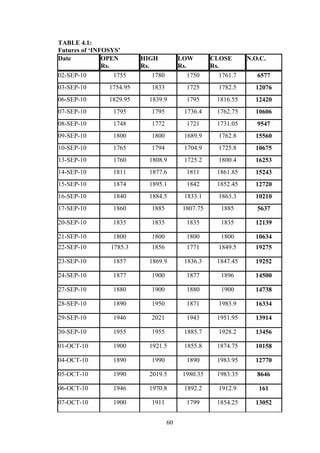

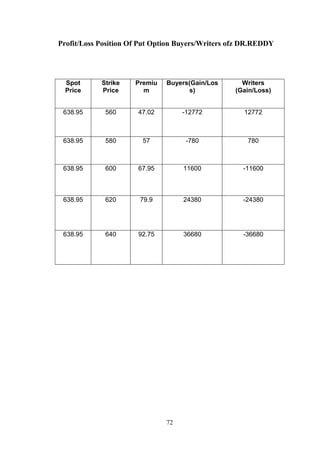

The document discusses the history and uses of derivatives in the financial markets. It begins by explaining that derivatives emerged as hedging devices against commodity price fluctuations, but now account for two-thirds of total transactions and include a variety of complex instruments. The scope of the study is on derivatives in the Indian context, specifically futures and options on two companies traded on the National Stock Exchange over one month. The objectives are to study the role of derivatives in Indian markets and analyze profits/losses of option holders. The methodology uses primary data from interviews and secondary data from publications and the internet. Derivatives are then defined as contracts deriving value from underlying assets, with the primary purpose of transferring risk between parties.