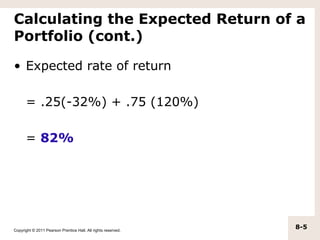

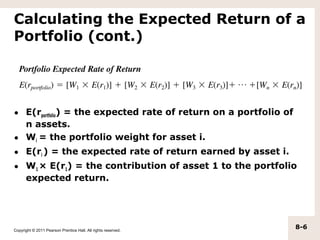

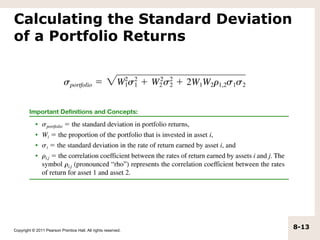

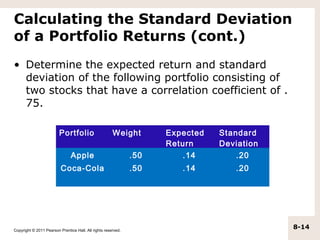

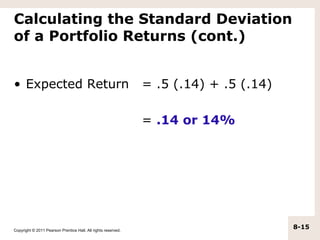

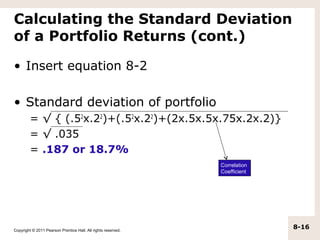

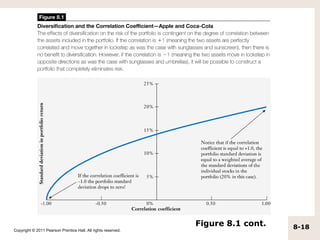

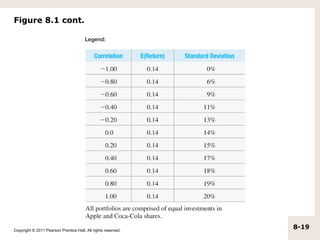

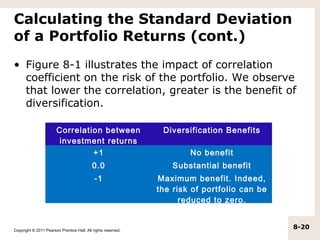

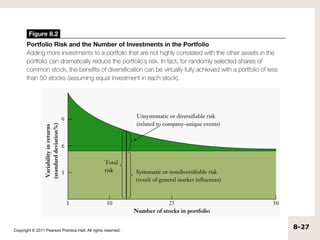

1) The chapter discusses portfolio risk and return, and how diversification can reduce risk without lowering expected returns. It also covers calculating expected portfolio returns and standard deviation.

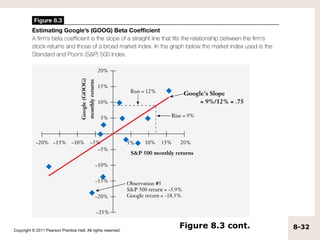

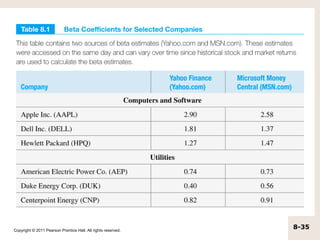

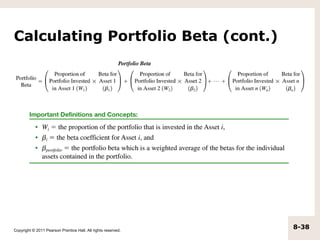

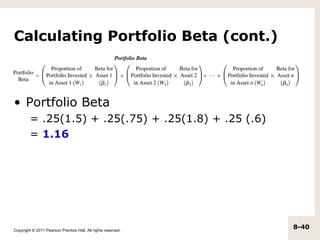

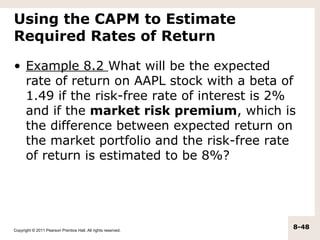

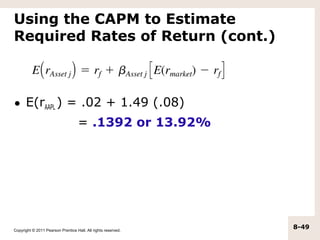

2) The Capital Asset Pricing Model (CAPM) measures systematic risk using beta coefficients. Systematic risk cannot be diversified away, whereas unsystematic risk can be through diversification.

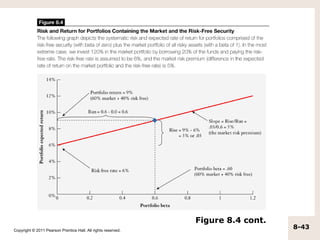

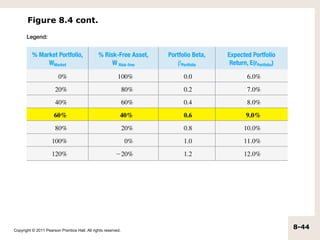

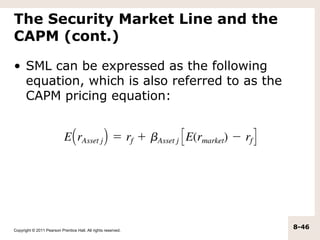

3) CAPM predicts that investors will require a higher expected return for investments with higher betas or systematic risk. This relationship is depicted by the security market line.