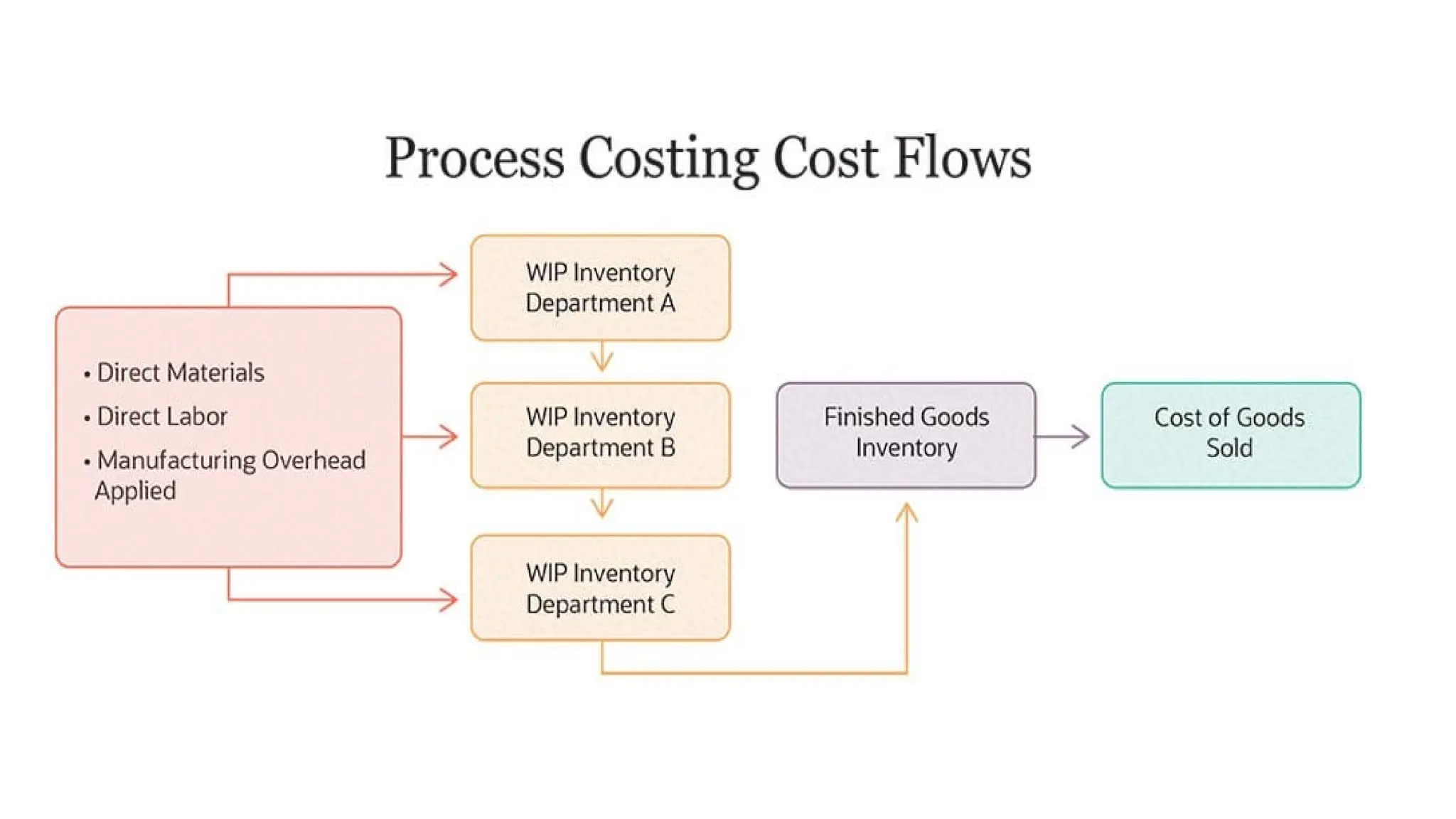

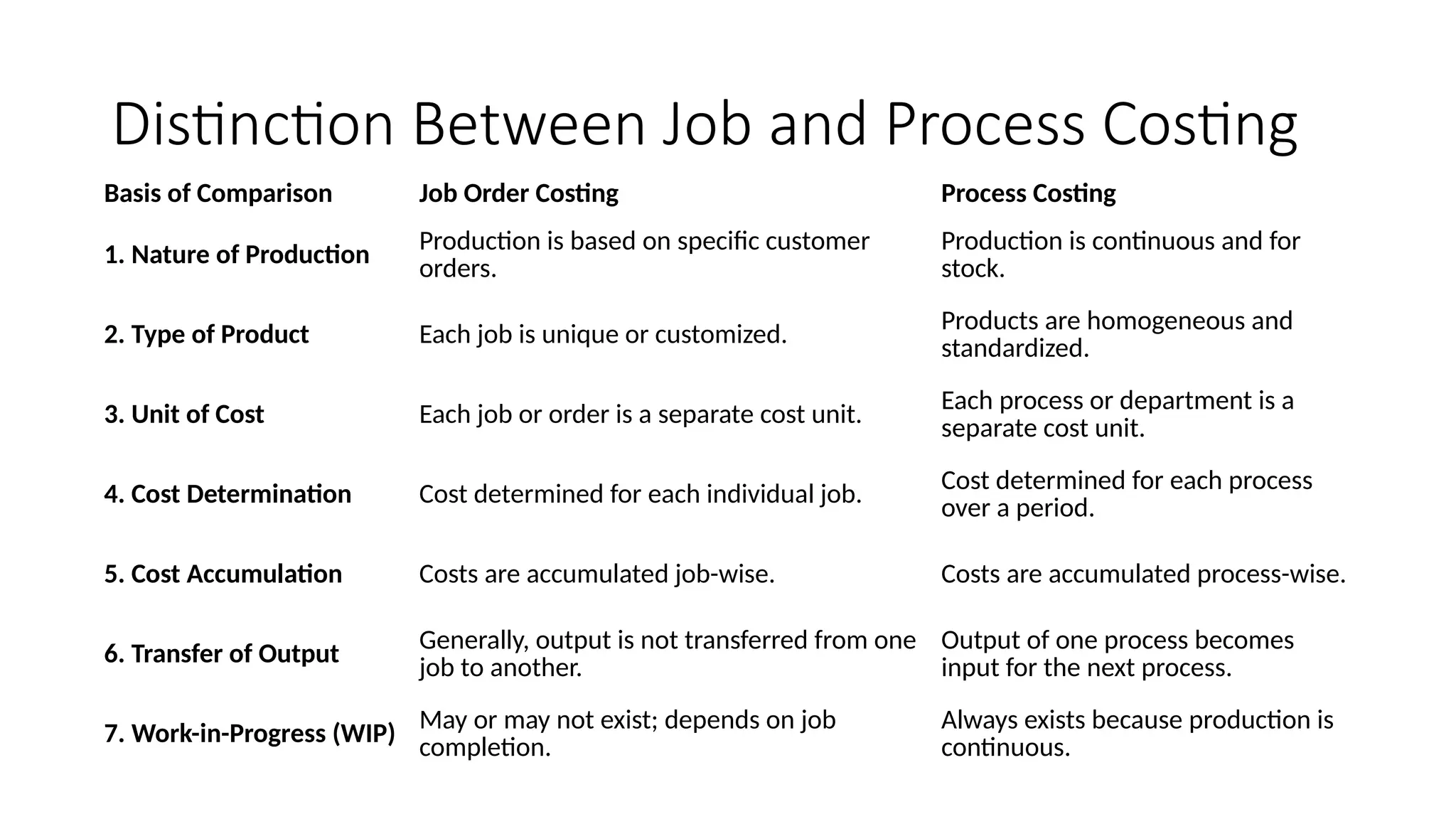

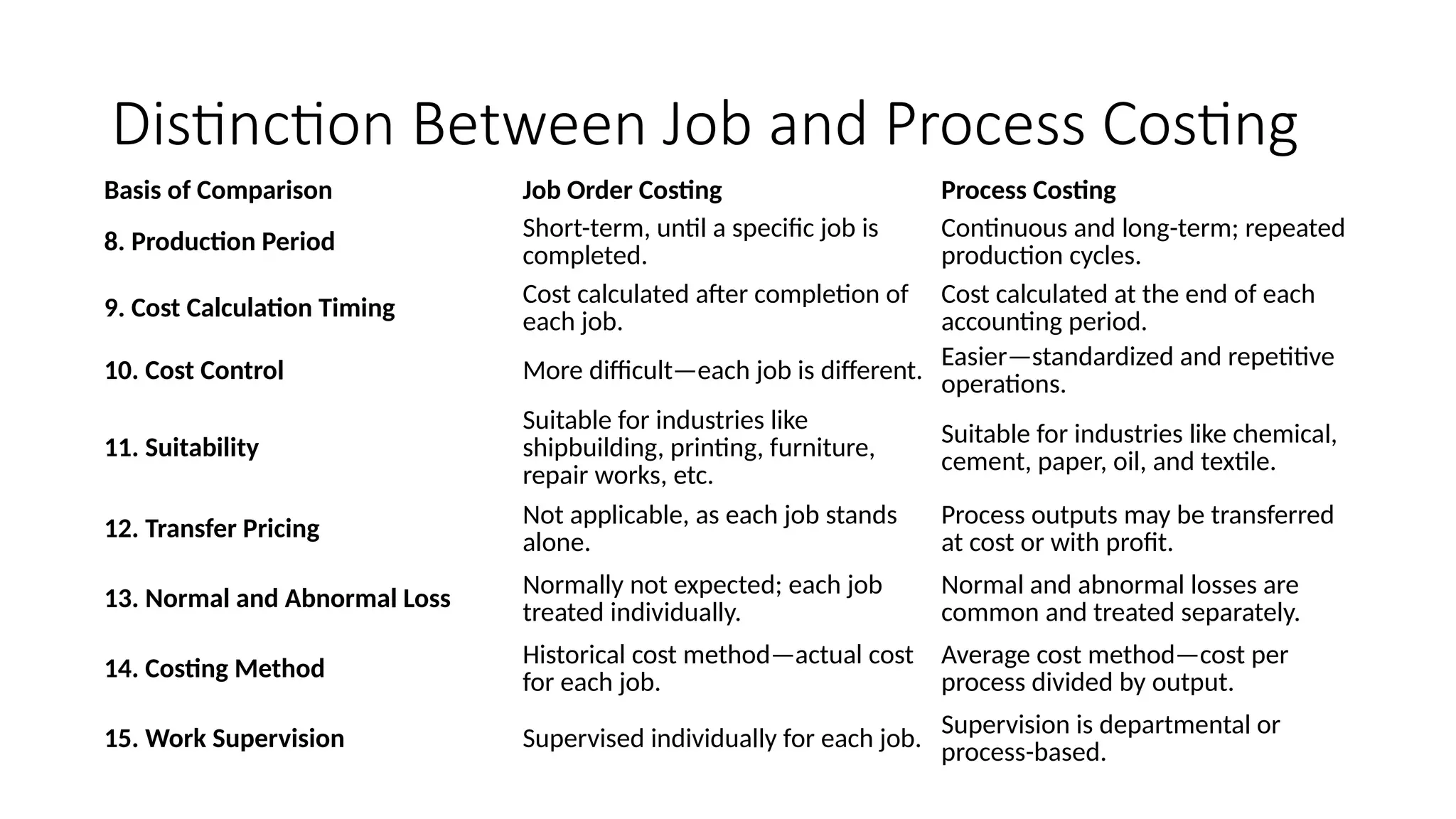

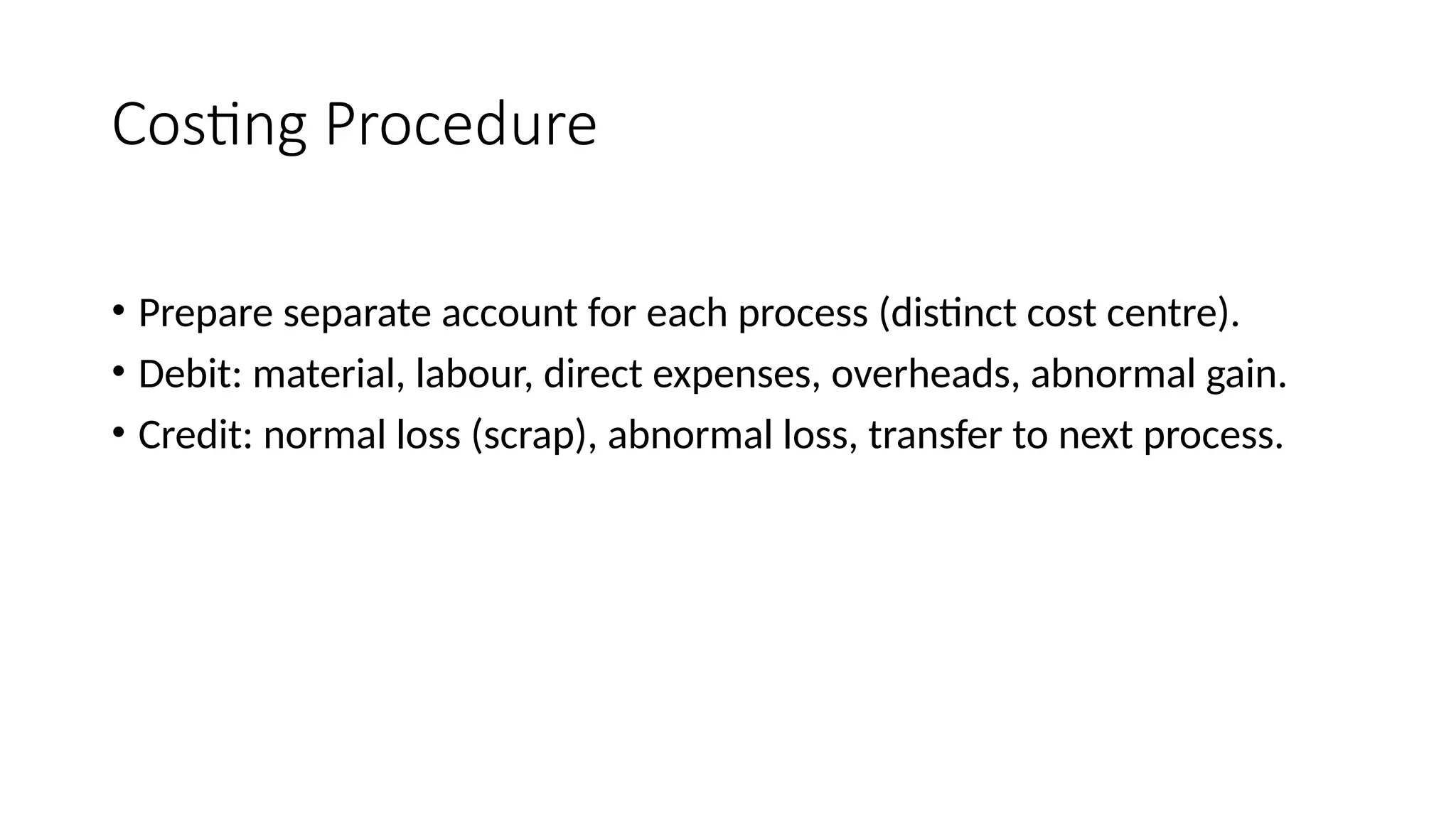

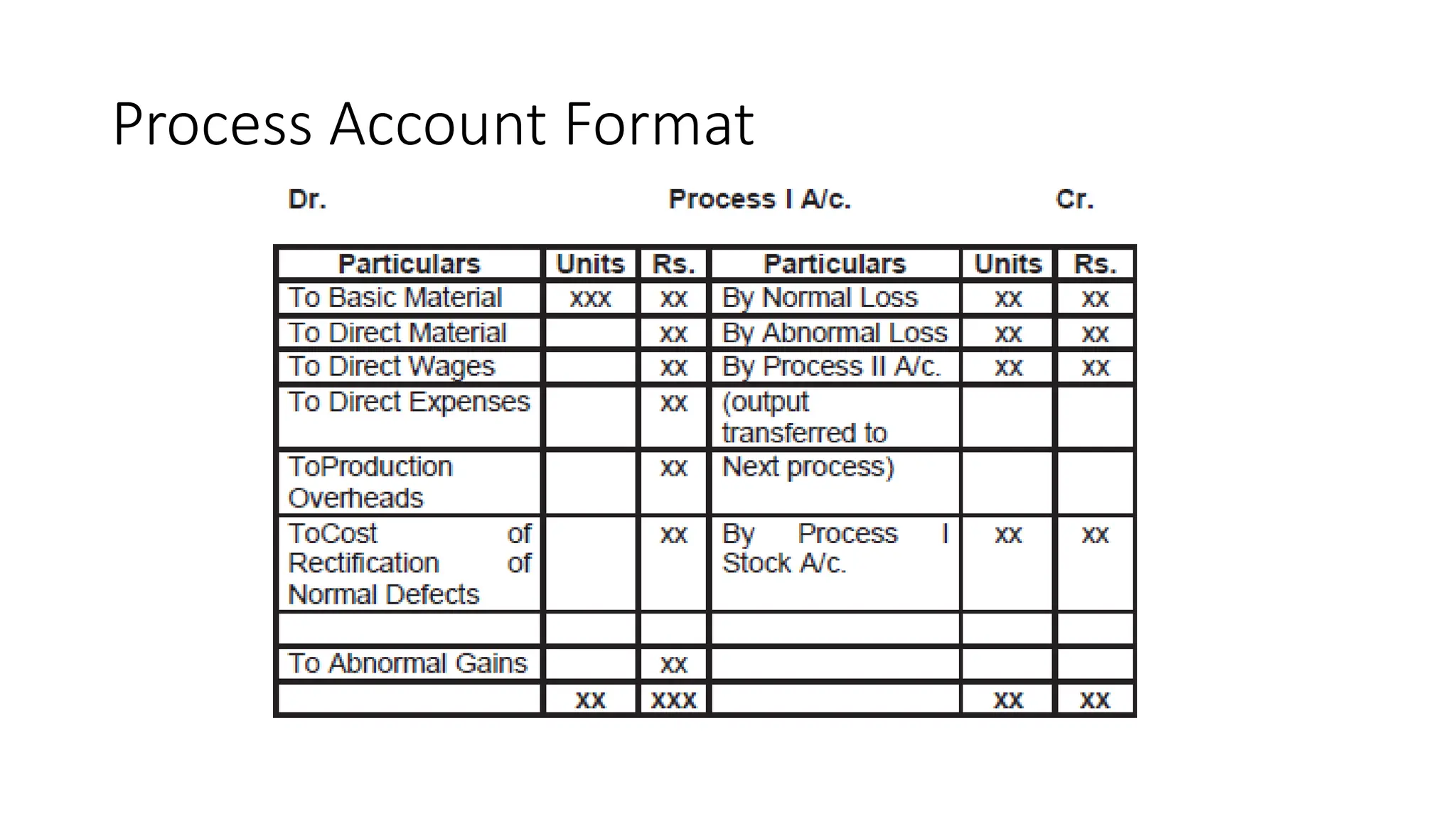

Process costing is a method used to calculate the cost of producing large quantities of identical or similar products. It is common in industries like chemicals, textiles, oil refining, and food processing, where production is continuous and products pass through various stages or processes. Costs are accumulated for each process and then averaged over all units produced to determine the cost per unit.