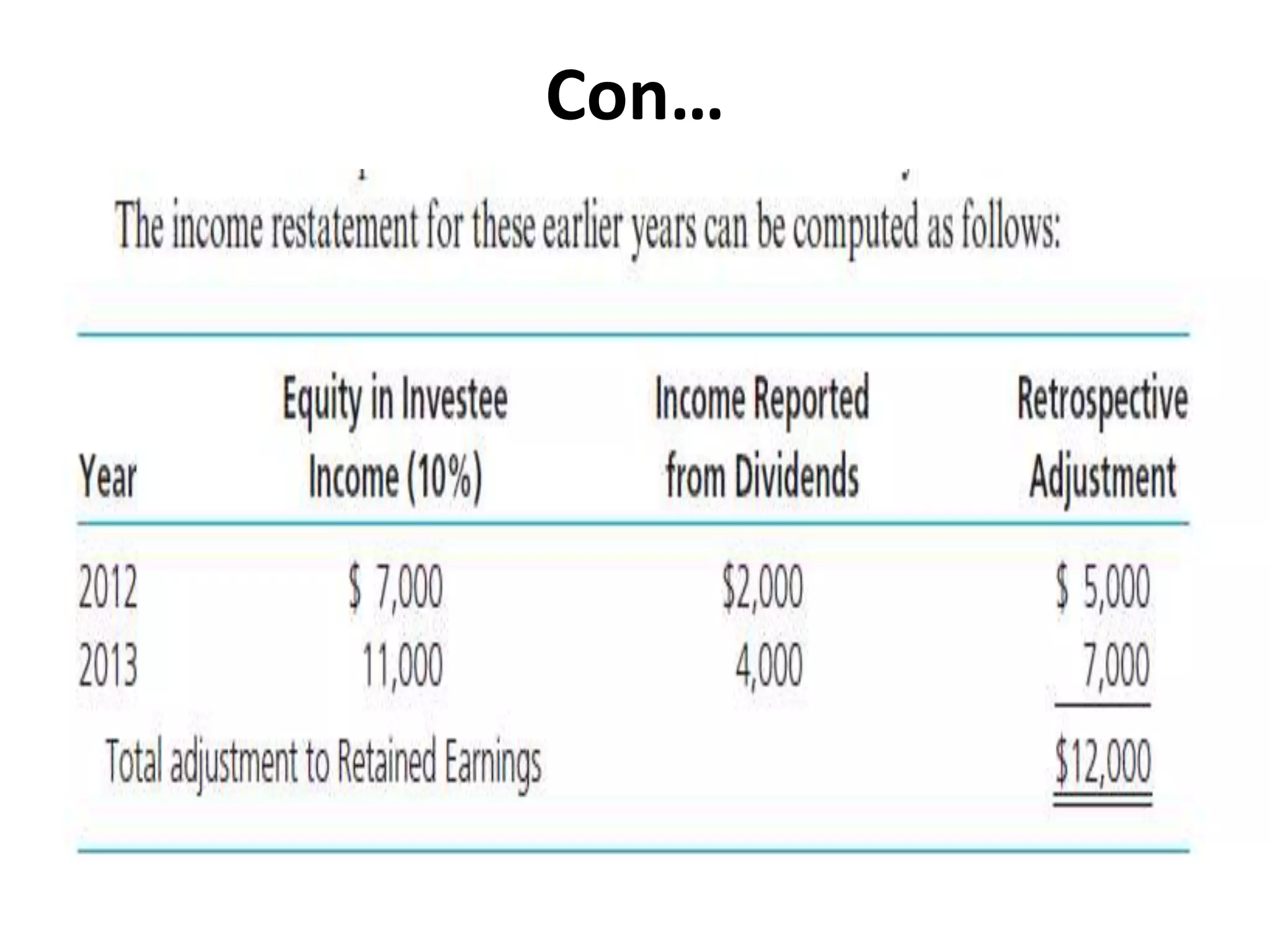

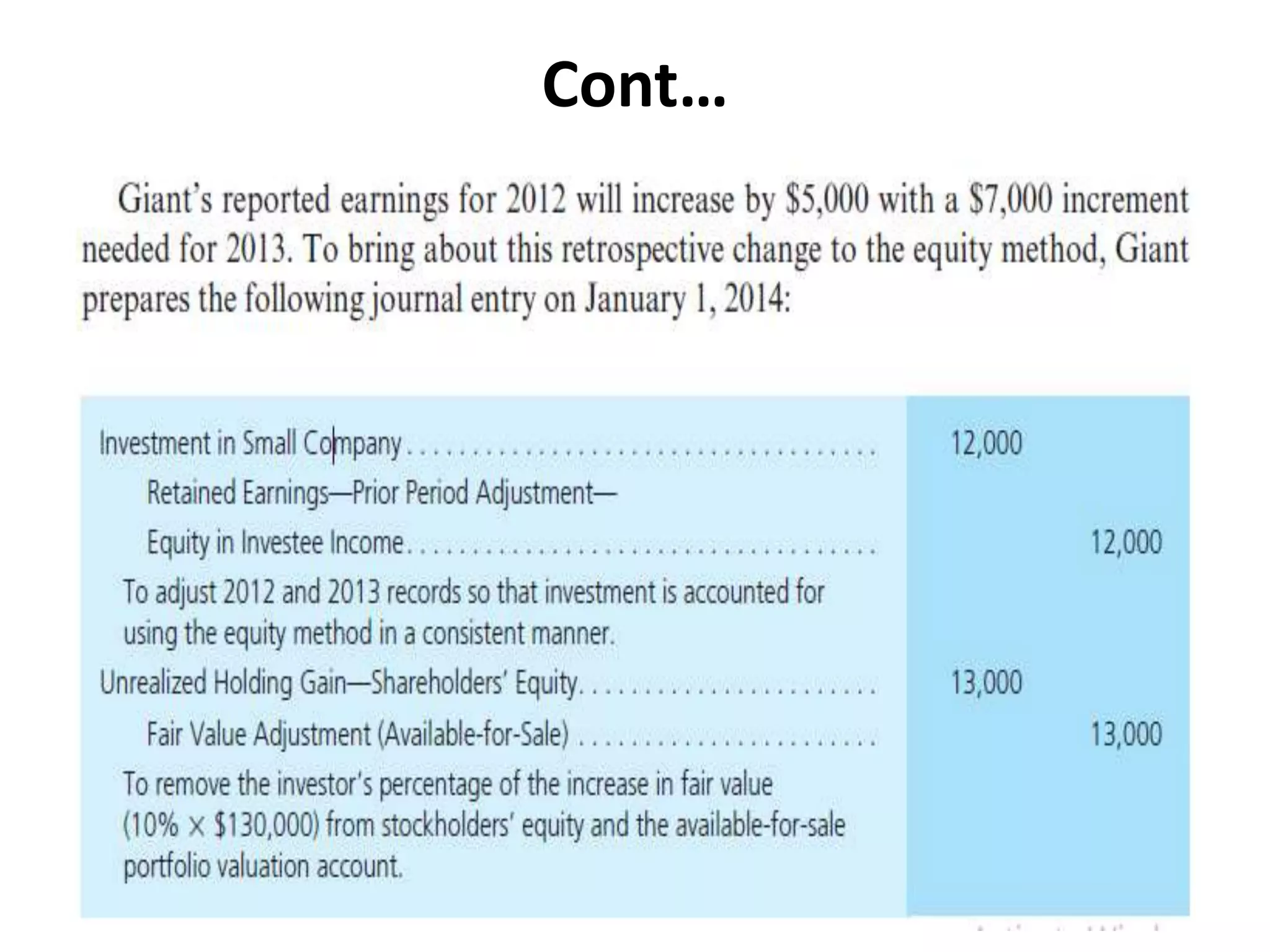

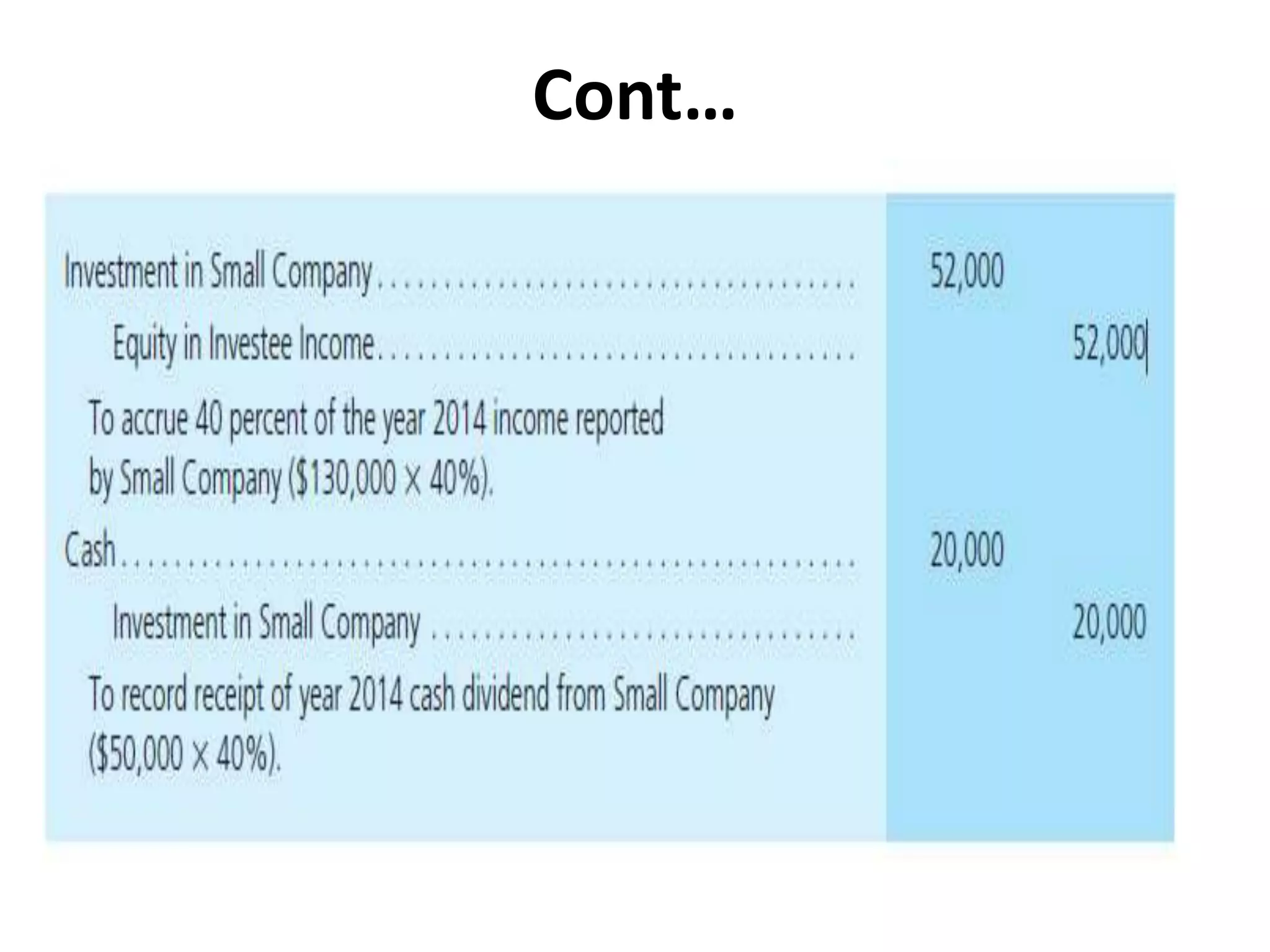

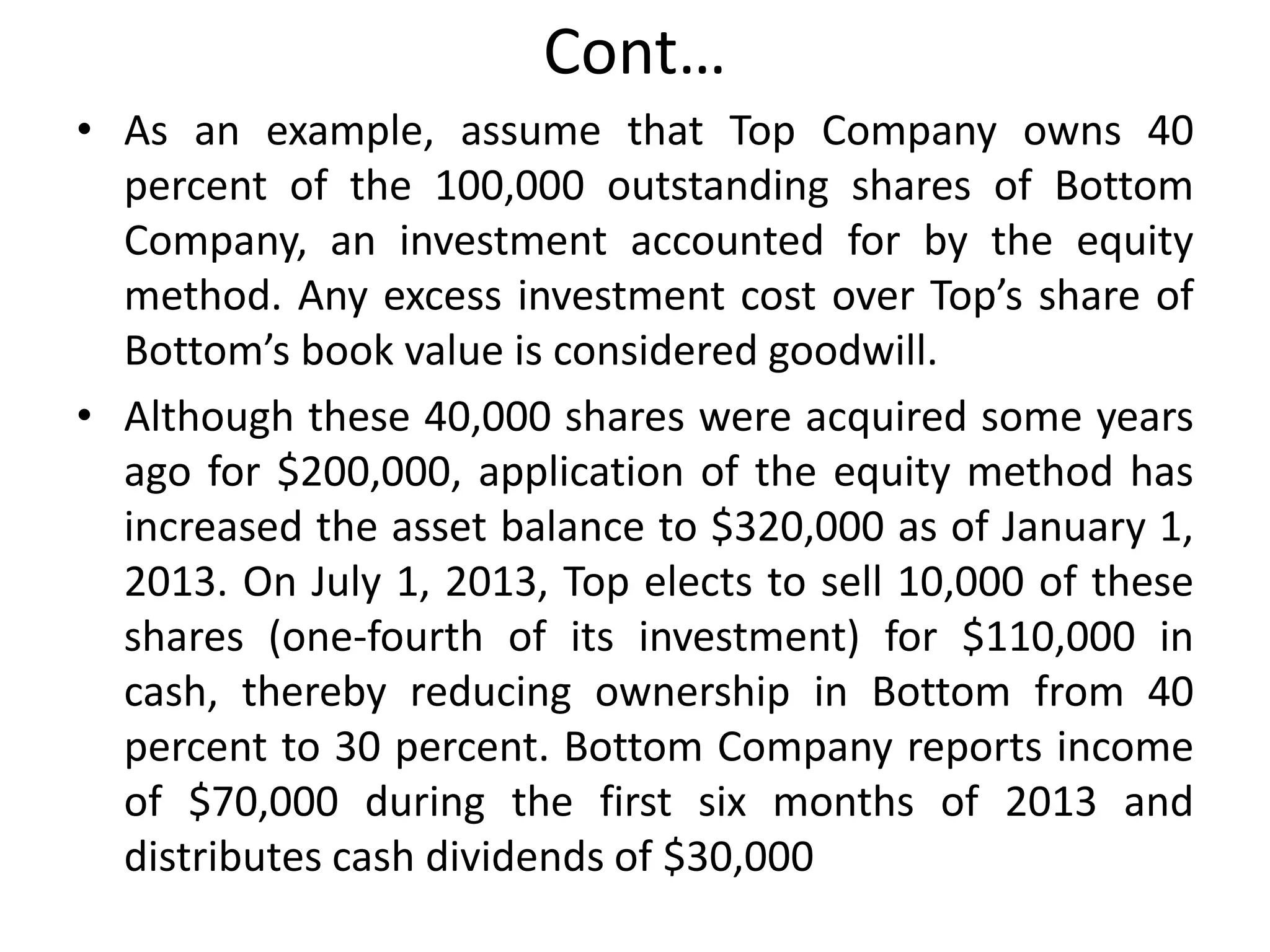

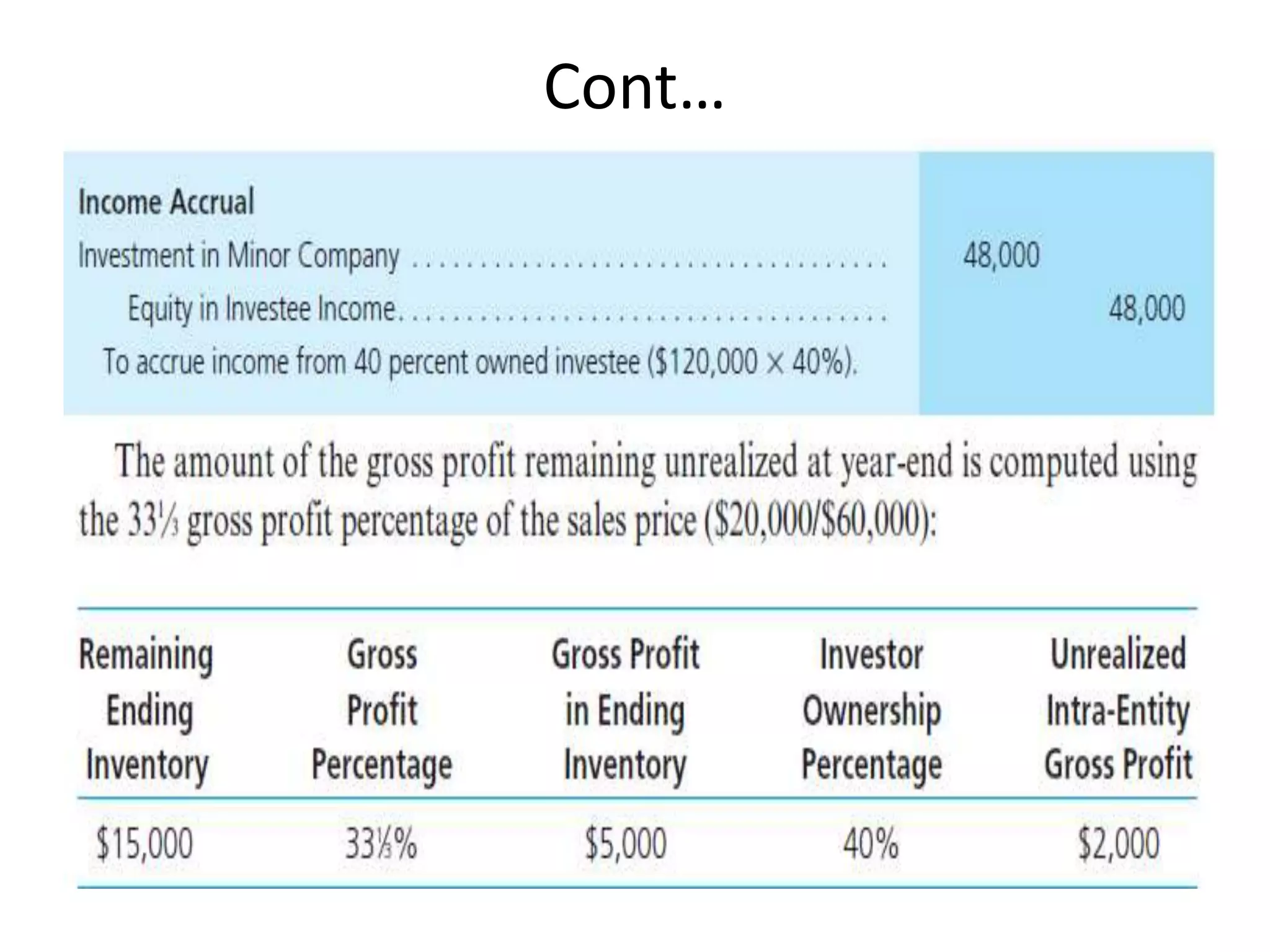

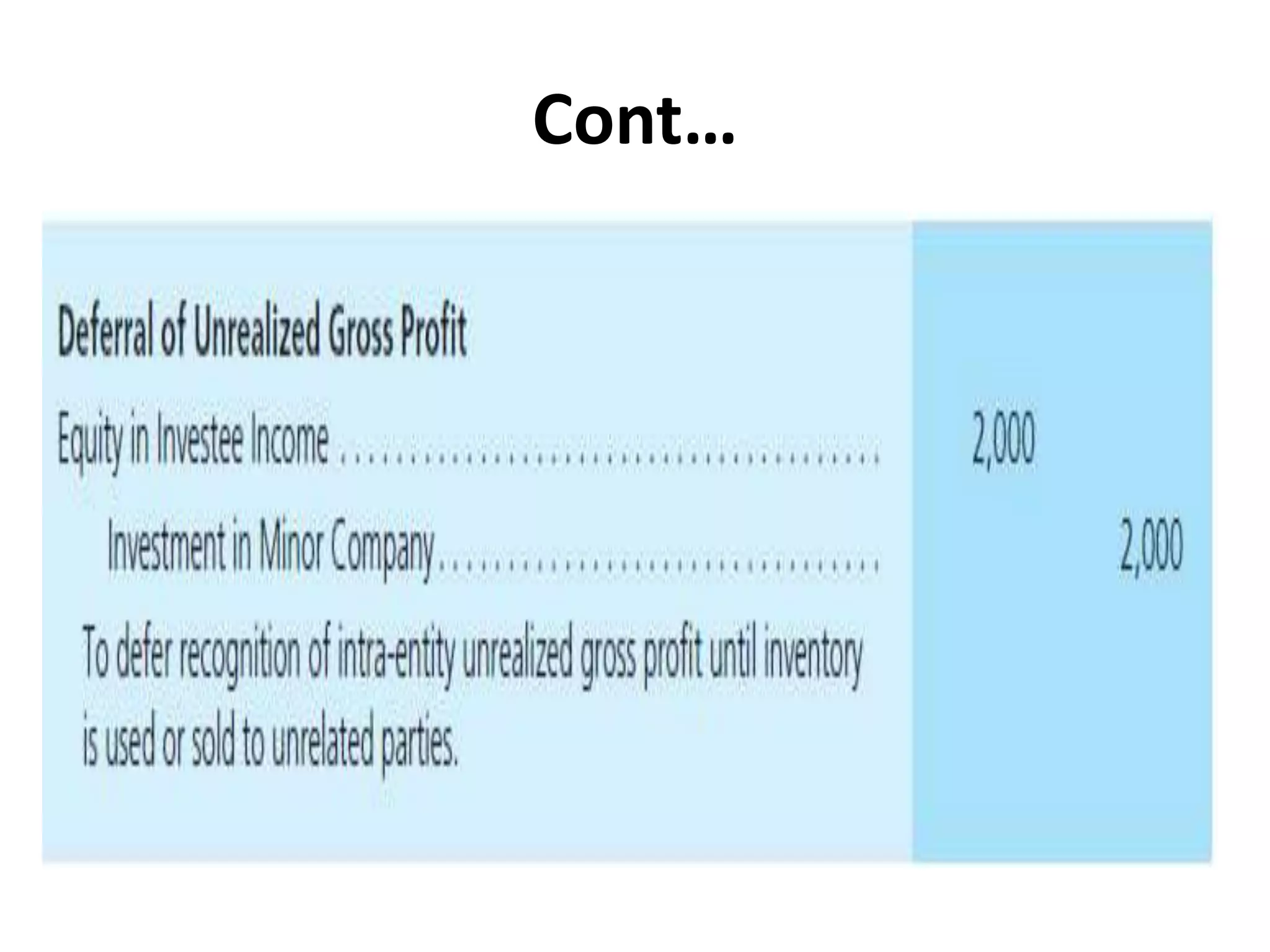

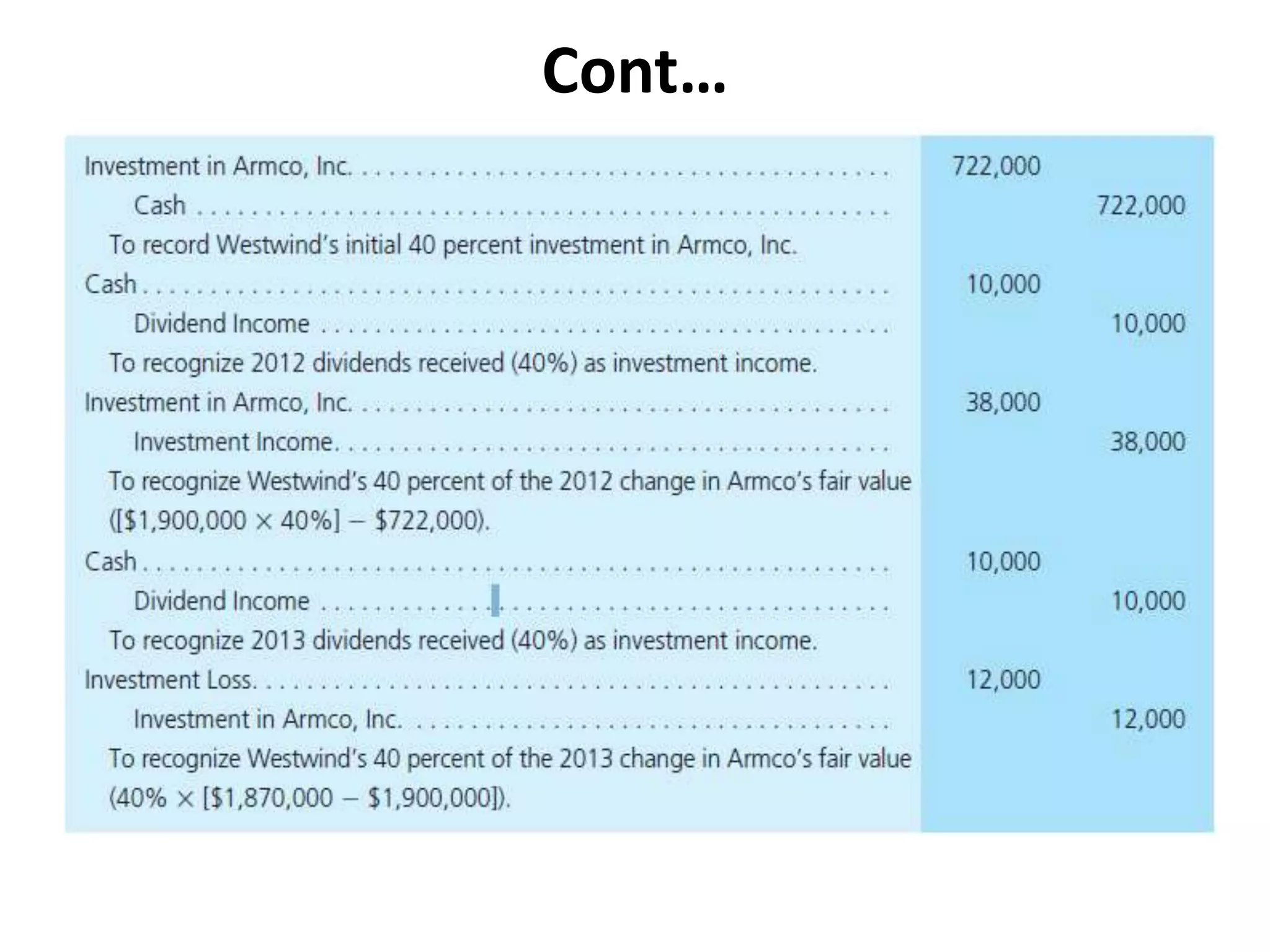

This document provides an overview of the equity method of accounting for investments. It describes the equity method criteria, accounting procedures, and journal entries. The key points are:

1. The equity method is used when an investor has significant influence over an investee, usually owning 20-50% of the voting shares.

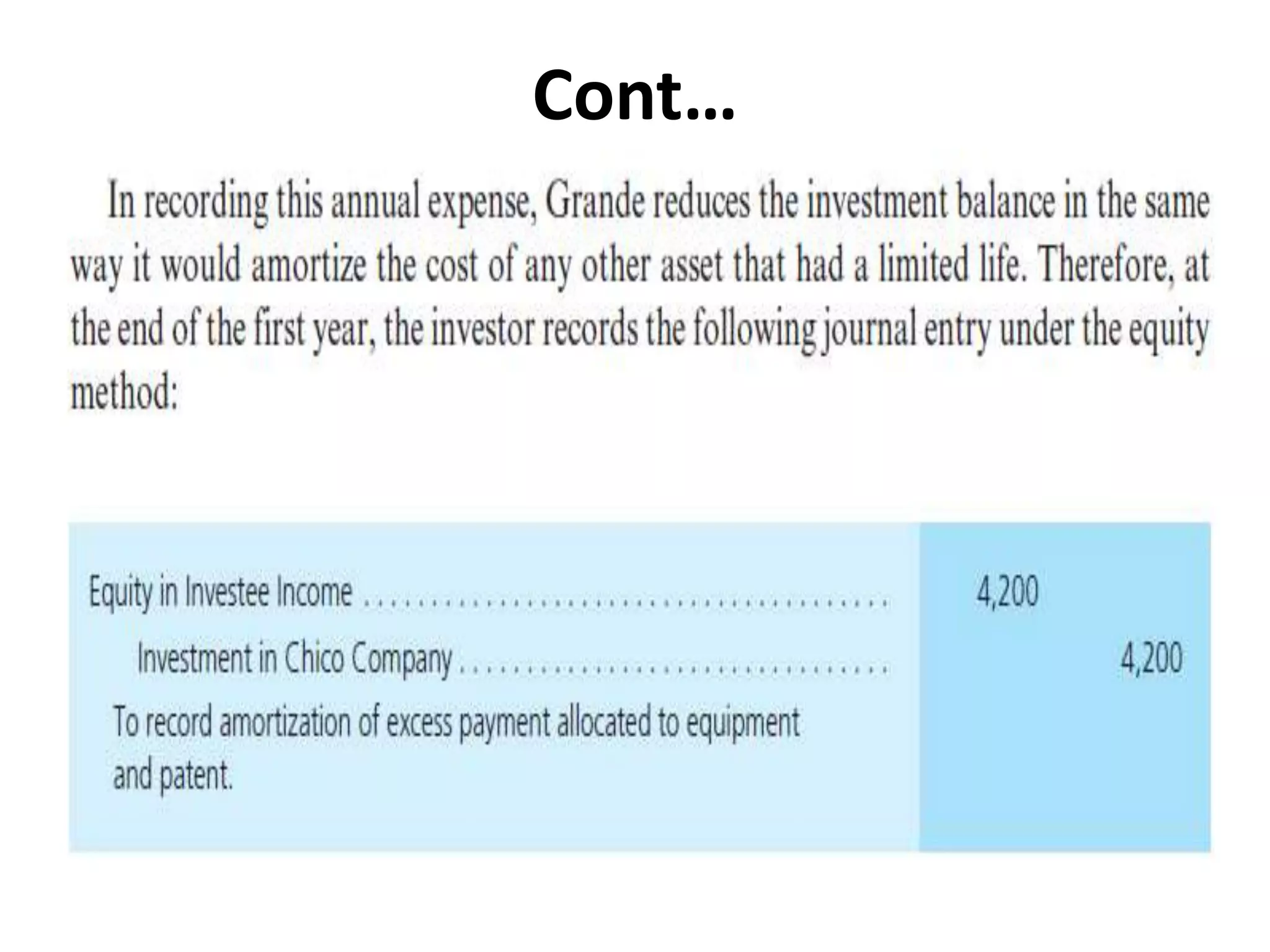

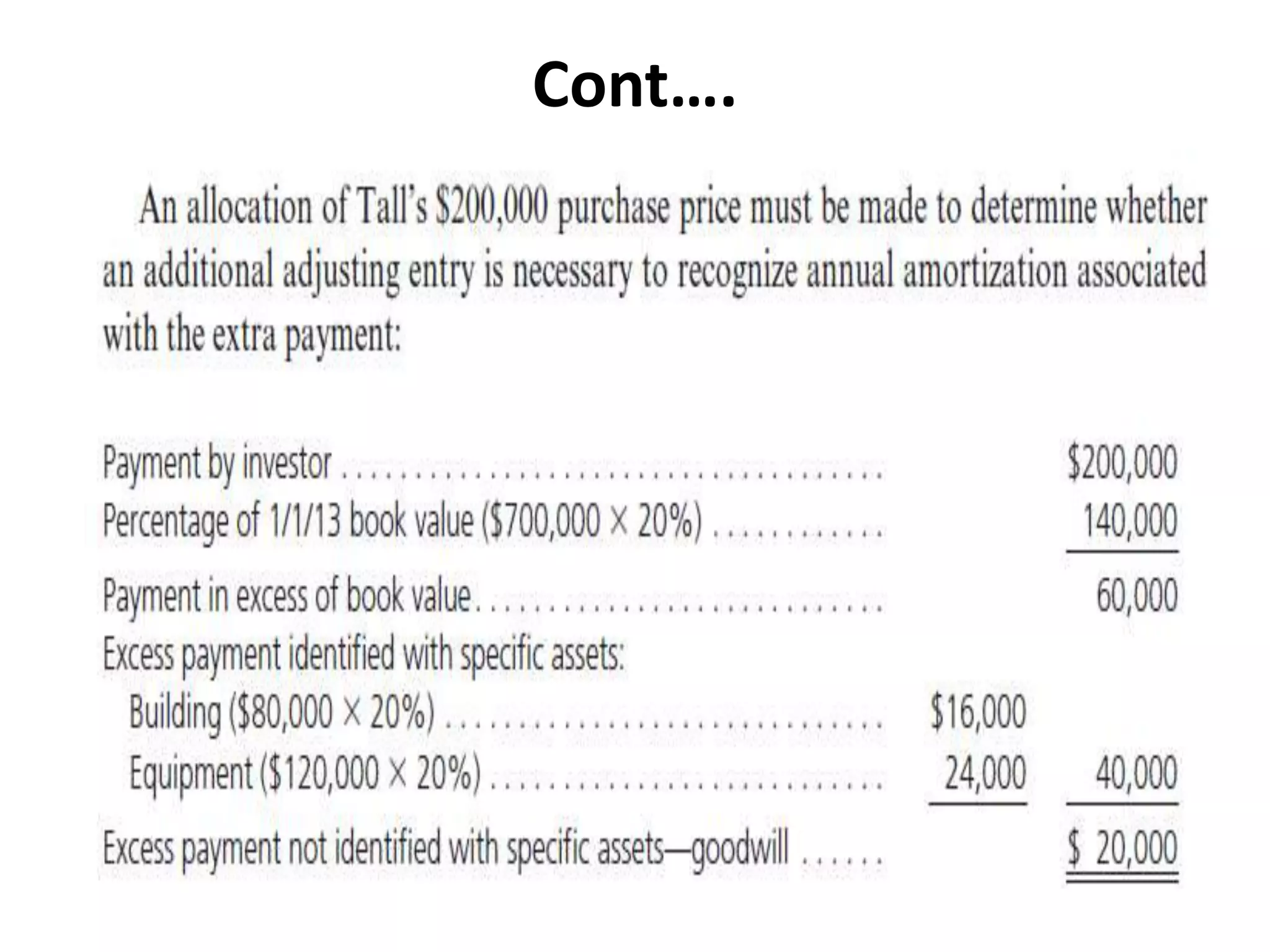

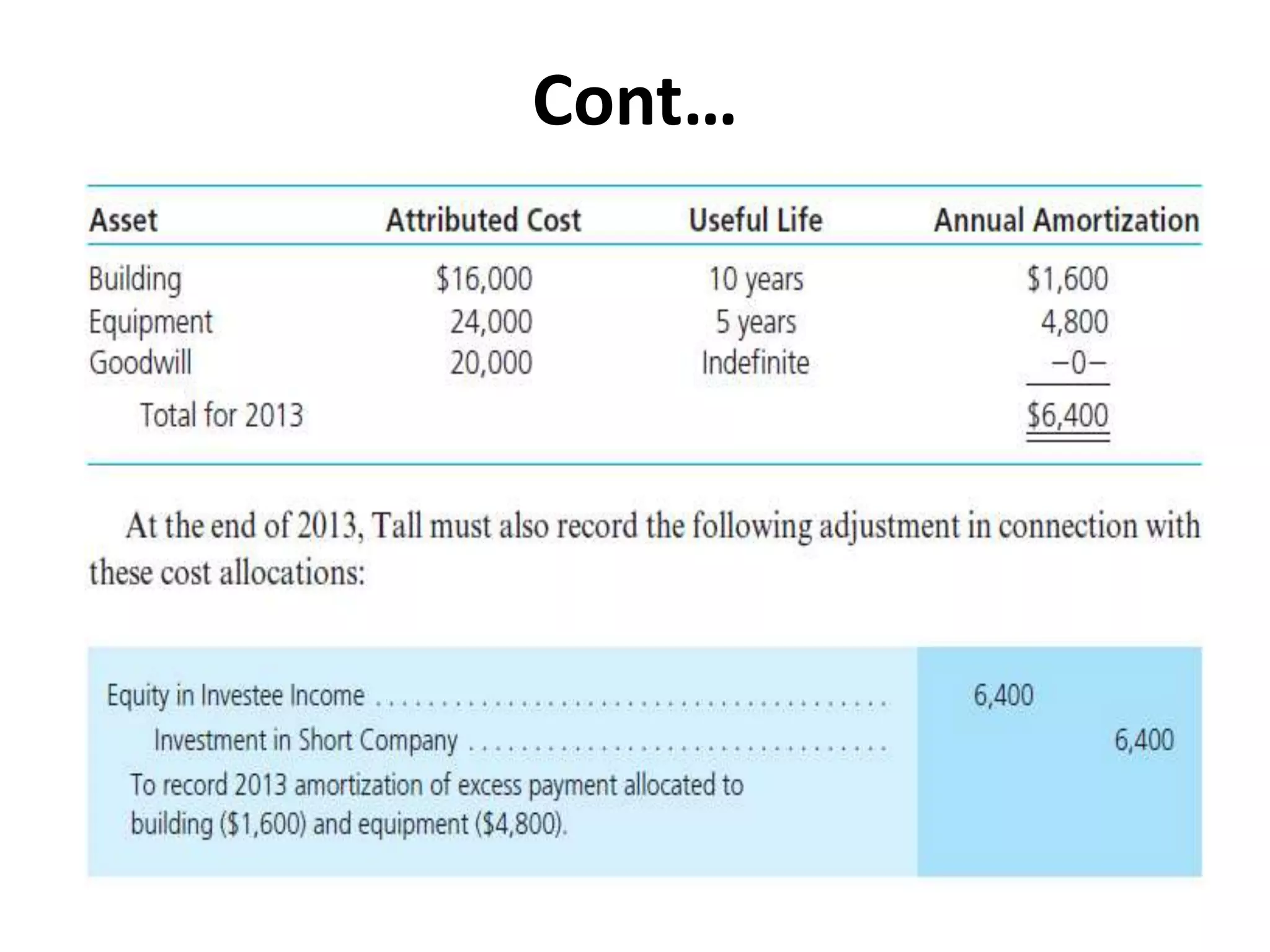

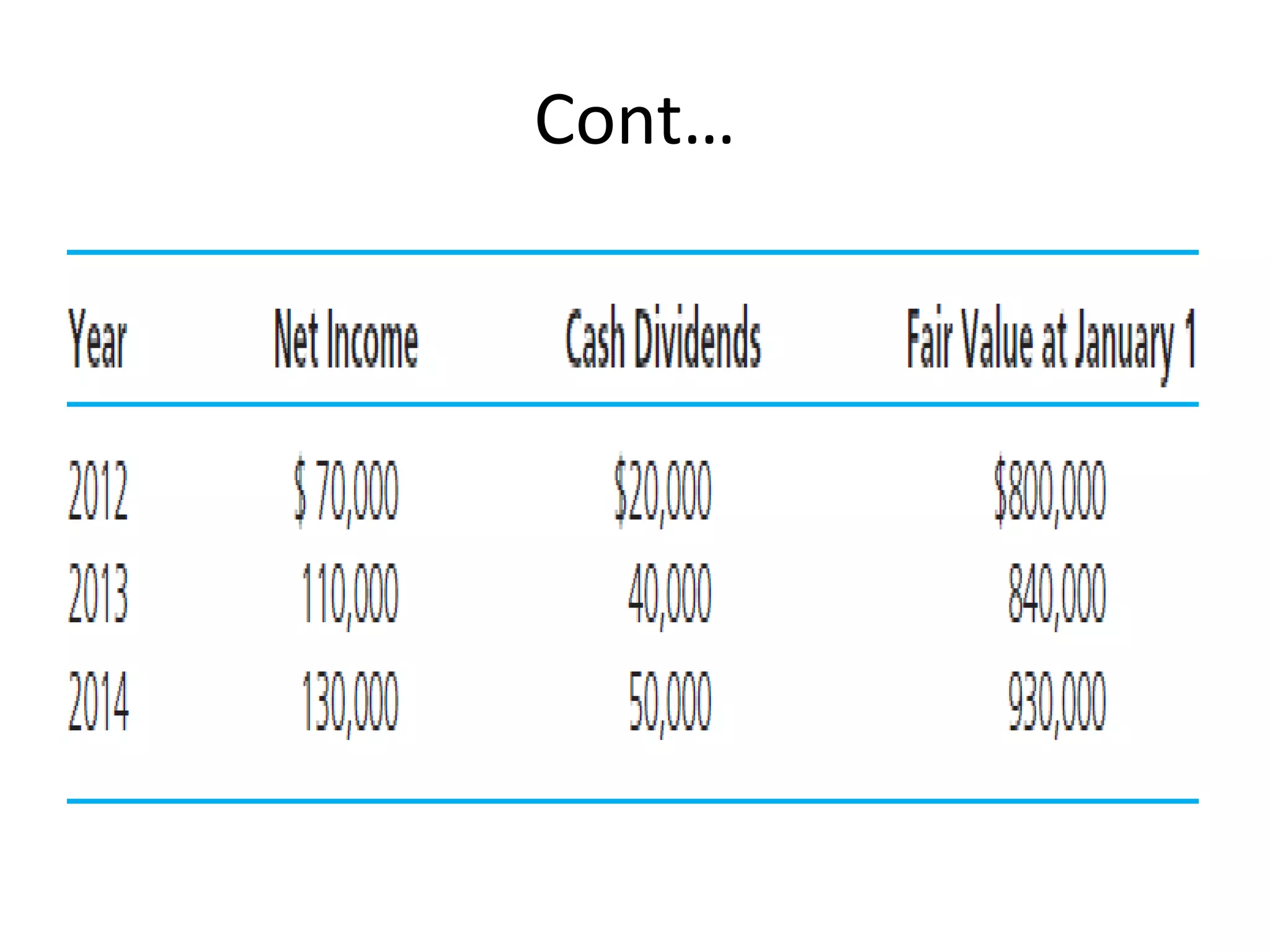

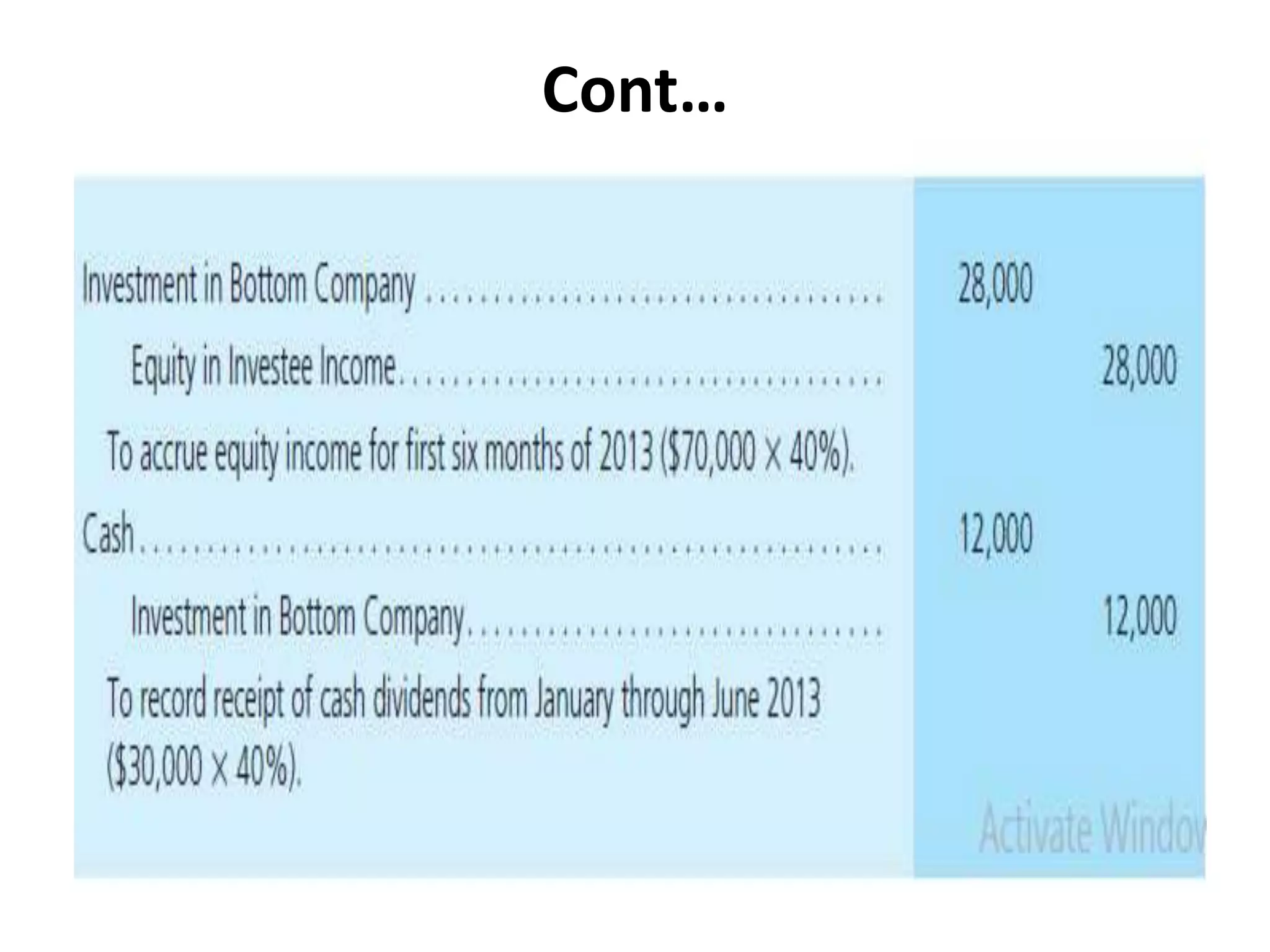

2. Under the equity method, the investment account increases with the investee's earnings and decreases with dividends. Income is recognized based on the investor's share of the investee's earnings.

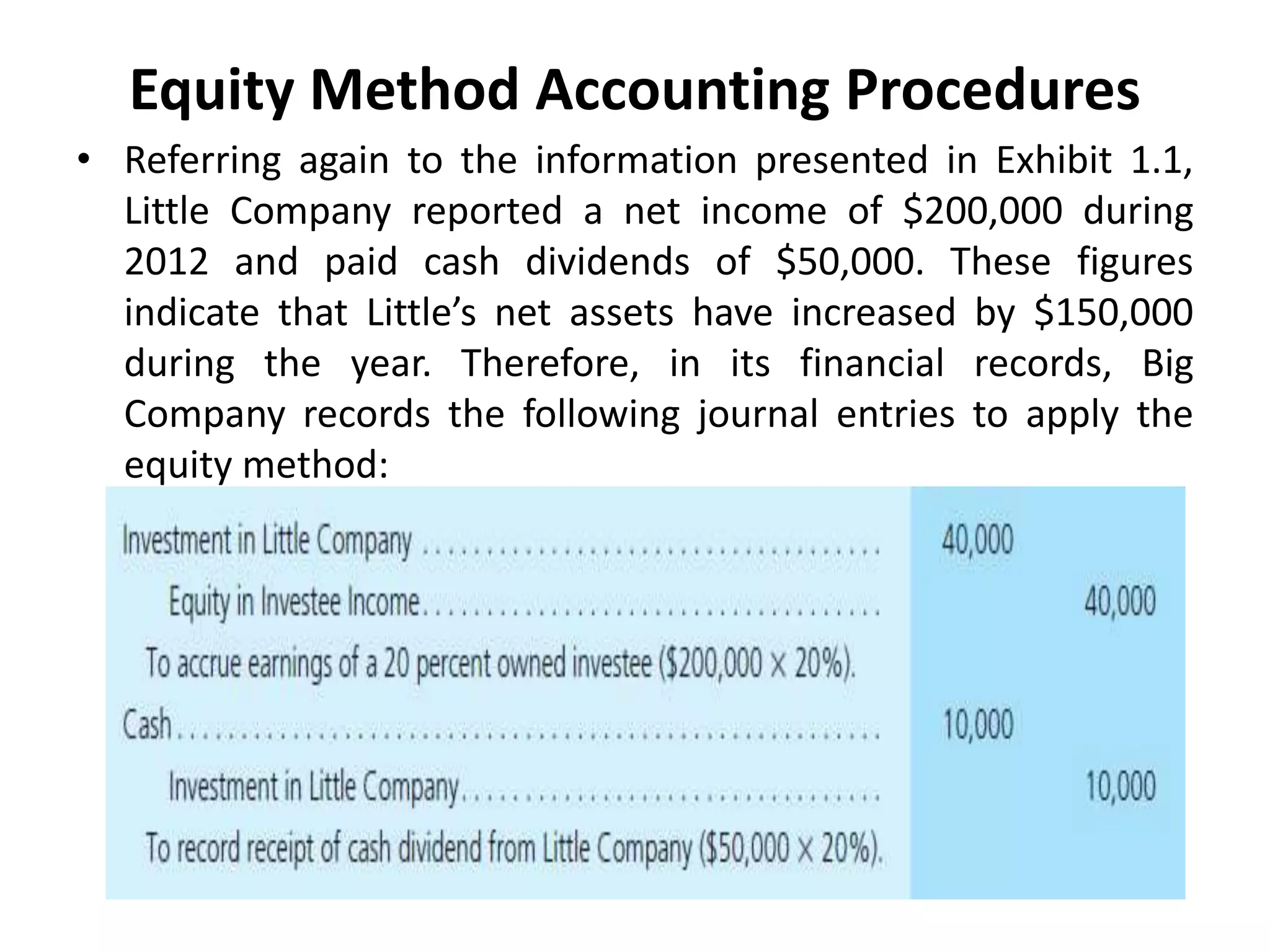

3. Example journal entries are provided to record an investor recognizing income from and dividends received from an investee under the equity method.

![Criteria for Utilizing the Equity Method

• The rationale underlying the equity method is

that an investor begins to gain the ability to

influence the decision-making process of an

investee as the level of ownership rises.

• According to FASB ASC Topic 323 on equity

method investments, achieving this “ability to

exercise significant influence over operating and

financial policies of an investee even though the

investor holds 50 percent or less of the voting

stock” is the sole criterion for requiring

application of the equity method [FASB ASC

(para. 323-10-15-3)].](https://image.slidesharecdn.com/ch1-161129200112/75/Advanced-Accounting-16-2048.jpg)