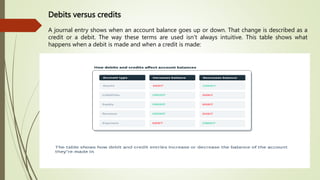

A journal entry records every business transaction with at least two entries, one for each account affected. It includes the date, reference number, accounts credited/debited, and an explanation. Accounts increase with credits and decrease with debits. Journal entries were traditionally made in separate journals but are now often directly entered into accounting software. They allow tracking all changes to accounts like cash, assets, liabilities, and equity from each transaction.