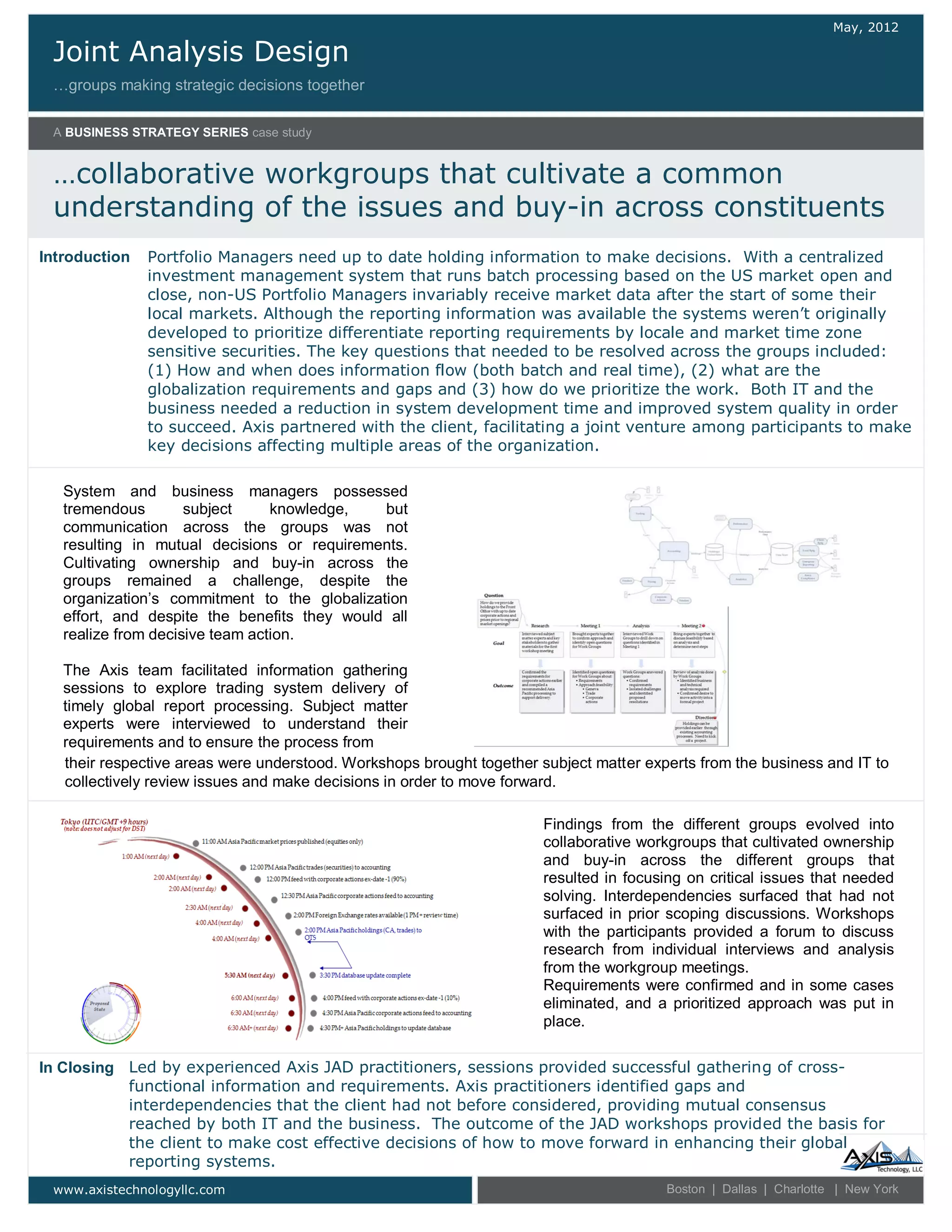

Axis facilitated joint analysis design (JAD) workshops between IT and business groups at a client organization to enhance their global reporting systems. Through interviews and collaborative workgroups, Axis helped surface gaps, interdependencies, and critical issues that had not previously been identified. This process cultivated mutual understanding and consensus across groups. The outcome of the JAD workshops provided an effective basis for the client to make cost-effective decisions on how to move their global reporting systems forward.