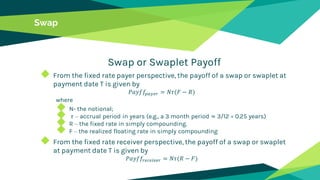

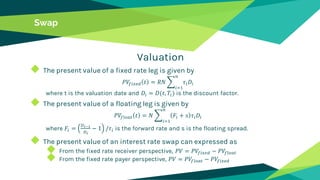

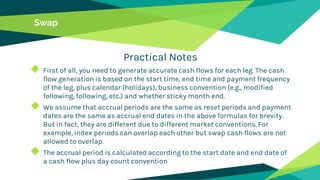

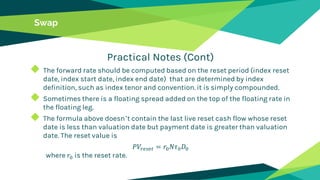

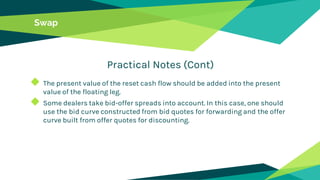

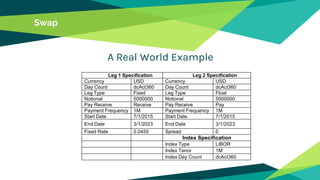

This document serves as a practical guide on the valuation of interest rate swaps, explaining their structure, uses, and payoff calculations. It covers the roles of fixed and floating legs, how to generate cash flows, and significant valuation formulas, while also providing real-world examples. Additionally, it highlights the increasing trend of using central counterparties for clearing swaps.