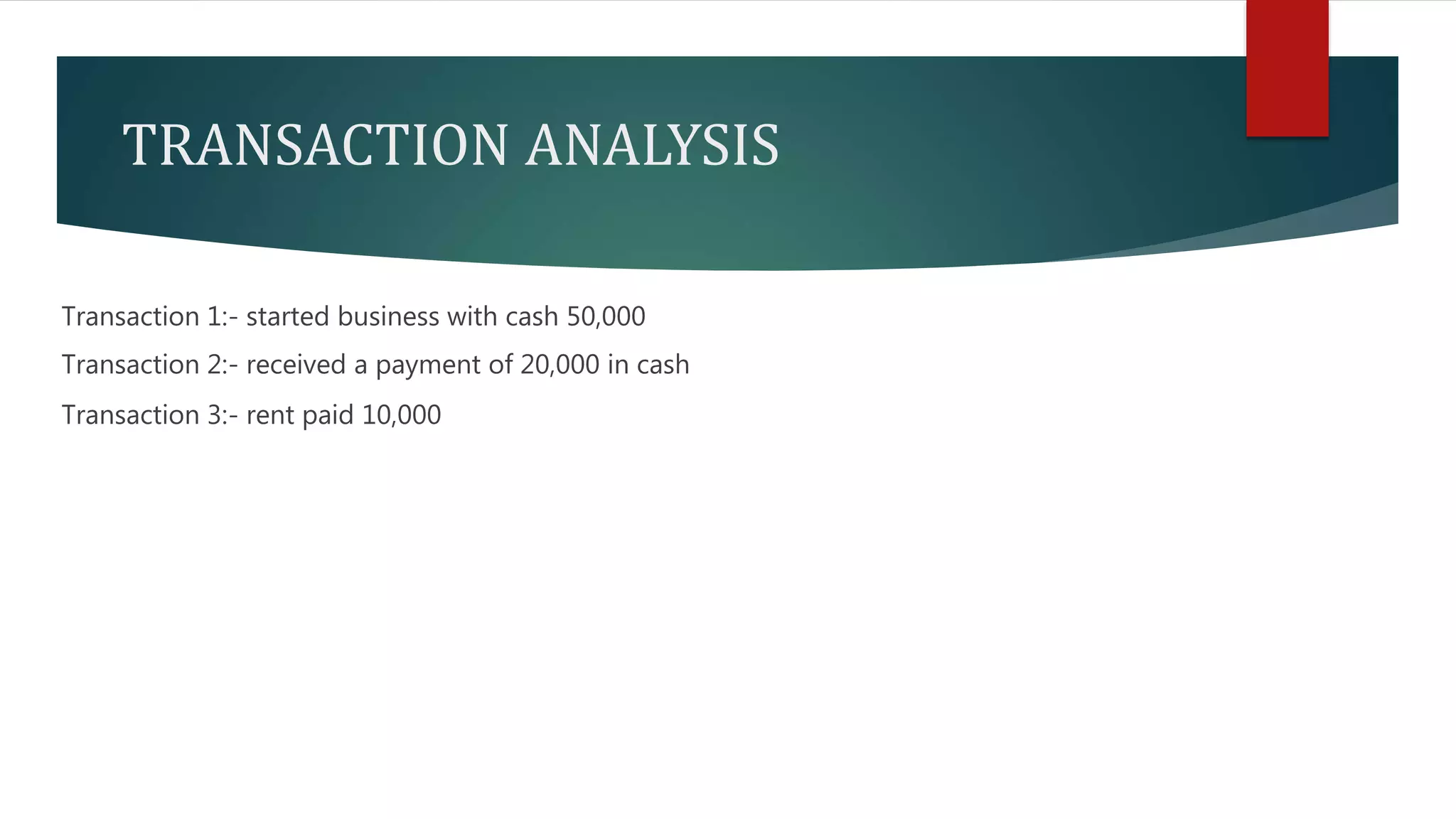

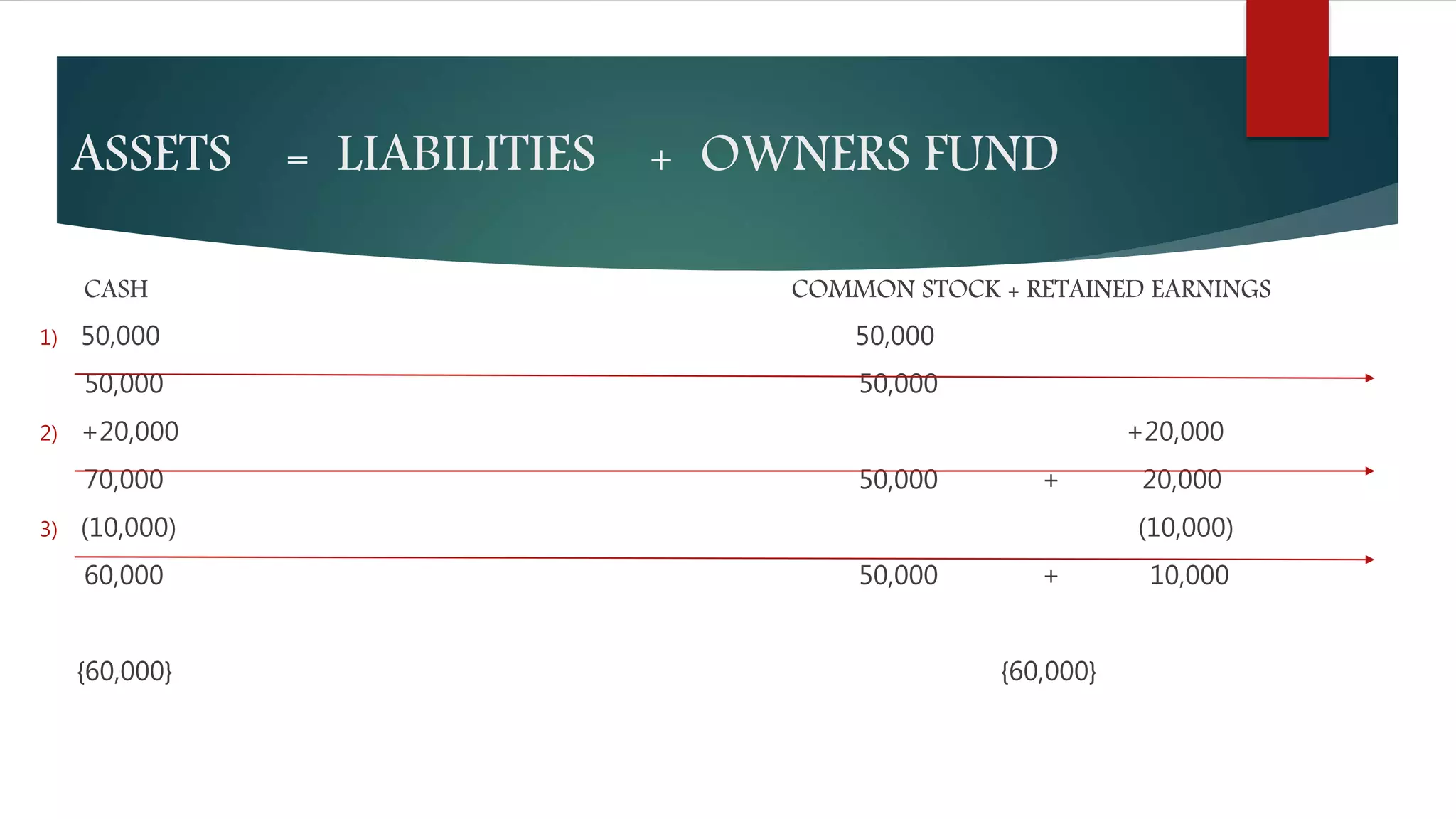

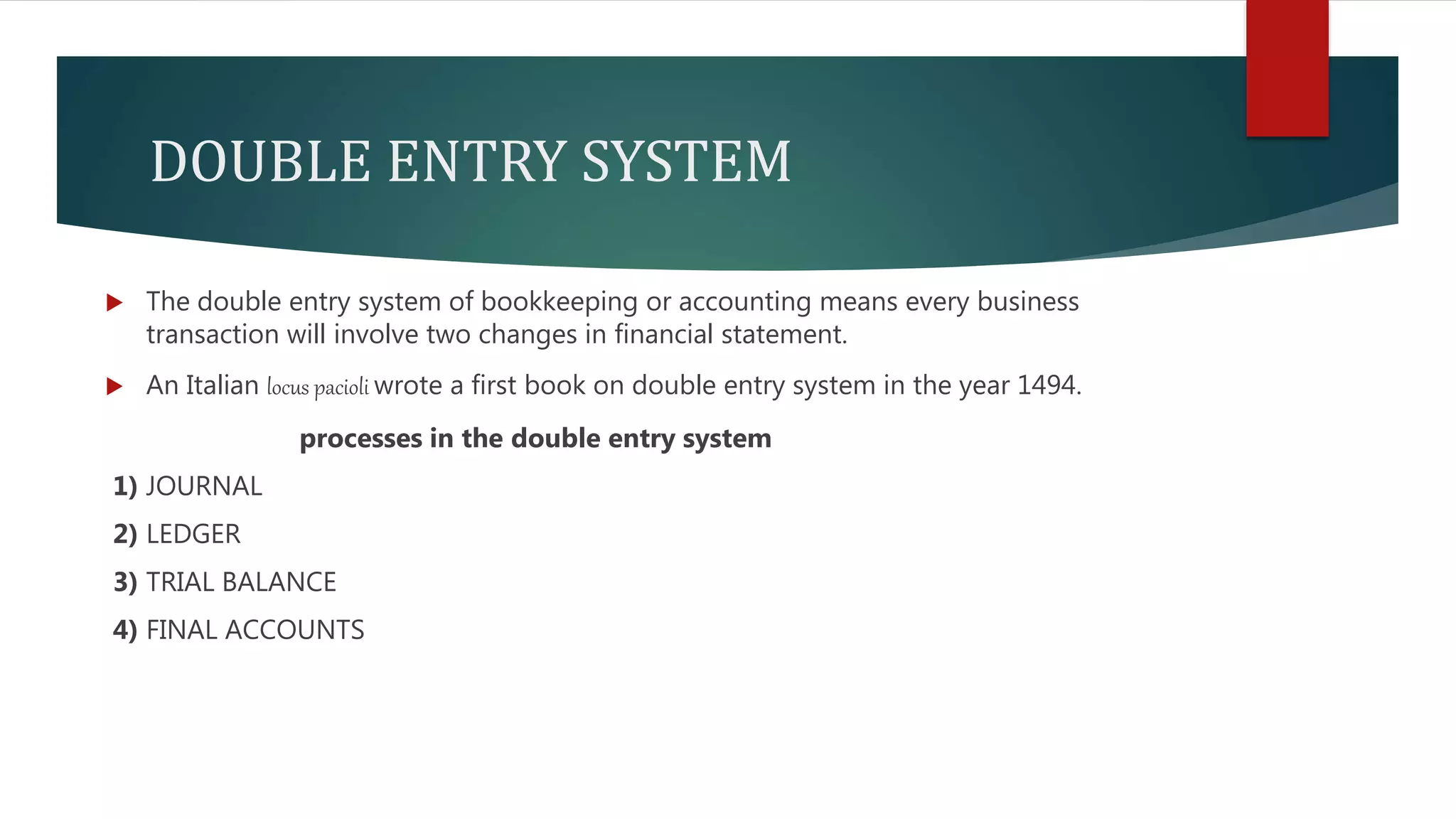

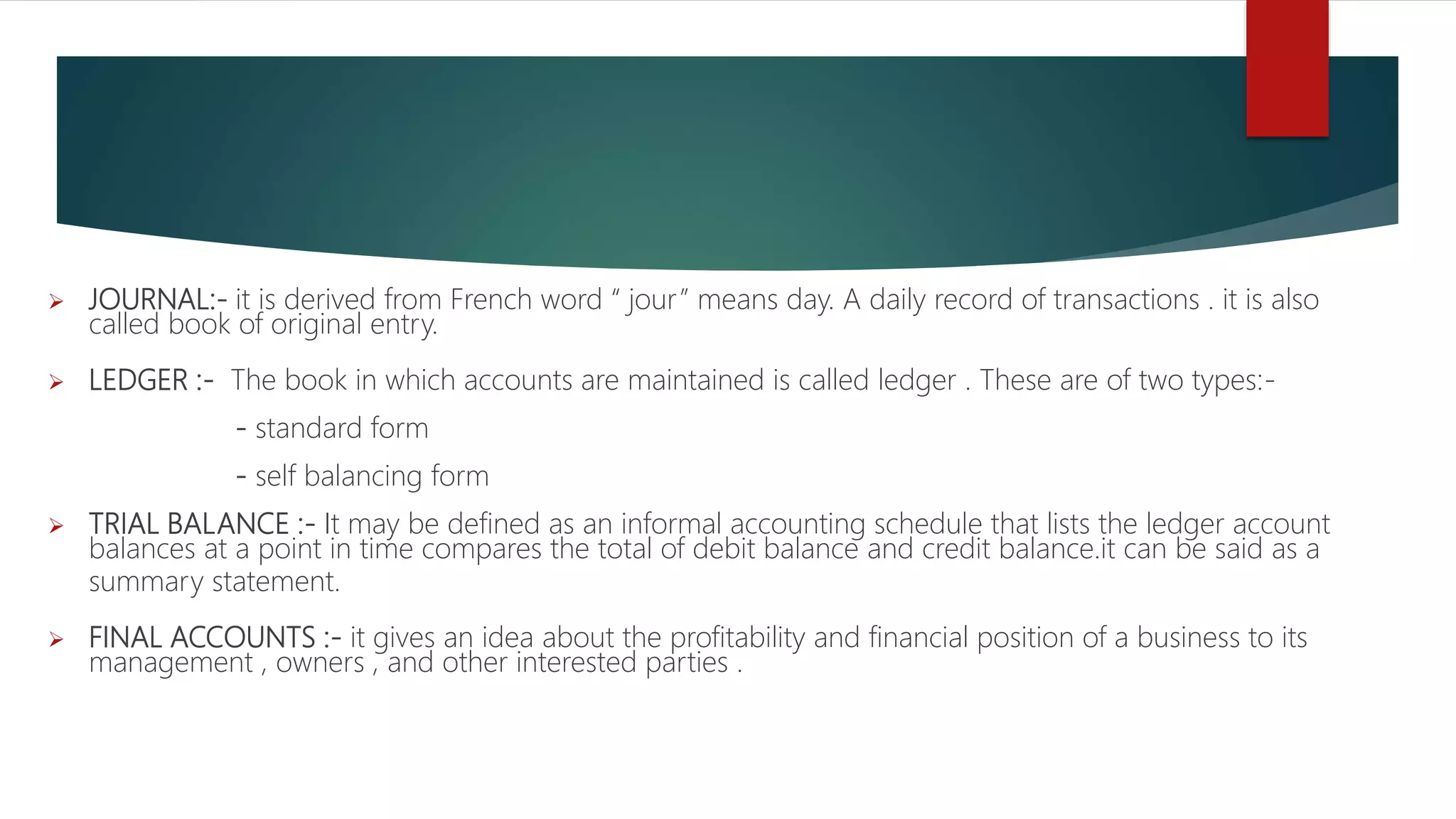

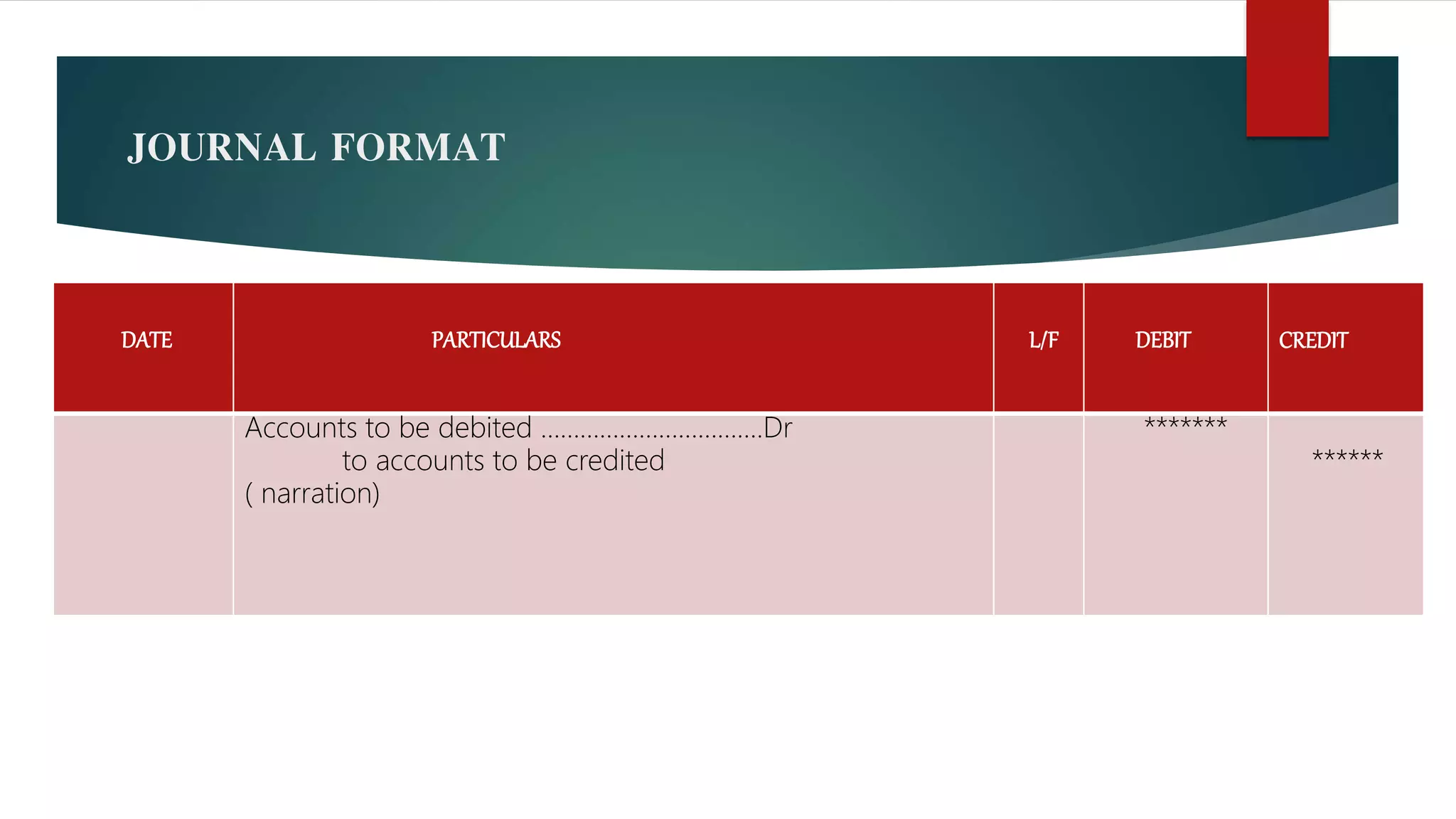

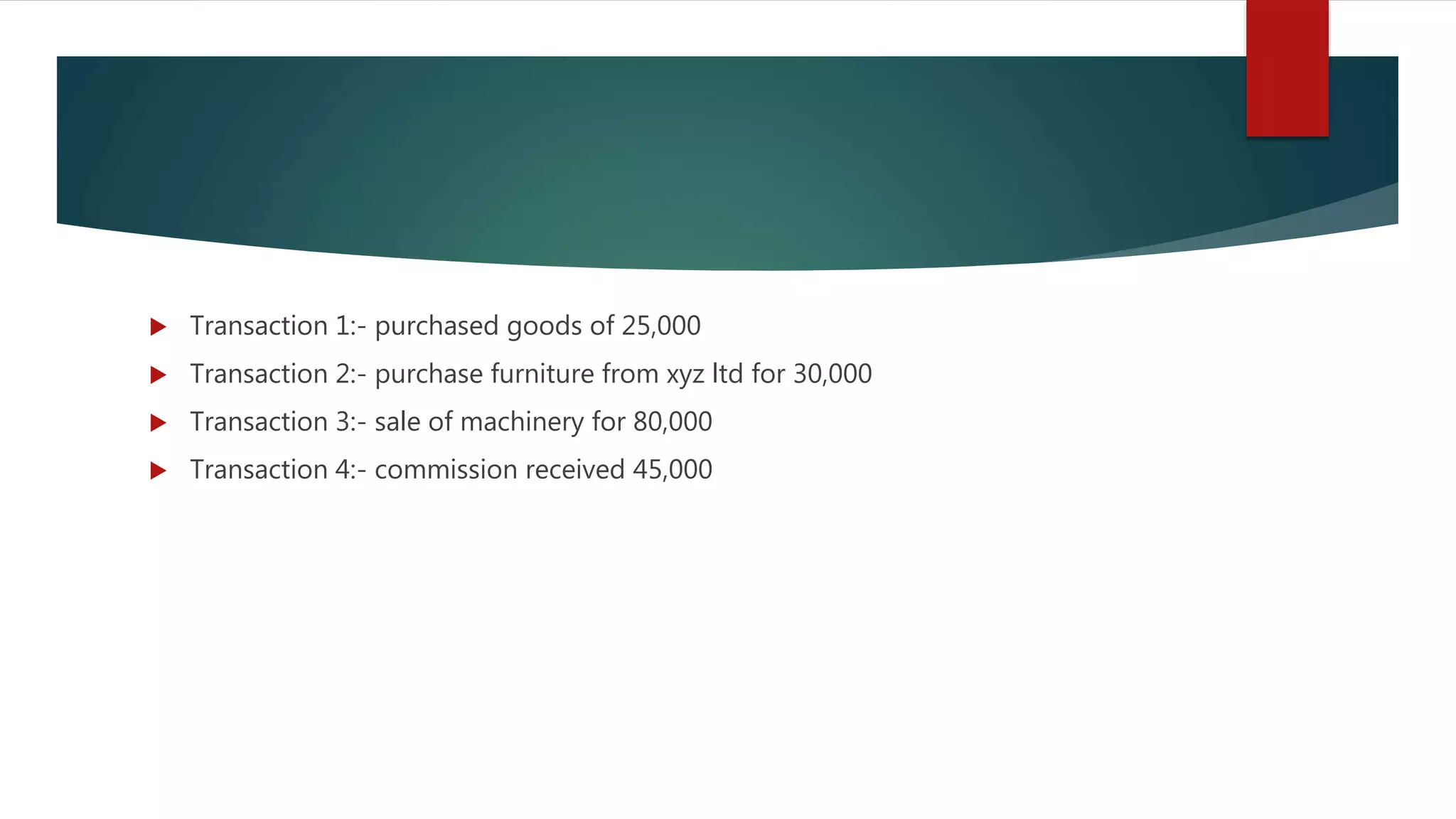

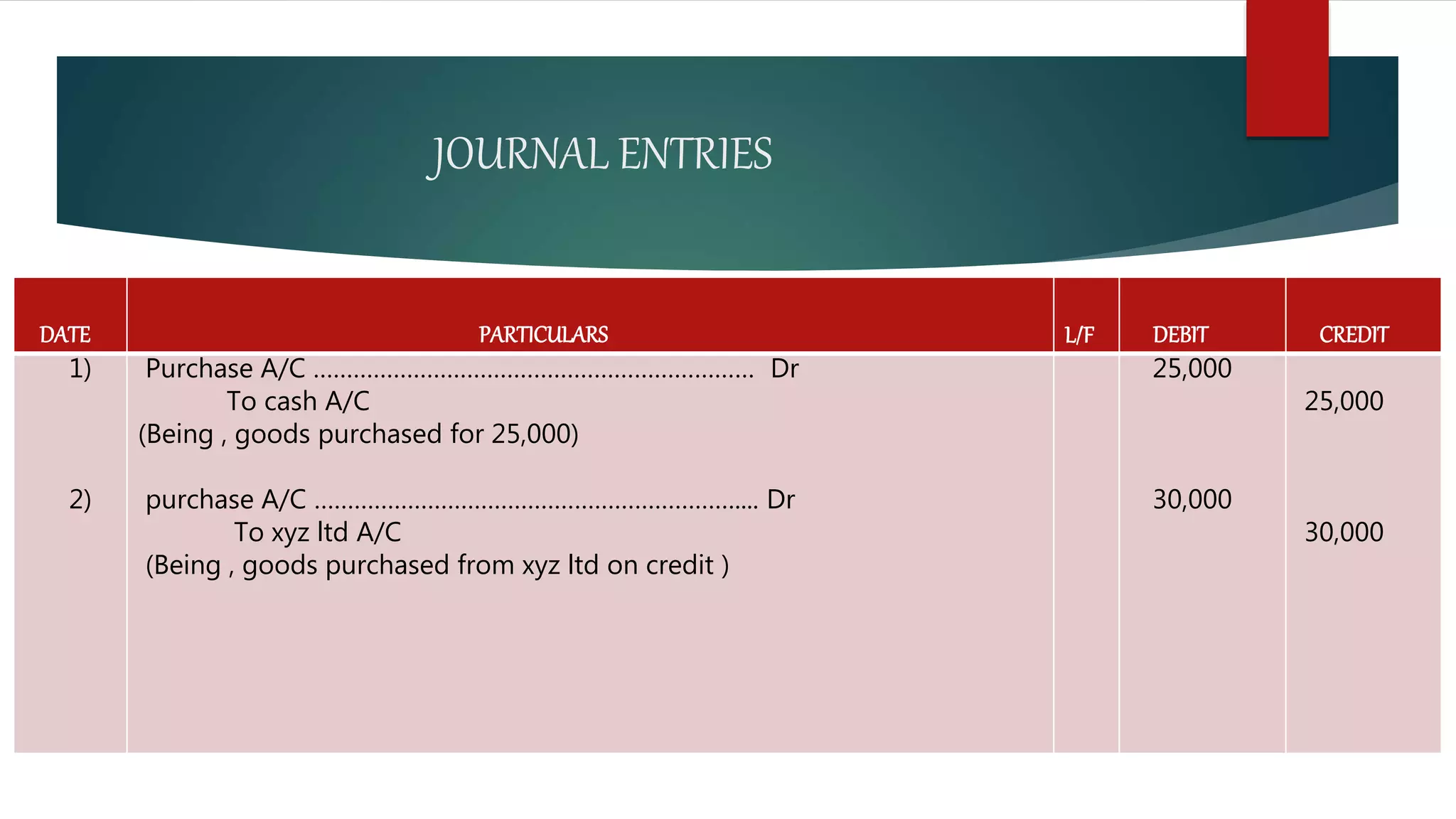

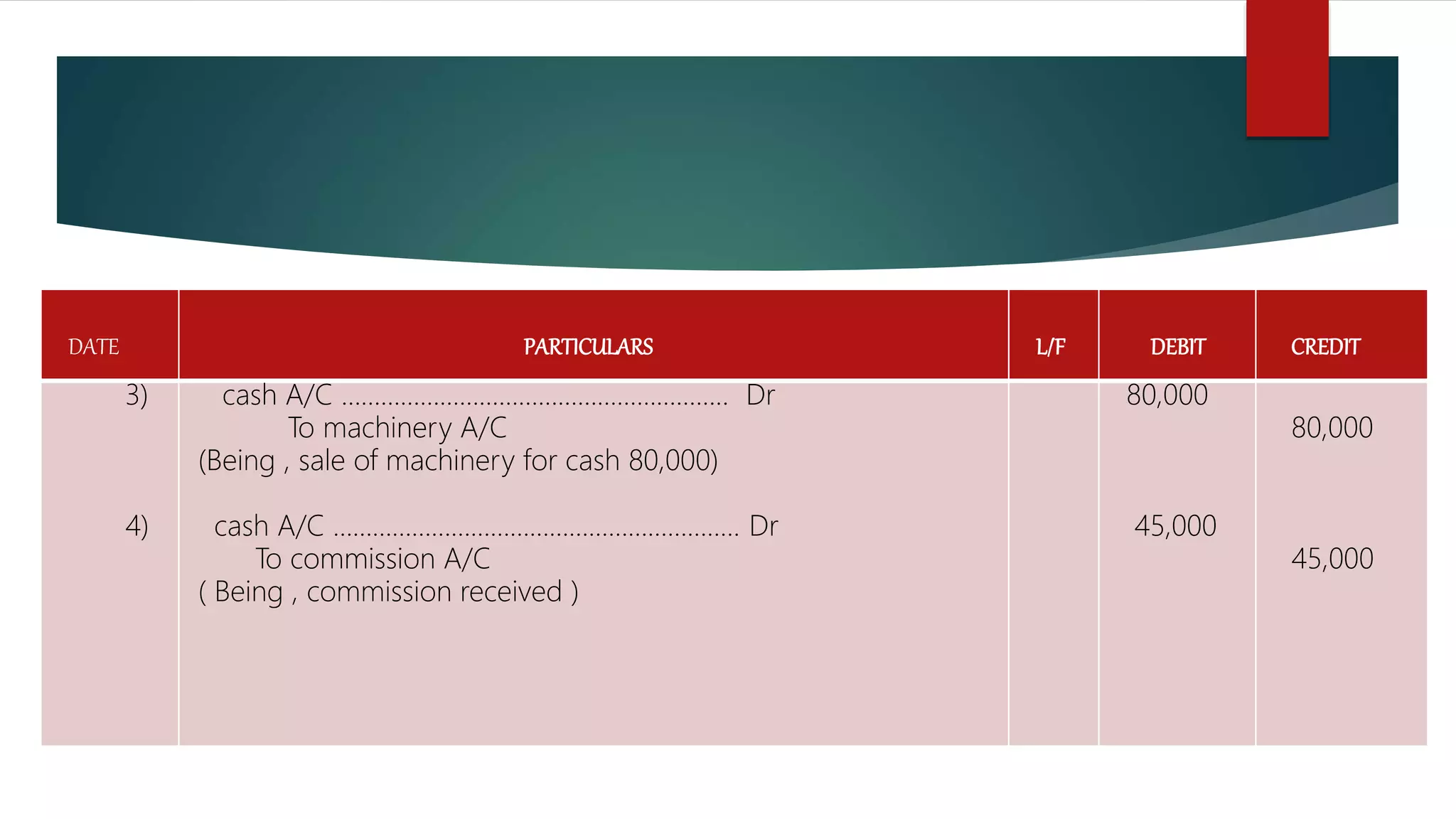

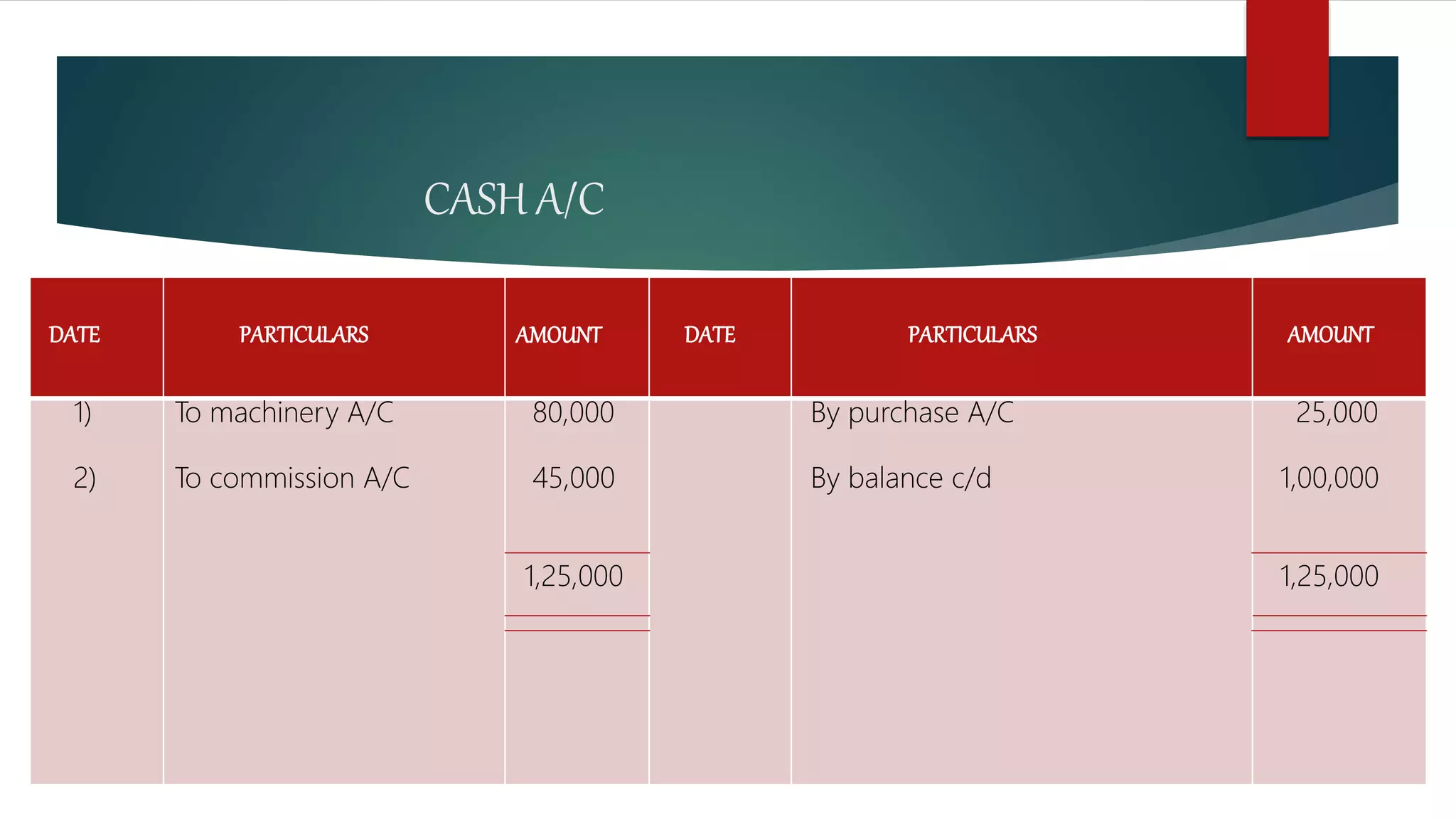

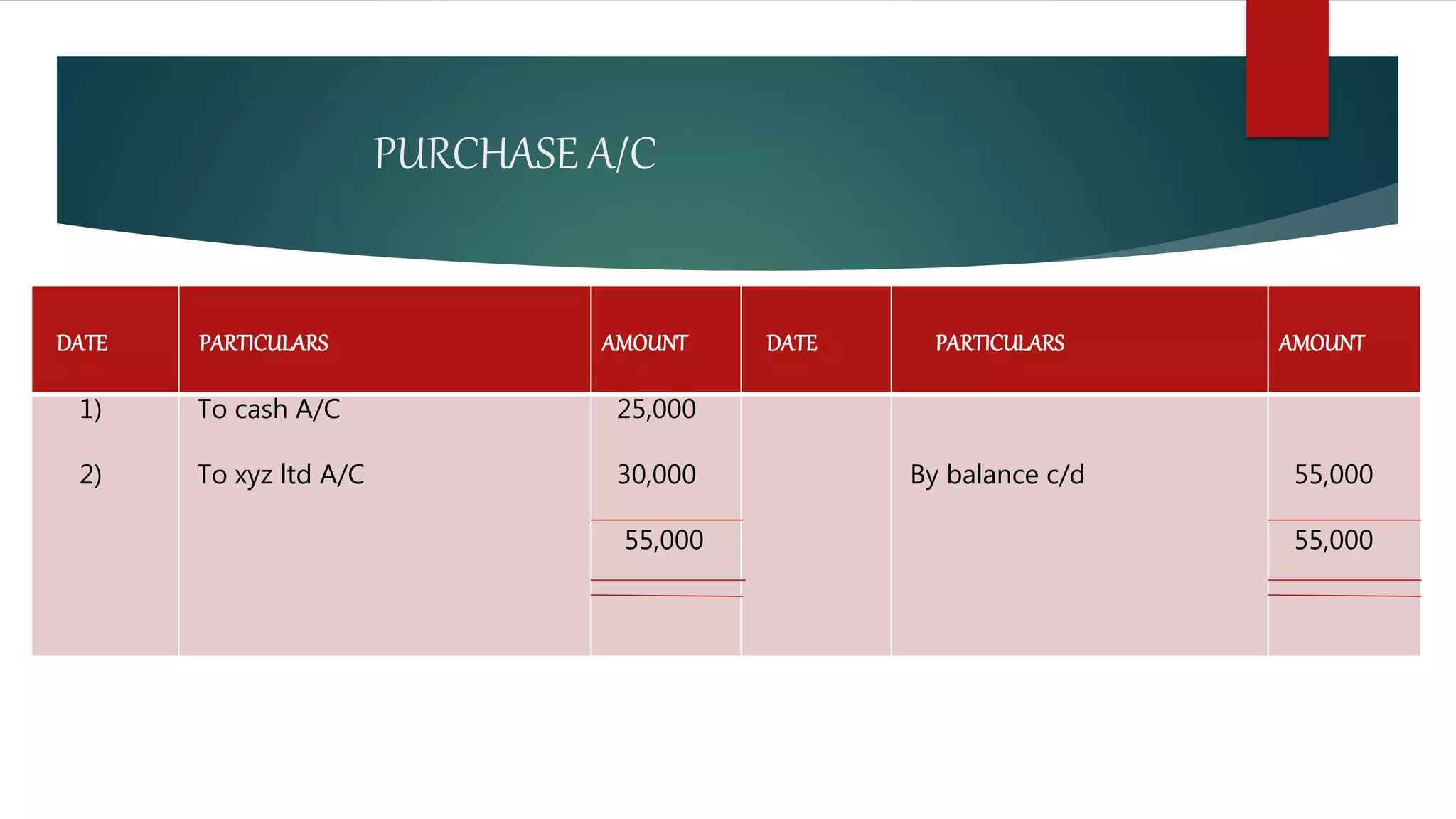

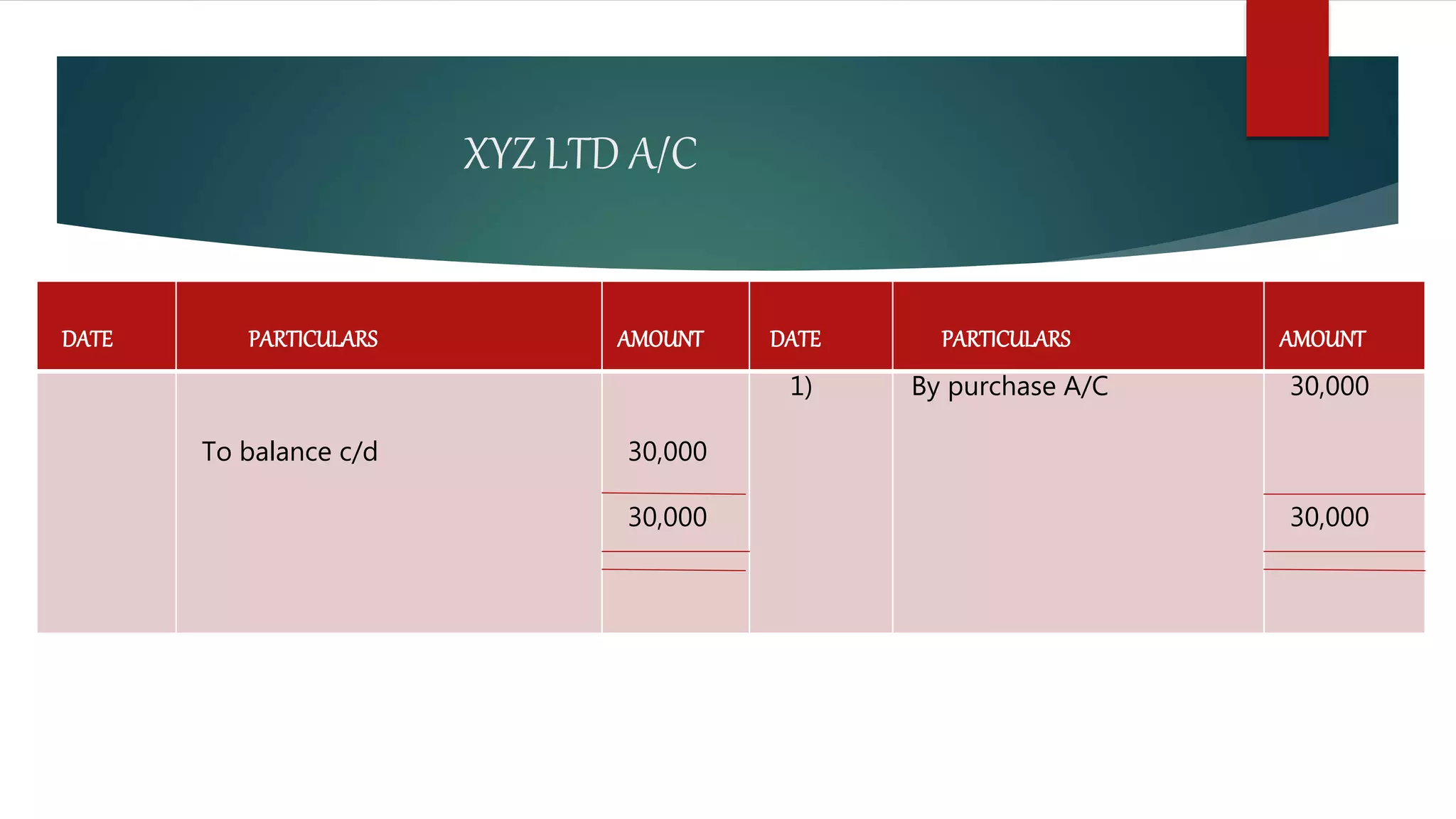

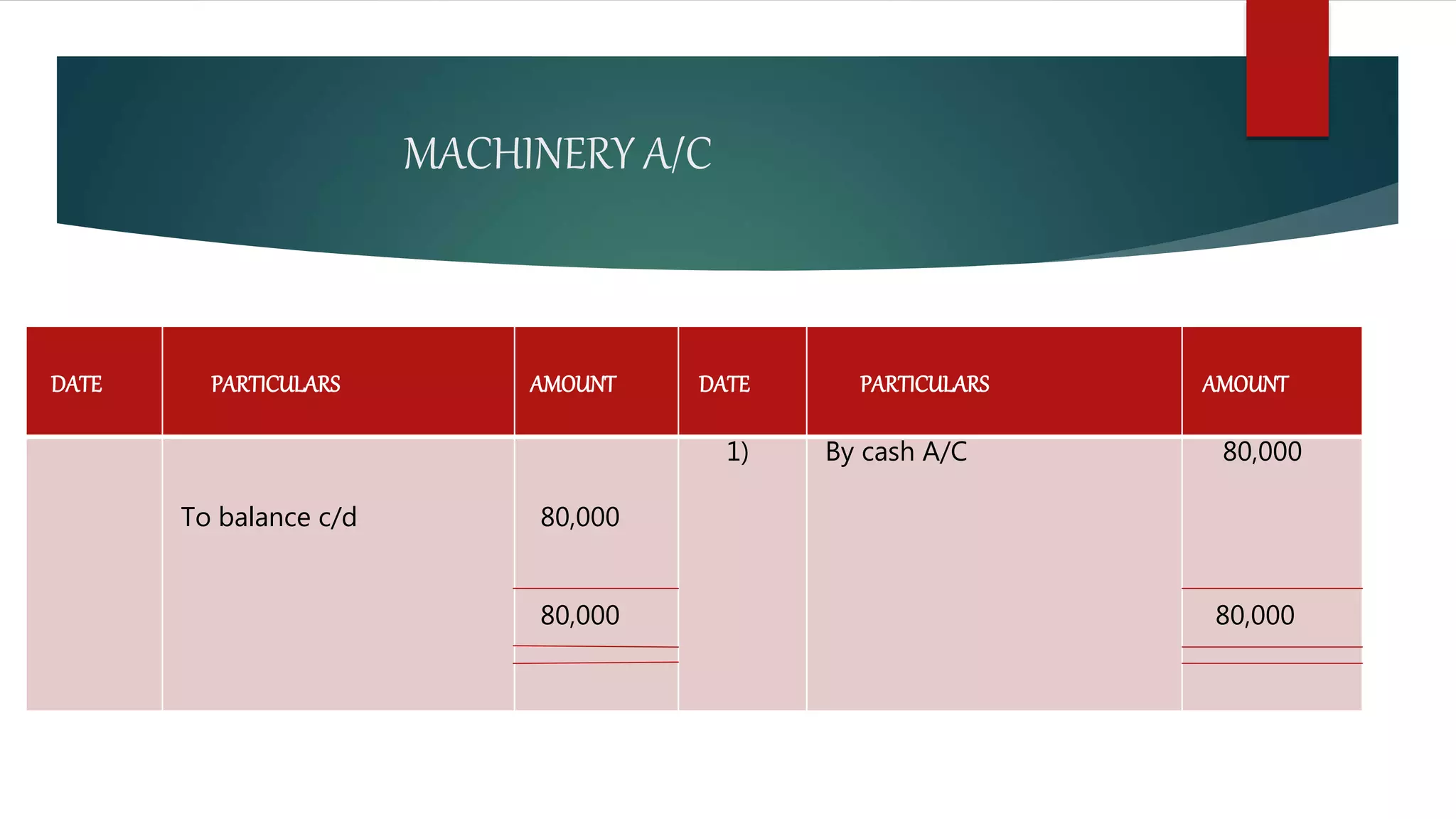

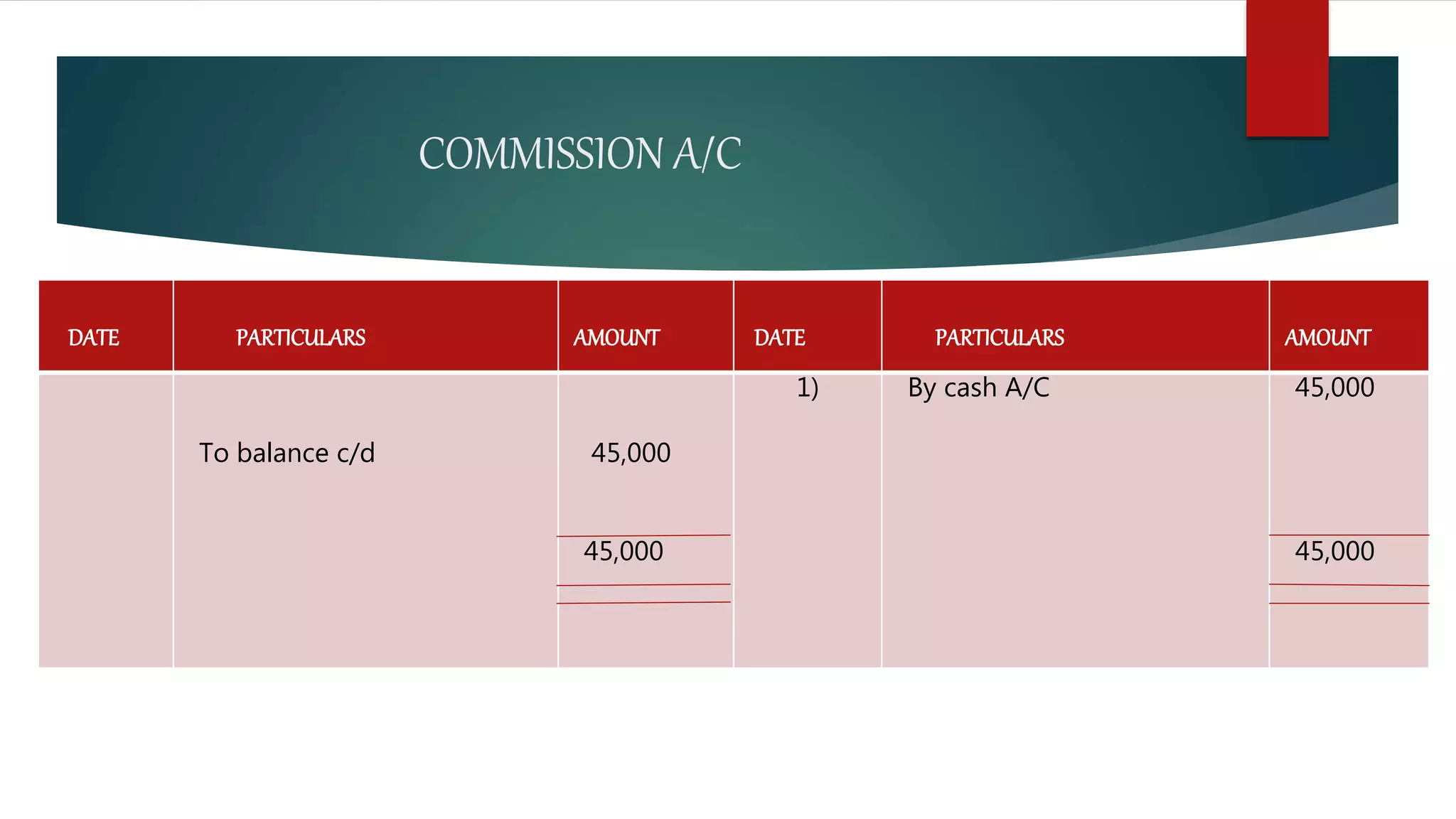

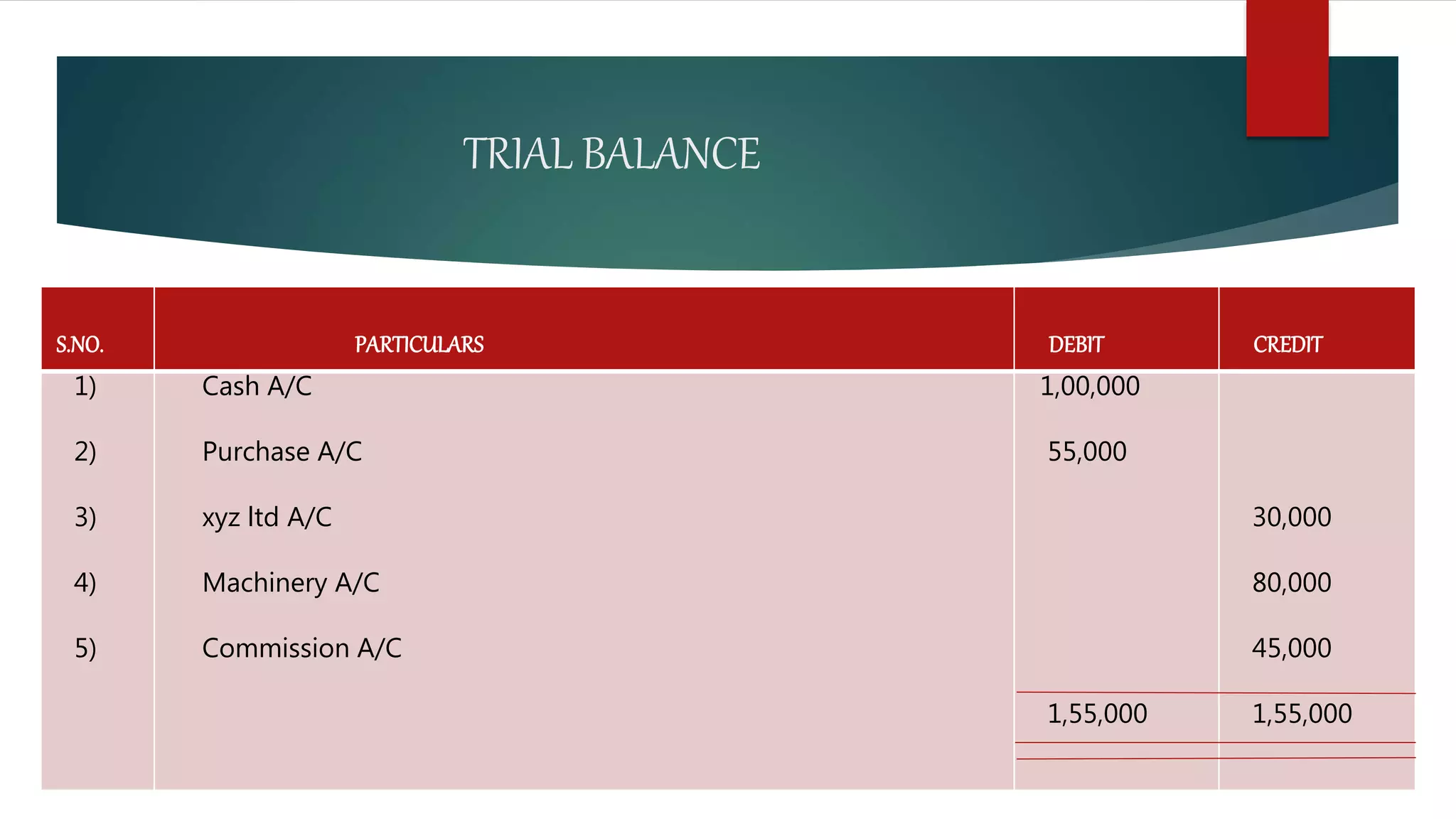

The document provides an introduction to accounting and the accounting equation. It discusses how accounting transactions are recorded in journals using double-entry bookkeeping. Specifically, it presents 4 transactions as examples of journal entries where debits and credits are equal. It also explains the accounting equation Assets = Liabilities + Owners Equity and shows how the equation is balanced through 3 example transactions. Finally, it provides an overview of the accounting cycle including journals, ledgers, trial balance, and final accounts.