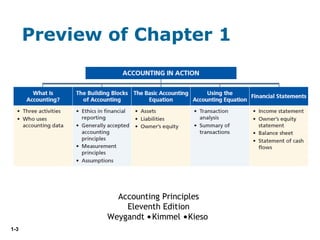

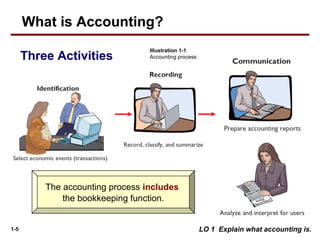

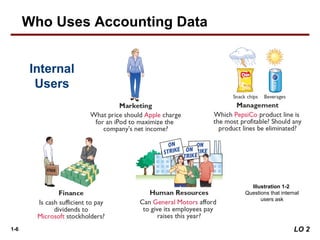

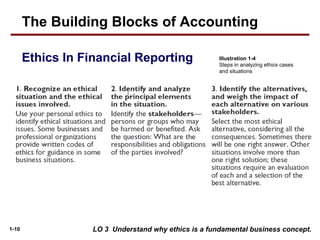

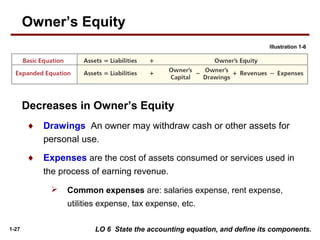

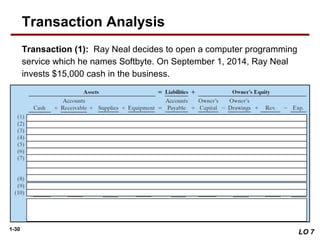

This document provides an overview of key concepts in accounting. It begins by listing the learning objectives, which include explaining what accounting is, identifying users and uses of accounting, understanding ethics and GAAP, and analyzing how business transactions affect the accounting equation. It then defines accounting as identifying, recording, and communicating the economic events of an organization. The three main activities are identifying, measuring, and communicating financial information. It discusses the users of accounting data, both internal and external. It emphasizes the importance of ethics in financial reporting. It also introduces the accounting equation, defines its components, and provides examples of how business transactions affect the equation. Finally, it briefly introduces the four main financial statements and GAAP.

![1-2

1

Learning Objectives

After studying this chapter, you should be able to:

[1] Explain what accounting is.

[2] Identify the users and uses of accounting.

[3] Understand why ethics is a fundamental business concept.

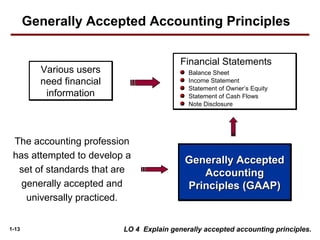

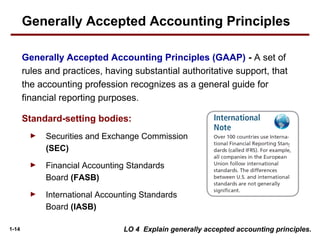

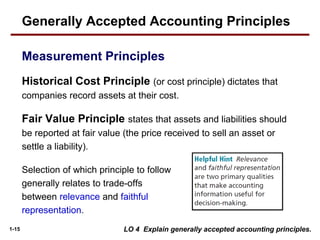

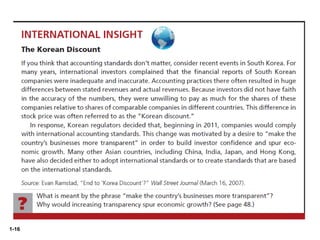

[4] Explain generally accepted accounting principles.

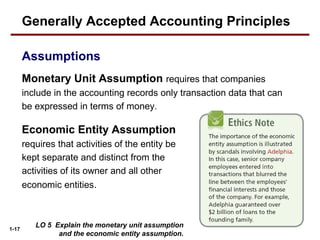

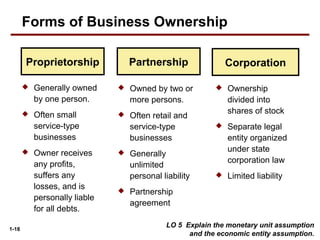

[5] Explain the monetary unit assumption and the economic entity

assumption.

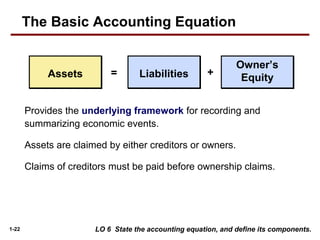

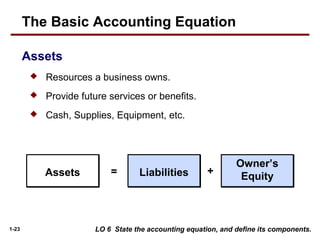

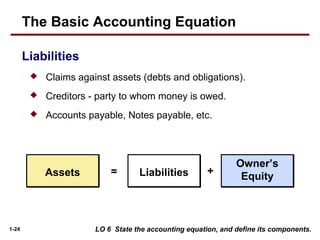

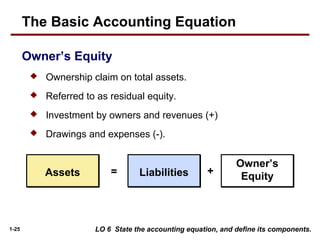

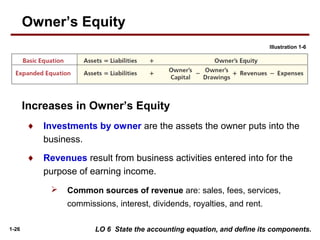

[6] State the accounting equation, and define its components.

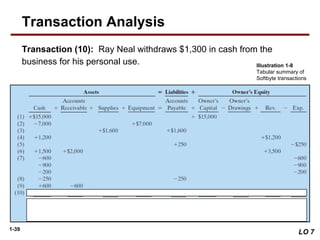

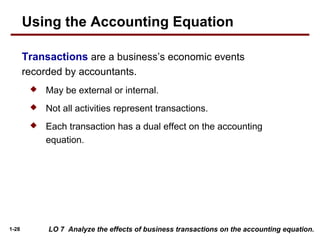

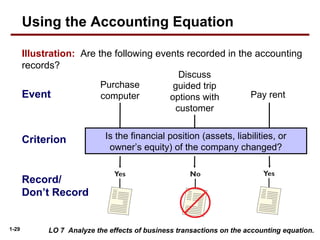

[7] Analyze the effects of business transactions on the accounting equation.

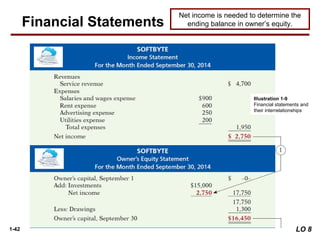

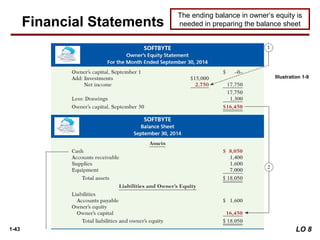

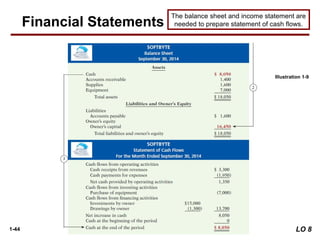

[8] Understand the four financial statements and how they are prepared.

Accounting in Action](https://image.slidesharecdn.com/ch01-1-170428165118/85/Chapter-1-accounting-kimmel-kieso-2-320.jpg)

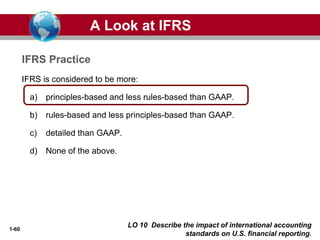

![1-38

Transaction (9): Softbyte receives $600 in cash from customers who

had been billed for services [in Transaction (6)].

LO 7

Transaction Analysis](https://image.slidesharecdn.com/ch01-1-170428165118/85/Chapter-1-accounting-kimmel-kieso-38-320.jpg)