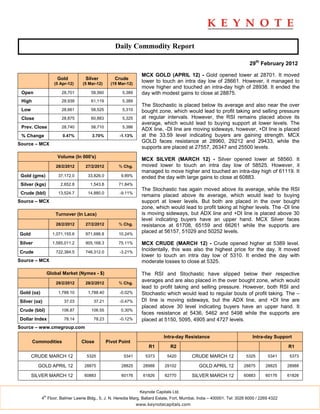

The daily commodity report summarizes the movement of gold, silver, and crude futures contracts on the MCX exchange. Gold futures closed slightly higher after fluctuating during the day, while silver futures had large gains. Crude futures closed lower after being higher early in the session. Technical indicators show mixed signals for further direction, with some pointing to potential further buying and others signaling the markets may be overbought. The report provides resistance and support price levels for the contracts.