The document discusses various types of financial markets including:

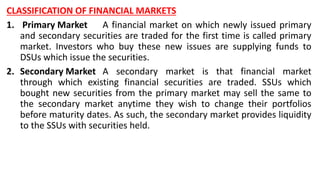

- Primary markets where newly issued securities are first traded.

- Secondary markets where existing securities are traded, providing liquidity to investors.

- Money markets for short-term debt up to one year. Capital markets include bond, stock, and mortgage markets for longer-term products.

- Organized exchanges like the Philippine Stock Exchange use auction formats, while over-the-counter markets electronically connect brokers and dealers for less standardized products.

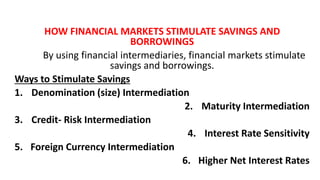

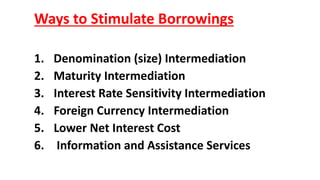

Financial markets bring together savers and borrowers, facilitating the flow of funds to their most productive uses in the economy.