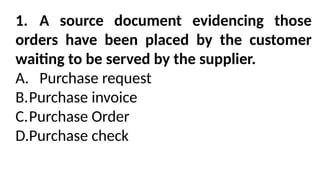

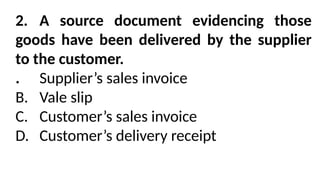

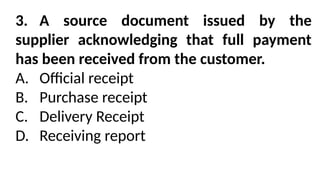

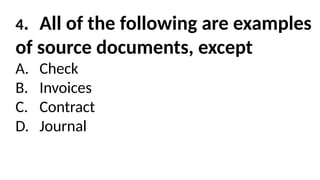

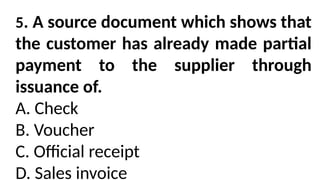

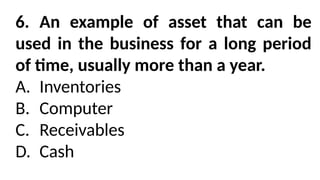

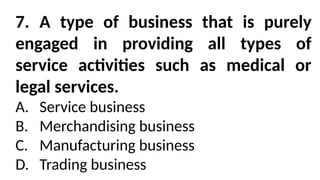

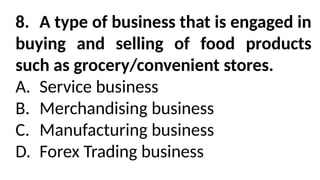

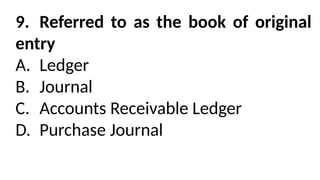

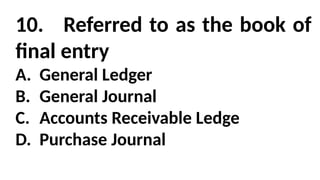

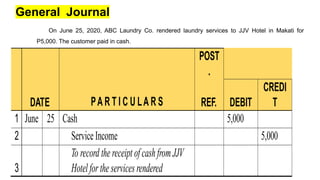

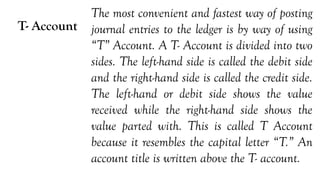

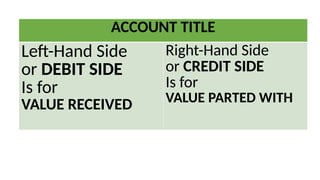

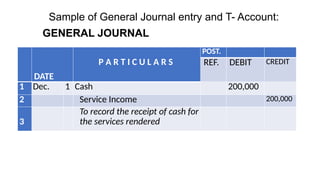

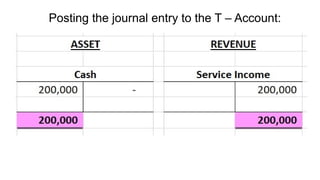

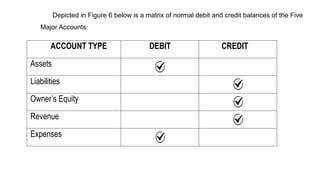

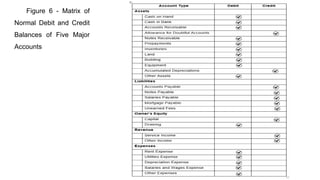

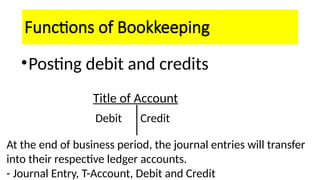

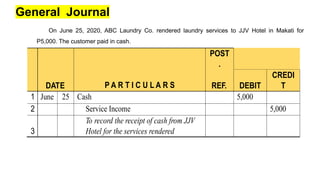

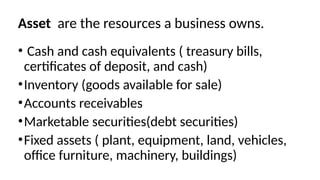

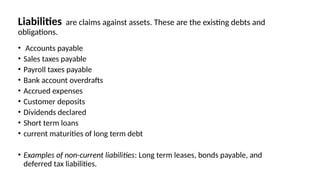

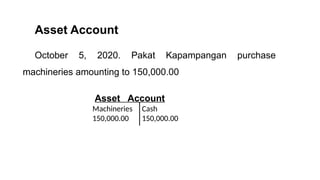

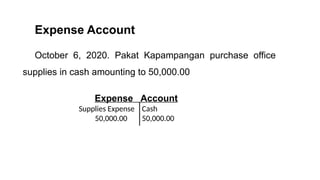

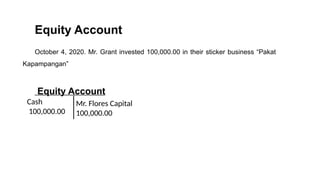

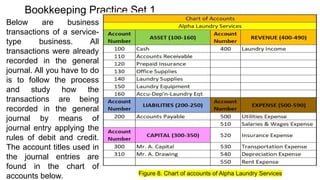

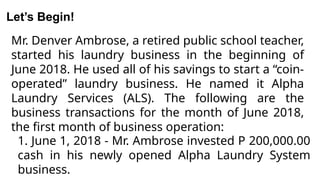

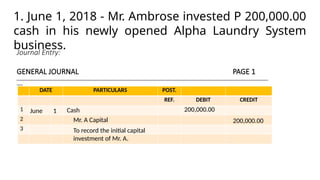

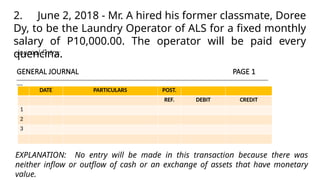

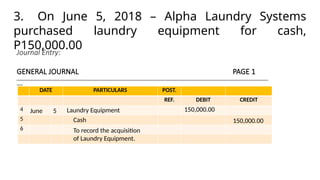

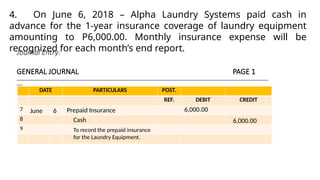

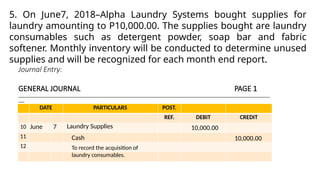

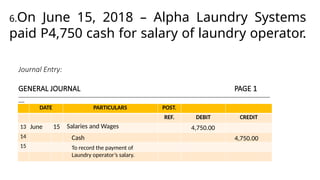

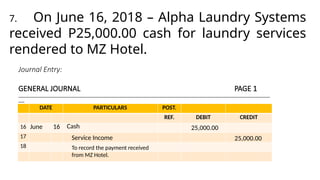

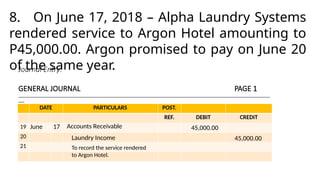

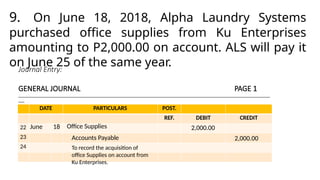

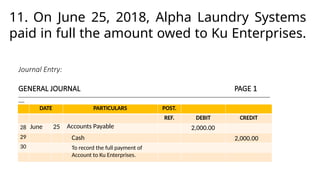

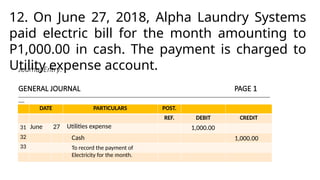

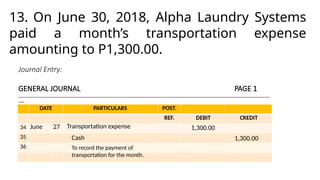

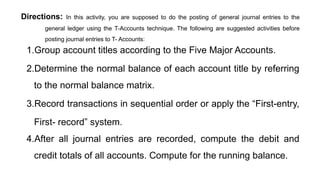

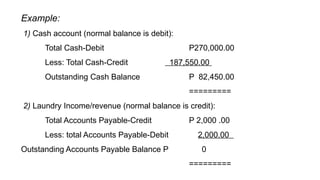

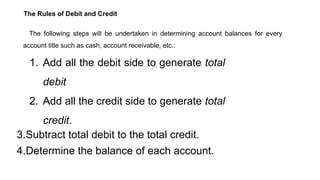

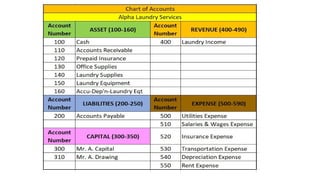

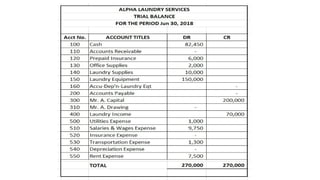

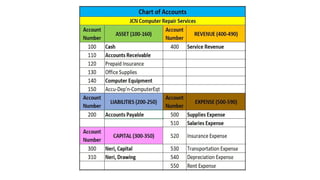

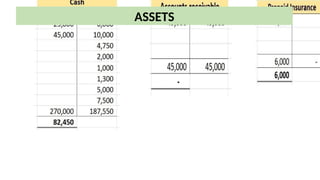

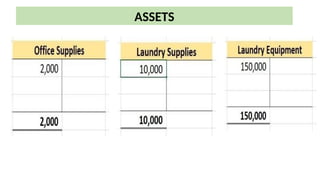

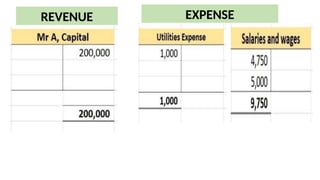

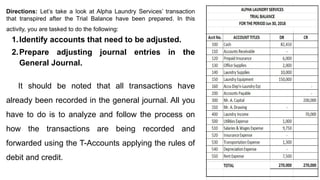

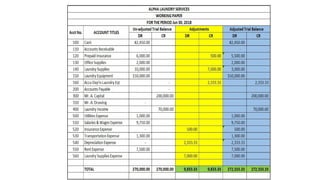

This document covers the basics of bookkeeping, detailing the recording of business transactions, source documents, and the differentiation between bookkeeping and accounting. It explains the types of accounts involved (assets, liabilities, owner's equity, revenue, and expenses) and includes examples of journal entries, T-accounts, and trial balances necessary for keeping accurate financial records. Overall, the document serves as a guide to managing business financial transactions systematically and effectively.