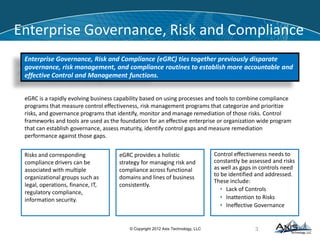

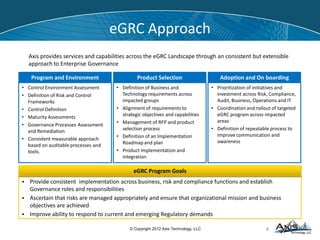

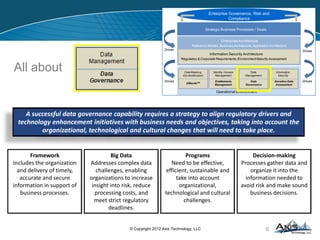

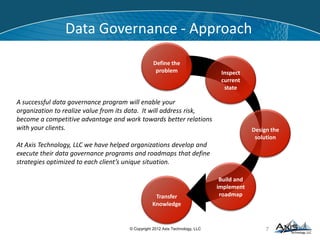

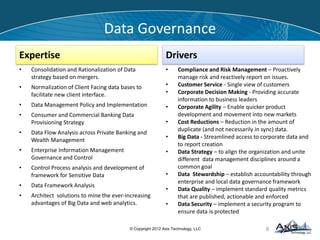

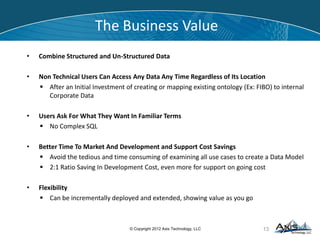

Financial firms face complex data challenges due to fast changing regulations, complicated instruments, and data silos. Traditional methods of modeling data before consumption are expensive and lack agility. The document proposes that a semantic web approach combining structured and unstructured data can help firms increase insight, reduce costs, and improve agility by allowing non-technical users to access any data in familiar terms without complex queries. This solution extends big data practices to corporate structured data and introduces ontologies to integrate disparate sources. The approach involves free seminars and pilots before a priced proof of concept and final engagement.