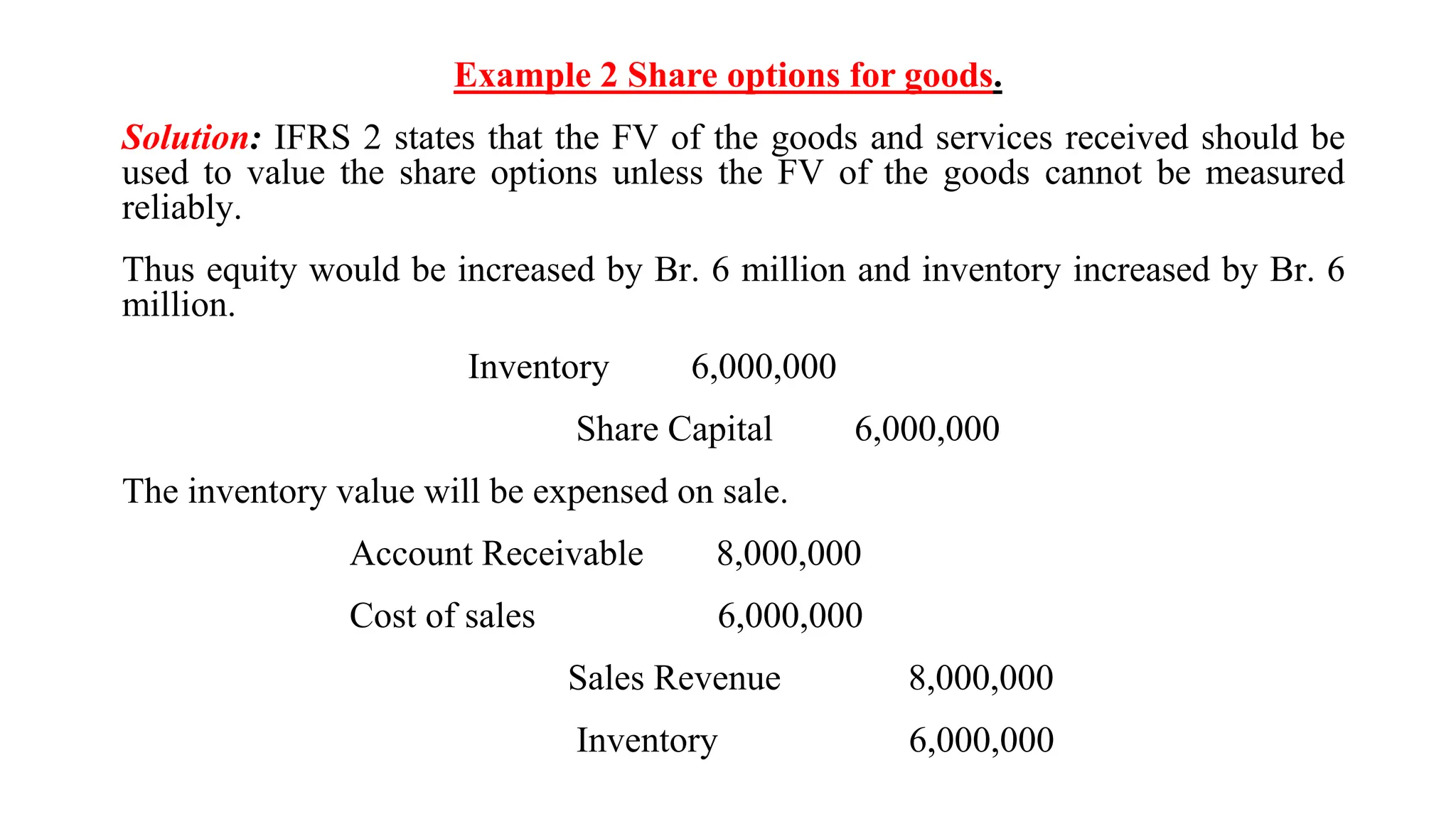

This transaction will be accounted for as an equity-settled share-based payment transaction in the company's financial statements as follows:

On June 1, 2010 (date of grant):

Inventory 6,000,000

Share capital/Reserves 6,300,000

(Inventory is measured at fair value of goods received)

On December 3, 2012 (date of sale):

Cash 8,000,000

Inventory 6,000,000

Gain on sale of inventory 2,000,000

(Inventory is derecognized at original cost on date of sale)

No expense is recognized in the income statement as this is an equity-settled transaction. The difference between fair value of shares granted and value

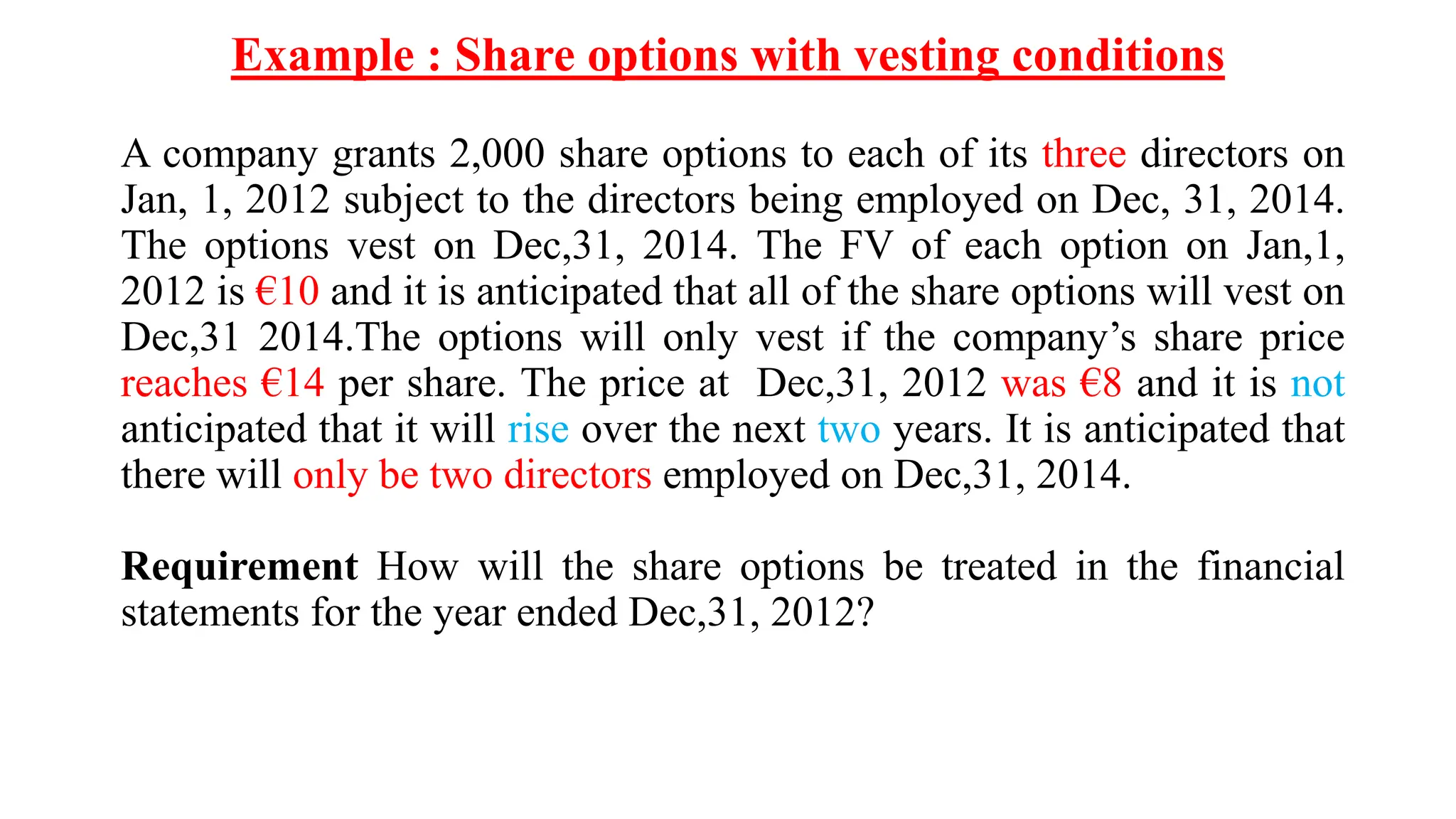

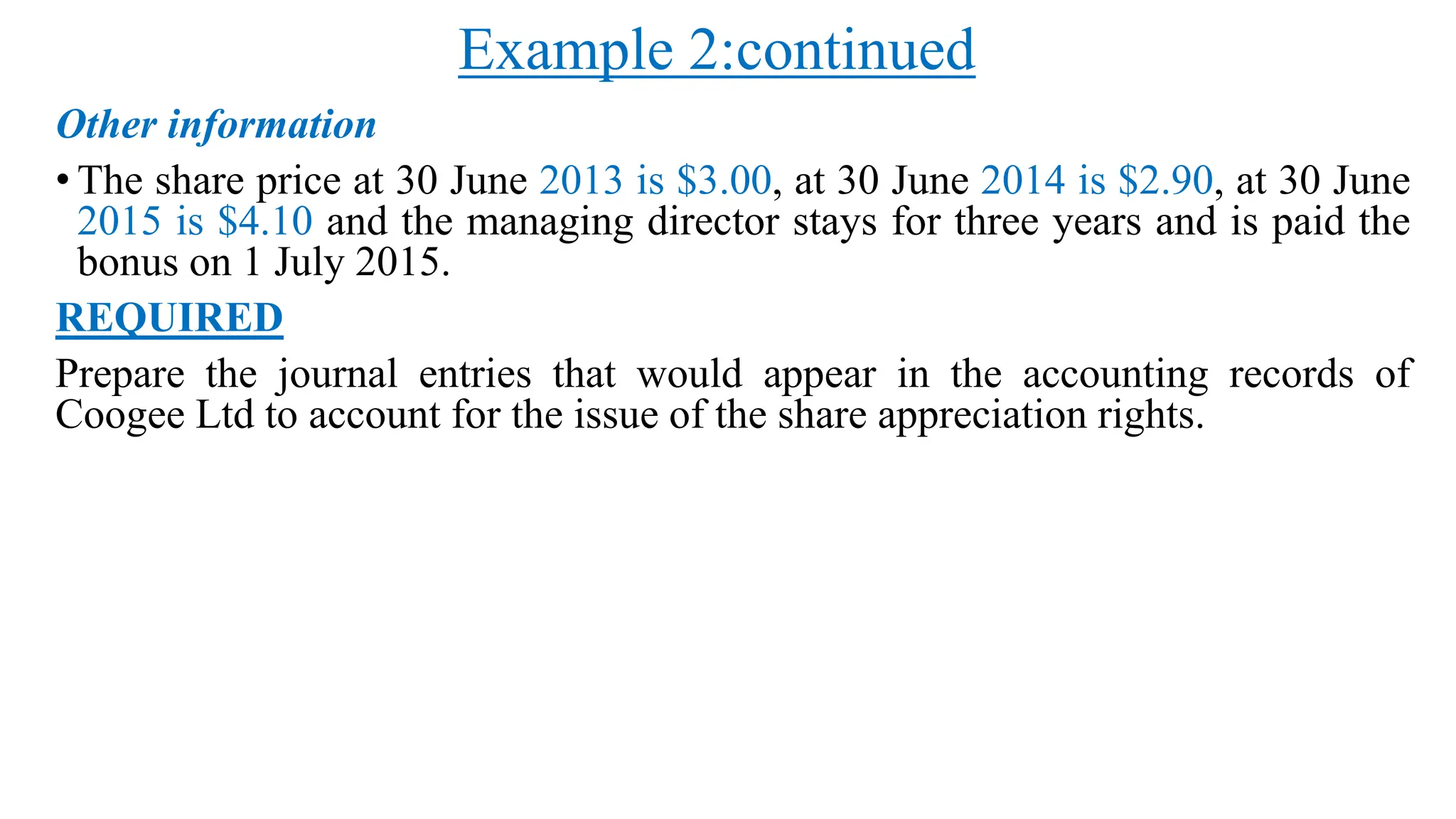

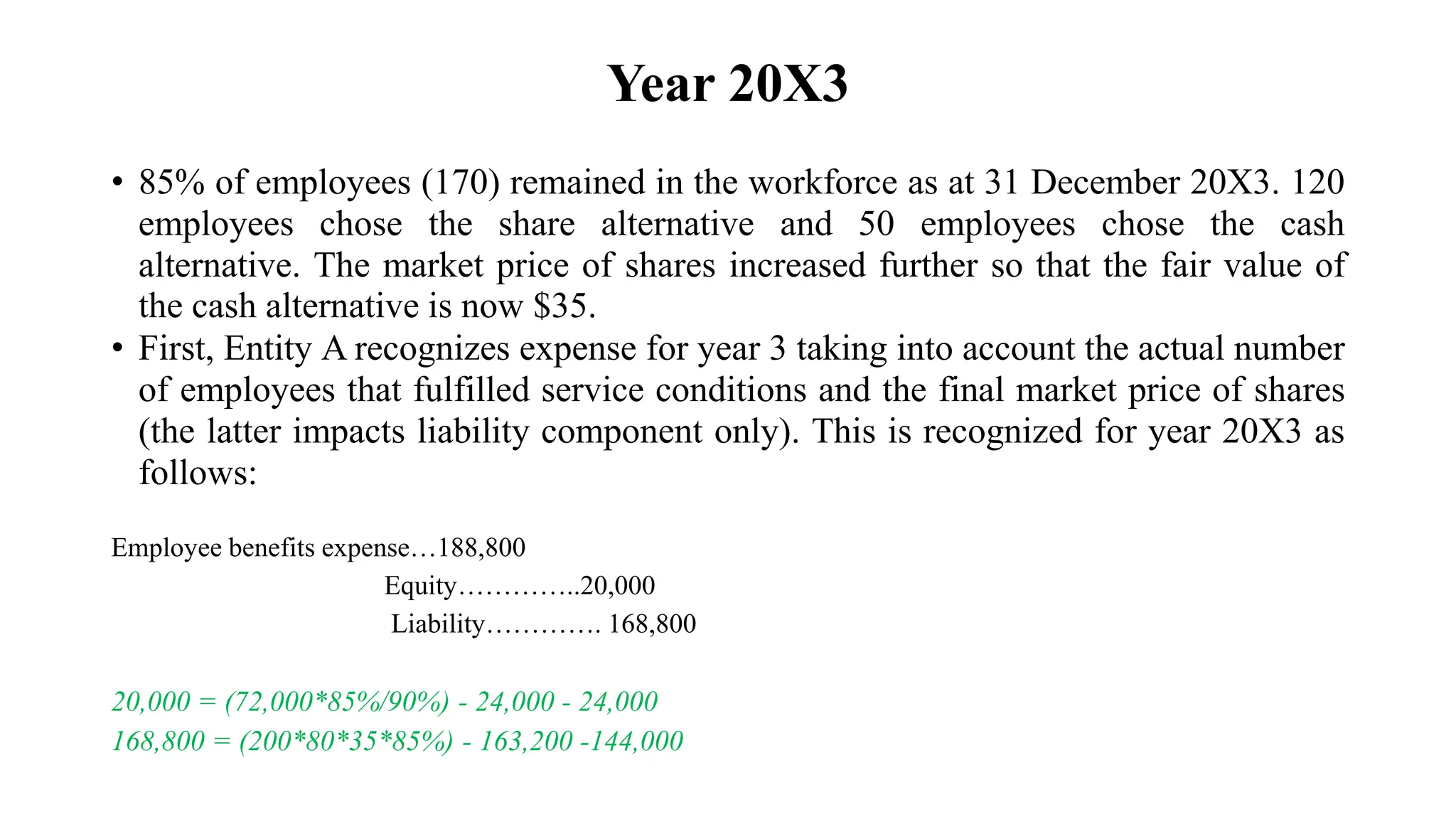

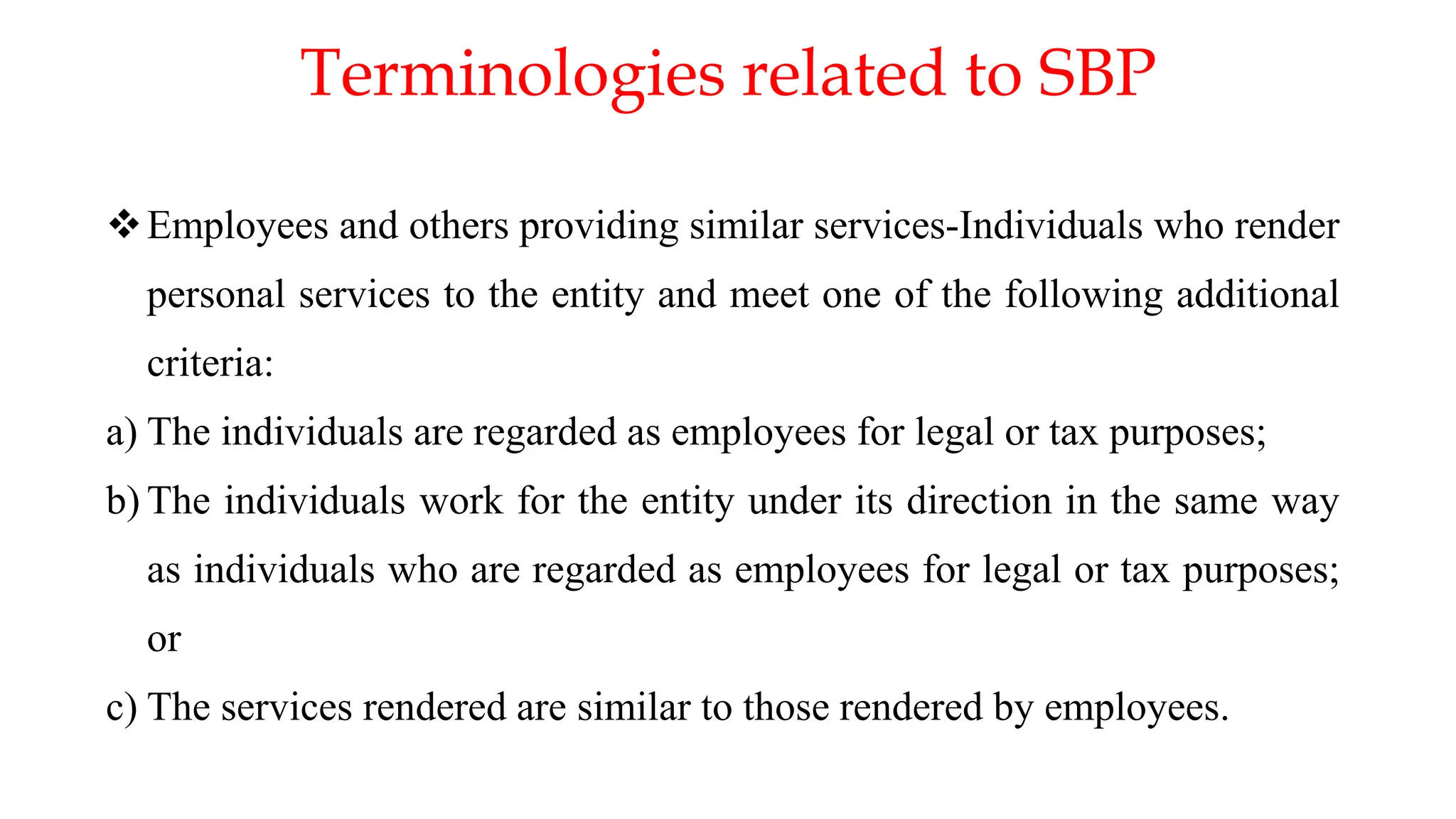

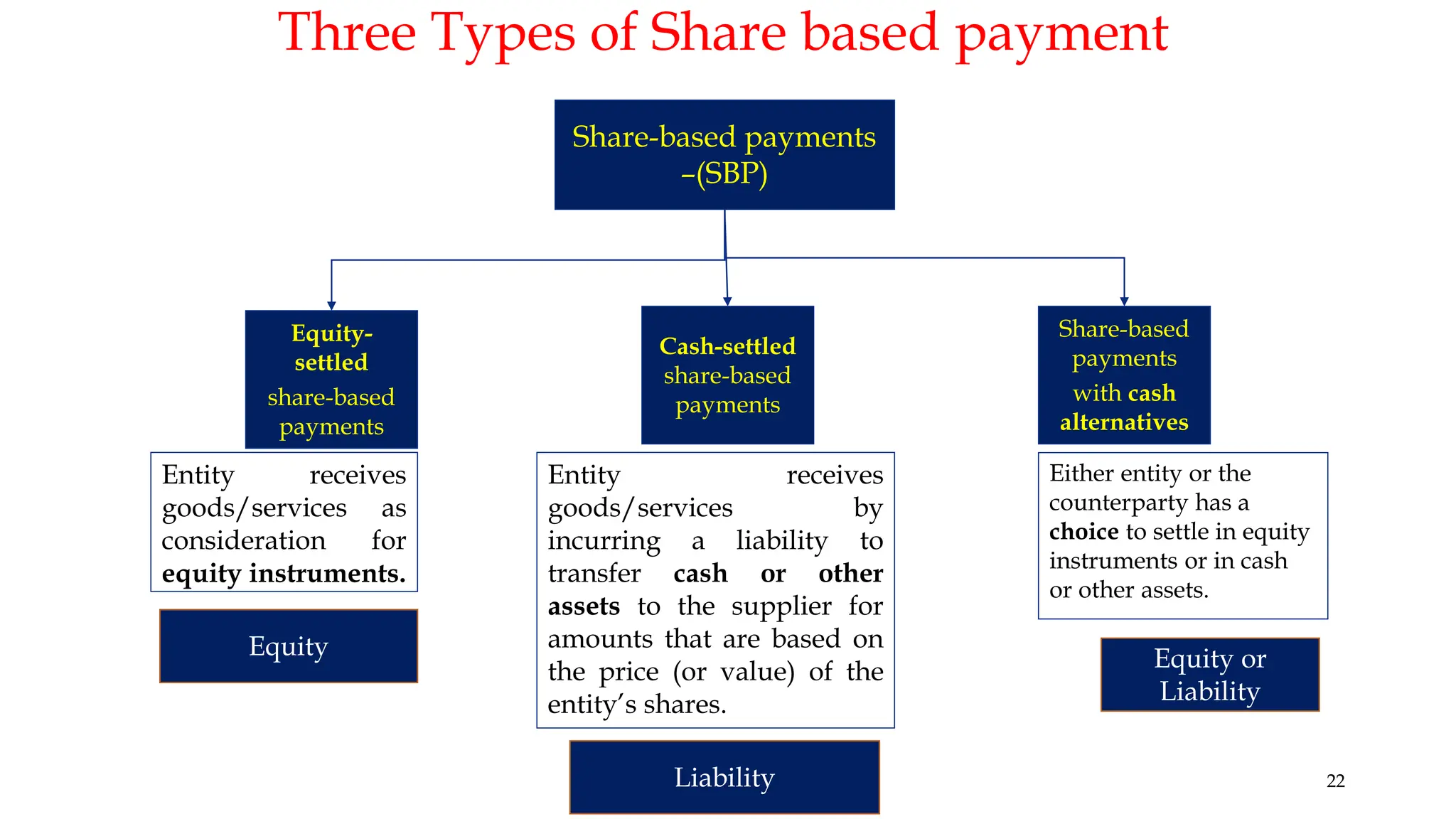

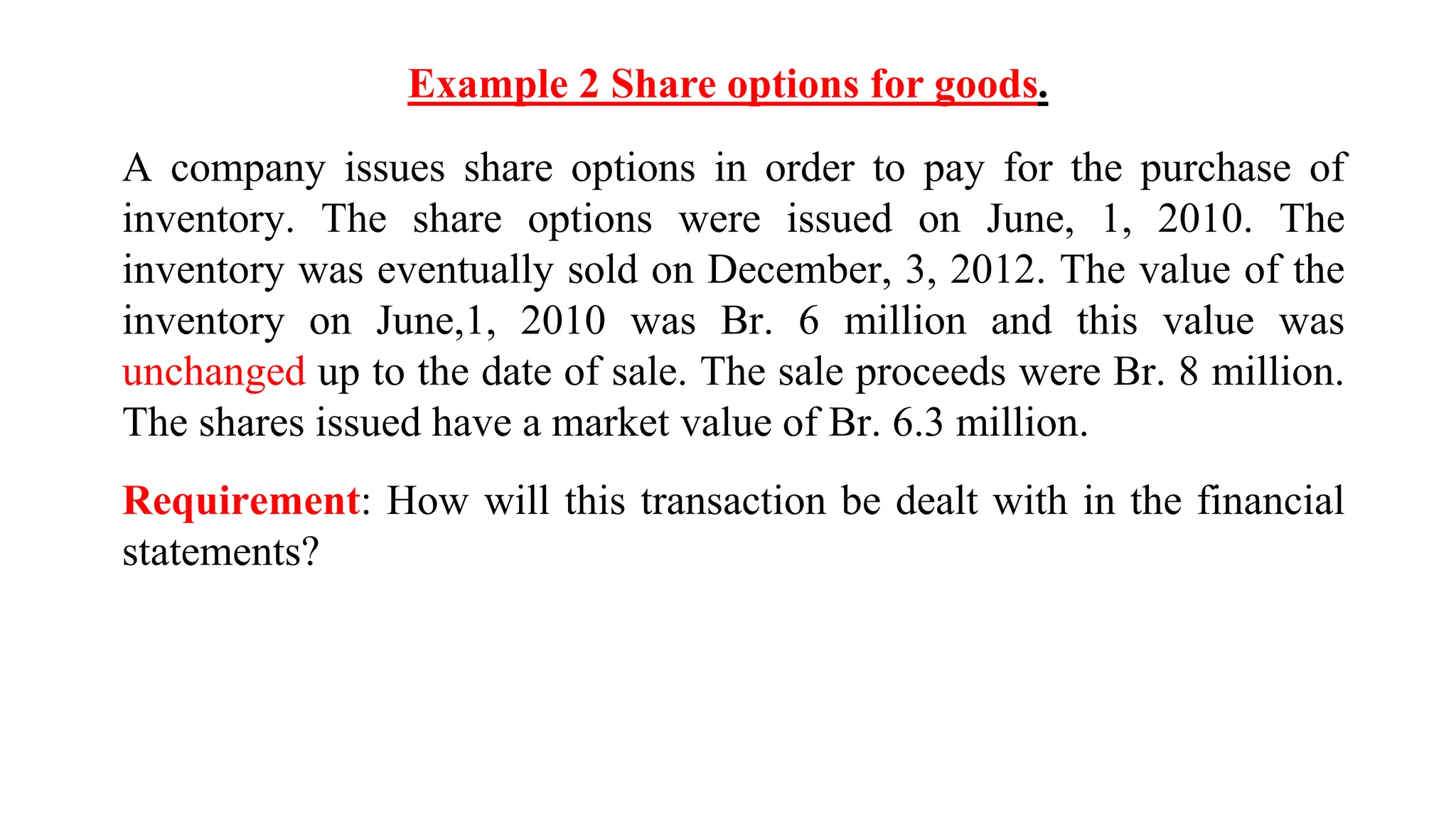

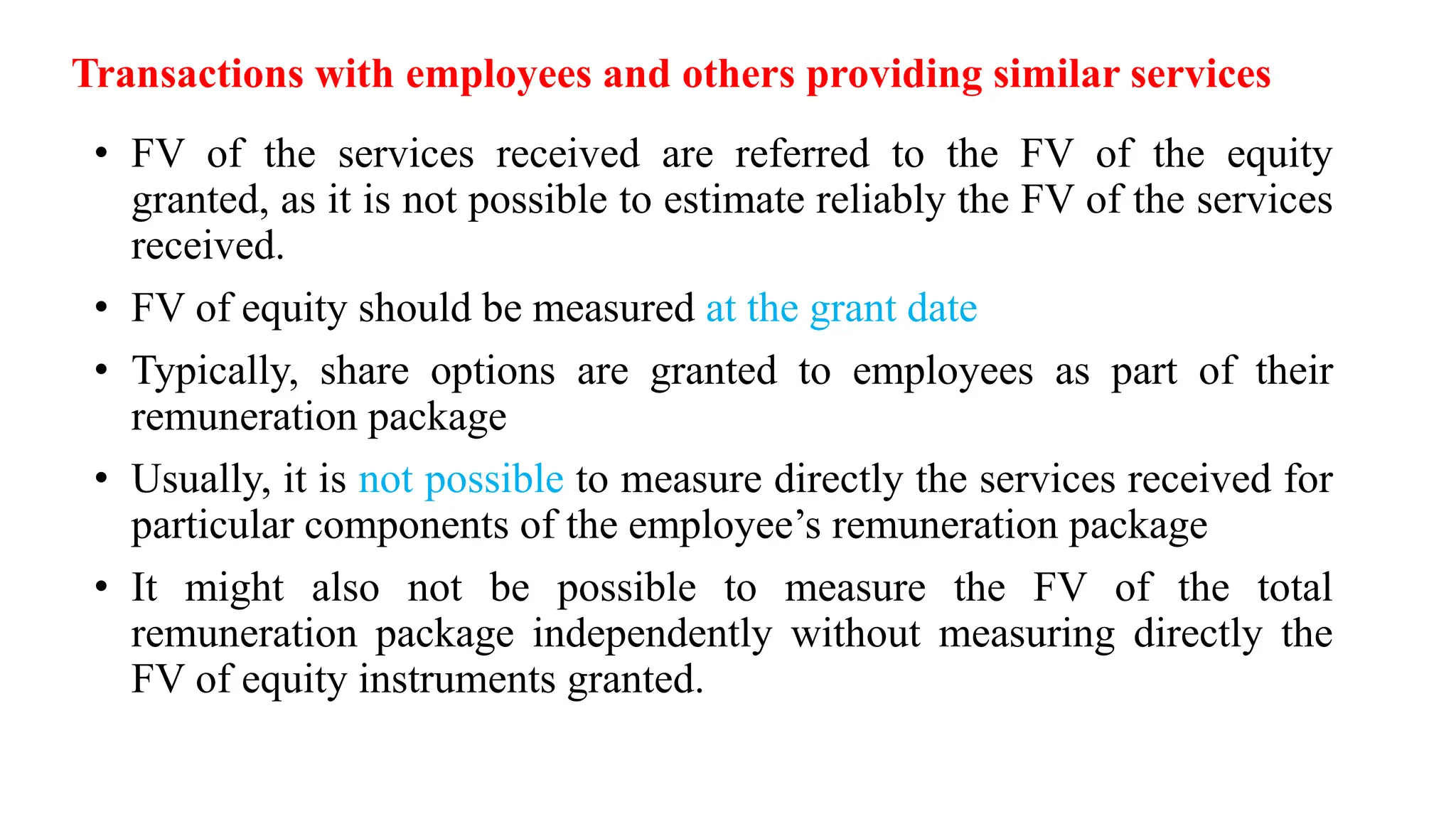

![Example: Share options for employee services

A company granted a total of 100 share options to 10 members of its executive

management team (10 options each) on 1 January 2012. These options vest at the

end of a three-year period. The company has determined that each option has a FV

at the date of grant equal to €15. The company expects that all 100 options will

vest and therefore records the following entry at 30 June 2012 (the end of its first

six-month interim reporting period).

Salaries ……… €250

Equity …………250

[(100 x €15) / 6 periods = €250 per period]](https://image.slidesharecdn.com/ifrs2-240404172956-2486987b/75/Share-based-payment-best-presentation-for-students-31-2048.jpg)