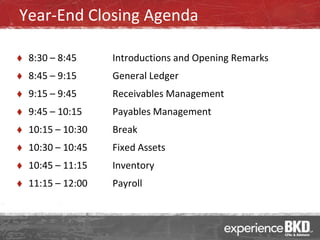

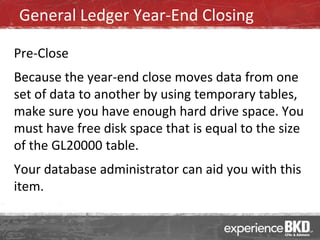

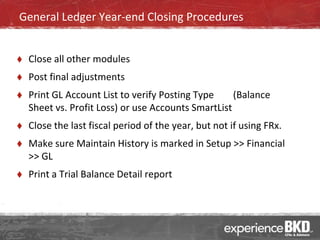

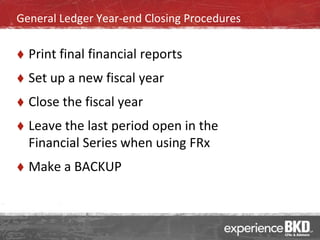

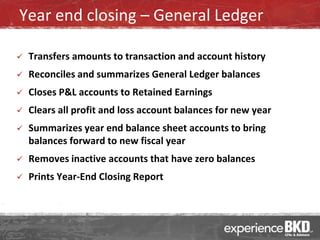

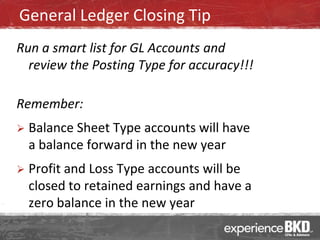

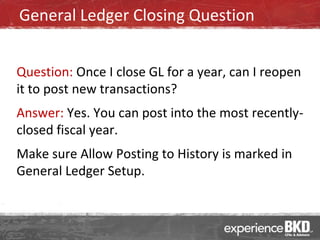

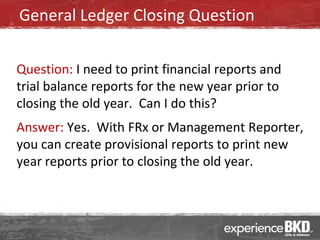

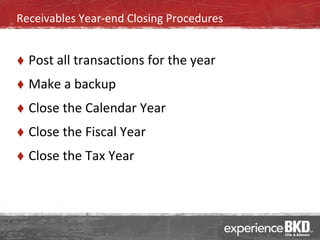

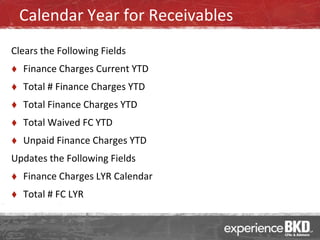

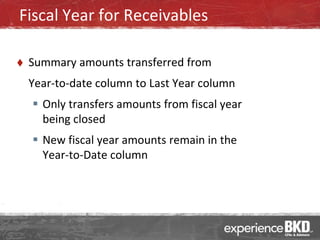

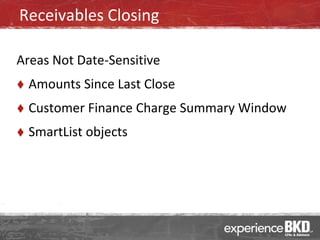

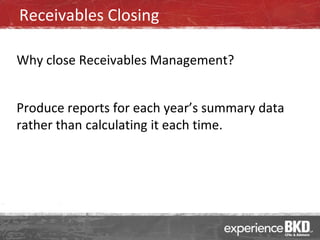

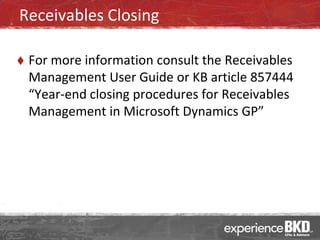

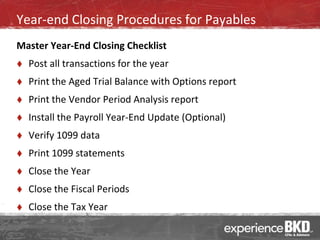

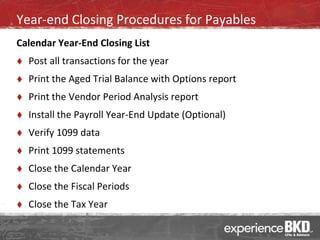

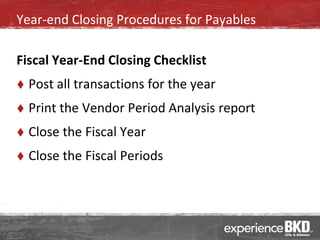

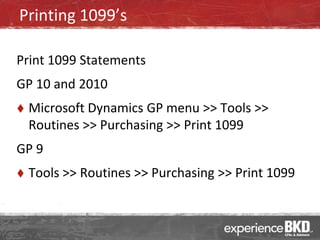

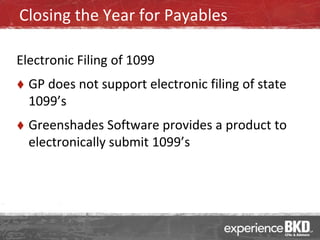

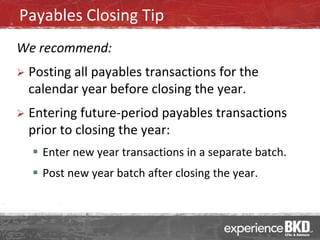

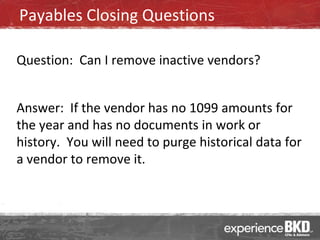

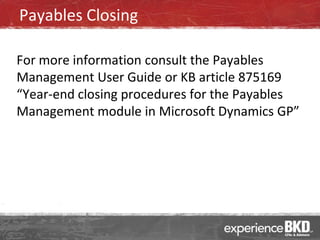

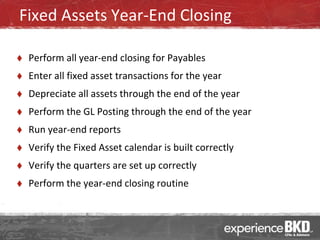

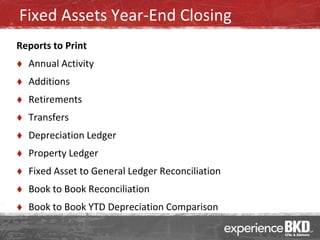

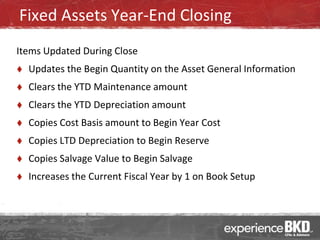

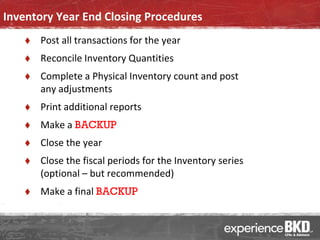

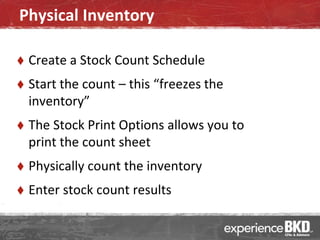

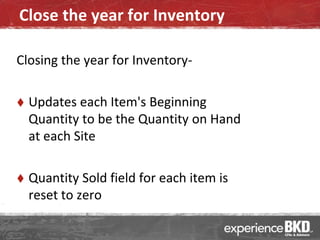

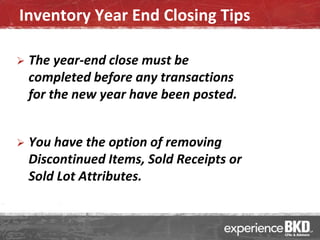

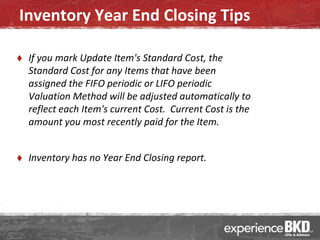

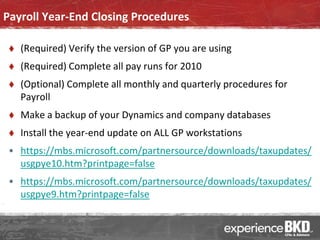

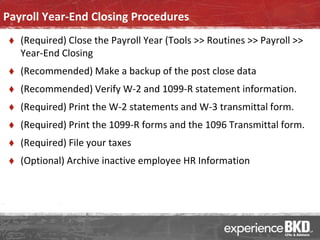

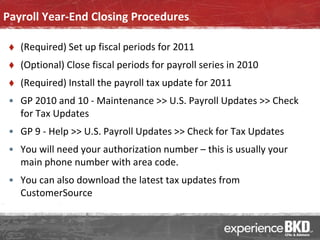

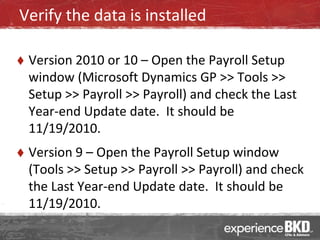

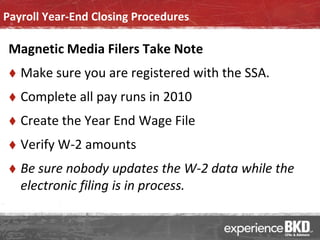

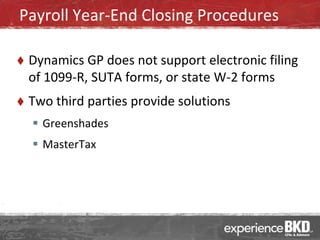

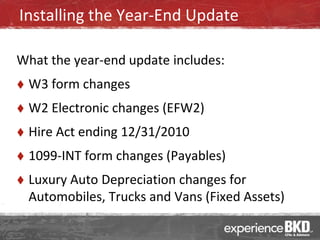

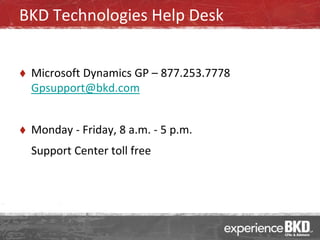

This document outlines the year-end closing procedures for various modules in Microsoft Dynamics GP, including general ledger, receivables, payables, fixed assets, inventory, and payroll. It provides detailed steps for closing each module, such as posting transactions, printing reports, and setting up new fiscal years. Additionally, it includes tips, FAQs, and resources for further guidance on the year-end process.