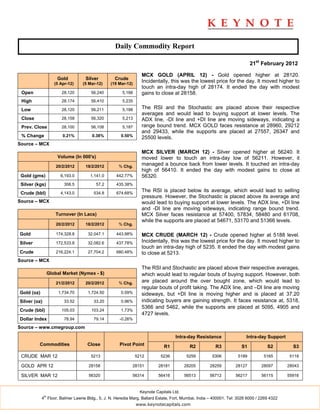

- The daily commodity report summarizes prices and trends for gold, silver, and crude oil futures on the MCX exchange for February 21, 2012.

- Gold prices opened higher and closed with modest gains. Silver opened higher but closed with only modest gains after dipping lower intraday. Crude oil opened higher and closed with modest gains above the day's lows.

- Technical indicators like the RSI and stochastic showed support for gold and crude oil at lower price levels, while the RSI showed selling pressure for silver. ADX lines pointed to range-bound trends for all three commodities.