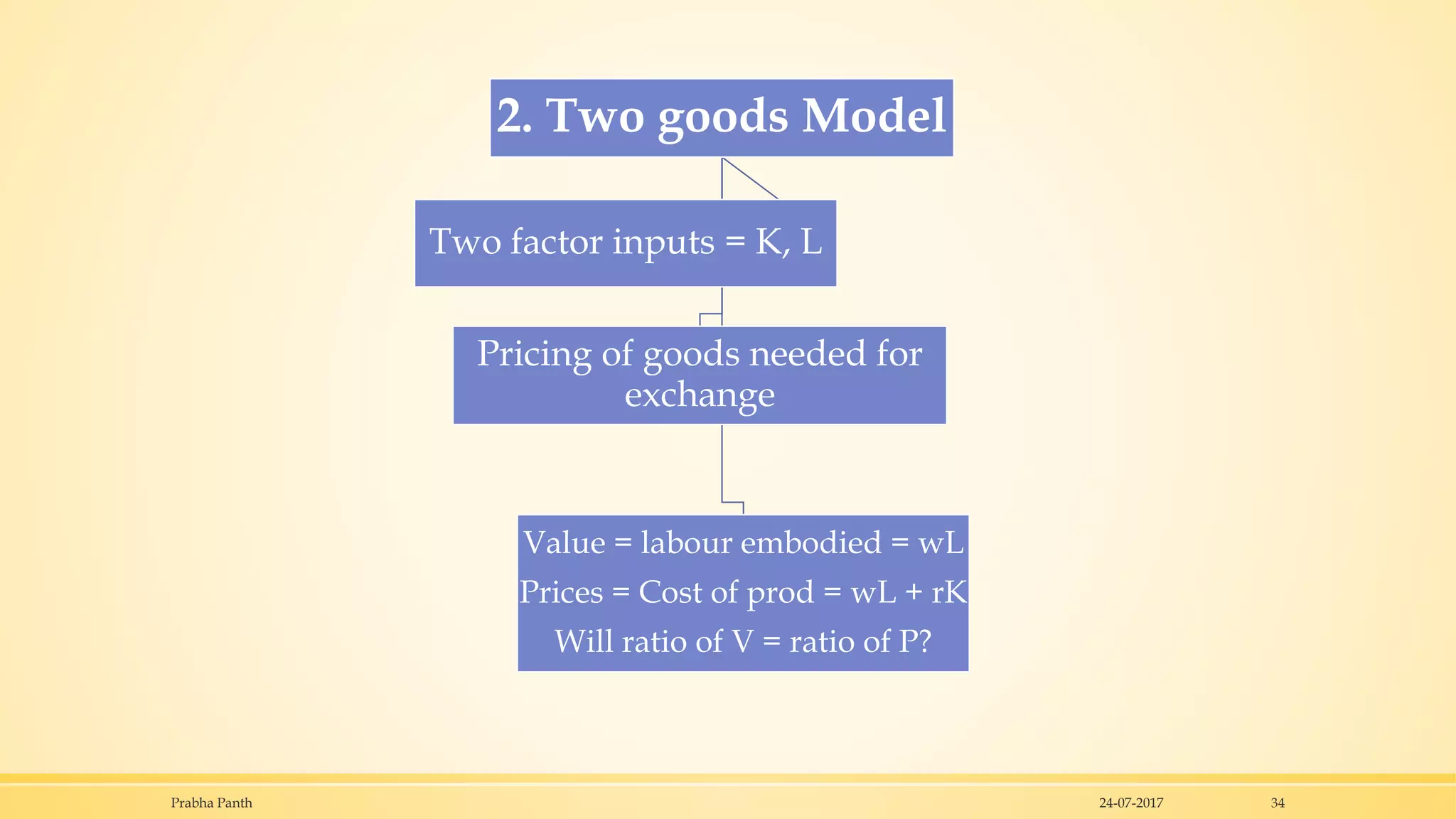

The document discusses Ricardo's theory of value, capital accumulation, and their interrelationship within a free enterprise economy. It emphasizes that capital accumulation drives economic growth, while the theory of value is linked to the labor embodied in commodities, rejecting previous concepts such as Smith's 'labor commanded' theory. Additionally, it presents Ricardo's one-good model and critiques it using Malthus' insights on wage rates and population dynamics, ultimately discussing how varying capital and labor inputs impact relative prices and profitability.