1) Axis partnered with a top US financial institution to streamline its regulatory technologies and reduce financial and compliance risk related to know-your-customer (KYC) and anti-money laundering (AML) policies and procedures.

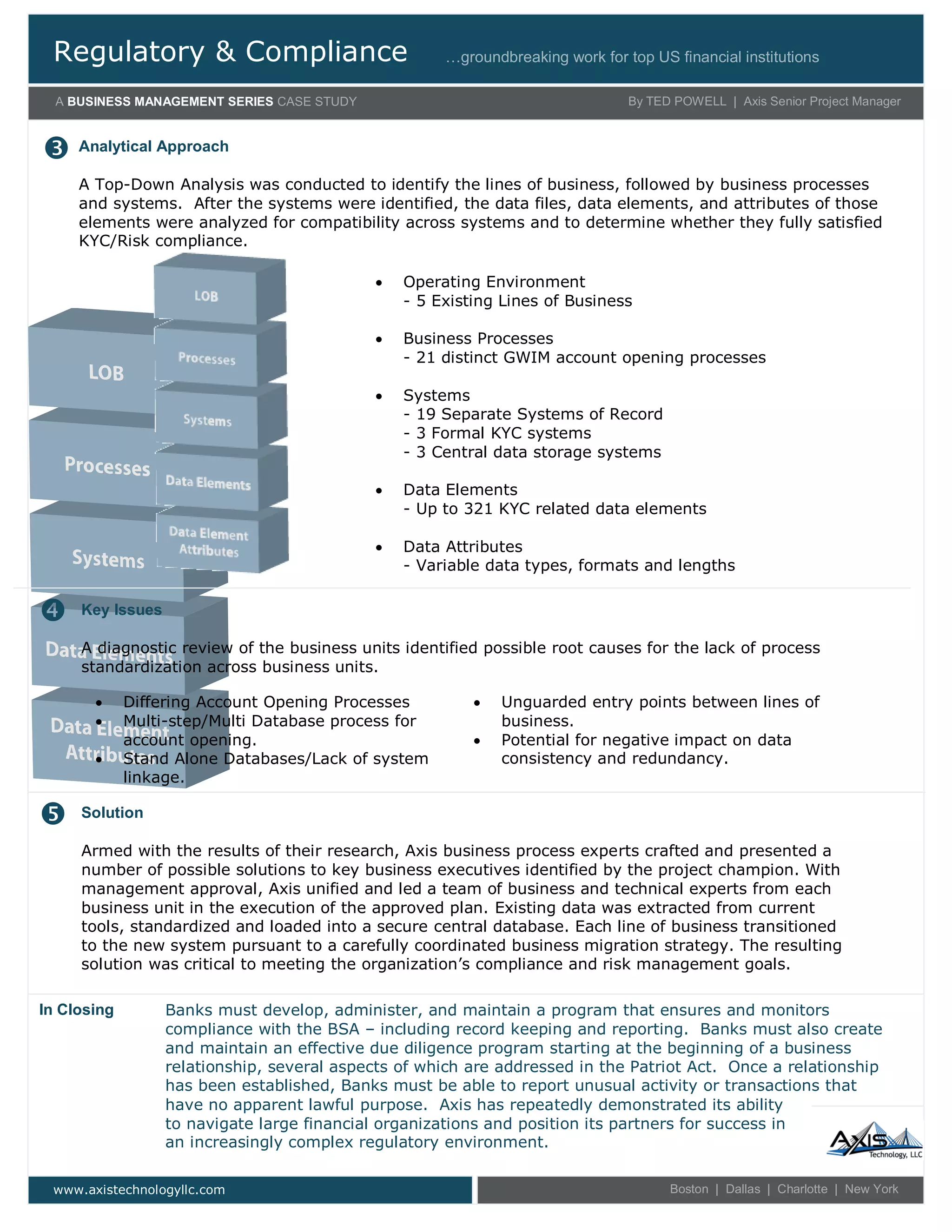

2) An analysis found the financial institution had inconsistent KYC and AML risk rating processes across its multiple business lines due to differing account opening processes, standalone databases without linkage, and unguarded entry points between business lines.

3) Axis proposed and helped implement a solution that standardized data collection and storage into a central secure database, streamlined customer onboarding processes, and ensured compliance with evolving money laundering and terrorist financing regulations.