ENI reported its 1Q 2023 results, delivering on performance and strategy:

- Production was up over 2% quarter-over-quarter to 1.66 million barrels of oil equivalent per day.

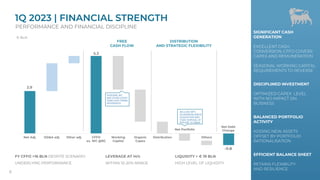

- EBIT was €4.6 billion and net profit was €2.9 billion, resisting price impacts through profit improvement.

- Cash flow from operations was €5.3 billion with excellent underlying cash conversion.

- Leverage remained low at 14% providing financial strength and flexibility.