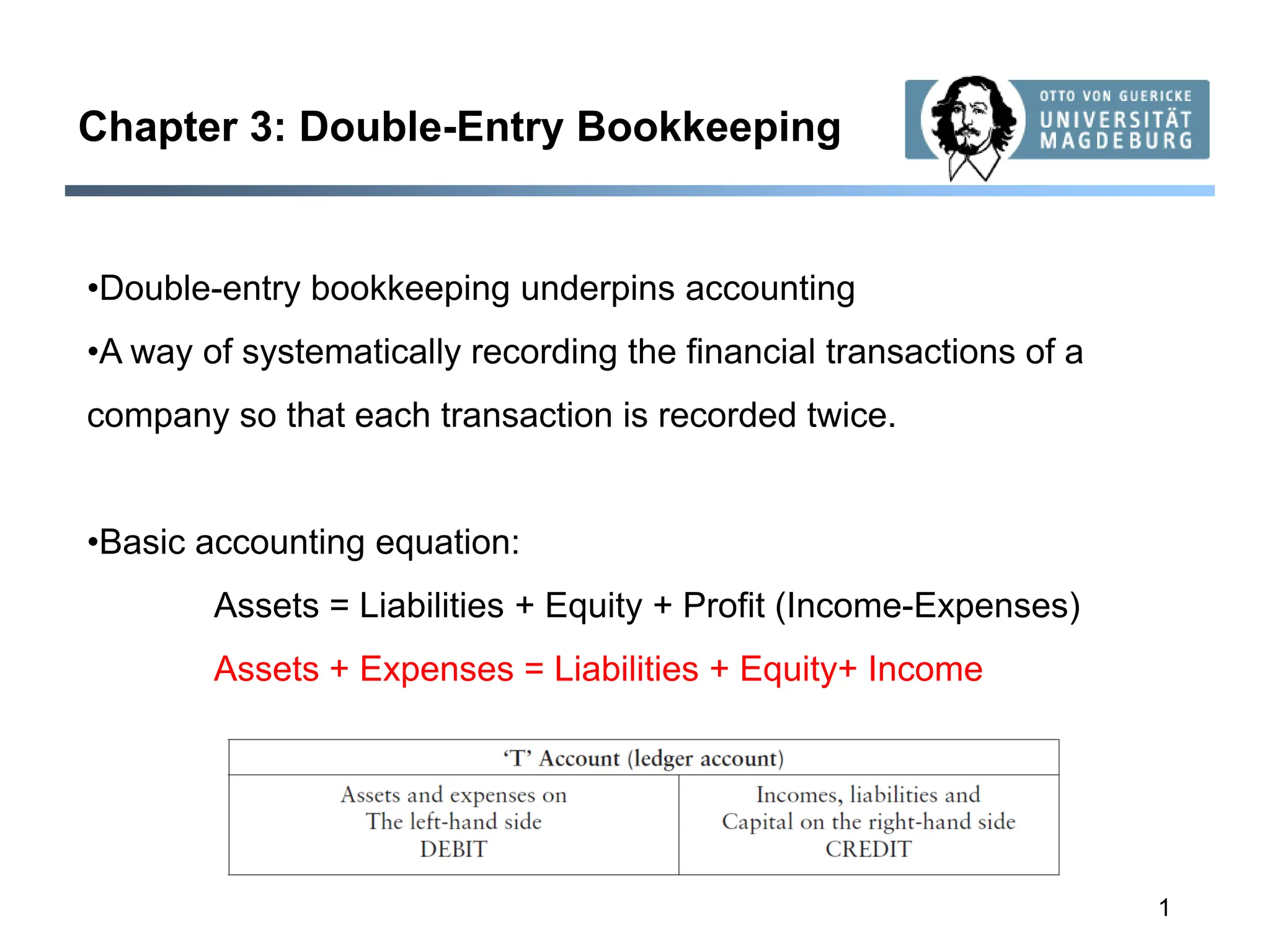

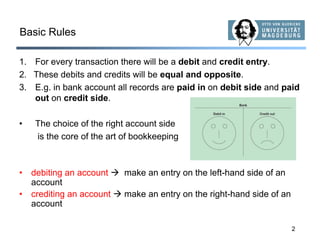

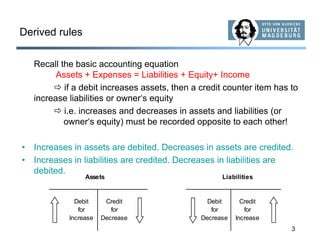

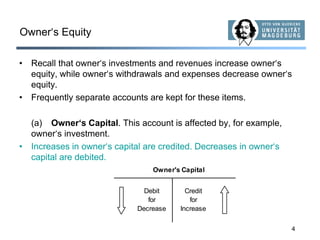

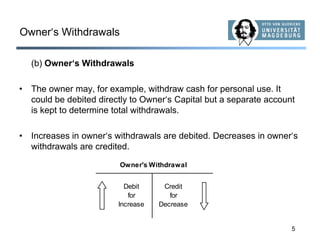

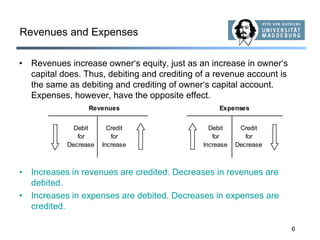

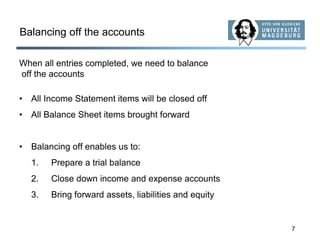

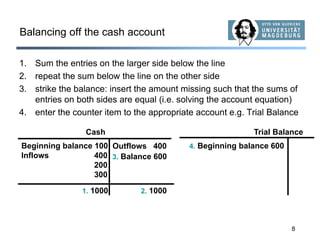

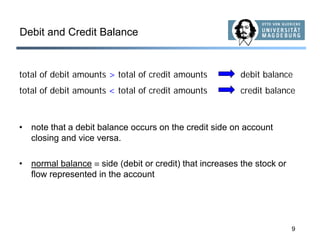

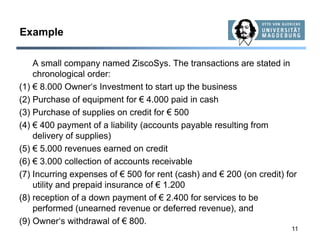

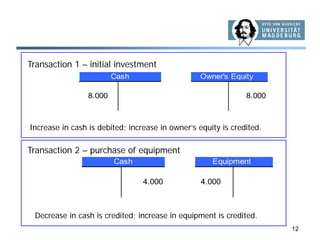

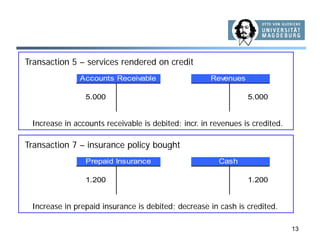

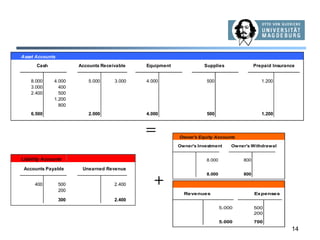

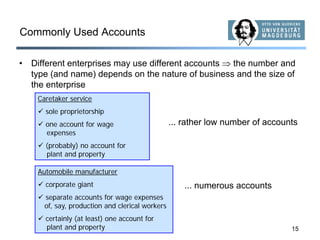

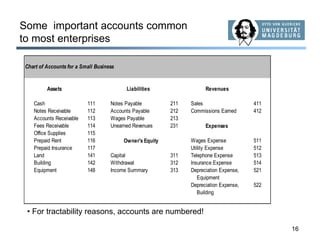

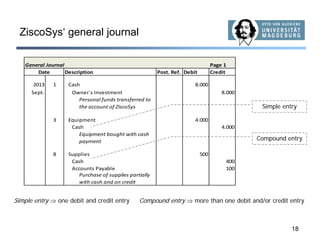

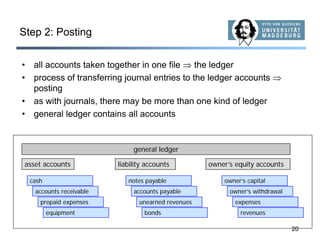

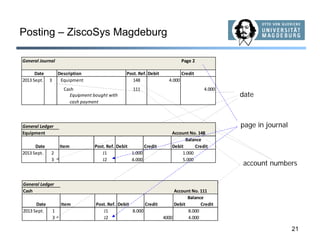

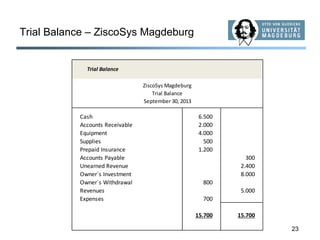

This document outlines the principles and mechanics of double-entry bookkeeping, highlighting the systematic recording of financial transactions with every entry having equal debit and credit counterparts. It explains the basic accounting equation, the role of owner’s equity, and common transactions categorized into assets, liabilities, revenues, and expenses. Additionally, it describes the processes of journalizing, posting to ledgers, and preparing trial balances to ensure the accuracy and integrity of financial records.