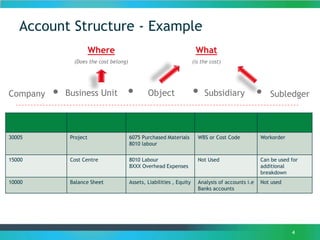

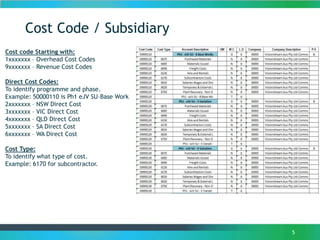

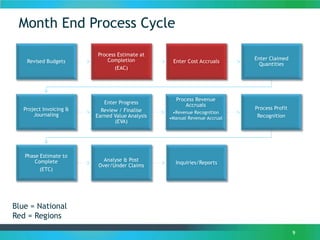

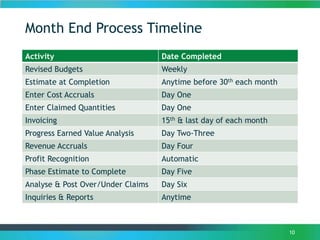

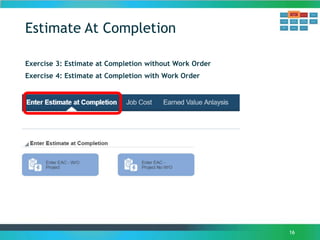

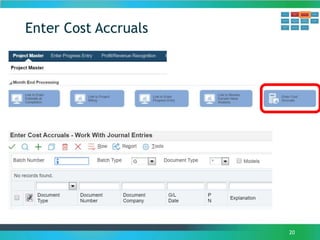

This document provides an overview of the month end process for JDE projects with work orders. It describes the key steps in the process including processing estimates at completion, entering claimed quantities, revenue and cost accruals, project invoicing and journaling, progress analysis, and various reports. Timelines for completing each step are provided. The document also includes explanations of concepts like budgets, cost codes, and estimate at completion calculations.