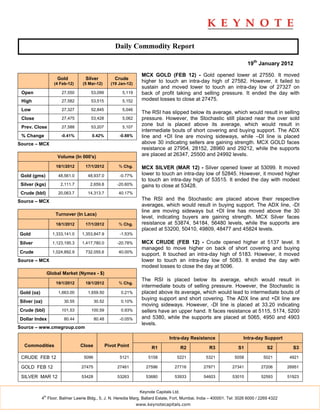

- The daily commodity report summarizes movements in gold, silver, and crude oil futures on the MCX exchange on January 19th, 2012.

- Gold and crude oil futures closed lower after reaching intraday highs, while silver futures closed modestly higher.

- Technical indicators like the RSI, Stochastic, ADX, and pivot points are referenced to gauge support and resistance levels and trading momentum.

- The report provides resistance and support price levels for futures contracts as well as a calendar of upcoming US economic data releases and speeches.