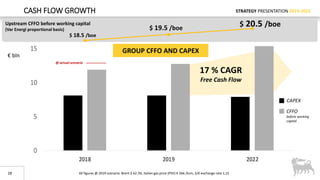

Eni's strategy presentation outlines plans for 2019-2022 focusing on organic growth, renewables expansion, upstream growth, and circular economy initiatives. Key targets include doubling the LNG portfolio by 2022, 3.5% annual upstream production growth, and over €900 million invested in decarbonization efforts. The strategy aims to balance capital discipline with sustainable long-term growth through projects increasing efficiency, natural gas production, and zero carbon energy sources.