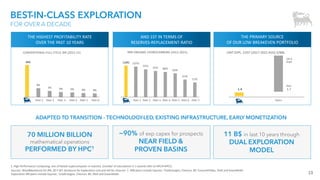

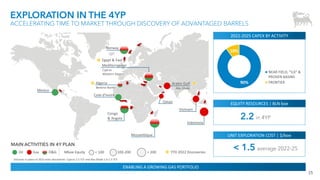

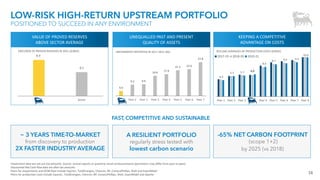

- Eni has a best-in-class exploration track record over the past decade, with the highest profitability rate and reserves replacement ratio among its peers.

- Eni focuses on near-field exploration in proven basins using advanced technology and high equity stakes, resulting in a low-risk, high-return upstream portfolio.

- Eni's exploration strategy is distinguished by its dual exploration model, proprietary computational capabilities, and continuous acreage reloading to sustain a large portfolio of prospects.

![38

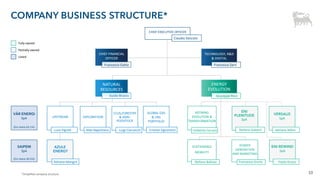

ENI TOP MANAGEMENT [1/3]

He was appointed Chief Financial Officer in Eni on 1st August, 2020.

He graduated in Economics and Commerce at the University of Bologna.

He joined Agip S.p.A. in 1995. From 2001 to 2005 he was Head of

Negotiations & Commercial Planning in Libya activities. From 2006 to 2008,

he became Head of Business Planning and Development activities for Africa,

Europe, Asia & America, supporting the E&P Division’s Deputy General

Director. In 2009, he was appointed Head of Upstream M&A, contributing

to the rationalization of the portfolio. In 2011, he became Senior Vice

President of Market Scenarios and Strategic Options in Eni SpA. In 2014, he

was appointed Head of Investor Relations and also acted as Secretary to

Eni's Advisory Board from 2016 to 2019. In 2019, he moved to Houston to

become Upstream Director of the Americas, managing the E&P business in

the USA, Mexico, Venezuela and Argentina.

Francesco Gattei - CFO

Claudio Descalzi - CEO

He has been Eni’s CEO since May 2014.

He graduated in physics in 1979 from the University of Milan.

He joined Eni in 1981 as Oil & Gas field petroleum engineer. In 1990

he was appointed Head of Reservoir and operating activities for

Italy. From 2000 to 2001 he held the position of Executive Vice

President for Africa, Middle East and China. From 2002 to 2005 he

was Executive Vice President for Italy, Africa, Middle East, covering

also the role of member of the board of several Eni subsidiaries in

the area.

In 2005, he was appointed Deputy Chief Operating Officer of the

E&P Division in Eni. From 2008 to 2014 he was Chief Operating

Officer in the E&P Division of Eni. In 2012, Claudio Descalzi was the

first European in the field of Oil&Gas to receive the prestigious

“Charles F. Rand Memorial Gold Medal 2012” award from the

Society of Petroleum Engineers and the American Institute of Mining

Engineers. In May 2022 he received the Distinguished Business

Leadership Award from the Atlantic Council.

Giuseppe Ricci – Energy Evolution

Guido Brusco – Natural Resources

He was appointed Chief Operating Officer Natural Resources of Eni

on February 7th, 2022.

After graduating with Honors in Mechanical Engineering at the

University of Roma “La Sapienza”, he joined Eni in 1997.

He began his career in drilling and production, holding positions of

growing responsibility, in different countries, up to the role of

Deputy Operations General Manager in Egypt in 2005 and

Operations Division Director in Kazakhstan in 2009. He took up the

roles of Managing Director of Agip KCO in Kazakhstan in 2013,

Managing Director of Agip Caspian Sea in 2014 and subsequently

Managing Director in Angola. In 2018 he was appointed Executive

Vice President for Sub-Saharan Africa Region and in 2020 Director of

Upstream.

He was appointed Chief Operating Officer of Energy Evolution on January

1, 2021. He joined Eni in 1985 initially working in the study and

development

of new refining processes at the Sannazzaro refinery, In 2000 he became

responsible for Refining Processes Development. He took over in 2004 as

director of the Gela Refinery, a challenging assignment both from a

managerial perspective and in terms of the refining cycle and plant

complexity. In 2006 he was appointed managing director of the refinery.

In June 2010 he was made Senior Vice President of the Industrial Sector

for Refining & Marketing, holding also chairmanship of Gela and Milazzo.

In 2012 he took on the delicate role of Eni’s Executive Vice President

HSEQ.](https://image.slidesharecdn.com/investor-presentation-221231205848-1b74bc7a/85/Investor-presentation-pdf-38-320.jpg)

![39

ENI TOP MANAGEMENT [2/3]

He was appointed as Upstream Director on Feb. 7th, 2022. He graduated

with honors in Mining Engineering from the Alma Mater Studiorum

University of Bologna in 1988. He joined Eni Group in 1990, at the beginning

of his career as a reservoir engineer at Agip SpA. Luca has matured a

considerable experience in managing complex Joint Ventures, and in

commercial negotiations in challenging environments. In 2009 he was

appointed Technical Director in Eni UK and in 2010 he became Managing

Director of Eni in Turkmenistan. He Moved to Egypt in late 2011, serving

Agiba as General Manager & Manager Director. In the period from 2012 to

2020 he was working in Kazakhstan, where he covered the position of EVP

of Central Asia Region (2016-2020). From 2020 to 2021 he has been the

Head of Commercial Negotiations for Eni, and the Head of Sub-Saharan

Africa Region Upstream Business from 2021 to early 2022.

Luca Vignati - Upstream

Umberto Carrara – Green/Trad. R&M

He was appointed as Deputy of Chief Operating Officer Energy Evolution

on November 4th, 2021. Since January 2021 he’s also Director of

Green/Traditional Refining and Marketing.

He graduated in Civil/Hydraulic Engineering and joined Eni in 1985.

He began his career in the Petroleum Engineering, holding positions of

growing responsibility in different countries up to the role of Managing

Director in the most critical Upstream geographical contexts (Norway,

Egypt, Libya). In 2005 he came back to Italy as Director of Exploration in

the E&P Division; then he took up the role of Managing Director of

Kazakhstan Subsidiary until 2013. Since 2013 he has been in charge of

the International Negotiations Department and in 2015 of the Sub-

Saharian Africa Region. At the beginning of 2018 he was appointed

Executive VP International Business Development R&M and in the 2019

he added also the responsibility of Licensing.

He was appointed Deputy of Chief Operating Officer Natural Resources

and also Director Global Gas & Lng Portfolio of Eni on July 1, 2020.

He graduated in Mechanical Engineering in 1999 from the Politecnico

di Milano. In 2000, he was awarded a scholarship for a research

doctorate at the Politecnico di Milano’s Department of Energy. After

experience in McKinsey and Citigroup, he joined Eni in 2007, in the Office

of the CEO. Between 2008 and 2016, he worked in Eni's Gas & Power

business, first as Senior Vice President International Sales and later as

Executive Vice President International Markets and LNG. In 2016, he took

the position of Executive Vice President Portfolio Strategy & Long Term

Gas Negotiations in the Midstream business. In 2018, he became

Executive Vice President of the Gas Business Unit with responsibility for

the entire midstream gas value chain. In 2019, he was appointed Chief

Gas & Lng Marketing and Power Officer of Eni.

Cristian Signoretto - Global Gas & LNG Portfolio

Francesca Zarri – Technology, R&D & digital

She was appointed Director of Technology, R&D & Digital of Eni

on July 1, 2020.

In 1997, she joined Agip S.p.A to work in the Reservoir Department

as reservoir modeler and petroleum engineer. In 2004, after moving

to the Engineering and Projects Department, she became the head

of the Adriatic Off-shore Projects department. In 2006, she became

Head of the Production Optimization Technology Department, which

at that time, also included most of the Eni’s Laboratories in Bolgiano.

From 2007 to 2010, she worked for West Africa as Project and

Development Director of Eni Congo. In 2011 she became the Head

of American Region in the procurement function, then the Head

of Procurement Services. During the same period, she was Eni's

representative for Commercial Committee in the South Stream

Project.](https://image.slidesharecdn.com/investor-presentation-221231205848-1b74bc7a/85/Investor-presentation-pdf-39-320.jpg)

![40

ENI TOP MANAGEMENT [3/3]

Adriano Alfani – Versalis S.p.A.

He was appointed Versalis’ Chief Executive Officer starting from the

1st January, 2021. He started his career at EniChem after working at Dow

since 2001, where he adopted a business model based on innovation,

circular economy and sustainability principles. He has 20-years of

experience in the international Chemical industry, having operated in

large, important and complex markets, and holding several international

roles at Senior Global Business Director and Senior Global Strategy

Director levels.

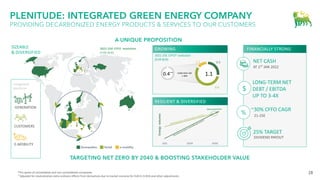

Stefano Goberti – Plenitude S.p.A.

He was appointed Plenitude’ Chief Executive Officer on November 5th,

2021. Stefano graduated in Economics and Banking from University of

Siena.

He joined Eni in 1991. Stefano spent over 30 years in Eni group, covering

different strategic positions in Italy and abroad, including : Eni Exploration

& Production division (various roles in Finance and Control), Executive

Vice President Planning & Control of Eni, CFO of Saipem, Head of Finance

and Insurances for Eni. Since March 2021 Stefano led the Eni Retail and

Renewables valorization project, and on November 2021 he was

appointed by Eni BoD as the new company CEO.](https://image.slidesharecdn.com/investor-presentation-221231205848-1b74bc7a/85/Investor-presentation-pdf-40-320.jpg)

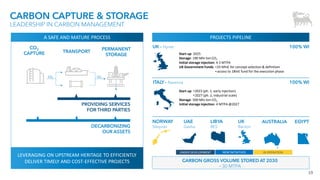

![42

KEY PROJECTS START UPS OVER 2022-25 [1/2]

Start up: February 2022

2022 Equity: 35 kboed

FF Progress: 69%

Prod. (kboed): 98 (100%) @ 2025 - 35 (eq.) @2022

Area 1 Full Field 100% WI

MEXICO LIQ

Johan Castberg 19% WI LIQ

Balder X 58% WI

Breidablikk 27% WI

NORWAY

LIQ

Start up: 2024

Prod. (kboed): 57 (100%) – 13 (equity) @2026

Start up: Q3 2024

Prod. (kboed): 71 (100%) – 41 (equity) @2024

Start up: 2024

Prod. (kboed): 184 (100%) – 36 (equity) @2025

LIQ

Cassiopea 60% WI

ITALY GAS

Start up: 2024

Progress: 24%

Prod. (kboed): 27 (100%) – 16 (equity) @2025

A&E Structure 50% WI

Start up: 2024 (Struct. A)

Prod. (kboed): 205 (100%) – 120 (equity) @2027

LIBYA GAS

Melehia ph.2 76% WI

EGYPT LIQ/GAS

Berkine South 75% WI

ALGERIA LIQ/GAS

Start up: Oct. 2022 (press release 10.10.22)

2022 Equity: 3 kboed

Prod. (kboed): 49 (100%) – 18 (equity) @2025

Start up: 2024 (Gas)

2022 Equity: 8 kboed (oil&gas)

Prod. (kboed): 50 (100%) – 27 (equity) @2025

NOTE: Average yearly production in peak year at plateau](https://image.slidesharecdn.com/investor-presentation-221231205848-1b74bc7a/85/Investor-presentation-pdf-42-320.jpg)

![43

KEY PROJECTS START UPS OVER 2022-25 [2/2]

NOTE: Average yearly production in peak year at plateau

Start up: 2023

Prod. (kboed): 15 (100%) – 12 (equity) @2024

Baleine ph.1 83% WI

IVORY COAST LIQ/GAS

Start up: 2024

Prod. (kboed): 17 (100%) – 9 (equity) @2025

Merakes East 65% WI

INDONESIA GAS

Start up: June 2022

2022 Equity: 10 kboed

Prod. (kboed): 106 (100%) – 28 (equity) @2023

Coral FLNG 25% WI

MOZAMBIQUE GAS

Marine XII LNG 65% WI

Start up: 2023

Prod. (kboed): 72 (100%) – 51 (equity) @2025

CONGO GAS

Agogo EP ph.2 18% WI

ANGOLA LIQ

Start up: Q4 2022 (Ph.1: Dec ‘19)

2022 Equity: <1 kboed

Progress: 81%

Dalma Gas 25% WI

Start up: 2025

Progress: 18%

Prod. (kboed): 56 (100%) – 14 (equity) @2025

UAE GAS

Start up: 2025

Prod. (kboed): 29 (100%) – 6 (equity) @2026

Maha 40% WI GAS](https://image.slidesharecdn.com/investor-presentation-221231205848-1b74bc7a/85/Investor-presentation-pdf-43-320.jpg)