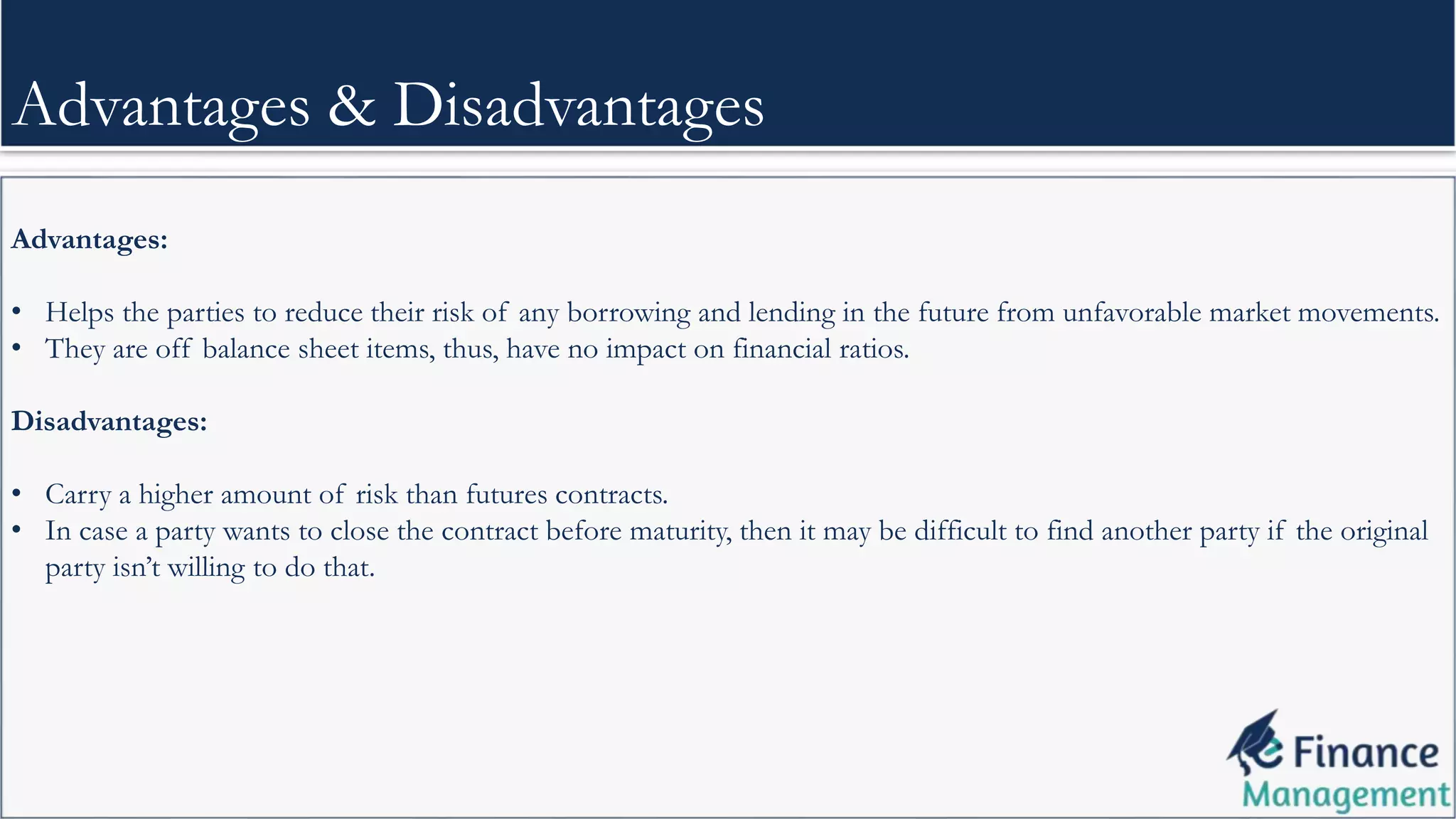

A forward rate agreement (FRA) is an over-the-counter contract where one party agrees to borrow or lend a specific amount at a fixed interest rate at a future date. This instrument helps parties hedge against interest rate fluctuations and can minimize foreign currency risks, though they carry higher risks than futures contracts and can be challenging to close early. Overall, FRAs offer advantages such as off-balance-sheet treatment while exposing users to potential difficulties if the market conditions change drastically.