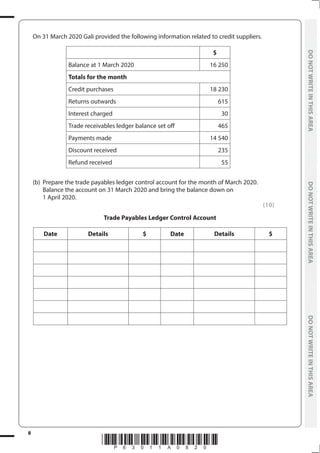

This document is a Pearson Edexcel International GCSE Accounting examination paper from May 2020, totaling 100 marks. It comprises multiple-choice questions, written responses, and practical exercises covering topics such as bookkeeping, financial statements, and accounting principles. Candidates are required to complete all questions within a 2-hour time frame, using a black ink or ball-point pen.