- Accounts is where business transactions are recorded in a ledger using double entry bookkeeping. It allows owners and stakeholders to evaluate performance.

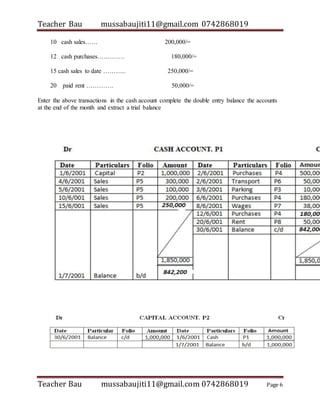

- Double entry bookkeeping requires every debit to have a corresponding credit. Transactions are recorded in accounts like cash, capital, purchases and sales.

- A ledger contains individual accounts with debit and credit columns. Worked examples show recording transactions like starting capital and purchases.

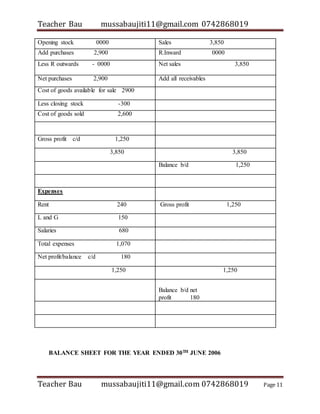

- Exercises provide additional practice recording transactions and preparing a trial balance, trading and profit and loss accounts to calculate net profit or loss.

![Teacher Bau mussabaujiti11@gmail.com 0742868019

Teacher Bau mussabaujiti11@gmail.com 0742868019 Page 9

Cost of goods available

For sale xxx

Less : closing stock xxx

Cost of goods sold xxx

Gross profit c/d xxx

Xxx Xxx

PROFIT AND LOSS ACCOUNT

This is an account prepared in order to ascertain the net profit and loss by the business. All

expenses are debited to this account while gains or profits are credited to this account and

debited with all incurred expenses.

Note

If the business has made profit it increases the capital and if it has suffered loss it reduces the

capital.

It’s lay out;

FIRM’S NAME

DR PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED CR

Expense xxx

Net profit xxx

Gross profit b/d from trading account xxx

Other gains [income] xxx

xxx](https://image.slidesharecdn.com/accounts-220130221238/85/Accounts-9-320.jpg)