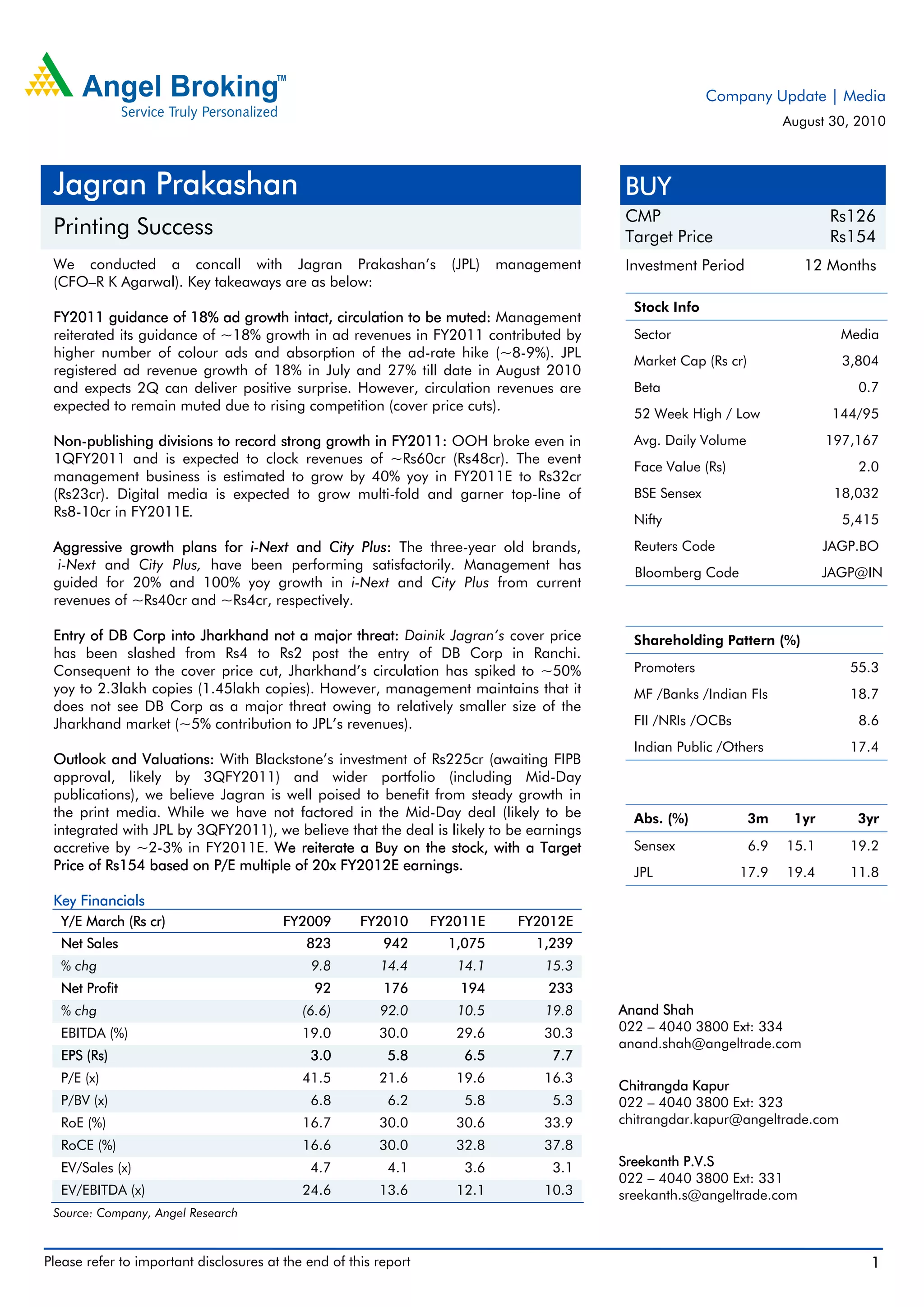

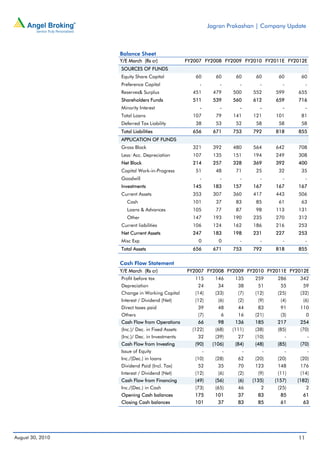

The document provides an update on Jagran Prakashan from a research report dated August 30, 2010.

Key points include:

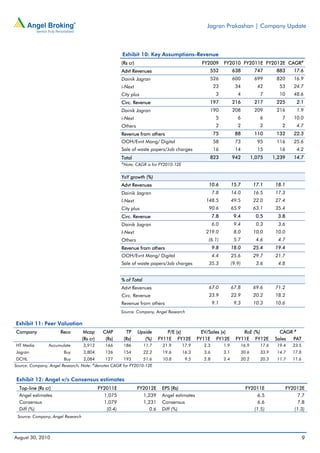

1) Management reiterated 18% advertising revenue growth guidance for FY2011 and expects a positive surprise in 2Q results. However, circulation revenues are expected to remain muted.

2) Non-publishing divisions such as OOH and event management are expected to record strong growth in FY2011.

3) The company's digital media business and compact publications i-Next and City Plus are also expected to achieve aggressive revenue growth targets in the coming years.