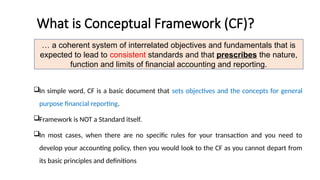

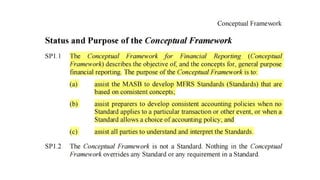

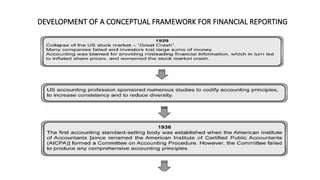

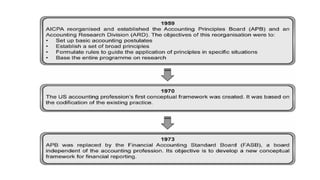

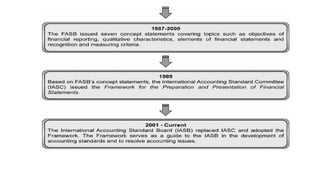

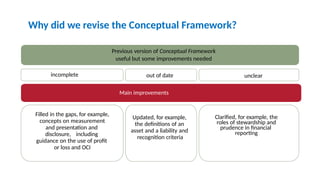

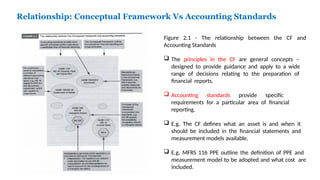

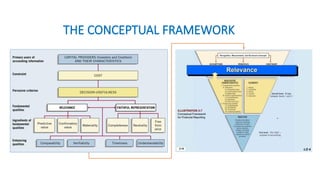

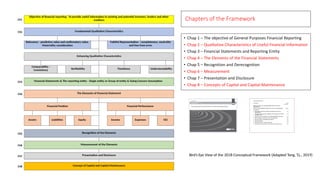

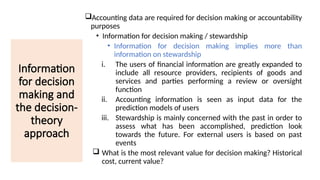

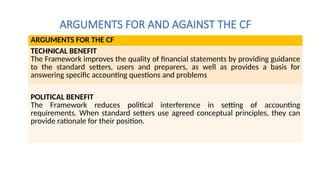

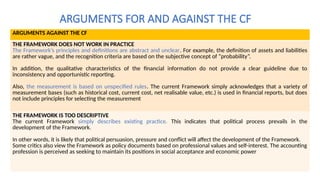

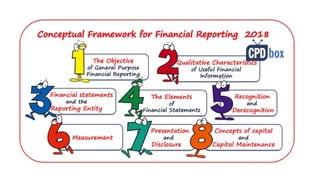

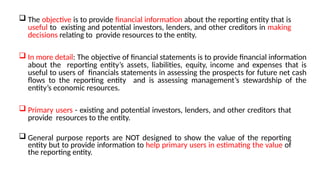

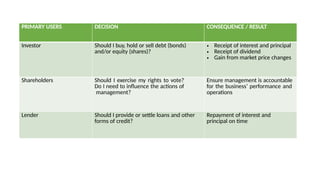

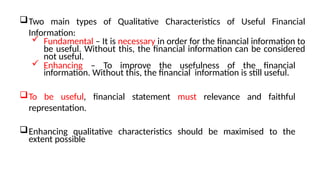

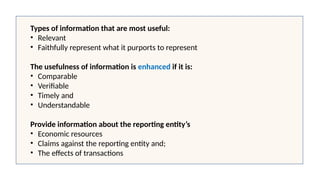

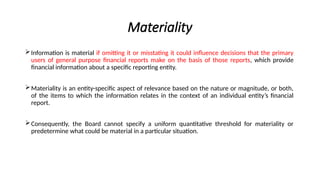

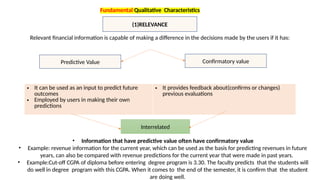

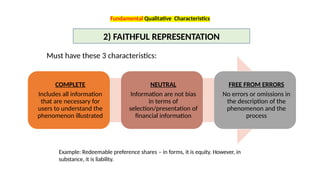

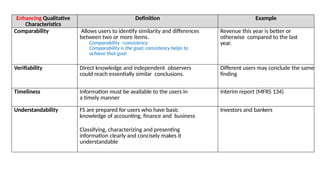

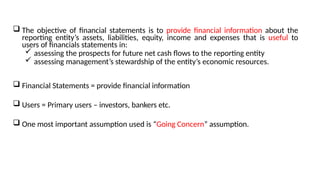

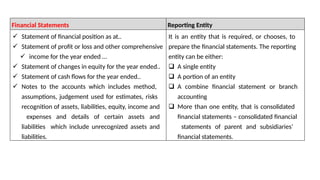

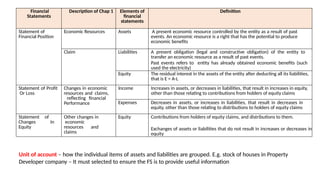

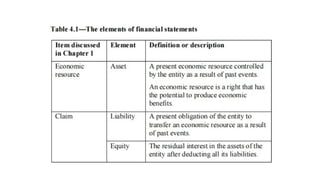

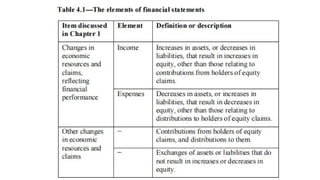

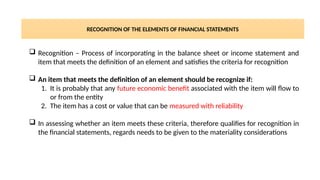

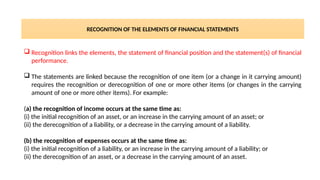

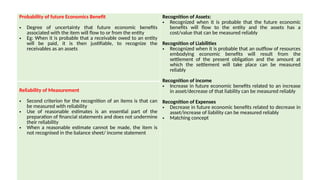

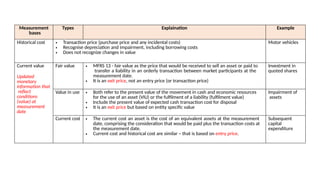

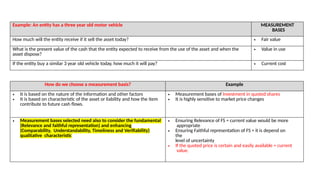

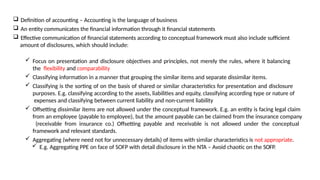

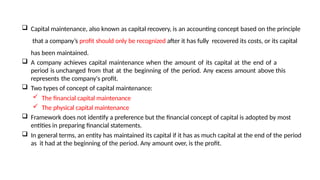

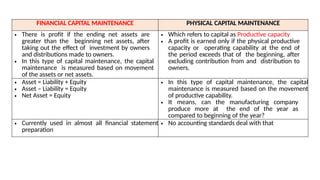

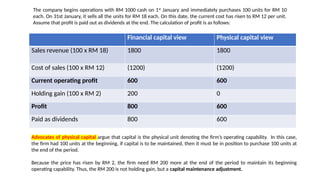

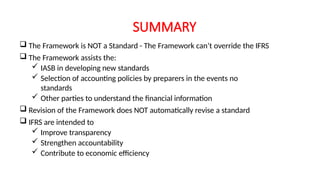

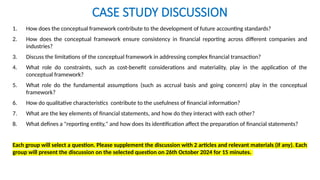

The document outlines the conceptual framework for financial accounting, detailing its objectives, qualitative characteristics, and the principles guiding financial reporting. It emphasizes the importance of the framework in assisting standard setters, preparers, auditors, and users by providing clarity in financial statements and guiding decision-making. Updates to the framework have been made to enhance relevance and clarity of concepts such as asset and liability definitions, measurement, and presentation.