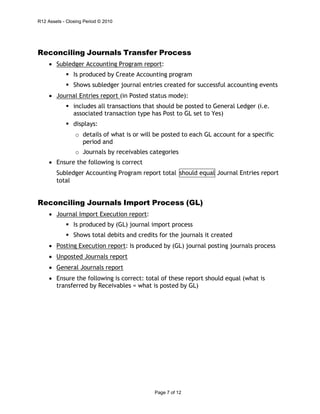

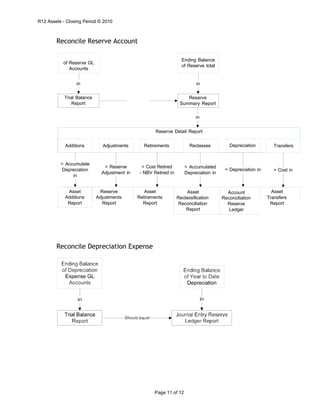

Oracle Assets period closing procedures require completing transactions, running depreciation, creating and posting journals, reconciling subledgers to the general ledger, and reconciling key asset accounts. The key accounts to reconcile are the asset cost account, asset construction in progress cost account, reserve account, and depreciation expense. Reconciliations must show that the ending subledger balances for additions, adjustments, retirements, reclassifications and transfers equal the ending general ledger account balances.