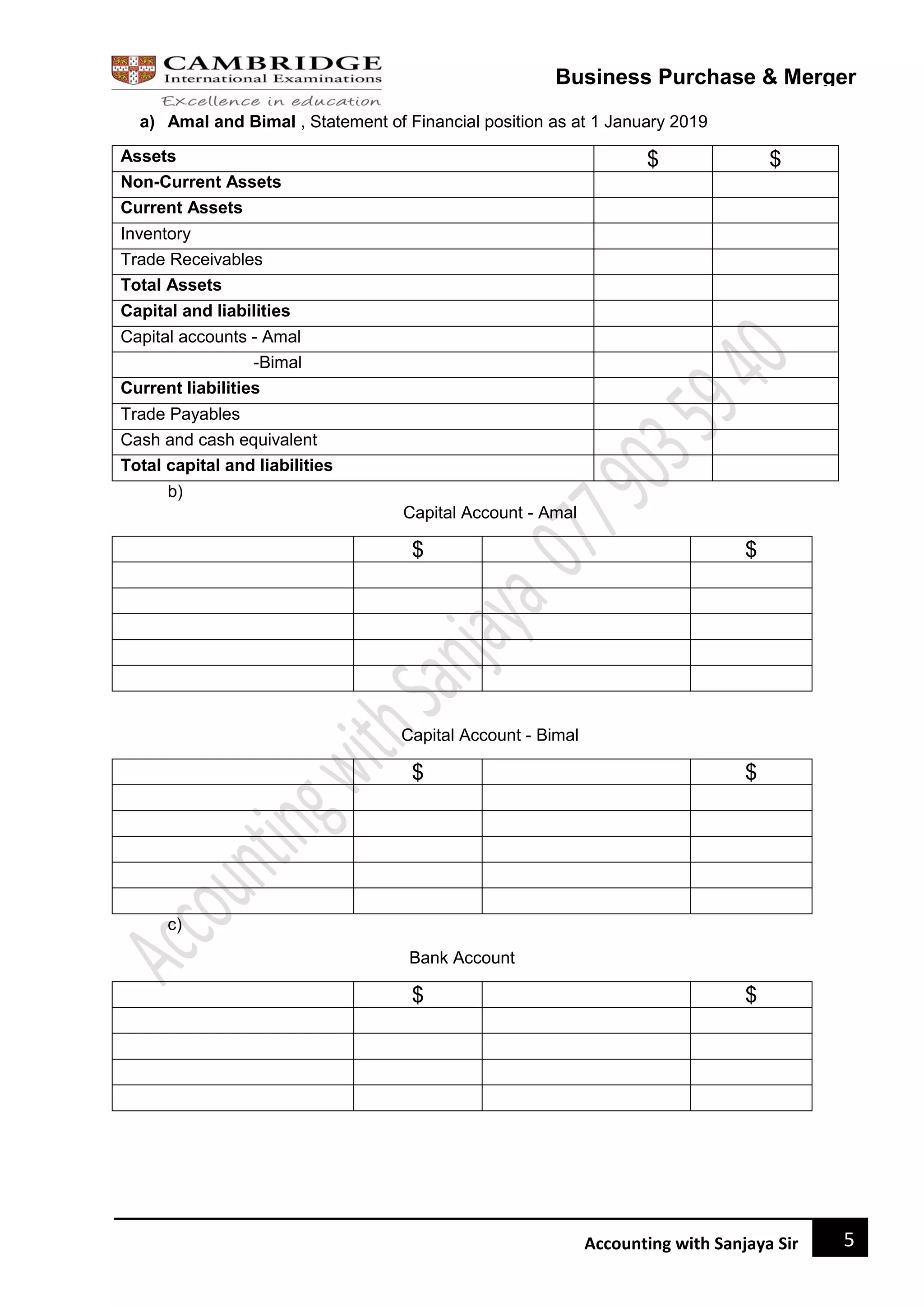

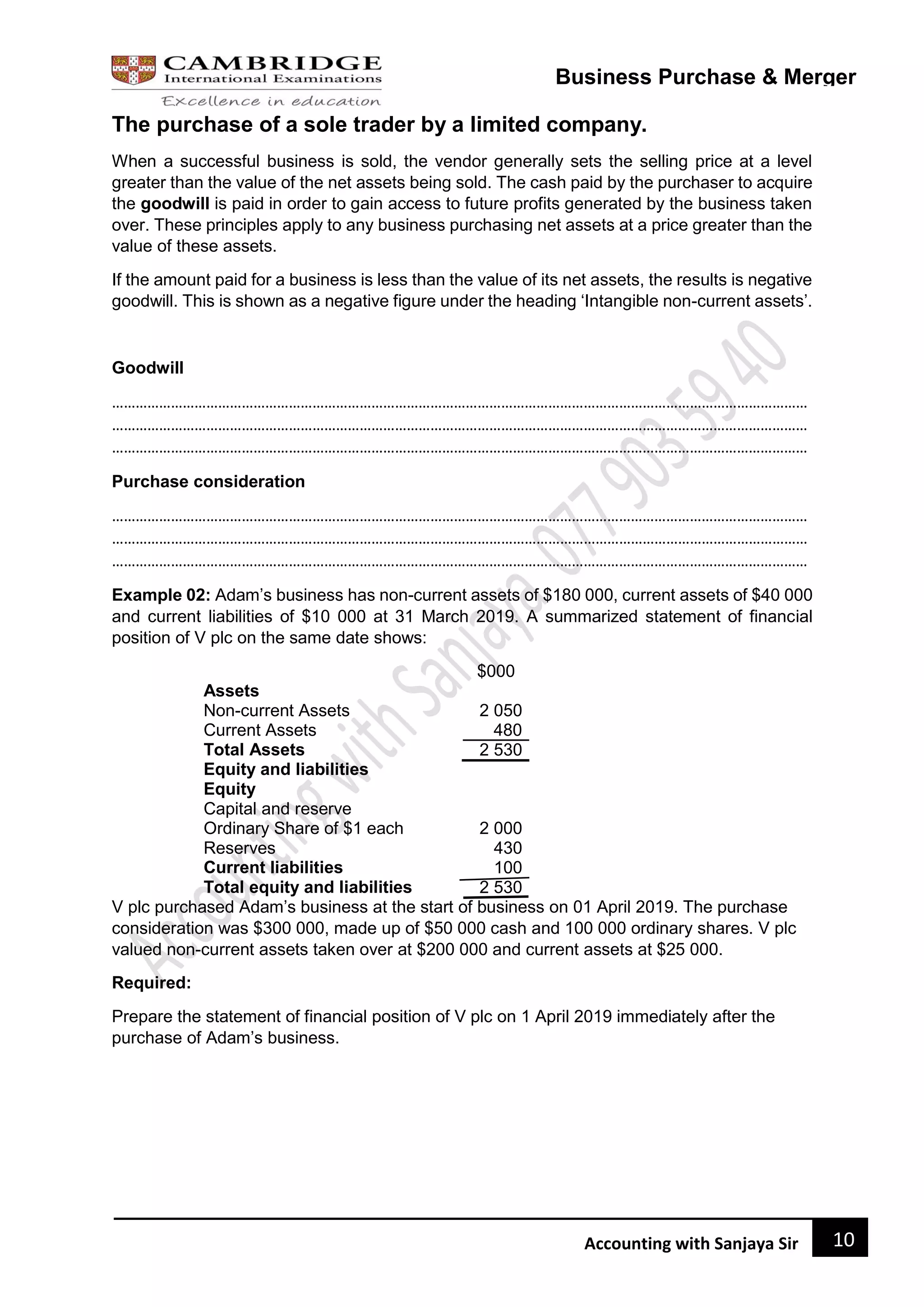

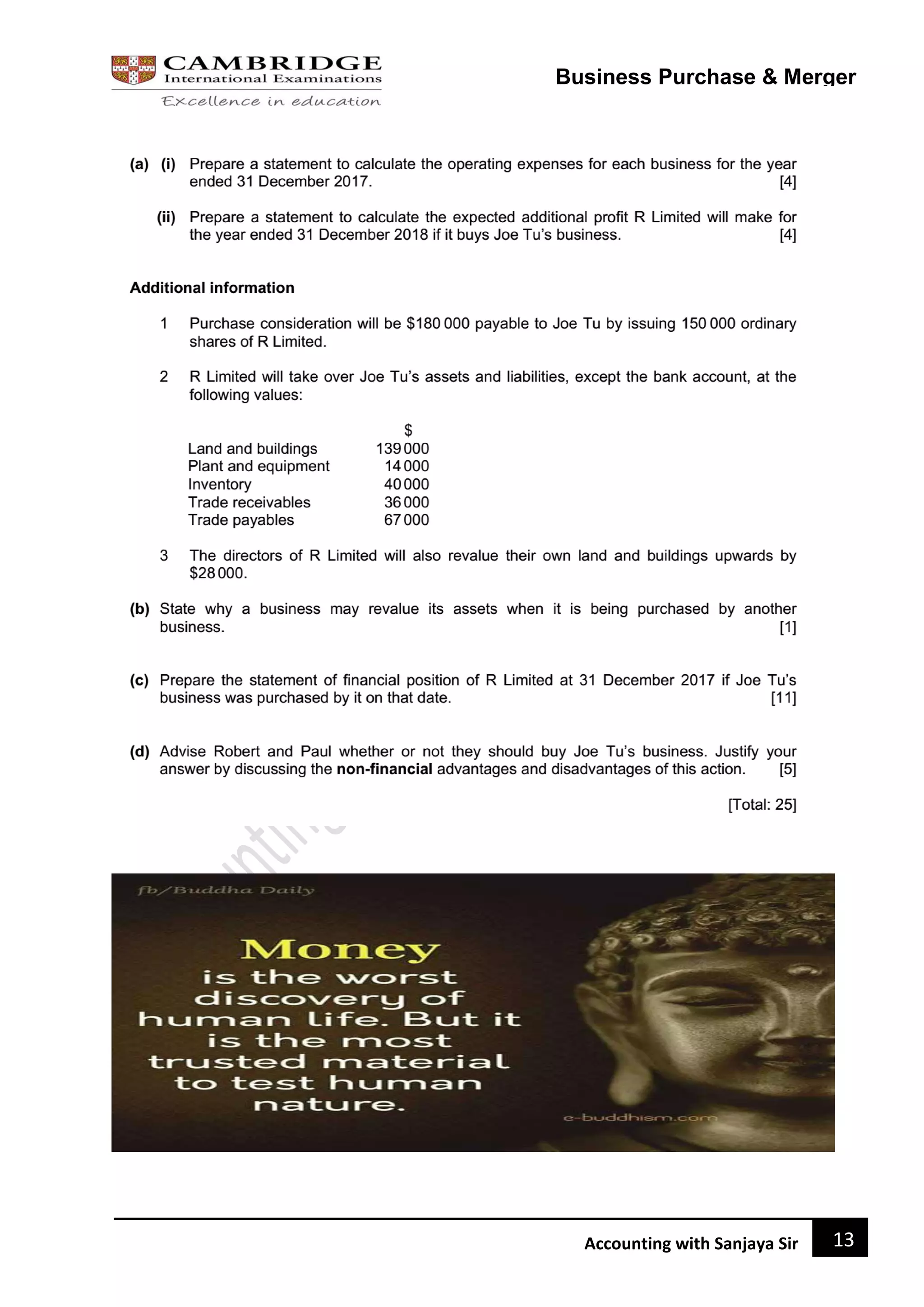

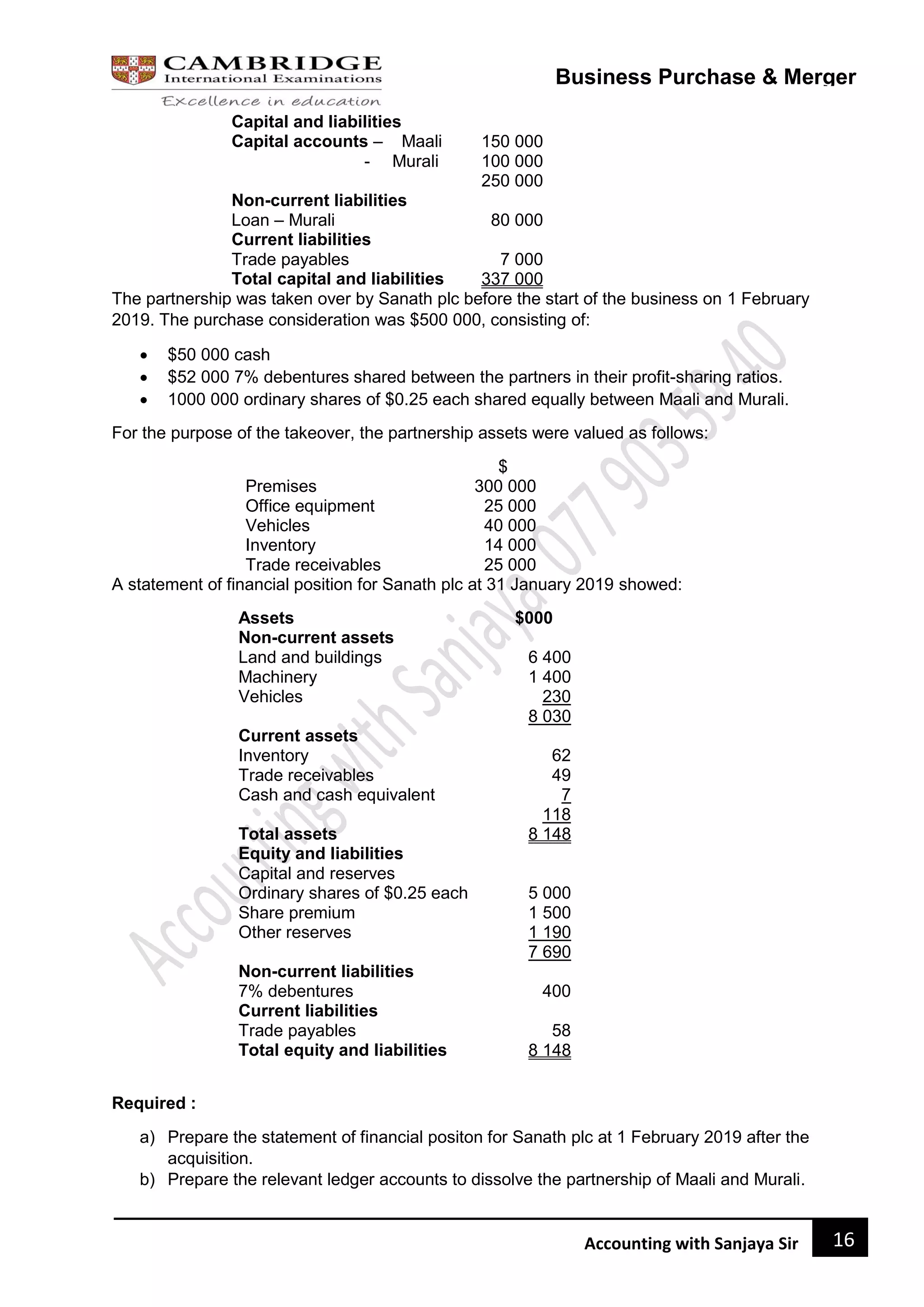

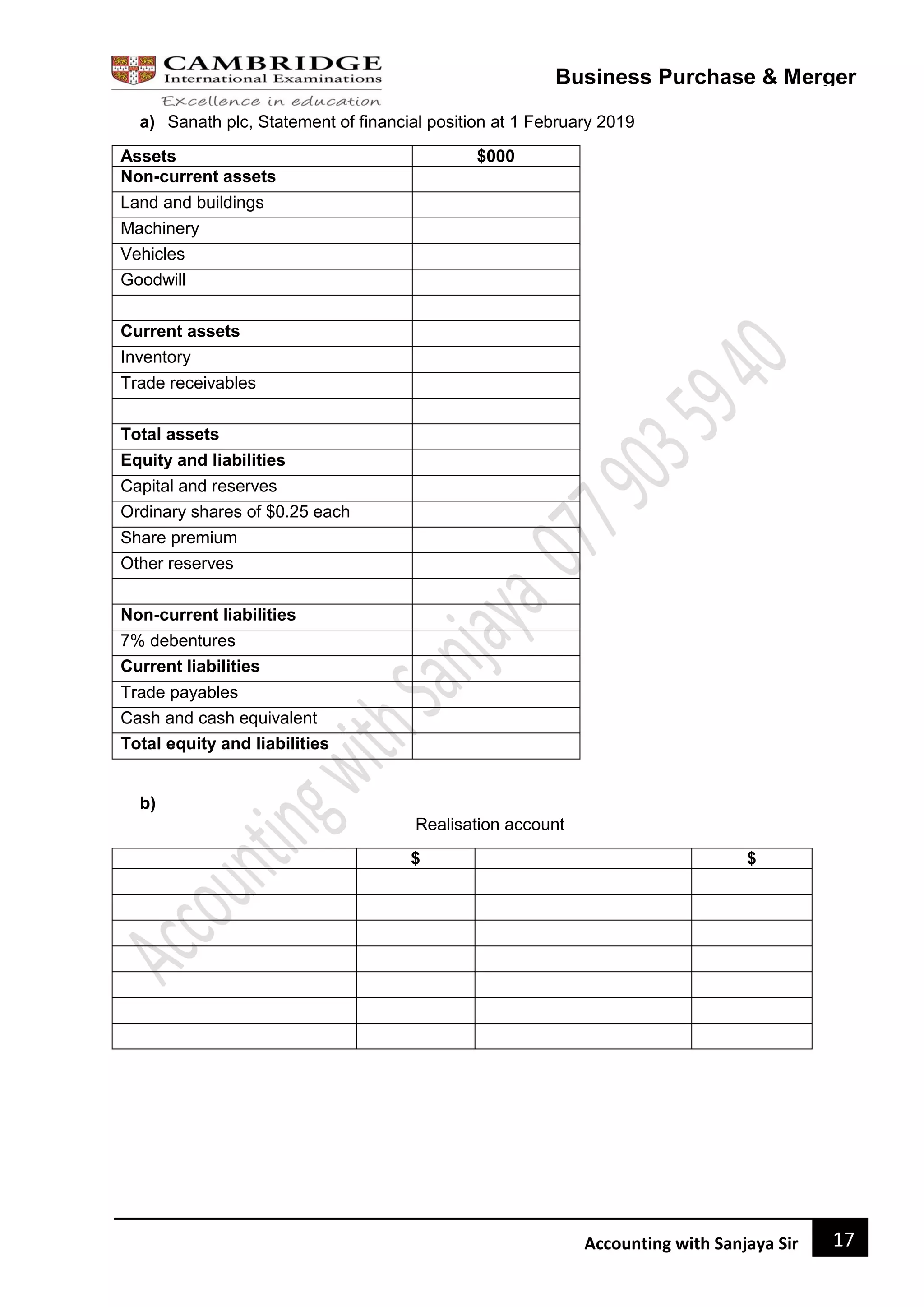

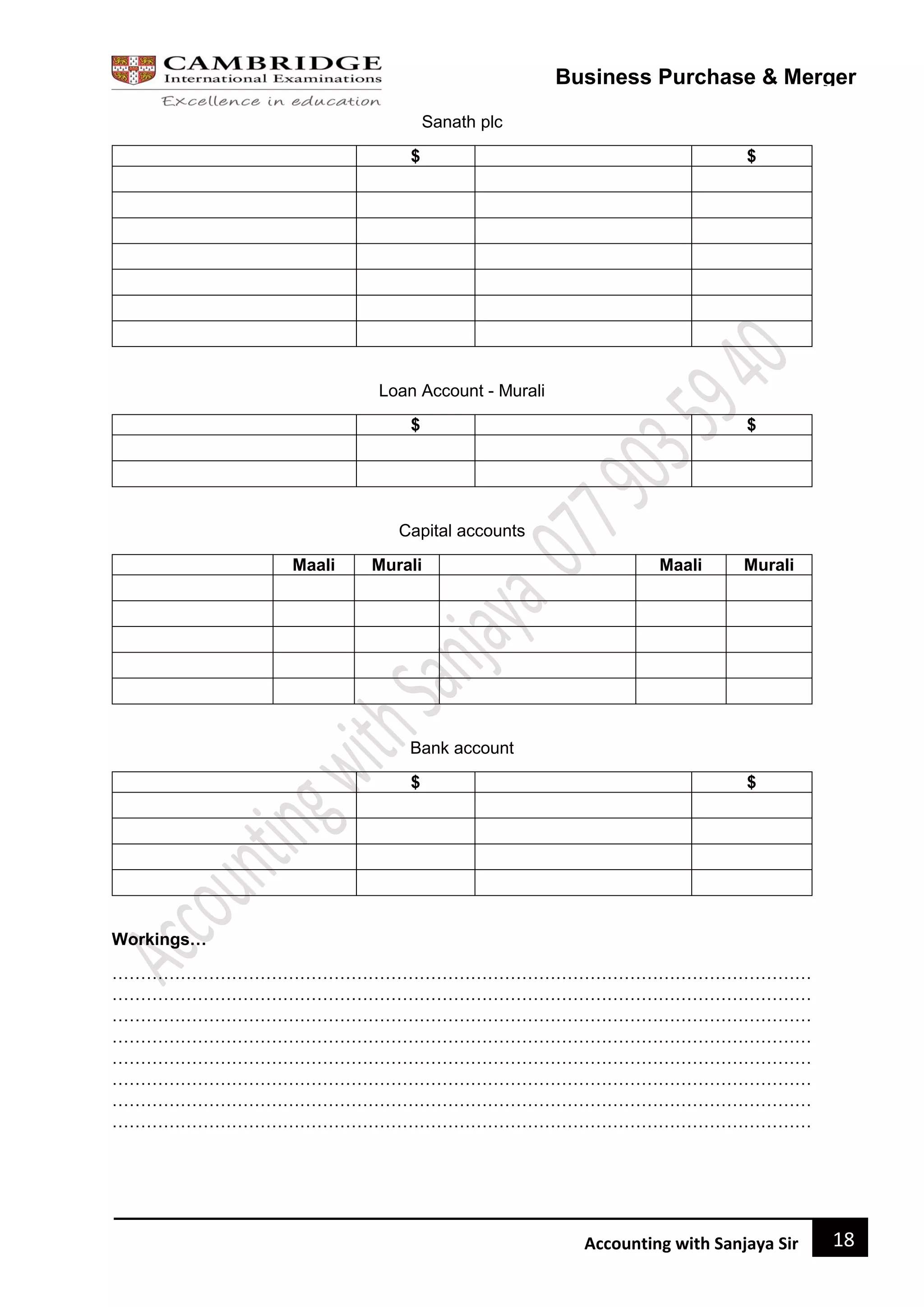

The document discusses business purchases and mergers, focusing on various scenarios such as the merger of sole traders, acquisitions by limited companies, and the impact on financial statements. It explains concepts like goodwill, economies of scale, and provides practical examples and exercises for understanding financial positions following mergers. The document also highlights the advantages and considerations of merging businesses for enhanced profitability and market presence.