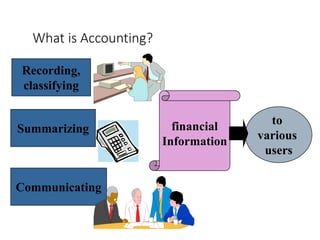

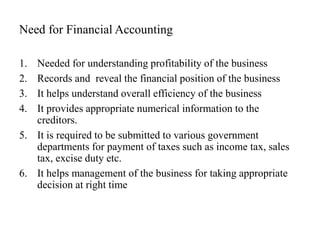

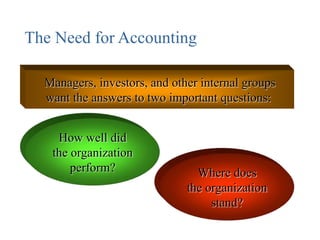

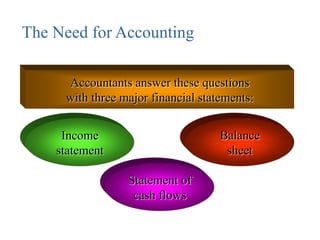

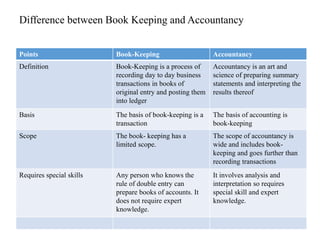

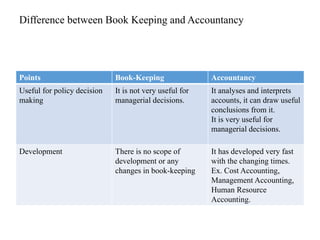

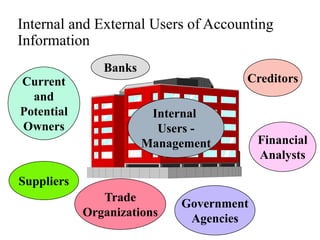

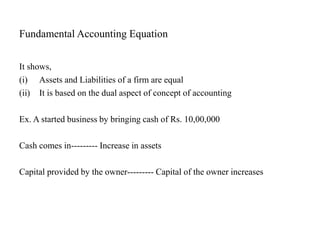

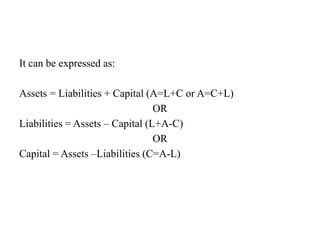

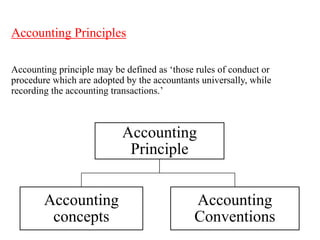

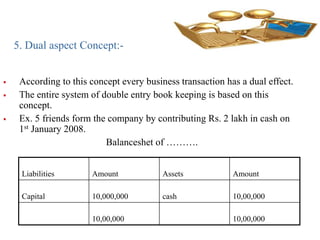

Accounting involves recording, classifying, and summarizing financial transactions and events. The objectives of accounting include maintaining business records, ascertaining profit/loss, determining financial position, and providing information to internal and external users. The fundamental accounting equation shows that assets equal liabilities plus capital. Key accounting concepts include money measurement, entity, going concern, cost, dual aspect, periodicity, prudence, and realization. Accounting conventions include matching revenues and expenses, consistency, and materiality.